Giving back your time by making insurance quoting simple

Engaging new customers with insurance products can be difficult. They’re often seen as a grudge purchase rather than an investment. Quote complexity can make it difficult for consumers to understand the benefits and premiums. And matching clients to the right product is often difficult and time-consuming for advisors.

Webline – our leading online quote and e-apply portal – is designed to address these challenges. It features intuitive, web-based, whole-of-market comparison software, seamlessly linking advisors to consumers. Webline provides answers in minutes even for multi-benefit and multi-client journeys – ensuring consumers have a clear, informed picture of their cover and associated premium.

How Webline helps

- Fastest solution for providing responses to customers

- Most robust and reliable application, with the very best uptime in the industry

- Always-on availability, for unlimited quotes, 24/7

- Simple, easy to understand portal. Quote screens have a clear layout and ask for minimum information

- COMING SOON: Available as a native application within Salesforce®

over

1 billion

quotes returned by Webline since its launch in 1995.

less than

24 hours

to on-board Webline Play. From contract to lead generation, including automated emails and integration with your CRM.

over

400

extra customers. One advisory firm using Webline Play had an additional 400 customers a month contact them for a quote.

3 ways to access the benefits of Webline

Gain the benefits as a web-based quote-and-apply platform, or secondly, as a web service, meeting web or CRM integration needs. Thirdly, access the benefits as a customisable embedded web app (Webline Play) seamlessly blending into any website – providing ‘plug-and-play’ protection lead generation to advisory firms and distributors of all sizes.

What you can do with Webline

Webline – quote portal

A market-leading quote-and-apply platform, allowing comparison of hundreds of products and rates.

- Level and Decreasing Term with CIx options

- Income Protection

- Instant Accident, Sickness & Unemployment Cover

- Annuity quotes

- Seamless eApply

- The capability to turn options on or off shows how features can affect investment values.

Webline – web services

Integrate Webline into your own online quote portal, internal CRM quote-and-apply engine or bespoke new business tool.

- White-label Webline functionality

- Seamless quote-and-apply journey

- Access to all provider documentation

- Customisable commission settings

Webline – Webline Play

A simplified Webline for your website. Fast installation, with:

- Single & Joint life options for Level & Decreasing Term quotes

- Income Protection quotations

- Leads automatically sent to your inbox and/or CRM

- Single click from lead to Webline Apply service

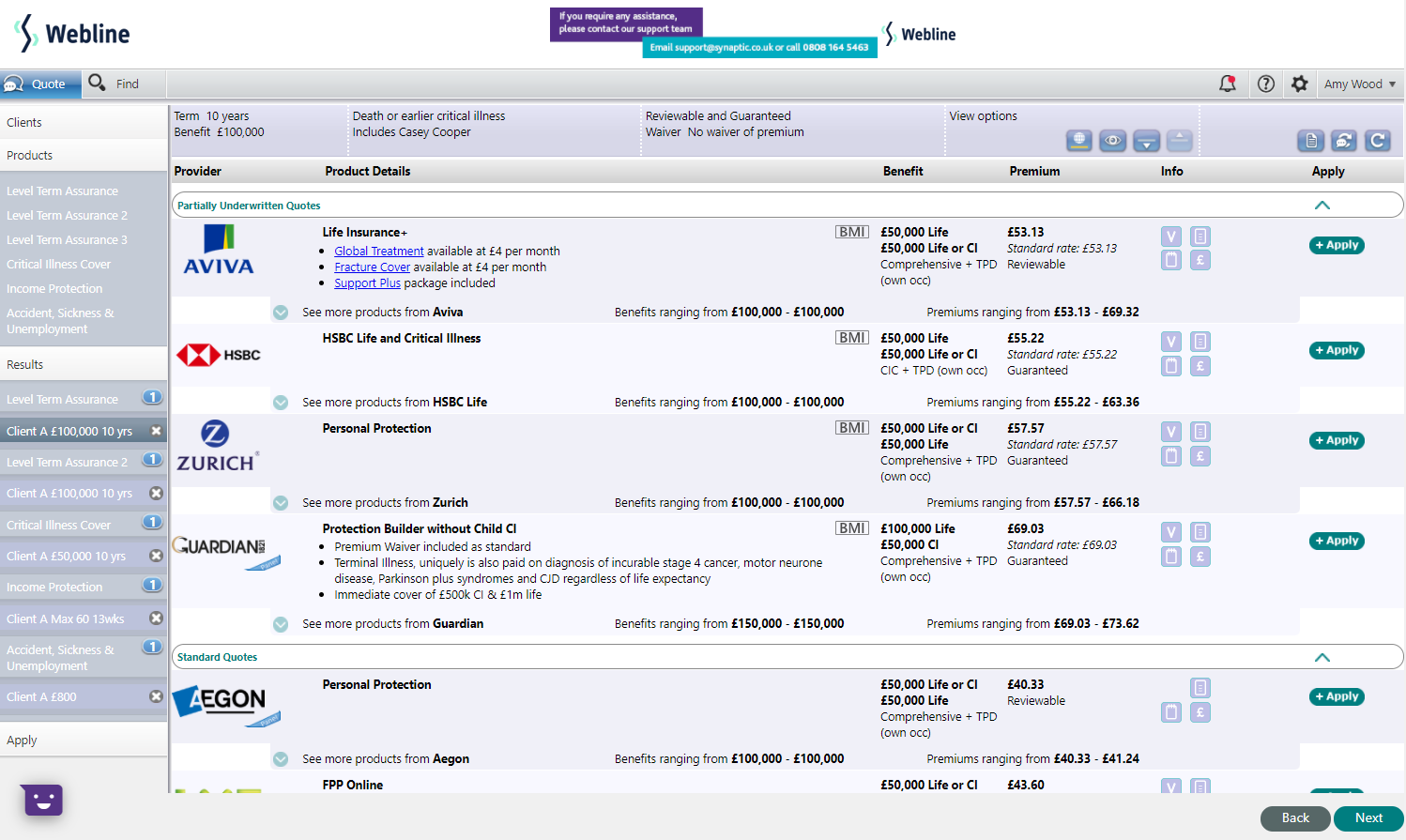

Quote-and-apply portal

Online quote portal for fast, simplified results for your protection business.

- All major providers

- Hundreds of products

- Comparison reports, product selection and end-to-end application in minutes.

One interface to create Product panels to suit your needs; view and print enhanced comparison reports; access provider documents.

Fast, simple protection quote-and-apply

Quote, compare, apply from one screen. Create comparison quotes with variations for customer choice. Provider extranet Applications in one click.

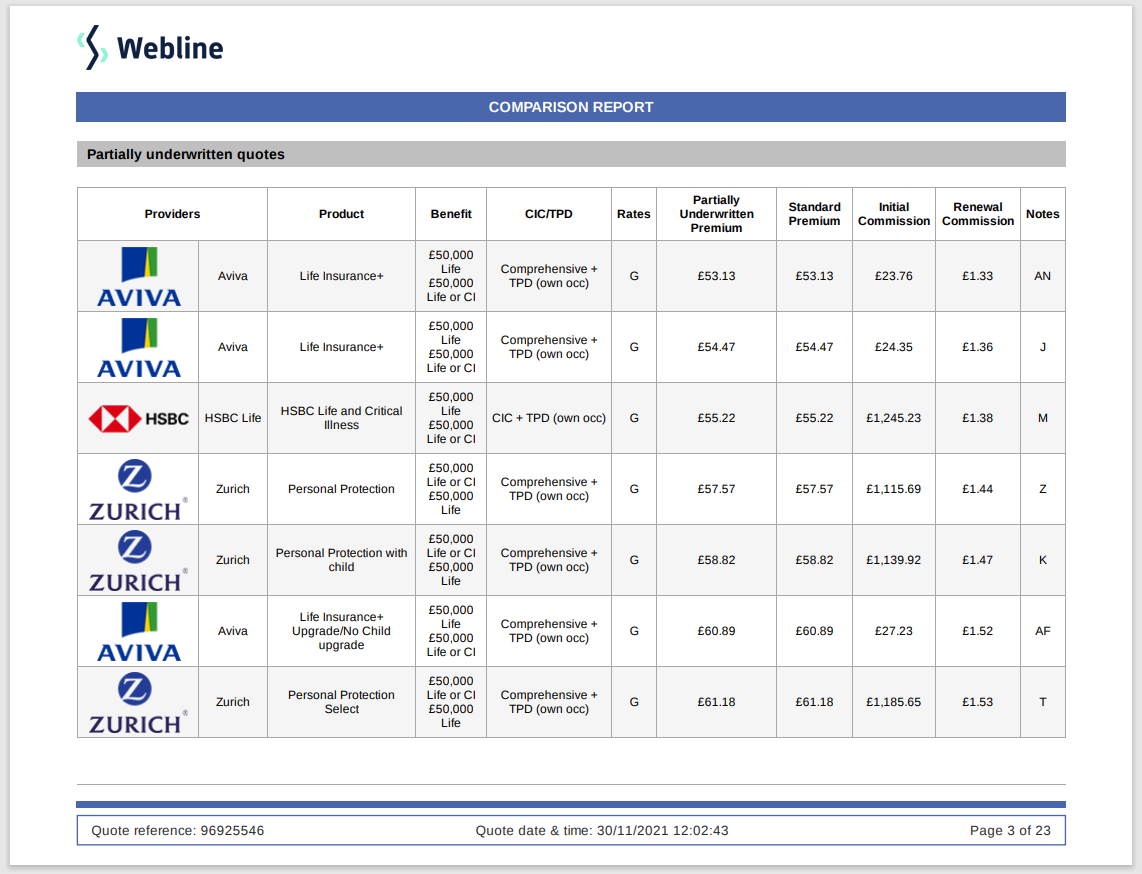

Partially underwritten quotes

See partially underwritten and standard options for quote prices – giving more insight into which providers will take your client’s business.

Streamlined comparison reports

Updated comparison report design and display gives adviser- and customer-facing views of all key information.

Instant Accident, Sickness & Unemployment Cover

Quote-and-apply through our ASU service and have confirmed cover in place in minutes.

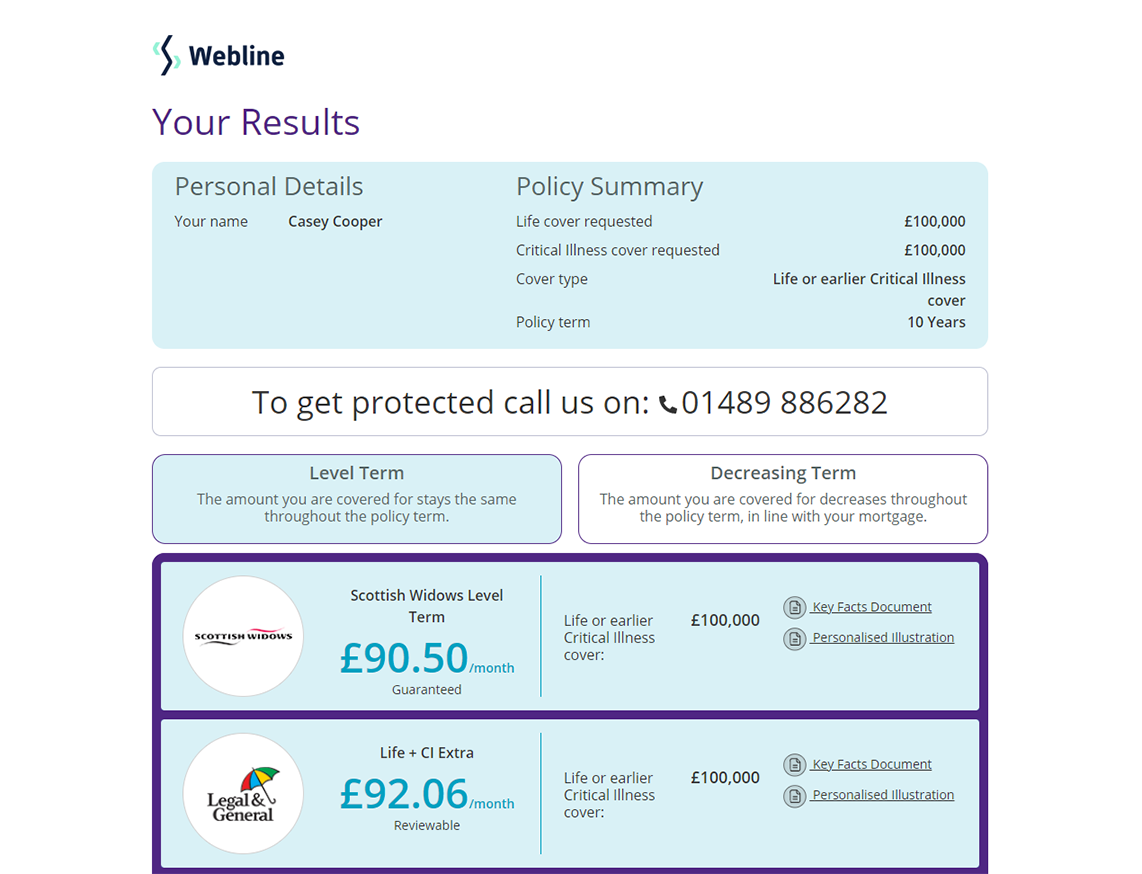

Webline Play

The ‘plug-and-play’ quote engine, ready to drop into your website and generate new business from day one.

- Offers real-time access to information

- Customisable to reflect your own brand and style

- No need for technical expertise

Simple to install and blends seamlessly into any website, advisers and distributors can provide a streamlined customer journey. Our ‘plug-and-play’ quote engine is ready to drop into your website and help you to generate new business from day one.

Ready ’out of the box’

Install Webline Play in minutes, for the power of instant quotes on your website, resulting in high-quality new protection business leads.

Mobile responsive

Install on any website in any space, and Webline Play will be optimised for mobiles as standard.

Automated lead generation

Instantly turns website quotes into high-quality leads, with key information sent to your inbox or CRM for fast follow-up and online applications.

Highly customisable

Webline Play is built to be customised – by colour, phone number and specific call-to-action text – so it sits seamlessly in your website.

Helping Guardian Financial Services shake up the protection market.

"Partnering with Synaptic is yet another important step in making sure Guardian's products are available to as many advisers' clients as possible."

"Synaptic has been an enthusiastic supporter of Guardian from when we first began to discuss our plans with the market."

Andy Peters

Distribution Director

Stay connected with our latest edition of Connection

Trends, insights and the latest industry commentary, covering the protection, wealth management and investment spaces. Connection magazine keeps you up to speed on everything advisers need to know each quarter.

See how Synaptic can streamline your business processes

Take a tour of the Synaptic toolkit, to discover how it can cut tasks from hours to minutes, and enable advisers to spend more time focussing on clients.