In this edition...

- Financially engineered advice now standard Eric Armstrong, Client Director Synaptic Software Limited

- What do portfolios mean to advisers? John Warby, Senior Business Relationship Manager Synaptic Software Limited

- Take your firm’s asset allocation a step further than Nobel prize winning Modern Portfolio Theory Ross Holloway, Business Development Manager Synaptic Software Limited

- Risk Explorer infographic Editorial team, Synaptic Software Limited

- Quantifying the future of remote work Joe Davis, Global Chief Economist Vanguard

- Annuities: a key to smarter drawdown? Patrick Ingram, Head of Strategic Partnerships Parmenion

- Multi-asset investing that doesn’t cost the earth Mark Parry, Director, Head of Strategic and Technical Sales BMO

- MPS 2020 Review James Burns, Partner Smith & Williamson Investment Management LLP

- 2021 outlook positive, but risks remain Jon Cunliffe, Chief Investment Officer Charles Stanley

- The Chinese consumer revolution Janet Mui, Investment Director Brewin Dolphin

- EEE ESS GEE: The Sequel Steve Nelson, Head of research the lang cat

- Drivers and developments in sustainable multi-asset investing Maria Municchi, Fund Manager, Sustainable Multi Asset Fund Range M&G Investments

- RSMR Weekly Broadcast: the battle for content – deal or no deal? Richard O’Sullivan, Investment Research Manager RSMR

- COVID-19: Bringing operational financial strength into sharper focus Guy Vanner, Managing Director AKG

- Video - every adviser’s new best friend Martyn Pask, Director Asset TV

Portfolios are more than just a tool of the trade. A layperson may not appreciate the importance of portfolios to an adviser – they are the distillation of all the expertise applied in selecting suitable investment solutions for clients, informed by deep experience and countless qualitative insights.

Portfolios carry the aspirations and dreams of clients. They are constructs of balance, poise and elegance, capable of delivering growth in the good times, but equally capable of weathering the worst storms of the markets and re-emerging triumphant in the long perspective demanded by investment strategies for retail clients. Advisers are therefore as reliant on the portfolios they recommend, as the clients they advise.

Users of the Synaptic risk proposition will appreciate the advantages of access to the Moody's risk model which is explained in more detail in the next article, but here is a list of the features and benefits of the new portfolio management tools available in Risk Explorer.

Independence

Synaptic is the only full advisory research solution independent of influence from provider or distributor ownership, avoiding bias, inducement or conflict of interests as per COBS 2.

Even if firms have outsourced investment to a discretionary manager or provider, Synaptic has the data to provide 'independent' research that can be applied across all research requirements for objective proof of suitability for clients, reducing the reliance of firms on platforms or providers.

Data collected directly from and verified by asset managers and providers

- A key feature for investment committees and compliance for users is the role of the Synaptic research team in collecting and verifying the portfolio data.

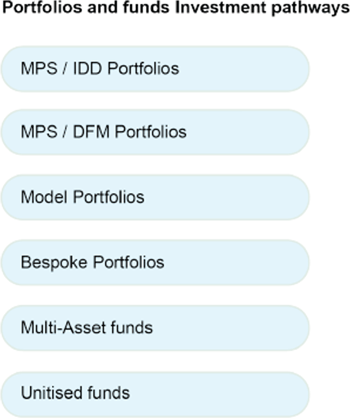

Coverage – types of portfolio

- The guiding principle for Synaptic is to acquire, maintain and make portfolio data available for research and reporting purposes, extending to I.D.D. and discretionary managed portfolios.

- The new portfolio area in Synaptic provides research access to 50 asset managers with over 1000 institutionally managed portfolios designed for retail distribution.

- The Synaptic Discretionary proposition is designed to provide alignment to RSMR coverage, who we link to in order to provide access to market-leading qualitative research.

Asset Allocation, costs and charges and Target Market data included

- The purpose of Synaptic research is to provide proof of suitability and assist advisers in their engagement with clients.

- Synaptic portfolio data includes asset allocation to allow firms to conduct independent risk analysis.

- Data collected by the research team extends to pricing and Target Market information (MiFID II) on discretionary portfolios.

Structure

- The Synaptic research proposition separates investment instruments by their regulatory status and relationship to relevant research journeys.

- 'Fund lists', marked 'Unitised funds' here are included as part of the portfolio options as this forms the basis of the fund and portfolio governance, where approved fund panels feed into portfolio fund choices.

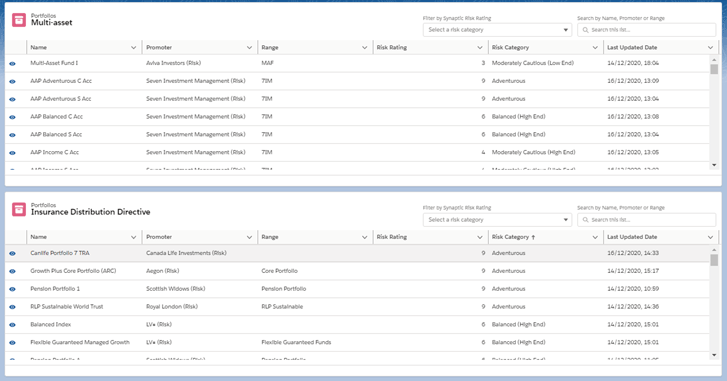

Ease of building and maintaining

- Synaptic has consulted widely as to the best ways to create and manage portfolios. Highlights include the ease of searching under fund code or name, working within approved fund lists, risk profiling of portfolios, and adjusting weightings 'on-the-fly'.

- Assigning 'model' or 'bespoke' status allows portfolios to be shared by groups of users where appropriate.

- Screen below show portfolio under construction.

Reporting

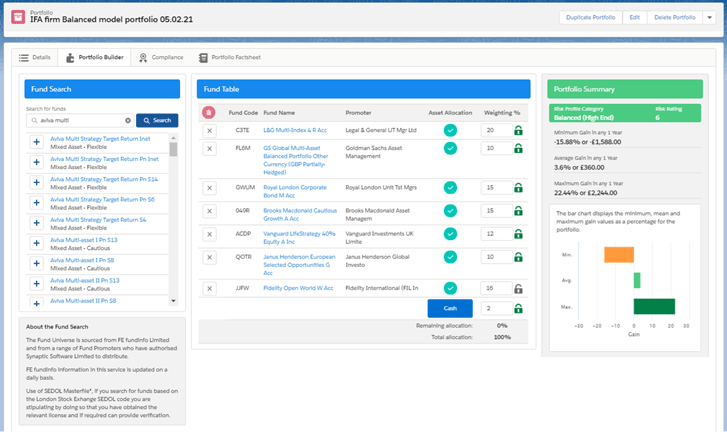

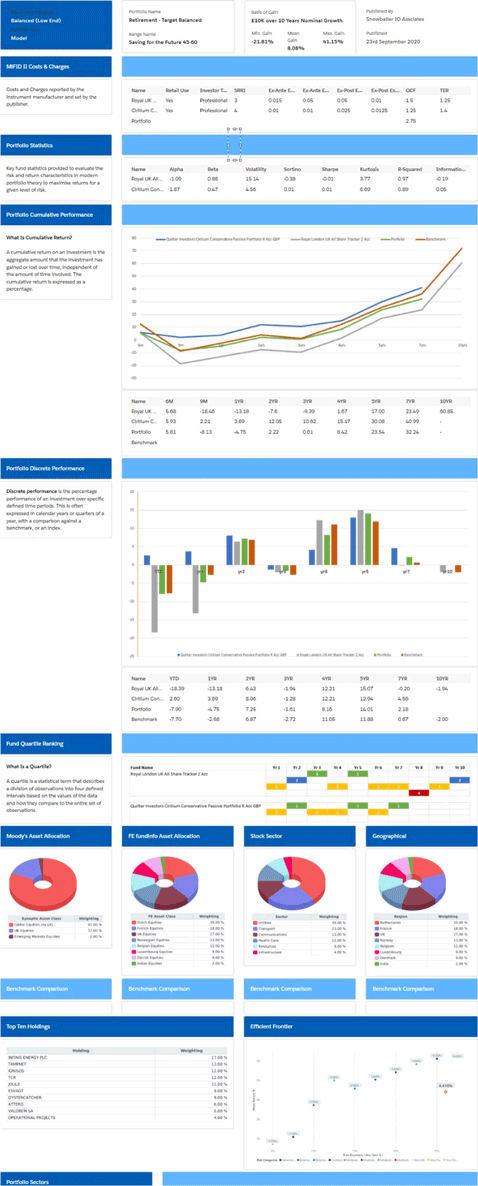

The Risk Explorer portfolio reporting capability combines the best features of the full range of current Synaptic reporting capabilities. These include:

- Asset allocation and risk profiling of portfolios.

- Past performance (where available).

- MIFID II information, quartile performance and asset allocation data.

Screen below shows part of a typical Fund Fact Sheet for a portfolio, incorporating Moody's risk analysis by default.

Wider research options

- The full Synaptic research proposition extends to full investment switching, ex-ante and ex-post illustrations. These all depend on accurate and comprehensive portfolio data as made accessible by the portfolio management tools in Risk Explorer.

- Switching, optimising and rebalancing analysis are also available in the wider research proposition.

For a free trial of the Synaptic Portfolio capabilities email hello@synaptic.co.uk

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.