In this edition...

- A Most Exceptional Recovery Guy Monson, CIO and Senior Partner Sarasin & Partners

- Staying the course Andrew Morris, Product Specialist Canada Life Asset Management

- Price and value: what you pay versus what you get John Husselbee, Head of the Liontrust Multi-Asset investment team Liontrust

- Why rebalancing client portfolios is good practice Georgina Yarwood, Investment Strategy Analyst Vanguard Europe

- Market Timing: is now the time to move your portfolio into cash? Hugo Thompson, Multi-Asset Investment Specialist HSBC Asset Management

- The investment journey: a balancing act Kirsty Wright, Head of Proposition – Pensions & Funds LV=

- Helping mining groups meet the challenge of sustainable development Sandra Crowl, Stewardship Manager Carmignac

- Introducing Multi-Asset Solutions in Goldman Sachs Asset Management Shoqat Bunglawala, Head of Multi-Asset Solutions for EMEA and Asia Pacific Goldman Sachs Asset Management

- What is the post-pandemic outlook for Asian shares? Richard Sennitt, Fund Manager, Asian Equities Schroders

- Retirement should be enjoyed, not endured John Stopford, Co-portfolio Manager, Diversified Income Fund Ninety One

- Is passive investing killing ESG? Jon Lycett, Business Development Manager RSMR

- Emerging from the winter of discontent Salman Ahmed, Global Head of Macro and Strategic Asset Allocation Fidelity International

- IG credit: bubble trouble, alpha opportunity, or both? Adam Darling, Co-manager Jupiter Corporate Bond

- The Unknown King-Makers of ESG Editorial team, Synaptic Software Limited

- How to drive more protection business to your website in 6 easy steps Editorial team, Synaptic Software Limited

- Innovation that protects: Webline journey updates Richard Tailby, Head of Sales Synaptic Software Limited

- Make your Central Investment Proposition (CIP) a pillar of your success Terry Lawson, Business Development Manager Synaptic Software Limited

- The ‘ex-ante’ compliance is icing on the financial planning cake Eric Armstrong, Client Director Synaptic Software Limited

The reason why Google can't identify a whole-of-market solution for a fully MiFID compliant ex-ante illustration and suitability report is that until now, it hasn't existed.

Standalone tools that can contribute part of the solution exist, as do report-writing tools for which you have to supply your own data. There are also elaborate claims of integration and interoperability of 'hub' style back-office solutions which all fall short in practice, as was very well documented in the lang cat and Origo industry report 'A Disconnected World: The Adviser's Reality' (2019), describing the inevitable shortcomings, re-keying and multiple systems needed to conduct due diligence and prepare reports using this approach.

A new financial planning solution

Synaptic has taken an unconstrained approach with modern software architecture and user experience design to create a financial planning solution that concentrates on the professional role of the adviser, whilst automatically meeting all the compliance proof and disclosure demanded by MiFID II. The client's goals and experience of investment are therefore able to take centre stage (rather than the contortions of compliance).

This has been possible thanks to the re-purposing of a range of Synaptic proprietary data and software solutions on a single technical platform, provided by Salesforce. There are no less than 16 separate API call destinations within the ex-ante solution – indicating the complexity and comprehensive nature of the proof of suitability on offer, and giving an idea of the adviser or paraplanner's time saved, as manual look up and reconciliation in all of these areas is no longer required. What took hours, now takes minutes.

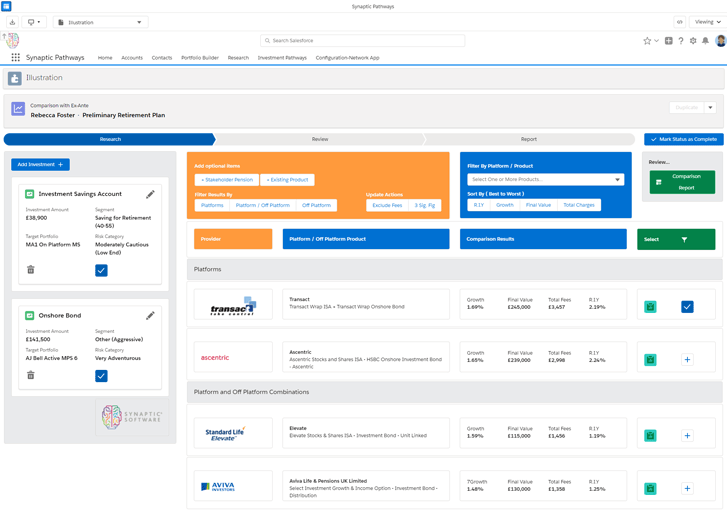

Screenshot shows additional research in support of the ex-ante process, whereby options to take forward to the ex-ante report can be assessed in order to demonstrate value for money for the customer. The cost calculations are taken into the ex-ante reporting. Note – the reduction in yield calculations (highlighted) for the client's wrappers under consideration.

The reason that this solution does not already exist is that no adviser software has been able to access all the relevant data, or been in a position to collate it. Now, Synaptic has used its 20+ years experience and long-term relationships with providers and asset managers to compile the necessary data sets, including for example, asset allocation data for discretionary portfolios for risk profiling purposes – data that is not necessarily in the public domain.

The purpose of this article is to look briefly at the scope delivered as part of the launch of the new ex-ante illustration tool as part of the new Synaptic Pathways research solution. Full switching, ex-post and valuations capabilities are also currently in build and will be released later in the year. The release of the Synaptic ex-ante feature represents the pinnacle of research capabilities for advisory businesses.

The role of research in supporting financial planning

The importance of research in financial planning is paramount, and Synaptic sets new standards for the presentation of investment outcomes whilst providing all the supporting information and analysis to fully meet MiFID II requirements around suitability.

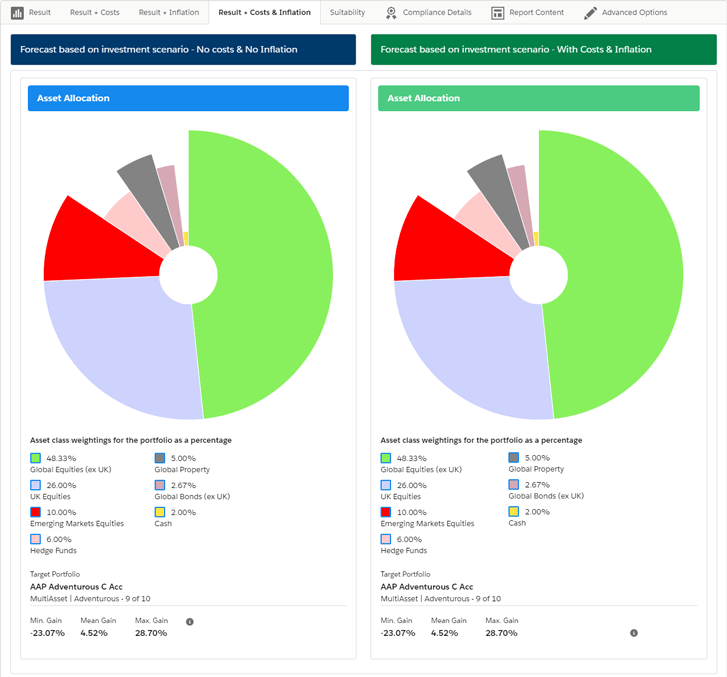

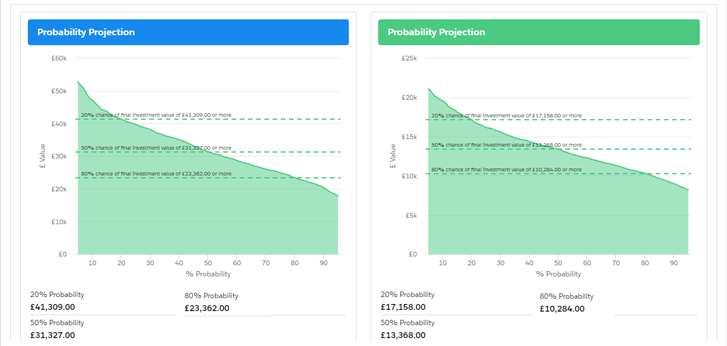

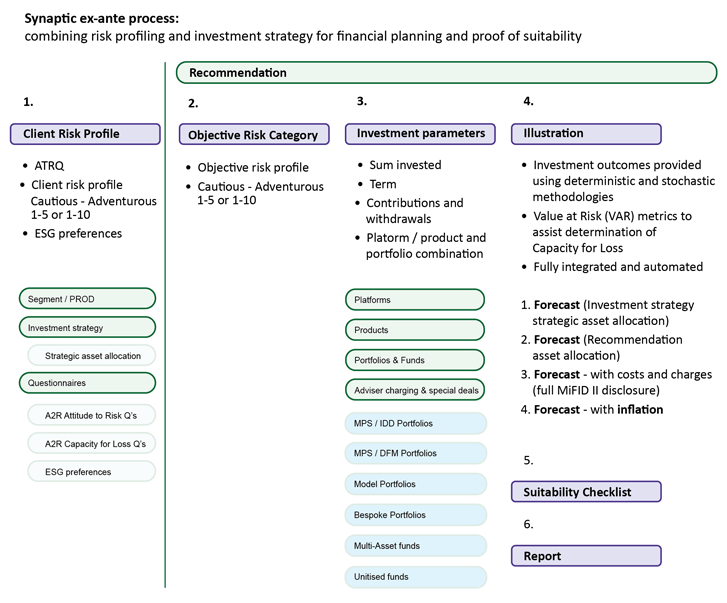

To evidence the expertise of the adviser, and provide transparency for the client in respect of the firm's investment strategy, Synaptic breaks down ex-ante illustrations into different stages and formats. Sight of these illustrations will allow clients to fully understand the proposal in order to agree to an investment strategy and to provide 'informed consent'. Informed consent requires insight into a range of questions; What is the likely outcome of the investment strategy? What does the journey look like? What are the risks involved? What extent of losses may I be exposed to in the journey?

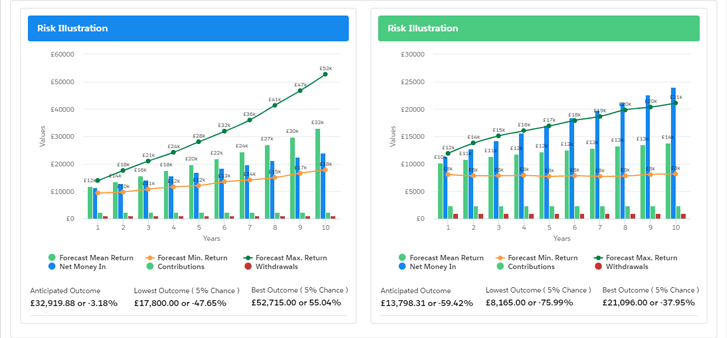

By using the Moody's Analytic's stochastic framework, fully integrated into the Synaptic tool, not only can all the compliance proof points be made, but consistent, accurate and compelling forecasts can be produced to assist all aspects of goal-based financial planning.

The screens above show part of the analysis that is accessible within a Synaptic ex-ante illustration.

The current literature that explores the value of advice correctly identifies the role of research in ensuring that the benefits of long-term investment are understood by the customer, and for them to be fully 'bought in'. Staying invested is essential for achieving financial security in the longer term, and this depends on trust developing between the adviser and their client. The quality of research, including the forecasts contained in the illustrations, is therefore essential.

The seamless combination of risk profiling, asset allocation and investment risk management means that the adviser is fully in control of the levers to engage effectively with their client, and build the necessary trust to make their relationship a success.

For over 10 years, the Synaptic Risk tools have fully integrated with the Moody's Analytics stochastic engine, the Wealth Scenario Generator. This has been proven through many market cycles as the most reliable and accurate stochastic tool for predicting expected market returns and losses. No other retail advice research tool has such strong risk credentials. (Other risk ratings reference Moody's outputs, but only Synaptic directly accesses the models and allows users to risk assess their portfolios on demand).

The Synaptic ex-ante illustration connects the components of advice like no other

Synaptic Pathways combines each stage of (ex-ante) advice into a single integrated process – knitting together risk profiling of customer, risk profiling of recommendation, alignment with firms investment strategy via asset allocation strategy, forecast of investment outcomes with full cost and charges and inflation analysis. All of this can be done in the framework of the firm's product and fund governance.

The role of research in support of compliance

In the Final Guidance document FCA FG11-05 'Assessing suitability: Establishing the risk a customer is willing and able to take and making a suitable investment selection', the central tenet of advice and suitability is laid out – 'Establishing the risk a customer is willing and able to take with their money is a key part of the suitability assessment'.

The compliance obligation for ex-ante is summarised in COBS 9A.3.3/3A. 'Providing a suitability report: MiFID II business / Insurance-based investment products':

'When providing investment advice, investment firms shall provide a report to the retail client that includes an outline of the advice given and how the recommendation provided is suitable for the retail client, including how it meets the client's objectives and personal circumstances with reference to the investment term required, client's knowledge and experience and client's attitude to risk and capacity for loss.'

COBS 6.1 focusses on the necessity for firms to account for all costs associated with the recommendation, including adviser charges, product costs and any 'ancillary services provided to the client'.

The only way these challenges can be satisfactorily met is by including probability-based (stochastic) forecasts, which combine the benefits of being understood by clients and covering the range of possible outcomes. A linear projection based on historical performance will not suffice as it is almost guaranteed to be wrong, however, COBS rules prefer 'deterministic' forecasts for the calculation of Reduction in yield values. The ex-ante illustration from Synaptic Pathways includes both deterministic and stochastic forecasts, allowing accurate and complete costs and charges analysis to be determined (using the former) and robust financial planning and assessment of risk (using the latter). This also provides the basis for fully illustrating the impact of inflation, again, something that is provided automatically in the Synaptic analysis.

The suitability checklist

The FCA and the European authorities (through MiFID II) have made suitability the lynch pin of their compliance regime. The FCA has announced that its investigation and enforcement activities will focus increasingly on suitability and long term investment. It has been hard for firms to combine research and suitability in the past due to the shortcomings of the tools available, but this is no longer the case with the arrival of Synaptic Pathways.

Synaptic Pathways provides a checklist and confirmation of the following in order for advisers to confirm key considerations alongside the investment proposal – to sail through proof of suitability:

- The objectives or goals of the client. Different goals can target different risk categories.

- Target market (MiFID II). The report will confirm client investor type, objective and needs, knowledge and experience and ability to bear loss, as mapped to the ESMA template.

- The risk profile of the client. This indicates the level of risk that they are comfortable with, and their understanding of investment. A client can never be exposed to more risk than they have indicated acceptance for.

- An investment strategy. The Moody's model defines risk categories by risk profile (Cautious through to Adventurous) and aligns an appropriate investment strategy to each, by defining an asset allocation. Any investment can then be mapped to the investment strategy to determine the risk profile. Having a consistent framework for investment risk profiling is a hallmark of modern advice.

- The risk profile of the recommended investment. The Moody's framework gives us the 'Minimum gain' metric to use for this purpose, as it is potential loss that ultimately defines risk. Note that it is not direct alignment with the asset allocation that is the determining factor here but mapping of the 'Minimum gain value' derived from the stochastic model.

- The client's capacity for loss. This is an objective assessment made by the adviser and must be quantified. Synaptic users refer to the investment's 'min gain' to frame this discussion and analysis. For example, if a client were exposed to a 20% loss of the savings they were dependent on in the short to medium term, this may have an impact on their standard of living and their Capacity for Loss may be insufficient.

- Consideration of term. The level of investment risk permissible is directly proportionate to term. The greater the investment horizon, the lower the risk or potential loss, and greater investment risk permissible. All Synaptic illustrations are term-specific.

Reduction in yield calculations

One further feature, unique to Synaptic, is the ability to analyse the ex-ante costs and charges of a recommendation, but also to return a whole-of-market table of comparative costs to demonstrate value of money for the chosen investment combination of platform, product and portfolio, down to accurate share class (cheapest available), combining both on and off platform options. It is easy therefore to append additional due diligence to the ex-ante report. Another feature is to include switching analysis (with multiple growth rates and critical yield calculation) if required. This fulfils the new software's potential to replace several standalone research tool with one integration solution.

Call now to book a demo or trial on 0800 783 4477 or email hello@synaptic.co.uk

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.