In this edition...

- A Most Exceptional Recovery Guy Monson, CIO and Senior Partner Sarasin & Partners

- Staying the course Andrew Morris, Product Specialist Canada Life Asset Management

- Price and value: what you pay versus what you get John Husselbee, Head of the Liontrust Multi-Asset investment team Liontrust

- Why rebalancing client portfolios is good practice Georgina Yarwood, Investment Strategy Analyst Vanguard Europe

- Market Timing: is now the time to move your portfolio into cash? Hugo Thompson, Multi-Asset Investment Specialist HSBC Asset Management

- The investment journey: a balancing act Kirsty Wright, Head of Proposition – Pensions & Funds LV=

- Helping mining groups meet the challenge of sustainable development Sandra Crowl, Stewardship Manager Carmignac

- Introducing Multi-Asset Solutions in Goldman Sachs Asset Management Shoqat Bunglawala, Head of Multi-Asset Solutions for EMEA and Asia Pacific Goldman Sachs Asset Management

- What is the post-pandemic outlook for Asian shares? Richard Sennitt, Fund Manager, Asian Equities Schroders

- Retirement should be enjoyed, not endured John Stopford, Co-portfolio Manager, Diversified Income Fund Ninety One

- Is passive investing killing ESG? Jon Lycett, Business Development Manager RSMR

- Emerging from the winter of discontent Salman Ahmed, Global Head of Macro and Strategic Asset Allocation Fidelity International

- IG credit: bubble trouble, alpha opportunity, or both? Adam Darling, Co-manager Jupiter Corporate Bond

- The Unknown King-Makers of ESG Editorial team, Synaptic Software Limited

- How to drive more protection business to your website in 6 easy steps Editorial team, Synaptic Software Limited

- Innovation that protects: Webline journey updates Richard Tailby, Head of Sales Synaptic Software Limited

- Make your Central Investment Proposition (CIP) a pillar of your success Terry Lawson, Business Development Manager Synaptic Software Limited

- The ‘ex-ante’ compliance is icing on the financial planning cake Eric Armstrong, Client Director Synaptic Software Limited

Asia's response to the pandemic served it well in 2020. However, with a risk of bubbles developing in some areas, investors will need to be agile in their stockpicking.

"It's important to be able to pick the overlooked areas which may have lagged but where recovery prospects are being underappreciated by the wider market. By the same token, we'd want to avoid those areas with little margin of safety."

How does Multi-Asset Solutions approach investing?

Despite the global turmoil caused by the Covid-19 pandemic, stock markets were generally strong in 2020 and the Asia ex-Japan region was no exception.

Indeed, in many ways the region was first into the pandemic and first out, with successful containment of the virus in many countries enabling economic activity to resume more quickly than elsewhere in the world.

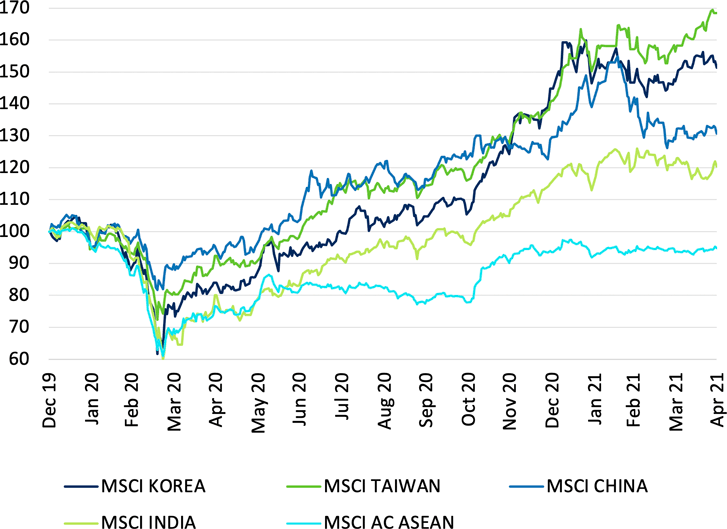

Diverging country and sector fortunes

While Asia fared well overall, what really stands out is the divergence in performance of different geographies and sectors. North Asian countries (China, South Korea, Taiwan), which generally had greatest success in containing the pandemic, outperformed Indian and ASEAN stock markets.

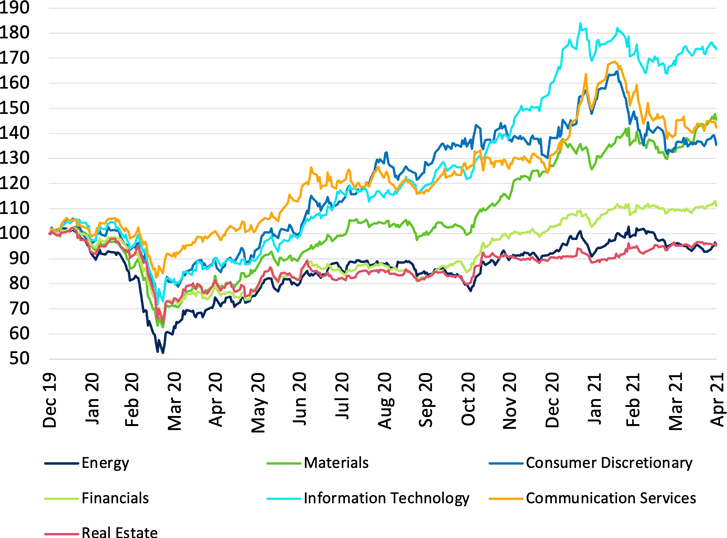

And at sector level, strong demand for digital services and work from home devices helped shares of semiconductor suppliers and other technology companies to outperform. Other "pandemic winners" included e-commerce – part of the consumer discretionary sector – and communication services. Companies operating in these fields tend to be found in north Asia, thereby contributing to the strong performance from those countries.

By contrast, traditionally economically-sensitive sectors such energy and financials lagged behind. These sectors tend to make up a higher proportion of the market in south and south-east Asia.

As 2020 progressed, optimism over swift economic recovery was joined by the very welcome news that successful vaccines had been discovered, and by the enormous levels of fiscal and monetary policy support coming from governments and central banks. These factors continue to support markets in 2021 but as expectations for growth have gone up, long-term interest rates have also started to rise which has unsettled markets to an extent.

Index* performance – Country

100 = December 31, 2019

Index* performance – Sector

100 = December 31, 2019

Source: Refinitiv Datastream, Factset, USD, 30 April 2021. *Based on MSCI AC Asia Pacific ex Japan. The countries shown are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

Past performance is not a guide to future performance. The value of investment can go down as well as up and is not guaranteed.

Earnings expectations high but achievable

As a result of the rally in share prices, stocks are now looking more expensive, trading well above their long-run averages. This suggest markets are pricing in quite a robust recovery in earnings.

Indeed, consensus earnings expectations have been revised up sharply as confidence builds in the recovery and roll-out of the vaccines. For the Asia ex-Japan region, market expectations are for around 30% earnings growth this year compared to 2020, and for over 10% growth next year.

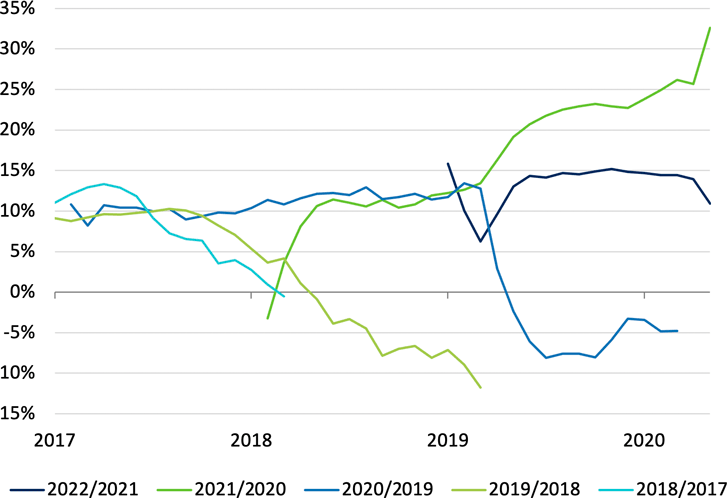

Earnings expectations picking up

Consensus EPS* growth for Pacific ex Japan

Source: FactSet Estimates, MSCI, as April 30, 2021. *Earnings Per Share (EPS).

Past performance is not a guide to future performance. The value of investment can go down as well as up and is not guaranteed.

We don't think these numbers are outlandish. However, much depends on the path of the pandemic, particularly how countries deal with new variants of the virus. The recent surge in cases in India is a tragic reminder of how susceptible countries can be to further waves of the virus, and it should be remembered that vaccination rates across Asia currently are generally much lower than we see in the UK. That means there is perhaps a higher degree of uncertainty than usual around these earnings forecasts and given valuations, markets would be susceptible to disappointment on this front.

What's more, there's only so much that can be gleaned from looking at aggregates. As we saw in 2020, there can be significant divergences both between and within markets.

Is retail participation contributing to a bubble?

Another phenomenon that has helped to drive up markets globally in recent months is the large increase in retail investor activity. This has perhaps been more widely noted in the US, given the publicity around GameStop for example, but it's in evidence in Asia too.

That increase in retail participation is perhaps a contributing factor to some of the more "bubbly" valuations we are seeing in certain parts of the market. Some of the "hot" areas of the market such as biotech, software, or electric vehicles are trading at or close to their historical peaks in terms of valuation multiples. Some of these valuations are based on extremely high levels of prospective growth, often well out into the future, and are therefore very vulnerable to any change in sentiment or rise in interest rates.

By contrast, lowly valued sectors – banks, property, capital goods, utilities – have not caught the imagination of retail investors and that is partly why they look more cheaply valued overall right now.

Importance of active stock selection

For us, this demonstrates the importance of active stockpicking in this region. It's important to be able to pick the overlooked areas which may have lagged but where recovery prospects are being underappreciated by the wider market. By the same token, we'd want to avoid those areas with little margin of safety because the strong momentum they have enjoyed could very quickly go into reverse.

This applies to sectors and it applies to countries too. Relative growth could soon move in favour of south and south east Asia, which have lagged, compared to north Asia. This is a "catch-up play" as the recovery broadens out.

We would also point out that China has already made some moves towards tightening policy and talking down more speculative areas. We would expect government and central bank support and liquidity to start being withdrawn earlier in those countries that have already done well.

Asia remains attractive for income investors

We'd also highlight that, in our view, Asian stock markets are very well placed compared to the rest of the world in terms of income potential and the robust dividend streams that Asian companies offer.

It is partly a legacy of the Asian financial crisis that companies in the region went into the crisis with generally more conservative balance sheets than their peers in other regions. They also had more reasonable payout ratios, especially compared to those seen in places like the UK.

We therefore see no reason why dividends cannot recover along with earnings.

Read our latest insights or visit www.schroders.com to find out how Schroders can support you.

Important information

Marketing material for professional clients only.

This information is not an offer, solicitation or recommendation to buy or sell any financial instrument or to adopt any investment strategy. Any reference to sectors/countries/stocks/securities are for illustrative purposes only and not a recommendation to buy or sell any financial instrument/securities or adopt any investment strategy.

The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Schroders has expressed its own views and opinions in this document and these may change.

Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realised.

For your security, communications may be recorded or monitored.

Issued in May 2021 by Schroder Unit Trusts Limited, 1 London Wall Place, London, EC2Y 5AU. Registered No: 4191730 England. Authorised and regulated by the Financial Conduct Authority. UK002685.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.