In this edition...

- A Most Exceptional Recovery Guy Monson, CIO and Senior Partner Sarasin & Partners

- Staying the course Andrew Morris, Product Specialist Canada Life Asset Management

- Price and value: what you pay versus what you get John Husselbee, Head of the Liontrust Multi-Asset investment team Liontrust

- Why rebalancing client portfolios is good practice Georgina Yarwood, Investment Strategy Analyst Vanguard Europe

- Market Timing: is now the time to move your portfolio into cash? Hugo Thompson, Multi-Asset Investment Specialist HSBC Asset Management

- The investment journey: a balancing act Kirsty Wright, Head of Proposition – Pensions & Funds LV=

- Helping mining groups meet the challenge of sustainable development Sandra Crowl, Stewardship Manager Carmignac

- Introducing Multi-Asset Solutions in Goldman Sachs Asset Management Shoqat Bunglawala, Head of Multi-Asset Solutions for EMEA and Asia Pacific Goldman Sachs Asset Management

- What is the post-pandemic outlook for Asian shares? Richard Sennitt, Fund Manager, Asian Equities Schroders

- Retirement should be enjoyed, not endured John Stopford, Co-portfolio Manager, Diversified Income Fund Ninety One

- Is passive investing killing ESG? Jon Lycett, Business Development Manager RSMR

- Emerging from the winter of discontent Salman Ahmed, Global Head of Macro and Strategic Asset Allocation Fidelity International

- IG credit: bubble trouble, alpha opportunity, or both? Adam Darling, Co-manager Jupiter Corporate Bond

- The Unknown King-Makers of ESG Editorial team, Synaptic Software Limited

- How to drive more protection business to your website in 6 easy steps Editorial team, Synaptic Software Limited

- Innovation that protects: Webline journey updates Richard Tailby, Head of Sales Synaptic Software Limited

- Make your Central Investment Proposition (CIP) a pillar of your success Terry Lawson, Business Development Manager Synaptic Software Limited

- The ‘ex-ante’ compliance is icing on the financial planning cake Eric Armstrong, Client Director Synaptic Software Limited

Vanguard believes in long-term, goal-oriented investing based on an investor's tolerance for risk. We don't advocate tactical trading or speculative trend-chasing, but there is one aspect of portfolio management that may require regular intervention – rebalancing.

"The benefits of rebalancing might not be immediately clear to many clients, so it's important to communicate the importance of regular rebalancing to keep clients on track."

Some all-in-one multi-asset funds, like our LifeStrategy and Target Retirement fund ranges, rebalance automatically. If a portfolio is made up of different funds, however, the onus is on the adviser to manually rebalance portfolios on behalf of clients.

That said, persuading investors to top up assets that are falling or providing lesser returns at the expense of their best-performing investments is a difficult conversation to have. It is an important conversation nonetheless and at Vanguard we believe rebalancing is crucial to helping investors achieve long-term investment goals.

Historically, rebalancing opportunities have occurred when there has been a wide dispersion between the returns of different asset classes (such as equities and bonds). Whether in bull or bear markets, reallocating assets from the better-performing asset classes to the worse-performing ones can feel counterintuitive.

This is where an adviser can add value by providing the discipline to rebalance when it is needed most, which is often when it involves a very uncomfortable leap of faith. If clients are resistant to the idea of rebalancing their portfolio, getting them on board may come down to highlighting the risks of not rebalancing.

Why rebalance?

It will come as no surprise to most advisers that asset allocation has been found to be the most important determinant of long-term investment success1. That's why portfolio construction requires a thoughtful approach that considers the investor's goals and risk appetite, resulting in a balanced investment portfolio tailored to the client.

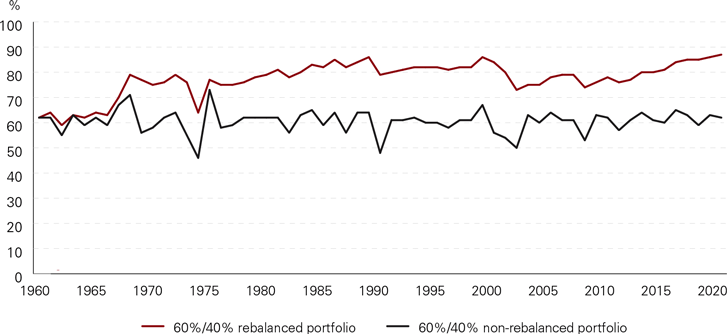

After deciding on the optimal mix of assets and sub-asset classes to hit a client's investment targets, as time goes by that original asset allocation will drift, as shown in Figure 1. This effect, known as portfolio drift, is common during normal market cycles, but can become more acute during times of increased volatility.

Figure 1

Regular rebalancing maintains the risk and return profile

Source: Vanguard calculations, based on data from Thomson Reuters Datastream and Bloomberg Barclays. Data from 4 January 1960 to 31 December 2020. Notes: The initial allocation for both portfolios is 60% global equity and 40% global bonds. The rebalanced portfolio is returned to this allocation at the end of each June and December. Global equity is defined as the MSCI All Country World Investable Market Index, GBP un-hedged. Global bonds are defined as the Bloomberg Barclays Global Aggregate, hedged to sterling. Returns are in GBP with income reinvested.

The chart above shows the effect of portfolio drift by comparing the mix of a rebalanced and non-rebalanced portfolio over time, both of which have an initial allocation of 60% global equity and 40% global bonds. The rebalanced portfolio is returned to its target allocation at the end of each June and December, whereas the non-rebalanced portfolio drifts to more than 80% equity – greatly changing the risk profile of the portfolio.

Manage risk

As opposed to maximising gains, clients need to understand the objective of rebalancing is to mitigate the risk of portfolio drift and unintended exposure to one asset class over another. While 'running the winners' might seem intuitive – i.e. keeping hold of the best performing assets – it is usually the higher-returning investments that carry the most risk. In other words, a portfolio's best performers could become the biggest detractors further down the line.

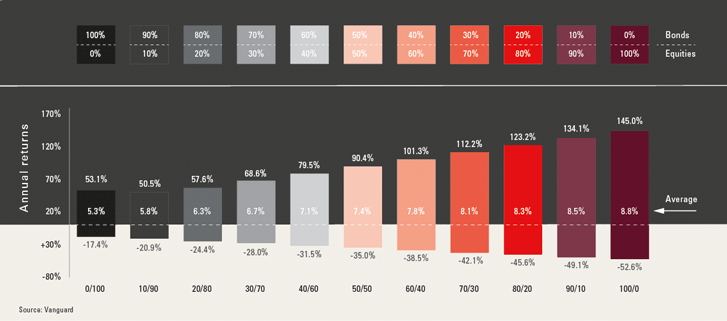

Figure 2 below shows the best, worst and average returns for different stock/bond allocations over more than a century. Higher expected return comes with heightened risk, which over time can be mitigated by regular rebalancing to realign with an individual's tolerance for risk.

Figure 2

Historically, higher-return assets have brought increased risk

Best, worst, and average returns for various stock/bond allocations, 1901-2019

So, given the uncertainty swirling around the global economy in light of the wide-ranging and extraordinary consequences of the Covid-19 pandemic, clients may be more receptive to the risk-mitigating benefits of portfolio rebalancing. Once the benefits of rebalancing are understood and the client is on board, the next step is to decide on the best approach to redress the balance.

Rebalancing options for advisers

The rebalanced portfolio in Figure 1 uses a simple 'time-only' rebalancing strategy, but more sophisticated approaches are also available. A time-only strategy will rebalance on a given date, regardless of the relative performance of the portfolio's component assets. In a threshold-only strategy, rebalancing is triggered when a portfolio's asset allocation has drifted by a given amount, say by 5%, irrespective of how often this happens.

A strategy combining the two will monitor the portfolio on a given schedule and have pre-set thresholds, but rebalancing will only occur when the two trigger-points cross. Here's a simple breakdown of three common approaches to rebalancing:

- Time only – rebalancing on a set schedule, such as daily, monthly, quarterly or annually.

- Threshold only – rebalancing when a target asset allocation deviates by a predetermined percentage, such as 1%, 5% or 10%.

- Time and threshold – rebalancing on a set schedule, but only if a target asset allocation deviates by a predetermined amount, such as 1%, 5% or 10%.

Vanguard research has found that none of the major rebalancing approaches holds a distinct or enduring advantage over the others. Advisers therefore ought to identify the best approach for the client and apply it in a consistent and disciplined manner to give them the best chance of reaching their long-term financial goals. Another way to redress the balance would be to direct any new cash contributions to those holdings that have underperformed.

We believe investors should stick to their investment plans and regular rebalancing is an effective way of keeping clients on track to reach their investment targets. Download our client-friendly explainer and share it with your clients to help them understand how a well-planned rebalancing strategy can be used to help dial down risk in their portfolios.

- Gary P. Brinson, L. Randolph Hood, and Gilbert L. Beebower, 1995. "Determinants of portfolio performance." Financial Analysts Journal 51(1):133–8. (Feature Articles, 1985–1994.)

Investment risk information. The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. For further information on risks please see the “Risk Factors” section of the prospectus on our website at https://global.vanguard.com.

Important information. This document is directed at professional investors and should not be distributed to, or relied upon by retail investors. This document is designed for use by, and is directed only at persons resident in the UK. The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment. The Authorised Corporate Director for Vanguard LifeStrategy Funds ICVC is Vanguard Investments UK, Limited. Vanguard Asset Management, Limited is a distributor of Vanguard LifeStrategy Funds ICVC. For further information on the fund's investment policy, please refer to the Key Investor Information Document (“KIID”). The KIID and the Prospectus for the fund(s) is available from Vanguard via our website https://global.vanguard.com/.Issued by Vanguard Asset Management Limited, which is authorised and regulated in the UK by the Financial Conduct Authority.© 2021 Vanguard Asset Management Limited. All rights reserved.

Connection Magazine

A most exceptional recovery

Q2 2021

Guy Monson, Sarasin & Partners

Andrew Morris, Canada Life Asset Management

Price and value: what you pay versus what you get

John Husselbee, Liontrust

Why rebalancing clien portfolios is good practice

Georgina Yarwood, Vanguard Europe

Market Timing: is now the time to move your portfolio into cash?

Hugo Thompson, HSBC Asset Management

The investment journey: a balancing act

Kirsty Wright, LV=

Helping mining groups meet the challenge of sustainable development

Sandra Crowl, Carmignac

Introducing Multi-Asset Solutions in Goldman Sachs Asset Management

Shoqat Bunglawala, Goldman Sachs Asset Management

What is the post-pandemic outlook for Asian shares?

Richard Sennitt & Abbas Barkhordar, Schroders

Retirement should be enjoyed, not endured

John Stopford, Ninety One

Is passive investing killing ESG?

Jon Lycett & Katie Poulson, RSMR

Emerging from the winter of discontent

Wen-Wen Lindroth, Anna Stupnytska & Salman Ahmed, Fidelity International

IG credit: bubble trouble, alpha opportunity, or both?

Adam Darling & Harry Richards, Jupiter Corporate Bond

The Unknown King-Makers of ESG

EBI

How to drive more protection business to your website in 6 easy steps

Synaptic Software Limited

Innovation that protects: Webline journey updates

Richard Tailby, Synaptic Software Limited

Make your Central Investment Proposition (CIP) a pillar of your success

Terry Lawson, Synaptic Software Limited

The ‘ex-ante’ compliance is icing on the financial planning cake

Eric Armstrong, Synaptic Software Limited

Previous Connection Magazines

Sign up for Connection

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.