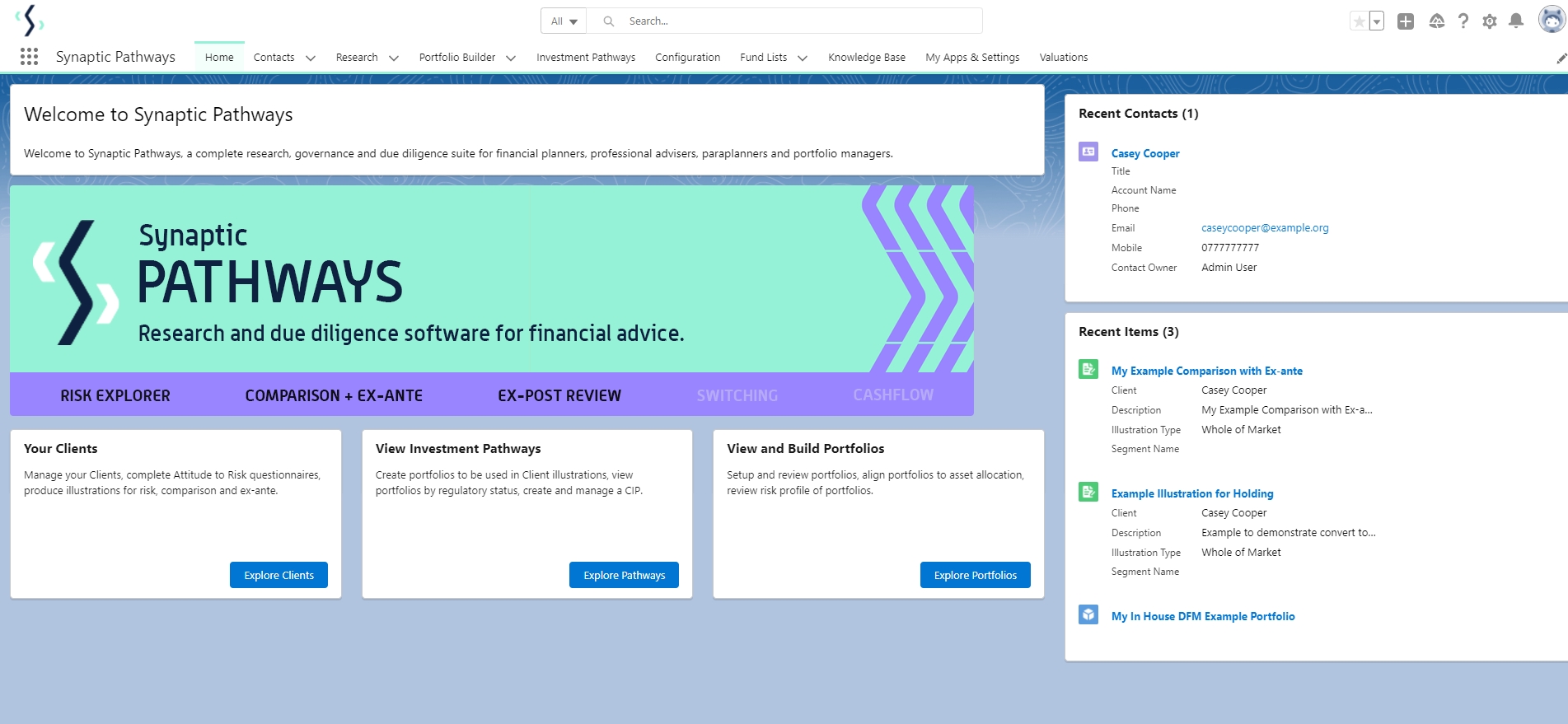

The power of Synaptic Pathways available as scalable APIs

If you are in financial services, or a back-office provider looking to build or enhance data-driven journeys for financial advisers then Synaptic Pathways APIs should be of interest to you.

Enabling you to access and manipulate data, calculations, valuations and modelling tools in modern APIs using access standards – but add your own user interface or build additional functionality into existing software such as CRM, ERP and adviser back-office tools.

Working with CRM Providers, Robo Advisers, Adviser Firms, other fintech firms, Investment Providers, Platform Providers, other data providers, Financial Services Firms and others with a requirement for data and specific functionality, we have built the most robust and easy to use APIs in the industry.

Well documented, receiving all the support you need to build what you want; we are experienced in getting you results.

Pathways API ecosystem

Gaining access to powerful, scalable, performant APIs with Synaptic can take a matter of hours. We can provide a sandbox environment, pricing structures to suit your requirements and support in implementation. If anything peaks your interest, contact us and we can give you some examples of the types of data and calculations you can use and get you up and running.

There is a plethora of data and functionality across the available API resources:

Product, Platform & Fund Information

With thousands of product/platform links, linked funds and charges at all levels you can access a huge ecosystem of fund data based around the UK market. Also, with access to the key DFMs under the Synaptic Risk Rating service, you can access risk data for funds and portfolios based on the Moody’s risk model.

Platform Comparison

Build investment profiles across the Synaptic product/platform/fund universe and deep-dive into cost and charge comparison data, reduction in yield and projection values. Platform Comparison brings powerful data into your back office to support advise journeys and compliance.

Pre-sales (Ex-ante) disclosure

For that ex-ante disclosure record we can provide details on stochastic and deterministic forecasts for investments, risk based on the Moody’s model and MiFID II disclosure for each fund in your portfolio. Bring the power of Ex-ante into your CRM and build bespoke reports based on your requirements.

Risk, Modelling and Portfolios

From mapping out clients’ risk appetite to matching and checking investments are still on track, this service helps you stay on top of risk-based compliance and find out when a portfolio may need rebalancing. From risk rating individual funds, through to complex portfolios or Synaptic Risk Rated DFMs you can understand stochastic outcomes, inherent annualised risk and probability of achieving investment outcomes. Reverse that and you can re-balance a portfolio automatically using the portfolio balancing service – chose a risk category and you’ll get the required weightings of your funds to meet that risk level.

Investment Calculation Modelling

If I have £10,000 today, how much will it be worth in 10 years? From the simple to the complex our modelling software allows you, or end-clients to model scenarios including inflation, indexation, contributions, withdrawals, total solution cost, risk levels, portfolios/funds and investment term. Along side simple forecasting the modelling suite can also help solve for given scenarios – if I want a £650,000 pension pot how much do I need to save each month to achieve my goal? Powering some of the leading robo-advice solutions in the UK.

Cashflow Modelling - Drawdown

Create complex income drawdown scenarios for retirement planning purposes. Supporting PCLS and UFPLUS, multiple income sources, inflation based modelling and flat or phased income requirements you can model drawdown scenarios or create a playground for your end-customers to design their own.

The Valuations Service & Ex-post Reviews

From pulling back valuations and contract enquiry data to using that in eEx-post reviews and rebalancing journeys our Ex-post disclosure services can help you build compliant reviews directly in your back-office.

Protection & Annuity Quote and Apply

Access whole of market protection quotes across protection products such as level term assurance, decreasing term, income protection, whole of life. Compare quotes and features before opting to apply – supporting both B2B and D2C provider products. Annuity quote services also supported.

MiFID II Disclosure Data

Access hundreds of data points on more than 100,000 funds covering the entire MiFID EMT V3/4 templates. Gather data about funds, use if for cost disclosure information or build fund information panels/factsheets. Direct access to single or portfolios of funds.

See our API Solutions in action

Learn how we can help to transform your business