When you’re balancing the need to provide high-quality advice with due diligence requirements, it’s essential to have a complete picture of products and funds.

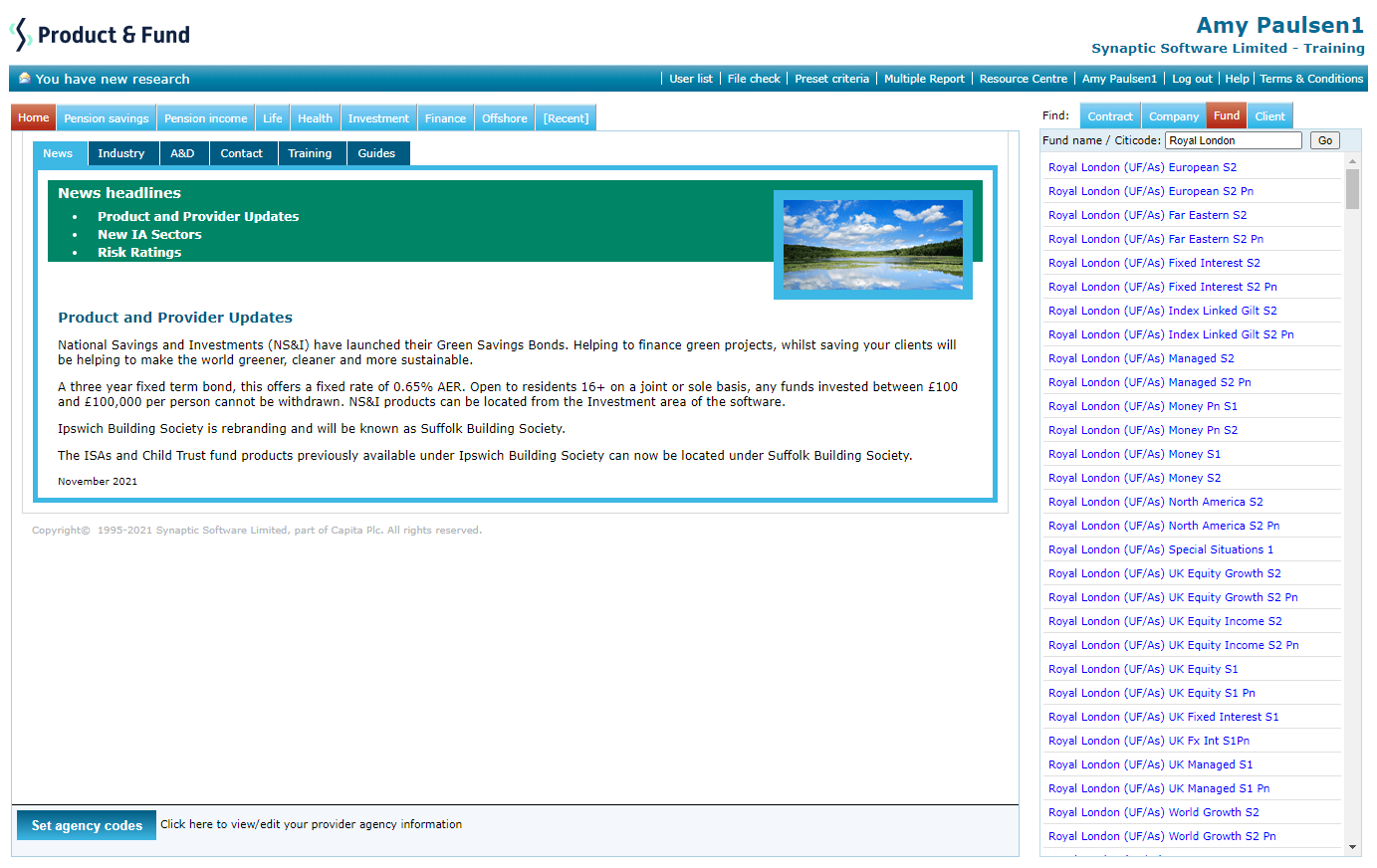

Quickly and expertly research the whole-of-market, navigate what’s available, and devise appropriate product and fund strategies for your customers.

Synaptic’s Product and Fund research directory provides easy access to all the information you need, so you can streamline and enhance recommendations for customers. Meanwhile, a full audit trail provides reassurance that you can meet the FCA requirement to prove due diligence.

How Product and Fund helps

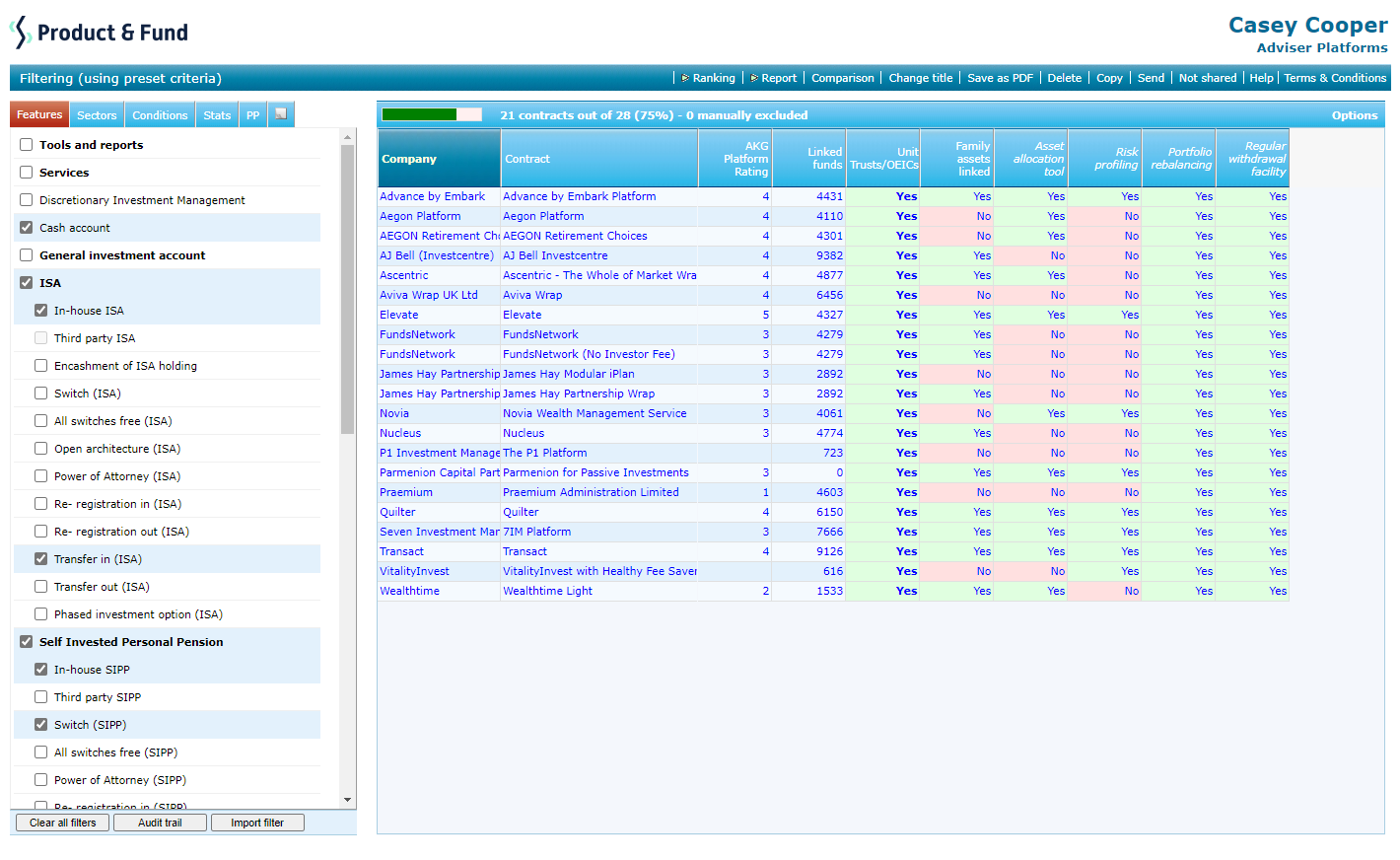

With thousands of funds and products, a huge range of filtering options, and comprehensive reporting, Product and Fund makes your compliance journey simple.

- Build compliant fund lists, ready to import to Synaptic Pathways for your Central Investment Proposition

- Enable compliance reviews across a whole-of-market view

- Find and research ethical investments

- Export and Report – helping to evidence your compliance journey

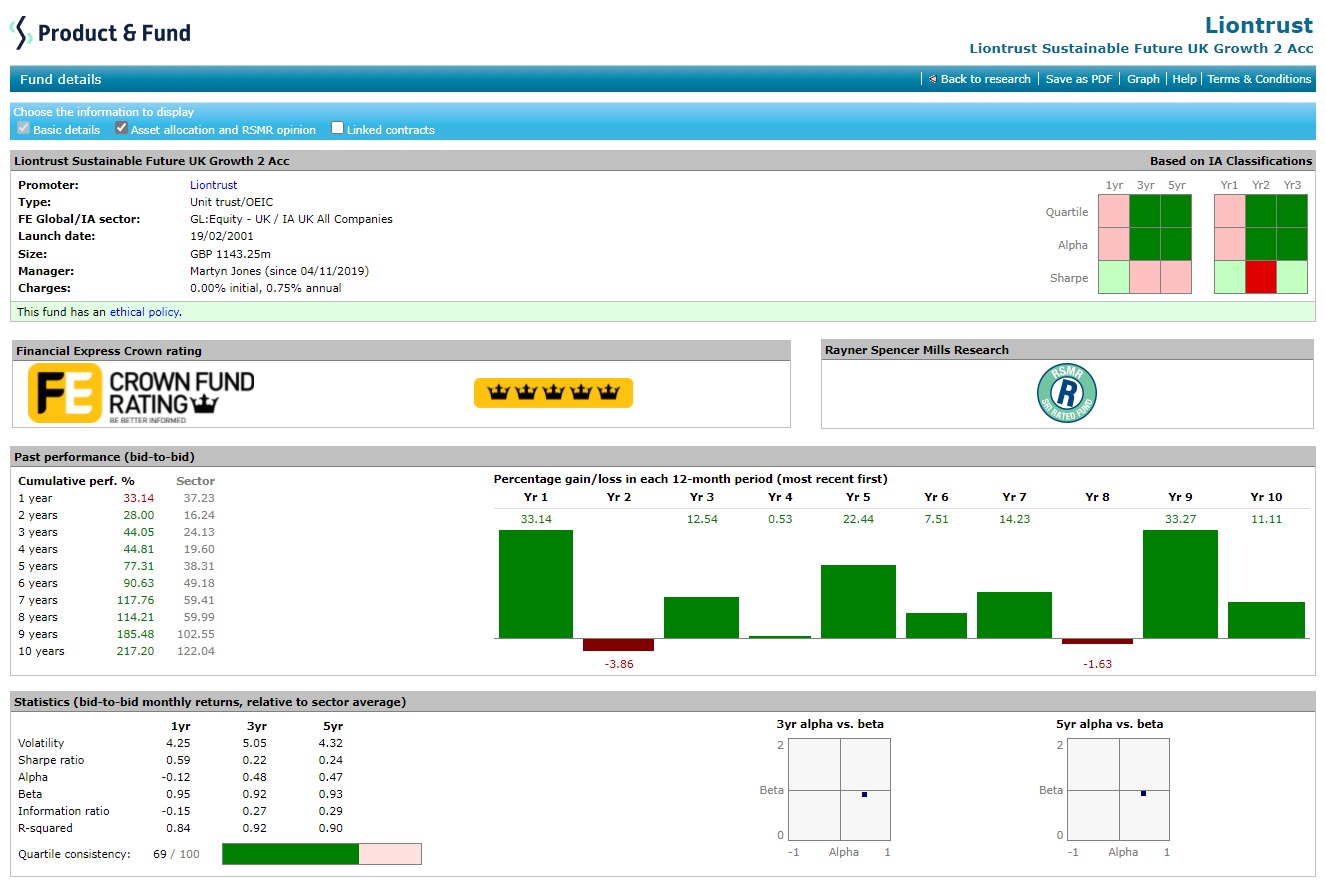

Detailed fund information

Access comprehensive fund promoter and manager information, past performance data, qualitative views (provided by Rayner Spencer Mills), and a full range of risk metrics.

Easy to review and compare

Look up, compare and filter all the information you need, including access to fund contract factsheets for further insight. User-friendly graphs and tables make it easier to communicate benefits to clients.

Track fund and share class

Know which funds are available in which products, and vice versa. Synaptic Product and Fund is the only comprehensive guide which tracks fund as well as share class availability by wrapper.

Configure central investment propositions

Make it easier to recommend appropriate investment bonds: generic advice is matched to client types, so you can quickly filter the options to find the most suitable investment and fund.

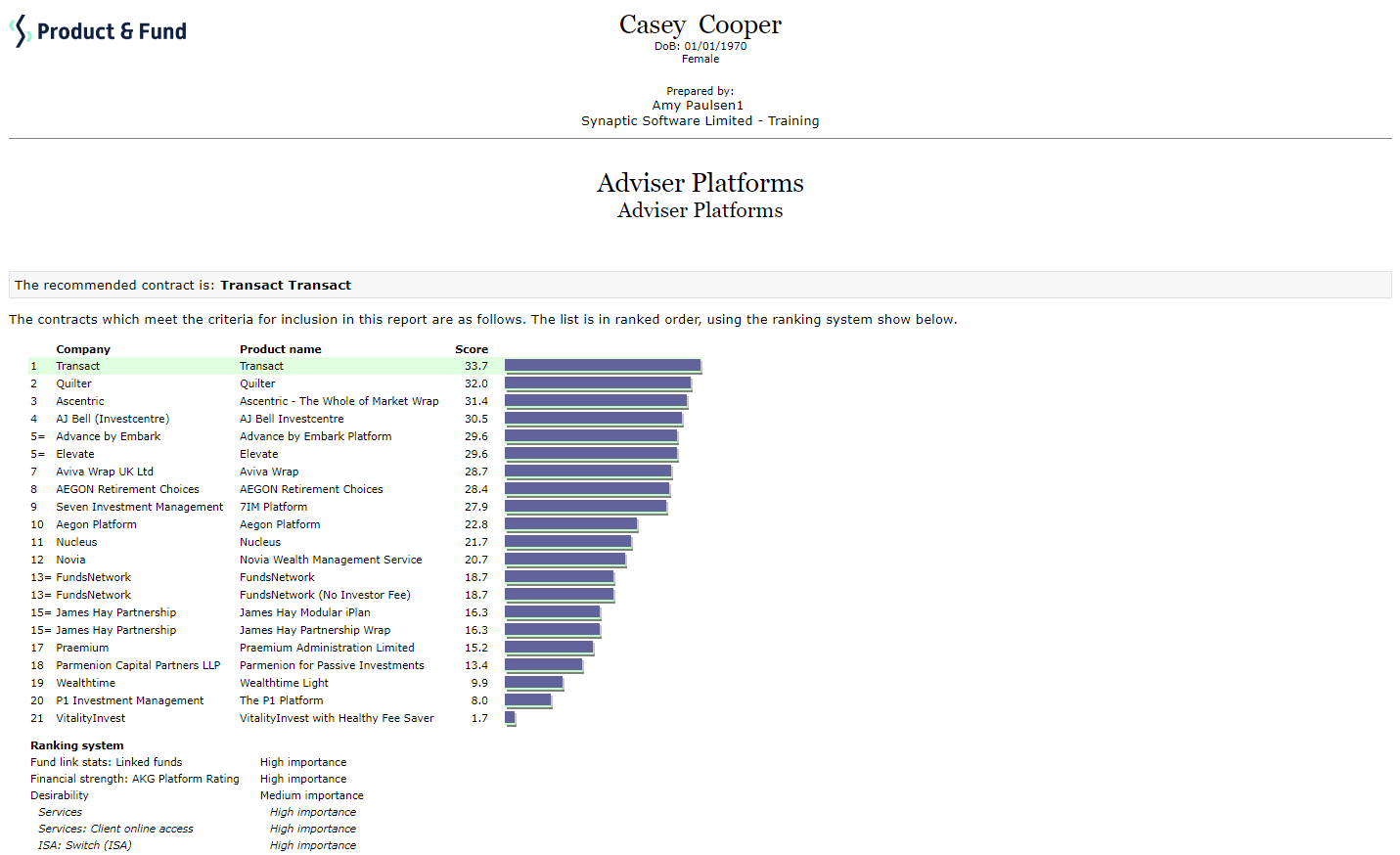

Full audit trail for reassurance of compliance

Full and automatic suitability reporting supports you with FCA requirements, including audit trails demonstrating the basis for your selection.

Developed to support business success

Collaboration tools make it easy to share research with clients and colleagues. The directory also features compliance monitoring and central administration of licences.

more than

1 million

links between funds, platforms and products to give whole-of-market coverage.

over

145,000

funds available for research in the Synaptic fund universe.

featuring

1,000+

filtering criteria for fast, accurate selection of the right products and funds for compliance.

Synaptic’s Product and Fund supports financial research at every step

Our Product and Fund solution has been developed according to proven research methodology, to support you in providing compliant recommendations.

1. Whole-of-market research

A complete picture of all available products and funds to review

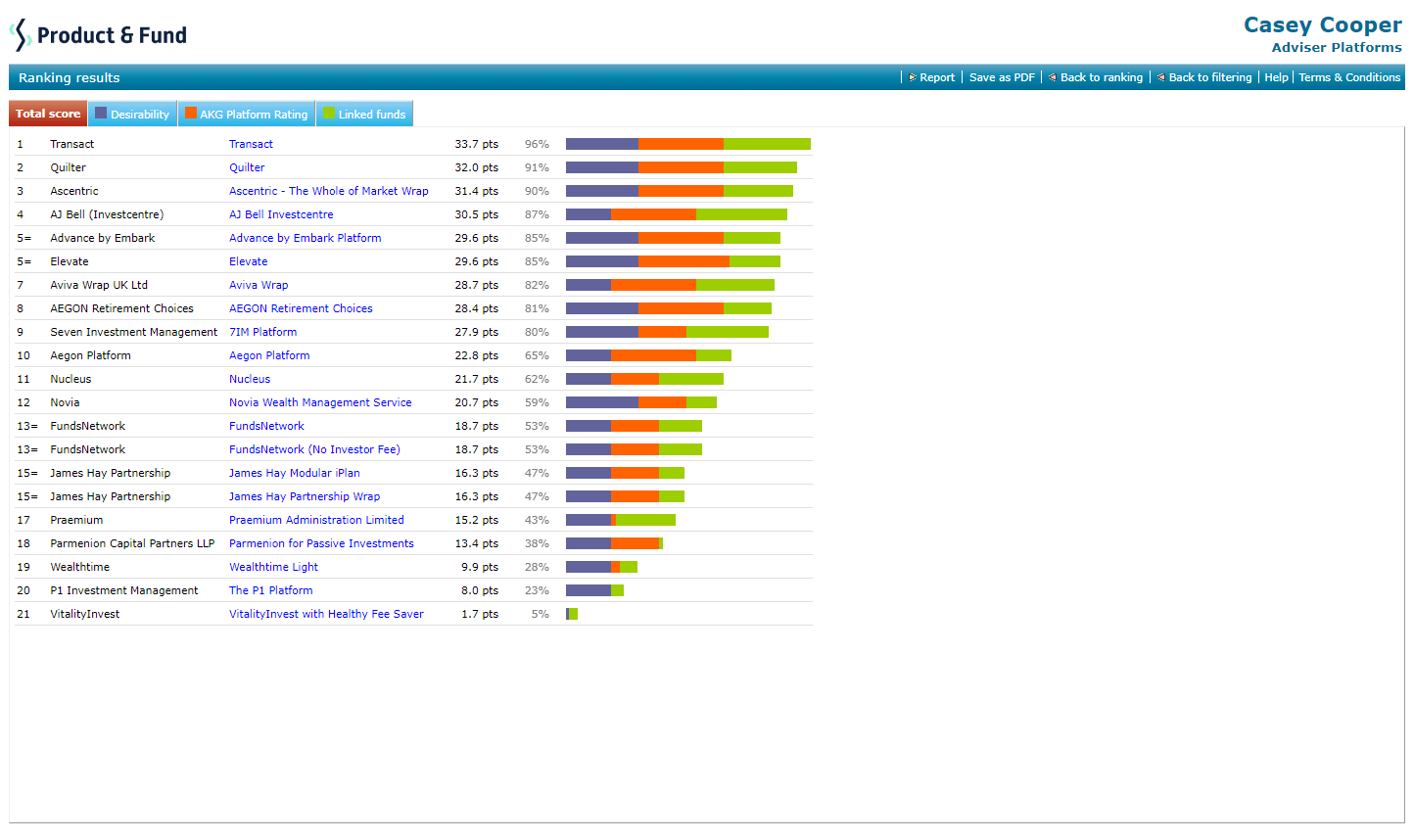

2. Easily compare products

Directly compare many products in a single view, with the creation of research grids

3. Filter what you don't need

Unsuitable contracts can quickly be eliminated for a clearer view

4. Make an informed decision

You have what you need to select suitable contracts and make your recommendation

Helping Canada Life clients prepare for modern retirement

"Although traditional target markets haven't necessarily changed, modern life has, which is creating different opportunities for advisers.

“There is an opportunity to rethink client communications and ensure clients are prepared for modern retirement".

Nick Flynn

Director, Retirement Solutions

Stay connected with our latest edition of Connection

Trends, insights and the latest industry commentary, covering the protection, wealth management and investment spaces. Connection magazine keeps you up to speed on everything advisers need to know each quarter.

See how Synaptic can streamline your business processes

Take a tour of the Synaptic toolkit, to discover how it can cut tasks from hours to minutes, and enable advisers to spend more time focussing on clients.