Streamline your clients’ risk, with Synaptic

To offer your clients reliable, robust advice, you need a clear view of investment risk.

The Synaptic solution combines Moody’s Analytics investment strategy and stochastic projections, to offer intuitive software for risk and suitability assessment and investment risk management – for head offices, paraplanners and advisers.

Adviser firms can access our risk assets free of charge, with the option to subscribe to additional software research tools to assist in other areas of due diligence or financial planning.

How Risk helps

- Investment strategy management

- Investment risk management tools

- Attitude to risk questionnaire

- Choice of 1-5 or 1-10 risk ratings

- Free access to risk ratings

access to over

1,300

Synaptic risk ratings.

from over

70

different promoters.

across

5

Synaptic products.

3 ways to access the benefits of Risk

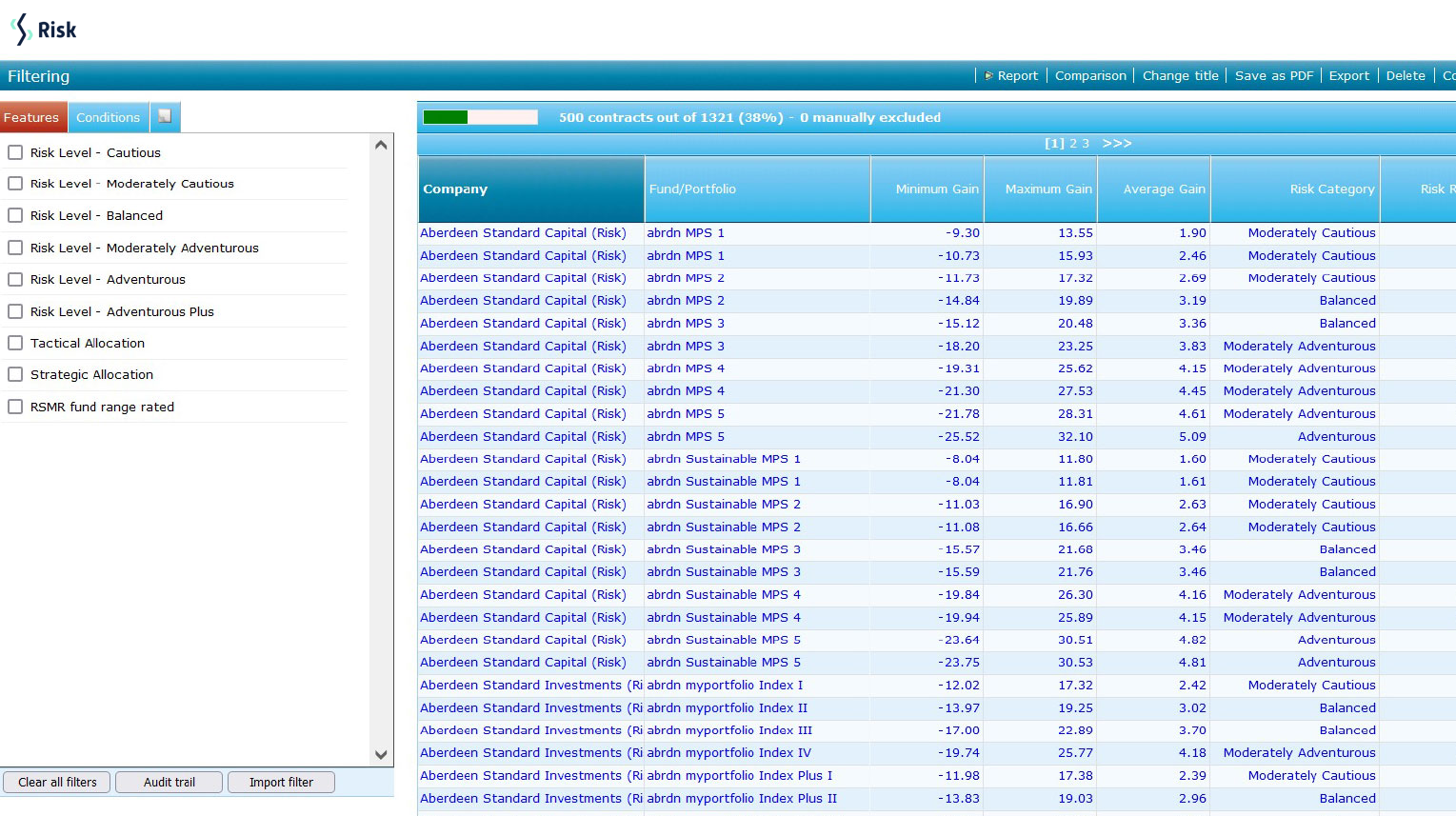

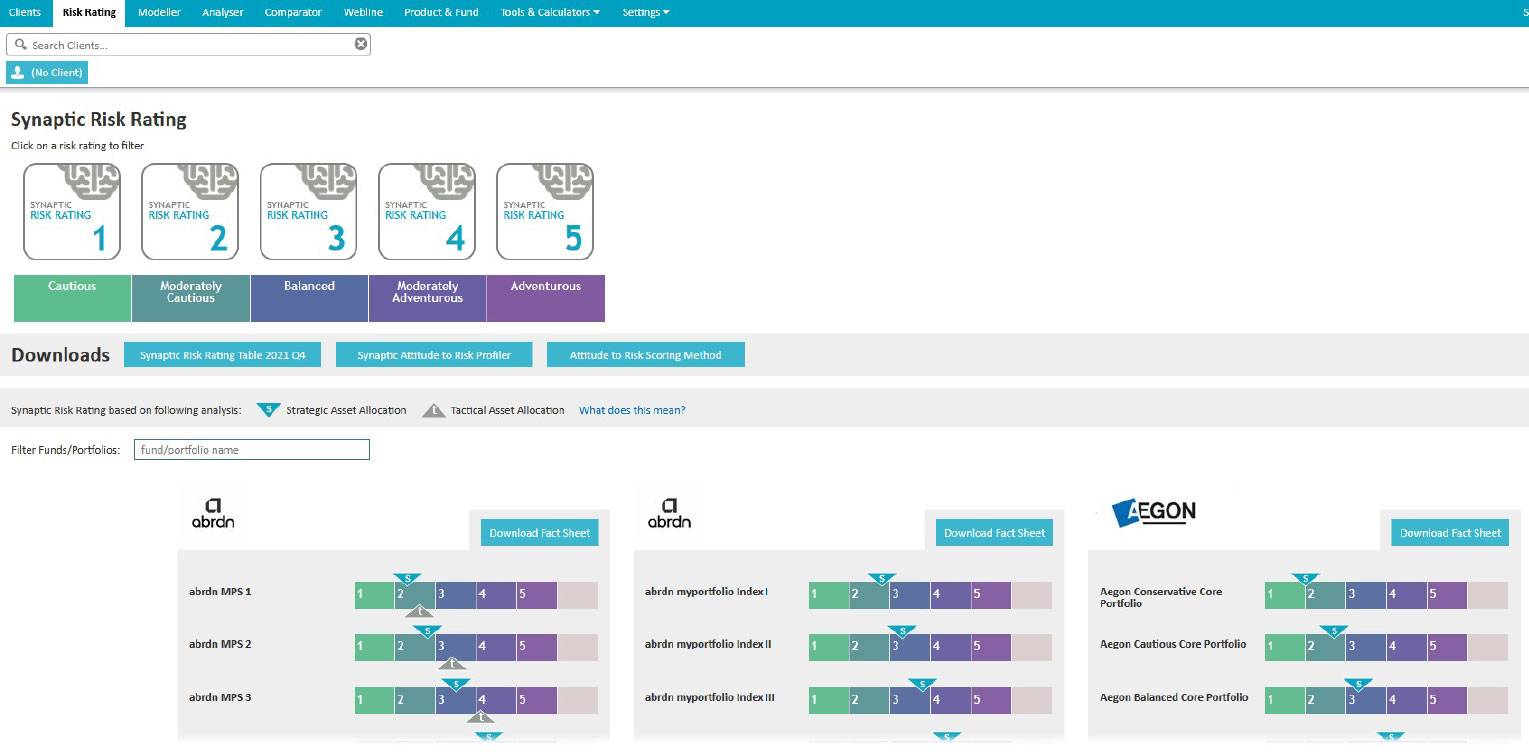

There are several ways in which users can access risk ratings. Either through the dedicated area in Synaptic Suite, or secondly, via Synaptic Product & Fund, where ratings can be filtered and compared. Thirdly, Synaptic Pathways can be used to access risk ratings.

What Synaptic Risk helps you to do

Find clients’ attitude to risk

The 12-question psychometric questionnaire is designed to align to the Moody’s risk model. Available in 1-5 and 1-10 formats, it assists in determining clients’ propensity for risk.

Compare ratings

The funds and portfolios of over 70 asset managers are risk mapped to the Moody’s risk framework. Risk is rated on a 1-5 and 1-10 basis to match your firm’s investment strategy.

Choose your investment strategy

Synaptic’s investment strategy tool enables investment profiling within the Moody’s risk framework. This helps you to identify a risk and reward framework, based on optimum asset allocation, and to better quantify and match risk to a client’s capacity for loss.

Synaptic Risk

To offer your clients reliable, robust advice, you need a clear view of investment risk.

Synaptic Risk is accessible free of charge, offering the capability to find your client’s attitude to risk and compare it against risk-rated DFM and multi-asset portfolios.

Find clients’ attitude to risk

A 12-question psychometric questionnaire, aligned to the Moody’s risk model. In 1-5 and 1-10 formats, it helps determine clients’ risk propensity.

Compare ratings

Funds and portfolios of 70+ asset managers, risk mapped to Moody’s risk framework. Risk-rated 1-5 and 1-10 to match your firm’s investment strategy.

Choose your investment strategy

Funds and portfolios of 70+ asset managers, risk mapped to Moody’s risk framework. Risk-rated 1-5 and 1-10 to match your firm’s investment strategy.

For Schroders, Synaptic is an invaluable tool

"Synaptic’s risk rating service is an invaluable tool which assists financial advisers in their fund/solution selection process to meet their clients’ attitude to risk and investment outcomes."

"We value their expertise and look forward to continuing to work together in how they assess our range of MPS, funds, and sustainable solutions we manage on behalf of UK-based intermediaries."

Alan Marshall

Senior Strategic Relationships Director

Stay connected with our latest edition of Connection

Trends, insights and the latest industry commentary, covering the protection, wealth management and investment spaces. Connection magazine keeps you up to speed on everything advisers need to know each quarter.

See how Synaptic can streamline your business processes

Take a tour of the Synaptic toolkit, to discover how it can cut tasks from hours to minutes, and enable advisers to spend more time focussing on clients.