In this edition...

- How to approach reviews: the task that defines firms Eric Armstrong, Client Director - Synaptic

- The UK market: Azkaban or Aladdin’s cave? Katie Poulson, Marketing Manager - RSMR

- Do multi-asset strategies provide good value? Andreas Zingg, Head of multi-asset solutions - Vanguard Europe

- Introducing ebi Jonathan Griffiths , CFA Investment Product Manager - ebi

- Generating income and capital growth – never the two shall meet? Jordan Sriharan , Fund Manager, Multi-Asset - Canada Life Asset Management

- The Merlin approach to ESG George Fox , Investment Manager, Independent Funds - Jupiter

- Protecting the vulnerable: navigating the evolving regulatory landscape in a post-pandemic world ,

- Optimise retirement income portfolios with a new asset class Yannis Katsis, Business Development Director - Just

- The first rule of financial planning: insure the breadwinner ,

As much as any other aspect of advice, how you handle your reviews defines your role as an adviser and determines the efficiency of your business. The majority of the income from advisory businesses relates to pensions, and the majority of pension work relates to reviews (Source ABI). Reviews can be very time consuming. The purpose of this article is to look at reviews in light of the launch of the new, improved review feature as part of the new Synaptic Pathways research and due diligence software solution.

As much as any other aspect of advice, how you handle your reviews defines your role as an adviser and determines the efficiency of your business. The majority of the income from advisory businesses relates to pensions, and the majority of pension work relates to reviews (Source ABI). Reviews can be very time consuming. The purpose of this article is to look at reviews in light of the launch of the new, improved review feature as part of the new Synaptic Pathways research and due diligence software solution.

Reviews are where the complex processes and inputs for ongoing advice converge. If they are not conducted well and consistently, then the best outcomes for your clients will be elusive and businesses will suffer with multiple systems struggling to keep up with technological and regulatory change, with too great reliance on manual processes.

The opportunity

Let us look first at the opportunity. Now is a fantastic time to be a financial adviser and a great time to have an adviser in the UK. When the modern era started in 2006 with A-Day or Pension Simplification, a steady stream of changes began to who got to advise on pensions and what pensions were offered. At this time, the lifetime allowance was £1.6m, when a million was a lot of money, and the annual allowance was over £200k (it’s now £60k and that’s only been raised to help keep fatcat NHS Consultants in their jobs to help stop healthcare in the UK imploding). The changes have marked the evolution of retirement planning to where we are today. With the relative demise of DB schemes, a generational demographic bulge and changing work patterns, there is now a tsunami of savings and investments destined for or in retirement, pointing to a genuine need of oversight from professional advisers. The incentive for firms to get their processes and systems around reviews working well is therefore enormous and we see this role belonging to Synaptic. Good advice, especially at scale, can be extremely lucrative, something that is recognised in the current industry trend of vertical integration and reflected in the extent of investment being made by ‘consolidators’ in our industry.

The challenge

The excellent 2019 report (and its follow up) by Origo and the Lang Cat ‘A disconnected world: an adviser’s reality’ documented the desperately poor technology experience of the average advisory firm. This includes the poor technological underpinning to advice, an area that has been notoriously under supported by software providers. The authors of the report suggested that a cap of £30m exists to the assets-under-advice that can be managed by a skilled administrator, due to the extent of work required and that’s only if you can find them or train them as they do not grow on trees. These administrators are skilful, producing results with so many factors working against them: working on multiple systems that don’t connect with delays caused by dealing with providers and platforms not providing information in a timely manner for decisions to made, creating delays in getting instructions acted upon.

Research-led digital transformation

Synaptic has developed the concept of ‘research-led digital transformation’. For 20 years or more, our industry has evolved an approach to technology where client and holding data would be stored in a central CRM, and third-party software tools bolted on that could access the relevant data and perform functions to support the advice process.

The Origo and Lang Cat report documented a different reality for advisers where there were almost no effective two-way integrations available to firms in order to build interoperability of systems. Synaptic has approached this problem by building the research tools fully integrated within the world’s leading CRM technology from Salesforce™ to ensure full integration of all the relevant components: access to the Moody’s stochastic engine for the risk framework, the ability to model expected growth and loss (VAR) and allowing portfolios to be risk assessed for alignment to clients’ risk profiles. Also in the list is the industry’s leading costs and charges engine, capable of producing accurate RIY figures on the fly and a range of proprietary platform, product and portfolio databases kept up by a team of dedicated researchers to ensure that streamlined, accurate research, including reviews. Research-led digital transformation erases the traditional shortcomings in the marriage of technology and advice and delivers a seamless, comprehensive and standardised process.

Suitability

Under previous rules, an adviser only had to demonstrate a service to justify on-going payments (trail) from a product. MiFID II changed that requirement to full re-assessment of suitability. Effectively, a new workload arrived overnight for firms to evidence a wide range of research and due diligence - involving revisiting the client’s objectives, attitude to risk, knowledge and experience, investment risk, investment horizon, capacity for loss and need to take risk. Not only that, the drive for transparency put more onerous demands for disclosure on costs and charges. As well as AMC, transactional costs on a line-by-line basis were demanded at specific share-class level. The service expanded from keeping in touch via a phonecall and an email to a full-blown advisory review.

Cost is now a central focus of all the current regulation, whether MiFID or Consumer Duty. The phrase ‘Value for Money’ has become a mantra. In most cases, Synaptic can collate costs automatically, including updates via the new Valuations service for the system to then set out the MiFID II costs and charges in a standard table format, including costs for the first year as a percentage, and as pounds and pence. The system is able to provide line item costings for funds, including separate transaction costs, platform, product, portfolio, adviser charging and special deals. Some firms we have talked to spend hours on MiFID II compliant research and due diligence. Synaptic can reduce that to minutes.

The Centralised Investment Proposition

Modern, platform-based solutions now facilitate the highest level of service and support to both adviser and investor. We have seen a complete transition of the role of financial adviser from sales person to financial planner, with increasing oversight on the custody of investments. New rules have come in to support the flow of assets from legacy products into new custody arrangements on investment platforms. The FCA defined for the industry, the role of the ‘Centralised Investment Proposition’, whose main attributes included the construction of investment solutions that were suitable for ‘client types’ or ‘segments’, and therefore were available on a ‘repeatable’ basis. It is after all much easier for the regulator to check a single investment solution with a firm rather than check the Whole-of-Market suitability of each investment made on a client-by-client basis. The regulator confirmed that it was possible for all clients in a firm to be invested in the same investment solution on the same platform (though warned of ‘shoe-horning’).

Advising outside a firm’s Centralised Investment Proposition

There is a specific issue relating to firms of all types, including firms with access to proprietary platform technology and restricted propositions. This is the ability to review legacy investments outside primary data, research and reporting mechanisms. Many firms can still have 50% or more assets under advice with third-party custody or ‘held away’ assets. If these are performing for clients, advisers will prefer to keep the funds invested (or they may be unable to be switched) and therefore not able to bring onto the domain of a firm’s Centralised Proposition.

Some firms have specialist functions within their organisations to deal with the reviews on these products that sit outside the research and reporting capabilities of their preferred platforms or providers. It is important to try to reduce the hours that can be spent analysing and reporting on legacy holdings. Synaptic Pathways has addressed this challenge and developed a review process that applies a consistent research methodology across all investments, legacy or not. Synaptic produces research to support recommendations into your Centralised Investment Proposition, as well as research and due diligence to review holdings efficiently.

This challenge will be particularly acute for firms that are in transition through consolidation or are growing their adviser numbers and seeking to provide consistent advice at scale. Conducting reviews on legacy products and managing Replacement business in a compliant manner is a determining factor of the quality of customer outcomes and the efficiency of a business. Without an efficient and reliable review process, streamlining advice will be difficult, business risk will be high, and profitability will be elusive. Firms aiming at scale need well-defined research and due diligence processes.

A final point. At the time of writing, even the Sunday papers are full of stories of consolidation of asset management firms (for example Rathbones and Investec), the approach to retirement age of many advisers (over 60% expected to retire before 2030) and the rise of the consolidators. What better way to ensure a decent valuation or hand over an advisory business than having a full record in Synaptic (Salesforce™) of all the investment recommendations that you have made, including custody details, underlying investments, historic costs and charges and income.

Synaptic Pathways is a complete research and due diligence solution. It will not dictate to you how you work, rather it will provide the research that will allow you to provide due diligence for every investment recommendation that you make, whether new money, a switch or of course a review.

Call to arrange a demo or a trial and transform the way your firm is able to conduct reviews the Synaptic way. Call now on 0800 783 4477

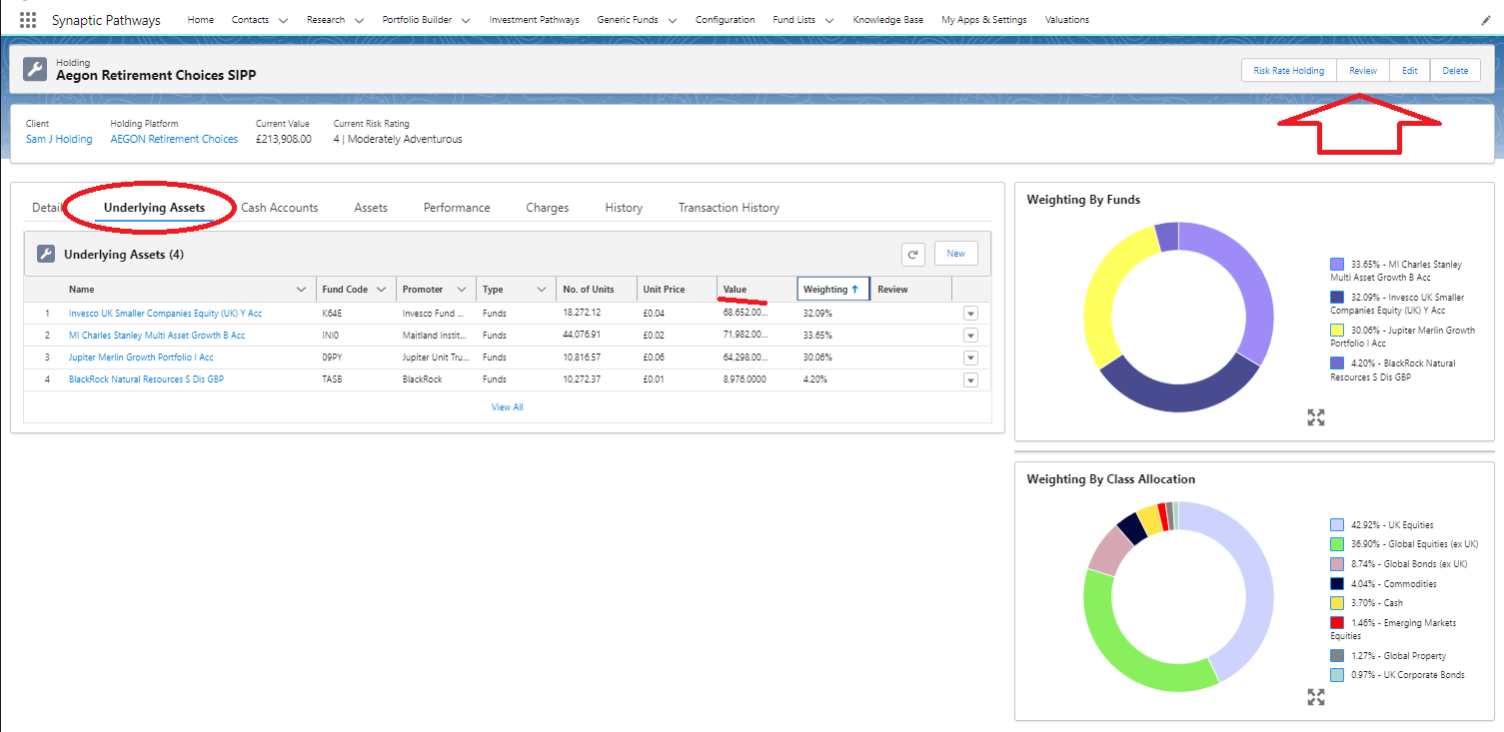

Screenshot above shows the holding information to be used for the review, where the current holding is updated to reflect the current valuation. This can be done manually or via the automated valuations service.

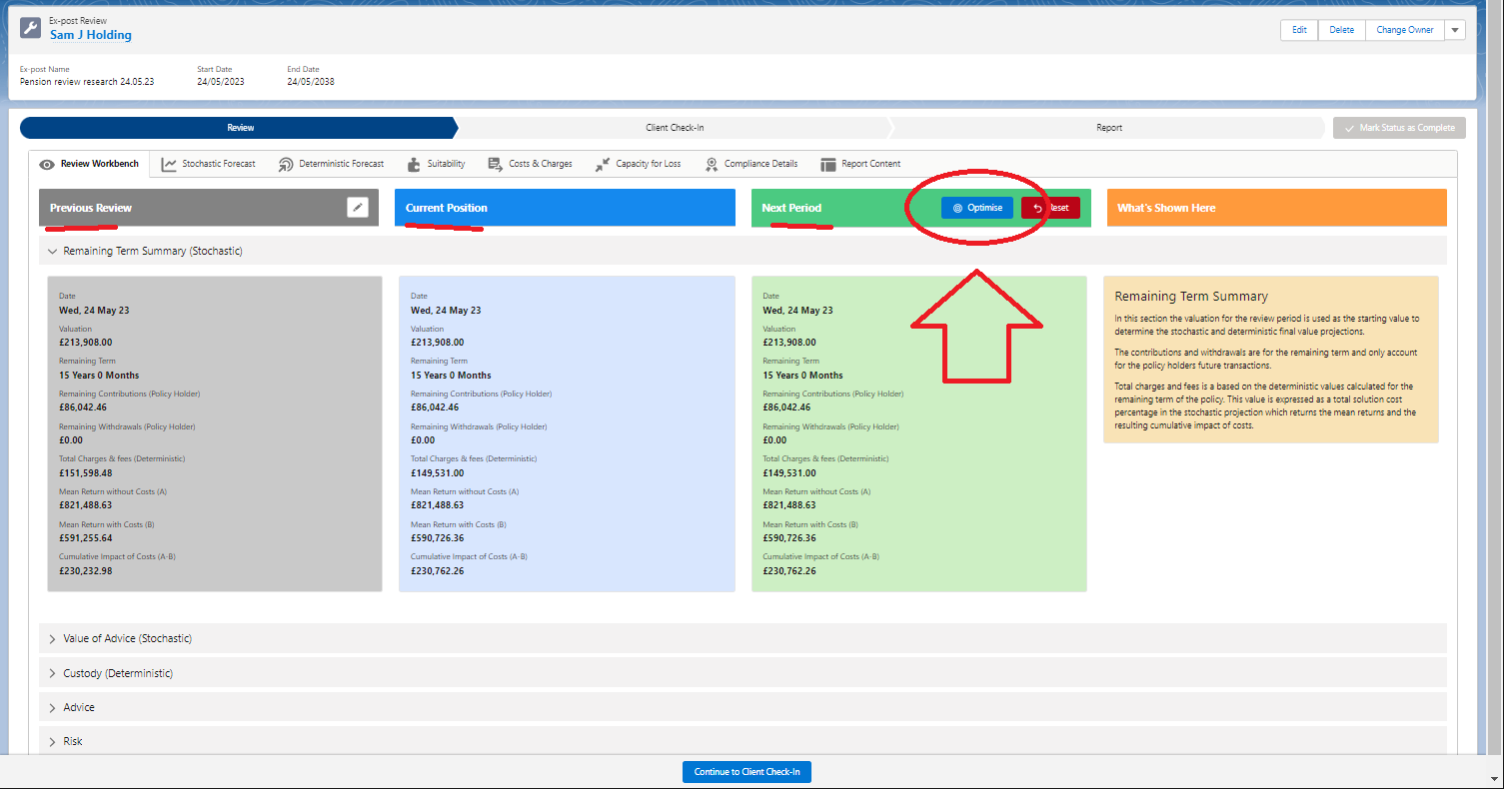

Screenshot above shows the set up for the review where previous research, current position and the forecast for the next period are all included in the software journey and the report. Highlighted is the ‘optimise’ button which allows rebalancing or other changes to the investments at the review.

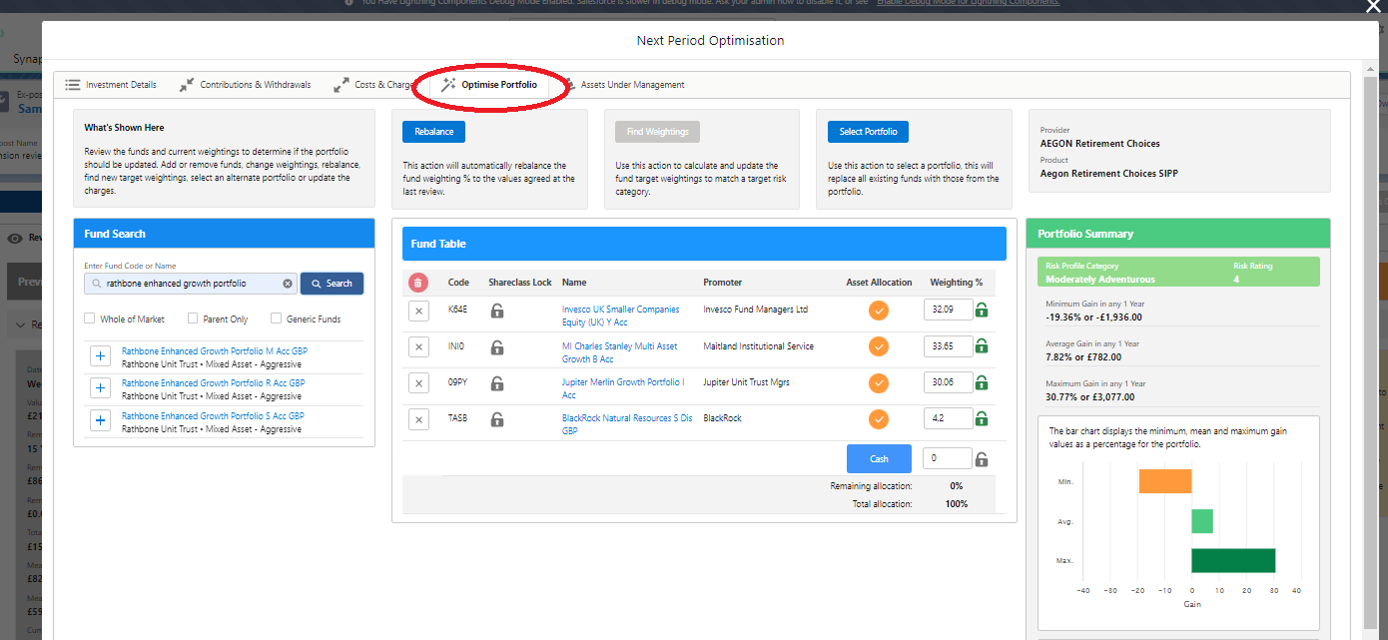

Screenshot above shows the ‘optimise portfolio’ tab where any adjustments to the portfolio can be made where necessary.

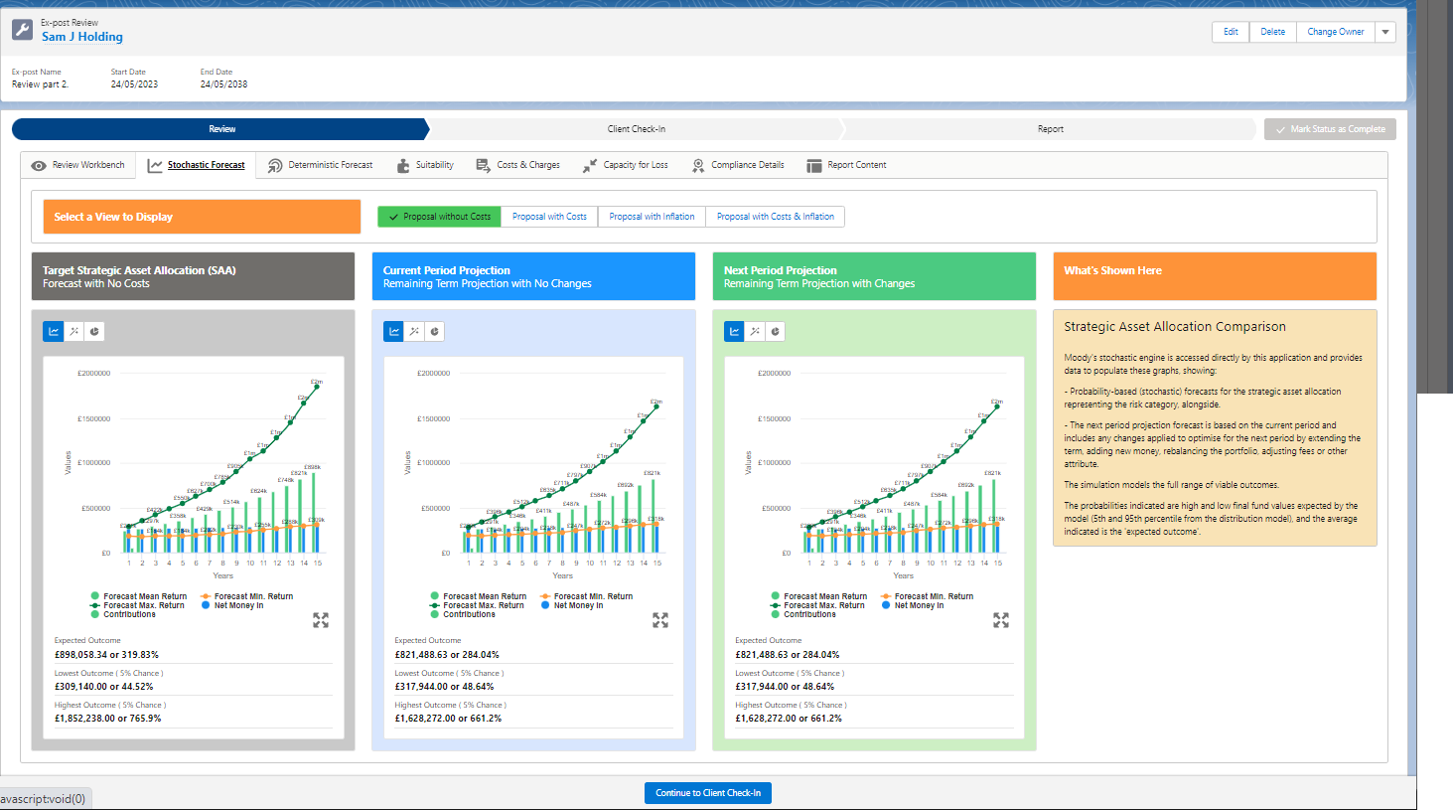

Screenshot above shows the stochastic forecasts for the different reporting periods relevant to the review, including in this case, the stochastic forecast graphs.

Get in touch

0800 783 4477

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.