In this edition...

- A Most Exceptional Recovery Guy Monson, CIO and Senior Partner Sarasin & Partners

- Staying the course Andrew Morris, Product Specialist Canada Life Asset Management

- Price and value: what you pay versus what you get John Husselbee, Head of the Liontrust Multi-Asset investment team Liontrust

- Why rebalancing client portfolios is good practice Georgina Yarwood, Investment Strategy Analyst Vanguard Europe

- Market Timing: is now the time to move your portfolio into cash? Hugo Thompson, Multi-Asset Investment Specialist HSBC Asset Management

- The investment journey: a balancing act Kirsty Wright, Head of Proposition – Pensions & Funds LV=

- Helping mining groups meet the challenge of sustainable development Sandra Crowl, Stewardship Manager Carmignac

- Introducing Multi-Asset Solutions in Goldman Sachs Asset Management Shoqat Bunglawala, Head of Multi-Asset Solutions for EMEA and Asia Pacific Goldman Sachs Asset Management

- What is the post-pandemic outlook for Asian shares? Richard Sennitt, Fund Manager, Asian Equities Schroders

- Retirement should be enjoyed, not endured John Stopford, Co-portfolio Manager, Diversified Income Fund Ninety One

- Is passive investing killing ESG? Jon Lycett, Business Development Manager RSMR

- Emerging from the winter of discontent Salman Ahmed, Global Head of Macro and Strategic Asset Allocation Fidelity International

- IG credit: bubble trouble, alpha opportunity, or both? Adam Darling, Co-manager Jupiter Corporate Bond

- The Unknown King-Makers of ESG Editorial team, Synaptic Software Limited

- How to drive more protection business to your website in 6 easy steps Editorial team, Synaptic Software Limited

- Innovation that protects: Webline journey updates Richard Tailby, Head of Sales Synaptic Software Limited

- Make your Central Investment Proposition (CIP) a pillar of your success Terry Lawson, Business Development Manager Synaptic Software Limited

- The ‘ex-ante’ compliance is icing on the financial planning cake Eric Armstrong, Client Director Synaptic Software Limited

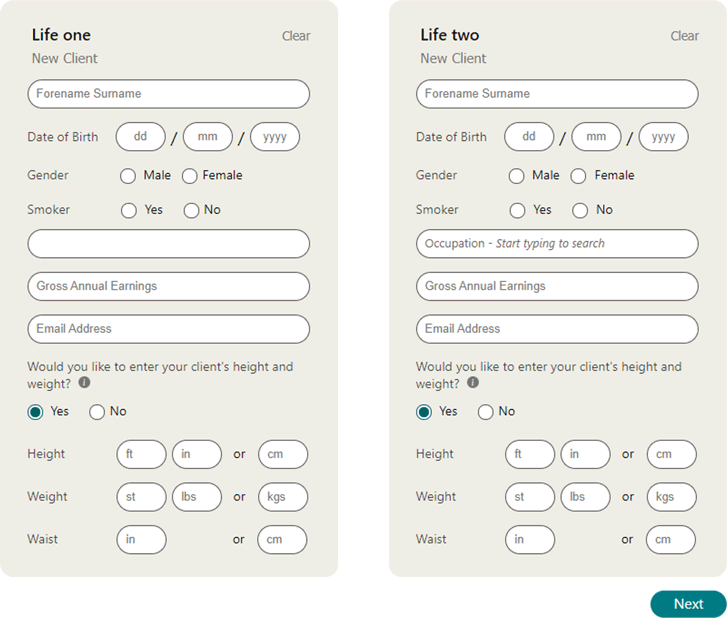

Synaptic's Protection division has been developing some valuable additions to the Webline journey. Whether you are an adviser or web-service consumer, these additional features will provide your clients with faster access to protection products and with more accuracy over the final premium than ever before. So, what's changed?

We have added a lifestyle question to the form, giving the adviser the option to capture the client's height and weight (BMI). This allows participating providers to return partially underwritten quotes, giving the end customer a more accurate view of what the end premium is likely to be.

This question is set to 'Yes' as default so that it can be seen from the outset of the quote. Once the adviser has entered the data or selected 'No' and updated the client record, it will not be asked again.

The form validation for Life two, including height and weight information, will only be activated once a client name has been entered for Life two. If this form remains blank, then the adviser can proceed to the next screen without entering any data for Life two.

Screen shows new entry fields to capture client's BMI details

Why is BMI important?

Height and weight are one of the first considerations for any protection provider when assessing an application for life cover, as these two measures are a great initial indicator of the overall health of a client.

The NHS guidelines state that a healthy BMI for adults is between 18.5 and 24.9 (ideal range). If your BMI is less than 18.5 it's classed as underweight, 25 to 29.9 is classed as overweight, and if BMI is above 30 it's classed as obese.

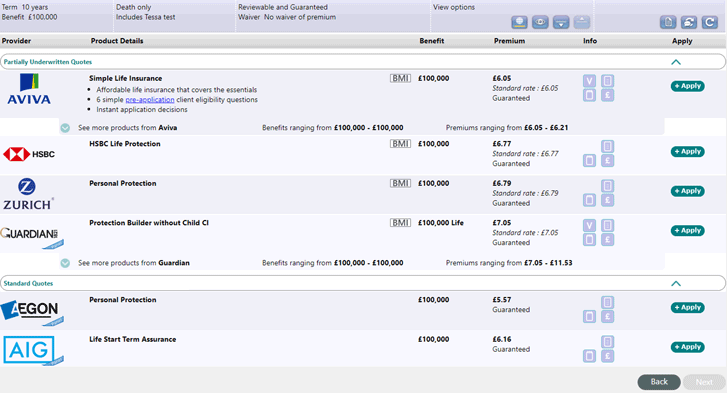

What is a partially underwritten quote?

A partially underwritten quote is where the premium returned by Webline has taken into consideration the client's height and weight (BMI). Protection Providers have a BMI range which fits their standard criteria. If the client's BMI goes outside the standard BMI range, then their premium will be underwritten and rated (or 'loaded').

Clearly the benefit of displaying a partially underwritten premium to the customer is that it gives them a more accurate view of what the end premium is likely to be, albeit other medical details and conditions will be handled at application stage.

Results screen displays partially underwritten quotes first, to speed up the application process.

Most of our protection providers have expressed an interest in presenting their quotations in this way. Phase one has made the following providers present:

Future developments

As part of the 2021 roadmap, Synaptic intends to bring more adviser/customer benefits, some of these are highlighted below:

Upsell and Conversion Initiative

Maximise engagement time and outcome, create a personalised experience for clients to match budget to feature to cover.

- Detailed CIC research with the integration of CI Expert.

- Indicative quotes for alternative benefits.

- Budget and benefits comparison.

- Feature-driven results.

- Data-driven augmented advice with social and business assurance factors.

Integration Partner Ecosystem

Extending automation with distribution partners by introducing 'conversion nudges' in our web services to empower your growth.

- Experience based APIs for indicative quotes and upsell options.

- Industry statistics and trend analytics.

- My 'MI' behaviour analytics.

- Protection feature data from the Synaptic Research Team.

Synaptic Protection Pathways

Protection re-imagined and delivered on the Salesforce™ platform for all our customers. Whether you use Salesforce™ today or not, we'll provide a Salesforce™ license as part of your annual Webline subscription. A single platform for all your protection needs, coming this Winter.

For more information or to arrange a demonstration, contact us on 0800 783 4477 or email hello@synaptic.co.uk

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.