In this edition...

- A Most Exceptional Recovery Guy Monson, CIO and Senior Partner Sarasin & Partners

- Staying the course Andrew Morris, Product Specialist Canada Life Asset Management

- Price and value: what you pay versus what you get John Husselbee, Head of the Liontrust Multi-Asset investment team Liontrust

- Why rebalancing client portfolios is good practice Georgina Yarwood, Investment Strategy Analyst Vanguard Europe

- Market Timing: is now the time to move your portfolio into cash? Hugo Thompson, Multi-Asset Investment Specialist HSBC Asset Management

- The investment journey: a balancing act Kirsty Wright, Head of Proposition – Pensions & Funds LV=

- Helping mining groups meet the challenge of sustainable development Sandra Crowl, Stewardship Manager Carmignac

- Introducing Multi-Asset Solutions in Goldman Sachs Asset Management Shoqat Bunglawala, Head of Multi-Asset Solutions for EMEA and Asia Pacific Goldman Sachs Asset Management

- What is the post-pandemic outlook for Asian shares? Richard Sennitt, Fund Manager, Asian Equities Schroders

- Retirement should be enjoyed, not endured John Stopford, Co-portfolio Manager, Diversified Income Fund Ninety One

- Is passive investing killing ESG? Jon Lycett, Business Development Manager RSMR

- Emerging from the winter of discontent Salman Ahmed, Global Head of Macro and Strategic Asset Allocation Fidelity International

- IG credit: bubble trouble, alpha opportunity, or both? Adam Darling, Co-manager Jupiter Corporate Bond

- The Unknown King-Makers of ESG Editorial team, Synaptic Software Limited

- How to drive more protection business to your website in 6 easy steps Editorial team, Synaptic Software Limited

- Innovation that protects: Webline journey updates Richard Tailby, Head of Sales Synaptic Software Limited

- Make your Central Investment Proposition (CIP) a pillar of your success Terry Lawson, Business Development Manager Synaptic Software Limited

- The ‘ex-ante’ compliance is icing on the financial planning cake Eric Armstrong, Client Director Synaptic Software Limited

"Although the composition of a portfolio should be stable, it should not be static. As valuations fluctuate, asset class momentum changes or the external economic conditions evolve, the return characteristics of each asset class will change."

Last year was a whirlwind for markets. Most investors started the year optimists: markets were in the midst of a rally, the global economy was expanding, and the prior decade's trade disputes were heading towards resolution. But we all know what happened next – the fastest market crash in history, with equity markets tumbling over 30% in a matter of weeks. Interestingly however, the recovery was almost as fast, and by the end of the year the S&P 500 was pushing all-time highs once more.

However, some are now concerned that equity markets look overvalued, credit spreads look too tight, and low yields mean government bonds offer scant protection, as a result they are wondering whether now is the time to solidify their gains, move their portfolios out of the markets, and store their savings in cash. Prima facie, this is a sound investment thesis, it rests on the first law of commerce: buy low and sell high. If the market is offering an attractive price for your assets, then sell up and store your money in cash, you can buy back in once valuations look more reasonable.

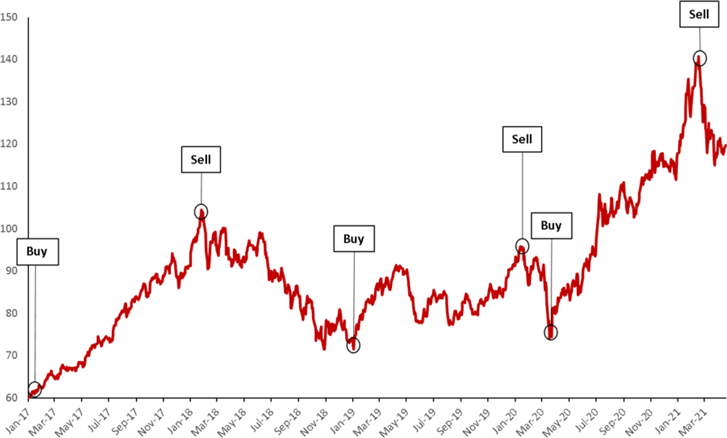

MSCI China – Net total return

Source: Bloomberg, 20/04/2021, for illustrative purposes only

A number of investment managers offer products which employ this principle as the primary investment device. Often referred to as market timing strategies, the investment thesis is simple: rotate client money out of markets which have reached their peak, and into markets which are due for a rally. An example would be rotating between Chinese equities and cash:

- Buy Chinese equities at the start of 2017.

- Sell before they fall in 2018.

- Rebuy the market at its nadir at the beginning of 2019.

- Hold it all the way to the next peak in January 2020, selling sell before the Covid-19 crash.

- And then ride the 2020 recovery, selling before markets dipped at the start of 2021.

Past performance is not a guide to future performance

Following the above strategy would have resulted in investment growth of almost 350% in under 4 years. Market timing strategies are able to deliver exceptional returns, all you need to know is which direction the market is going to move next. That said, anyone would make money if they knew how the market was going to move next, that is why these strategies often have impressive backtests, but struggle to deliver live track records with the same stellar returns. All too frequently investors pull their money out of the market too early and miss a great deal of growth, or buy back in too late, having missed the vast majority of the appreciation. The problem is that, in the short term, markets are volatile, unpredictable and frequently dislocated from fundamentals. This makes consistent, accurate prophecy of short term market movements very difficult.

Rather than just attempting to time the market, we believe that the best way to create value is by constructing a diversified portfolio which maintains long term exposure to a wide array of lowly correlated asset classes. This smooths volatility while maintaining strong performance and attractive risk adjusted returns. Academic research also supports the sentiment that the most effective way for investors to weather drawdowns is through diversification, not market rotation.

The question remains, how to decide which assets are included in the portfolio, and in what proportion? We advocate using robust, academically recognised investment techniques. The academic literature tells us that, in the long run, the returns of an asset are determined by a combination of the asset's current valuation, the macro and style factors exposures of the asset, the present economic environment, and the tendency for mean reversion. Using these inputs it is possible to model long term asset class returns and then construct an optimal portfolio considering asset class correlations.

Although the composition of a portfolio should be stable, it should not be static. As valuations fluctuate, asset class momentum changes or the external economic conditions evolve, the return characteristics of each asset class will change. These changes should be reflected in a portfolio's long term asset allocation. Shorter term, or 'tactical', positions can and should be used to add value. However, when short-term positions are initiated they should have a sound economic rational and not solely focus on following the crowd.

Market timing makes for a compelling investment narrative. It can certainly be useful as one input into tactical asset allocation decisions, but a sustainable driver of long term returns it is not. Investors who want to move beyond myopia, neutralise the market noise, and generate sustainable returns should focus on creating globally diversified, long term, fundamentals driven, investment portfolios.

For more information on our multi-asset strategies, please visit www.assetmanagement.hsbc.co.uk/en/intermediary/investment-expertise/multi-asset or contact us at: wholesale.clientservices@hsbc.com

For Professional Clients only and should not be distributed to or relied upon by Retail Clients.

Not for further distribution. This material is provided for informational purposes only and is not a solicitation or an offer to buy or sell any security or instrument or to participate in any trading or investment strategy. The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Any views expressed are those of HSBC Global Asset Management (UK) Limited only and are subject to change without notice. Care has been taken to ensure the accuracy of the information but HSBC Global Asset Management (UK) Limited accepts no responsibility for any errors or omissions contained therein.

To help improve our service and in the interests of security we may record and/or monitor your communication with us. HSBC Global Asset Management (UK) Limited provides information to Institutions, Professional Advisers and their clients on the investment products and services of the HSBC Group.

Approved for issue in the UK by HSBC Global Asset Management (UK) Limited, who are authorised and regulated by the Financial Conduct Authority. HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities provided through our local regulated entity, HSBC Global Asset Management (UK) Limited.

www.assetmanagement.hsbc.com/uk

Copyright © HSBC Global Asset Management (UK) Limited 2021. All rights reserved. ED2768 EXP311221

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.