Reducing research from hours to minutes

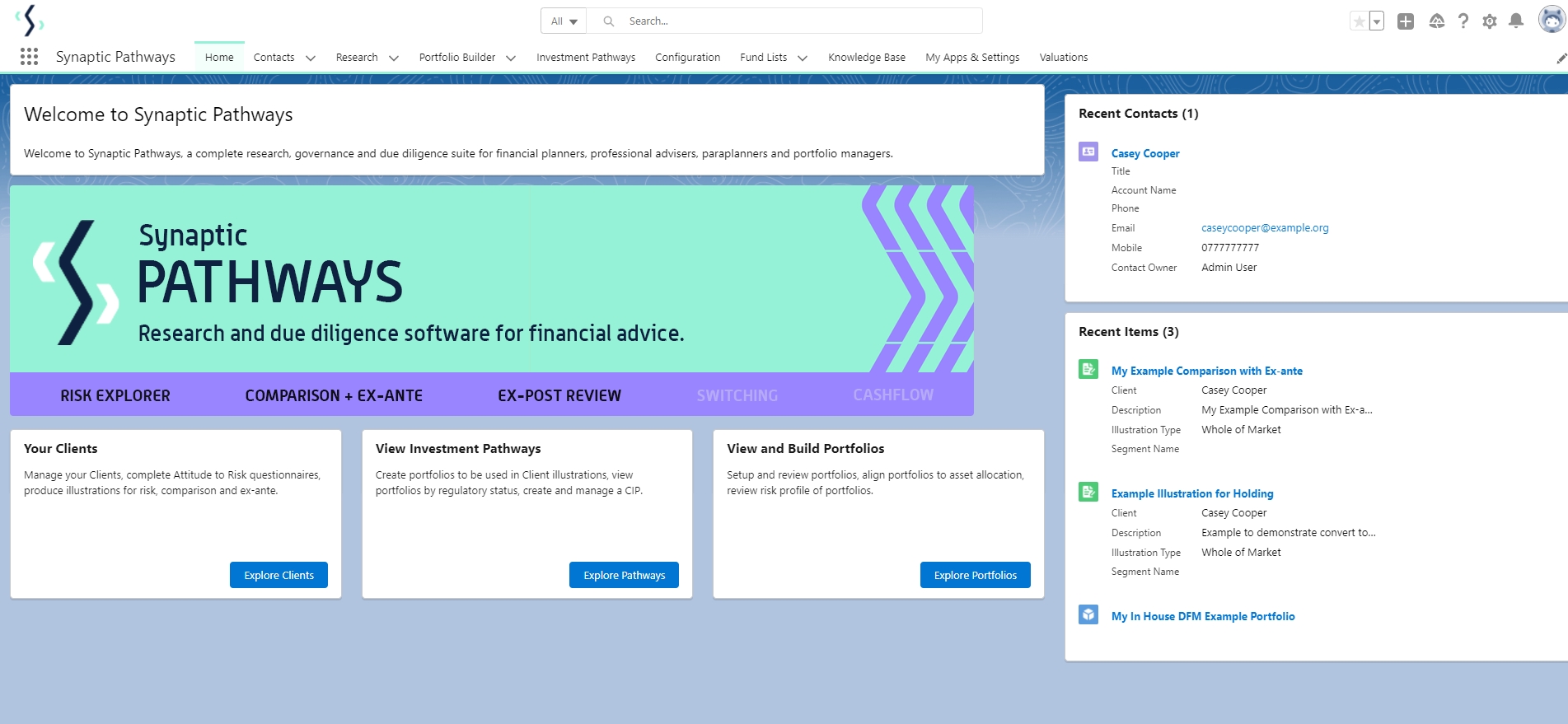

Pathways is an entirely new, comprehensive technology solution, for the modern advisory firm – enabling efficient delivery of streamlined, consistent advice, based on their own investment strategy.

A complete research, governance and due diligence suite, Synaptic Pathways has been created especially for financial planners, professional advisers, paraplanners and portfolio managers.

It delivers comprehensive data on platforms, products, portfolios and funds across integrated research tools. These include client risk profiling, investment risk profiling, asset allocation and forecasting from Moody’s Analytics. Synaptic Pathways also offers costs and charges analysis to MiFID II disclosure rules (Ex-ante and Ex-post) and Switching.

Start your 30-day free trial today to see for yourself.

In addition, you can easily and quickly gain access to powerful, scalable, performant APIs with Synaptic. Contact us and we can give you some examples of the types of data and calculations.

Research redefined

- Create compliant Ex-ante and Ex-post advice

- Build a Central Investment Proposition to ensure compliance

- MiFID II data in each stage of research

- Built around risk – digital Client ATR, risk-focussed client segments and risk built in every report

- Built on the powerful Salesforce™ platform

See Synaptic Pathways in action

Take a free fully functioning, instant-access 30-day trial of Synaptic Pathways and see how it could transform your advice business.

Pathways in 90 seconds!

- See how to create compliant ex-ante and ex-post advice

- Watch how easy it is to build a Central Investment Proposition

- See how Pathways is built on Salesforce™

How Synaptic Pathways helps

Pathways is the only complete advice and due diligence research solution on the market. Fully automated and integrated, and designed in close collaboration with advisors, our technology enhances the efficiency of advisory firms of all sizes, giving them more time to deliver an improved customer experience.

Independent whole-of-market analysis

Meet the highest standards of research, due diligence and disclosure. Data on products and funds – across a suite of integrated research tools – includes investment income forecasts from Moody’s Analytics. A 360° view enables advisors to provide advice in line with customers’ life situations, personal values, economic factors, risk and opportunity cost.

Supports all compliance requirements

Pathways makes it easier to deliver MiFID-compliant disclosure and investment outcome illustrations, to demonstrate suitability (ex-ante and ex-post). It also facilitates work with segments, client types and full Centralised Investment Proposition (CIP) management, as directed by the PROD rules.

Secure collaboration and data-sharing

The powerful and compliant Salesforce® enterprise messaging platform is integrated with our portfolio builder, so you can make enquiries about individual investment or pension wrappers while reducing the risk of data loss or security breaches.

Automation reduces administration

Client information, product and fund data, costs and charges analysis, and goal-based financial planning illustrations, are all integrated and fully automated. So you’ll spend less time on administration, compliance and audit, leaving more time to focus on growing your business.

Quick and powerful for high-quality advice

Pathways supports digital transformation with powerful, innovative tools combining crucial elements of your workflows and processes to streamline operations. Advisors are freed from rekeying data, running multiple systems or relying on an overstretched back office.

Enhance customer experience, from onboarding to reviews

Share compelling and instructive documentation with your clients as part of the advice process. With administration significantly reduced, you’ll have more time build customer relationships and attract new clients.

1. DETERMINE

Determine their risk and capacity for loss, alongside investment selections, using market-proven income forecasting. Pathways leverages Moody’s Analytics, available for the first time for retail advice.

2. Identify

Our secure, powerful, enterprise messaging platform and portfolio builder helps you identify all viable alternatives for portfolio and fund management, managed solutions and discretionary funds.

3. Evaluate

Our research and due diligence software provides the full picture, including total cost, advisor charging for on- and off-platform products, investment switching and critical yield. You can also generate retirement income analysis and cashflow modelling.

4. Automated

For the first time, a single automated system is capable of conducting ex-post research. This includes illustrations to show compliance and suitability, and whether the advice requires rebalancing or switching or indeed, no action.

data for over

140,000

funds available in Pathways, including asset allocation data and MiFID II.

built on the

#1

CRM provider worldwide.

powered by

65+

APIs harnessing the power of Synaptic data, research and the proprietary calculations engines.

Risk profiling and suitability

Match customer investments to their objectives and risk profile.

- Digital ‘Attitude to Risk’ questionnaires

- Moody’s-based stochastic risk modelling

- Build risk-focussed portfolios

- Access fund data from 55+ Discretionary Fund Managers

- Create reports

Ex-ante pre-sales reporting

Compare cost and charge data, to identify suitable investments, demonstrate compliance.

- Compare RIY across product / platforms

- Create investments with multiple wrapper types

- Convert ex-ante directly to notional holding

- Comparison / suitability reporting

- Stochastic and deterministic modelling

Central Investment Proposition

Create bespoke CIP around compliance needs. Build MiFID II compliance segments for clients.

- Build and manage include / exclude fund lists

- Specify platforms, products, portfolios and funds for your CIP

- Create client segments and assign to advisers

- Whole-of-market override permissions options

- Build compliant portfolios

Helping Julian Harris with professional reports

"For Investment and Pension advisers, we recently chose to recommend the full suite of Synaptic Software.”

“In our view, this improves the compliance standard of our client files, improves efficiency and time for advisers, assists with protecting them and the network from future complaints, and provides advisers with easy-to-produce, professional reports."

Julian Harris

Director

Stay connected with our latest edition of Connection

Trends, insights and the latest industry commentary, covering the protection, wealth management and investment spaces. Connection magazine keeps you up to speed on everything advisers need to know each quarter.

See how Synaptic can streamline your business processes

Take a tour of the Synaptic toolkit, to discover how it can cut tasks from hours to minutes, and enable advisers to spend more time focusing on clients.