In this edition...

- A Most Exceptional Recovery Guy Monson, CIO and Senior Partner Sarasin & Partners

- Staying the course Andrew Morris, Product Specialist Canada Life Asset Management

- Price and value: what you pay versus what you get John Husselbee, Head of the Liontrust Multi-Asset investment team Liontrust

- Why rebalancing client portfolios is good practice Georgina Yarwood, Investment Strategy Analyst Vanguard Europe

- Market Timing: is now the time to move your portfolio into cash? Hugo Thompson, Multi-Asset Investment Specialist HSBC Asset Management

- The investment journey: a balancing act Kirsty Wright, Head of Proposition – Pensions & Funds LV=

- Helping mining groups meet the challenge of sustainable development Sandra Crowl, Stewardship Manager Carmignac

- Introducing Multi-Asset Solutions in Goldman Sachs Asset Management Shoqat Bunglawala, Head of Multi-Asset Solutions for EMEA and Asia Pacific Goldman Sachs Asset Management

- What is the post-pandemic outlook for Asian shares? Richard Sennitt, Fund Manager, Asian Equities Schroders

- Retirement should be enjoyed, not endured John Stopford, Co-portfolio Manager, Diversified Income Fund Ninety One

- Is passive investing killing ESG? Jon Lycett, Business Development Manager RSMR

- Emerging from the winter of discontent Salman Ahmed, Global Head of Macro and Strategic Asset Allocation Fidelity International

- IG credit: bubble trouble, alpha opportunity, or both? Adam Darling, Co-manager Jupiter Corporate Bond

- The Unknown King-Makers of ESG Editorial team, Synaptic Software Limited

- How to drive more protection business to your website in 6 easy steps Editorial team, Synaptic Software Limited

- Innovation that protects: Webline journey updates Richard Tailby, Head of Sales Synaptic Software Limited

- Make your Central Investment Proposition (CIP) a pillar of your success Terry Lawson, Business Development Manager Synaptic Software Limited

- The ‘ex-ante’ compliance is icing on the financial planning cake Eric Armstrong, Client Director Synaptic Software Limited

We seem to talk a lot about risk these days. Whether it's risk of infection or the risk of investment, that four letter word is high on most peoples' agenda.

"Last year reminded us how unforeseen external factors can quickly escalate to challenge even best laid plans. A 1-in-20-year market shock was a very real risk that many experienced for the first time and, if you were in drawdown, that potentially hurt."

Of course, managing risk is nothing new – and as an insurer with a 178-year heritage, risk is a currency we're pretty familiar with.

Last year reminded us how unforeseen external factors can quickly escalate to challenge even best laid plans. A 1-in-20-year market shock was a very real risk that many experienced for the first time and, if you were in drawdown, that potentially hurt.

Whilst advisers are skilled in communicating the risks taken by investment managers to generate returns, few clients would have appreciated the likelihood of double digit dips. Last year tested everyone's composure, particularly those clients who are predisposed to investor anxiety.

Managing the risks which emerge as clients move through later life is fundamental to a successful decumulation plan. Many advisers use a Centralised Investment Proposition (CIP) to build a bespoke investment journey that helps clients ascend the accumulation mountain. Increasingly, advisers are also developing an equivalent Centralised Retirement Proposition (CRP) to build a decumulation journey that offers clients a safe descent in the drawdown phase.

Whichever journey, advisers need to master a three-part balancing act to ensure they are choosing the right investment engine:

- The risk required for the client's journey.

- The client's attitude to that risk journey; and crucially.

- The client's capacity for loss.

This, in particular, is key post-Covid. Our own research, the Wealth and Wellbeing Monitor*, shows that 66% of mass affluent customers aged 55-64 are not 'retirement confident', 36% said their finances were worse now than 3 months ago, and 66% of mass affluent parents with 18-30-year-old children spent money helping them out. Clients' lifestyles are changing, their finances are under different pressures, and they are re-evaluating what's important.

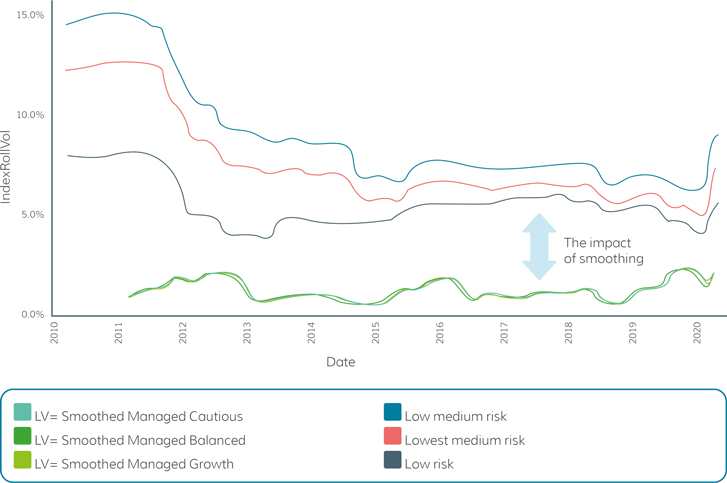

Chart 1: Comparing realised volatility of the LV= Smoothed Managed Funds with relevant risk profiles

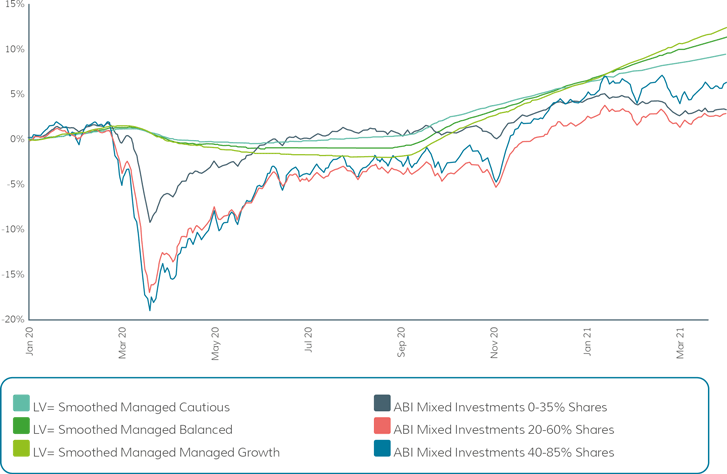

Chart 2: LV='s smoothing mechanism throughout 2020

Running out of money or having to reduce future withdrawals are the main concerns for many clients in drawdown. While each adviser will bring expert knowledge to help their clients navigate drawdown over possibly a 20 or 30-year planning horizon, two potential problems to address are volatility drag and sequencing risk.

- Volatility drag is the difference between average returns and compounded returns. For example, if a £100,000 pension plan fell by 10% to £90,000 in year 1, it would need to grow by 11.1% in year 2 to get back to parity (ignoring withdrawals). Volatility drag is amplified by withdrawals, which can lock in losses meaning the portfolio needs to work harder to get back to its original valuation.

- Sequencing risk refers to how the order of returns impacts the longevity of a drawdown plan. Once regular withdrawals are underway, poor returns in the early years can have a disproportionately negative effect on the value of the plan, even if poor returns are subsequently followed by good returns. The emotional and financial impact of this can be particularly detrimental.

These risks can severely reduce the level of income clients can sustainably withdraw and impact the longevity of the drawdown plan. As such, the ability to access a smoother investment journey is proving attractive for many clients.

Of course there are key differences in the smoothed solutions available in the market. One that's proven to absorb the impact of market shocks, provides a low-volatility investor experience, and delivers steady performance over the medium to long term is surely worthy of consideration.

The Smoothed Managed Fund range from LV= provides effective downside protection for investors when they need it most, such as in March 2020 (see chart 1).

Through the funds' unique smoothing mechanism, LV= take on the significant majority of the investment risk in volatile markets (see chart 2). You can see that the smoothing process effectively dampens market fluctuations when comparing the realised volatility of the LV= Smoothed Managed Funds with relevant indices for their risk profiles (2010-2020).

While managing risk is essential in drawdown, the first hurdle for any plan is being able to stick to it. Smoothing can help deliver emotional comfort to investors along their investment journey, and for anxious, risk-averse clients that could just help provide them with the best plan they could realise in practice.

Find out more at lvadviser.com/smoothed-investments

Sources:

* LV= Wealth and Wellbeing Monitor, December 2020

Chart 1: FE fundinfo performance as at 31st March, 2021

Chart 2: LV= Smoothed Managed Fund range mapped to independent risk framework. Based on Data to the end of June 2020.

Disclaimer: In exceptional market conditions (when the underlying price is 80% or less of the averaged or `smoothed' price) the fund will be valued on the underlying or daily gradual averaged price. We reserve the right to move to the underlying or daily gradual averaged prices at other times.

Past performance doesn’t reflect what will happen in the future. The value of your investment can go down as well as up.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.