In this edition...

- Hours to minutes Editorial team, Synaptic Software Limited

- Synaptic Pathways: the advice research revolution has arrived Eric Armstrong, Client Director, Synaptic Software Limited

- Value for money matters when assessing suitability John Warby, Senior Business Relationship Manager, Synaptic Software Limited

- The road ahead on suitability and disclosure Natalie Holt, Content Editor The Lang Cat

- Developing your investment proposition David A Norman (DAN), CEO TCF Investment

- State of the Nation Ian McKenna, Founder of Financial Technology Research Centre and AdviserSoftware.com FTRC

- Few places to hide Guy Monson, CIO and Senior Partner Sarasin & Partners

- Ensuring the “new normal” is a better normal Ben Lester, Head of Distribution – UK & International Praemium

- Stay the course if you can (but better too early than too late) James Klempster, Deputy Head of the Liontrust Multi-Asset team Liontrust

- Can financial goals be achieved through one fund? Mohneet Dhir, Multi-Asset Product Specialist Vanguard Europe

- Talking Trash: Why it’s not a waste of time Luke Barrs, Head of Fundamental Equity Client Portfolio Management for EMEA & Asia ex-Japan Goldman Sachs Asset Management

- Demand for growth funds rises amid risk-on environment Antony Champion, Head of Intermediaries Brewin Dolphin

- The best of both worlds Ian Jensen-Humphreys, Portfolio Manager Quilter Investors

- Global Sustainable Equity: a renewable, electric and digital future Hamish Chamberlayne, Head of Global Sustainable Equities | Portfolio Manager Janus Henderson

- Four steps to choose an ESG manager Daniel Ryan, Manager Research Analyst Fidelity International

- The path to retirement is changing … are you? Editorial team, Synaptic Software Limited

- Are unregulated investments ever a good idea? Jon Lycett, Business Development Manager RSMR

- Putting the children first Jacqui Gillies, Marketing and Proposition Director Guardian

- Why not Serious Illness Cover? Nick Telfer, Protection Development Manager VitalityLife

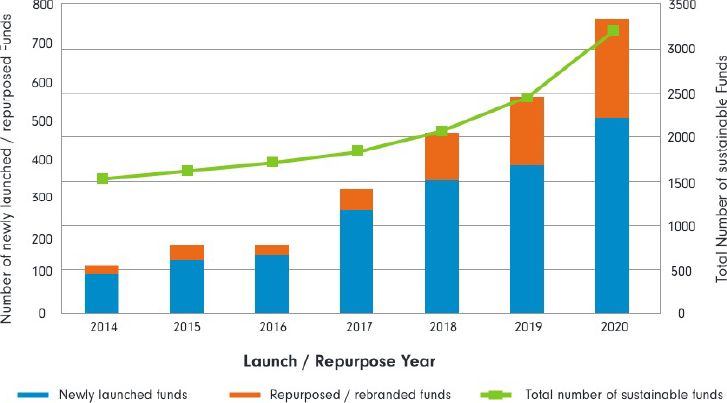

Investors and regulators have become increasingly attentive to the ESG impacts of investments in recent years. But how do you choose between sustainable funds?

The ESG and sustainable fund universe has grown significantly in recent years

"To overcome those shortfalls, we must somehow assess how sustainability is built into the security selection process. That requires analysis of the quality of ESG research and the degree of integration with security valuations, buy and sell recommendations and portfolio construction."

Many equity and fixed income portfolio managers integrate sustainability into their funds through proprietary and/or industry-standard ratings systems, which help them to assess individual companies. Understanding and selecting fund managers, rather than individual securities, requires a different approach.

In selecting and combining managers within a portfolio, first and foremost, we must be alert to the risk of 'greenwashing'. That requires a combination of quantitative and qualitative analysis.

Aggregating underlying ESG scores

Just as the equity or fixed income manager might do, aggregating the sustainability metrics for underlying securities – whether proprietary or provided by vendors such as MSCI ISS – gives an average ESG score for the overall portfolio or a distribution of ESG scores for its constituents. This allows for comparison of portfolios in a quick, consistent and automated way.

However, the result might simply be describing a portfolio's style, its holdings' market cap, or its geographic focus, without offering any new insight. Moreover, it doesn't tell us if the rating is the result of a sustainable investing process or a coincidence of the investment universe.

Forward-looking qualitative analysis

To overcome those shortfalls, we must somehow assess how sustainability is built into the security selection process. That requires analysis of the quality of ESG research and the degree of integration with security valuations, buy and sell recommendations and portfolio construction. This links holdings-level characteristics to the investment decisions made by the manager and helps understand the full extent of any potential ESG risks.

Speaking directly to portfolio managers about their approach and process also ensures ESG analysis is forward-looking. It means we can anticipate changes in the process – for better or worse – and build investment recommendations around the strategy's direction of travel regarding ESG factors, not just its recent history.

Four tests for ESG managers

When we're looking to select a manager, there are four key areas we consider:

- The investment policy.

- The integration of ESG research within the investment process.

- The quantitative ESG profile of the portfolio.

- The quality of engagement with companies and issuers.

- To build an understanding of how a manager scores in these four areas, these are some of the key questions we ask.

Does the investment process target measurable, sustainable outcomes?

Assessing whether a portfolio manager requires investments to have a measurable social or climate impact, in addition to financial targets.

How is ESG research integrated within the investment process?

Building a picture of how a strategy benefits from proprietary, holdings-level ESG research and whether it is applied consistently.

Do holdings-level ESG scores and portfolio carbon intensity show a positive bias relative to the benchmark?

If a strategy stands out relative to its style and region, it can be useful to check the stated process against its ESG commitment, and to query buy/sell decisions or sector weights relative to the benchmark. This also allows us to test whether managers have well-justified and well-integrated exclusion policies.

Is there a record of effective engagement with corporates to increase their contribution to a sustainable economy?

We like to see proactive engagement on a range of ESG issues that have specific and measurable outcomes. For fixed income strategies, we also look for a record of engagement, including whether there have been any reverse enquiries – where investors approach potential issuers and request certain characteristics for a new transaction.

Engaging with underlying managers

To build this level of qualitative insight, it is important that we engage with managers and monitor their progress over time. That allows us a recurring opportunity to discuss how they set and implement their voting and engagement policies – including discussing the circumstances in which managers can override central stewardship teams and how centralised stewardship teams can escalate disagreement with individual portfolio managers. We also look at how senior management is incentivised and the extent to which voting responsibility extends up the asset manager's executive chain.

As the ESG universe continues to evolve, so must our research approach

There is no doubt that creating a truly diversified and fully sustainable multi asset solution can be a challenge. Many ostensibly sustainable or ESG-labelled strategies may, in practice, fall short of their ambitions. This makes the need for careful analysis even more important.

As the industry changes, our selection process will need to evolve. But in doing so, our aim should always be to distinguish between those managers that 'say' and those that 'do', as well as find those who have previously performed poorly in ESG terms, but which are now improving rapidly.

For more information, visit professionals.fidelity.co.uk, email salessupport@fidelity.co.uk or call us on 0800 368 1732.

Daniel Ryan

Daniel is a Manager Research Analyst in the Solutions & Multi Asset team of Fidelity International. He joined the team in 2018. He is a CFA Charterholder and holds a PhD in Theology from Cambridge University.

Important information

This article is for investment professionals only and should not be relied upon by private investors.

The value of investments and the income from them can go down as well as up so the client may get back less than they invest. The views expressed may no longer be current and may have already been acted upon. Issued by Financial Administration Services Limited and FILPensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0721/36060/SSO/NA.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.