In this edition...

- Hours to minutes Editorial team, Synaptic Software Limited

- Synaptic Pathways: the advice research revolution has arrived Eric Armstrong, Client Director, Synaptic Software Limited

- Value for money matters when assessing suitability John Warby, Senior Business Relationship Manager, Synaptic Software Limited

- The road ahead on suitability and disclosure Natalie Holt, Content Editor The Lang Cat

- Developing your investment proposition David A Norman (DAN), CEO TCF Investment

- State of the Nation Ian McKenna, Founder of Financial Technology Research Centre and AdviserSoftware.com FTRC

- Few places to hide Guy Monson, CIO and Senior Partner Sarasin & Partners

- Ensuring the “new normal” is a better normal Ben Lester, Head of Distribution – UK & International Praemium

- Stay the course if you can (but better too early than too late) James Klempster, Deputy Head of the Liontrust Multi-Asset team Liontrust

- Can financial goals be achieved through one fund? Mohneet Dhir, Multi-Asset Product Specialist Vanguard Europe

- Talking Trash: Why it’s not a waste of time Luke Barrs, Head of Fundamental Equity Client Portfolio Management for EMEA & Asia ex-Japan Goldman Sachs Asset Management

- Demand for growth funds rises amid risk-on environment Antony Champion, Head of Intermediaries Brewin Dolphin

- The best of both worlds Ian Jensen-Humphreys, Portfolio Manager Quilter Investors

- Global Sustainable Equity: a renewable, electric and digital future Hamish Chamberlayne, Head of Global Sustainable Equities | Portfolio Manager Janus Henderson

- Four steps to choose an ESG manager Daniel Ryan, Manager Research Analyst Fidelity International

- The path to retirement is changing … are you? Editorial team, Synaptic Software Limited

- Are unregulated investments ever a good idea? Jon Lycett, Business Development Manager RSMR

- Putting the children first Jacqui Gillies, Marketing and Proposition Director Guardian

- Why not Serious Illness Cover? Nick Telfer, Protection Development Manager VitalityLife

Synaptic Pathways now capable of full, automated, ex-ante reporting with the current new software release.

Firms are always being extolled about the potential to improve the delivery of advice using technology, and software vendors have traditionally promoted the idea that a good back office system will allow firms to create a hub from which integrations with standalone research tools can be made. The influential report from Origo and Lang Cat, 'A Disconnected World, An Adviser's Reality' put paid to that unrealistic premise, documenting the lack of effective two way integrations available to advisers when configuring their IT and tools, or the ability of back office software to link effectively to platforms or providers. Multiple tools with multiple re-keying have been the norm for advisers in the complex area of financial planning and advice. We believe that the digital transformation' sought by firms would work better if research-led using Synaptic. Review the new client and holdings areas in the new Synaptic Pathways software to see a more modern way of accessing data that integrates with key applications.

Better has arrived

Synaptic can show firms a better way of working by combining the power of Salesforce (the world's leading CRM platform) in handling all the required data and the provision of intuitive workflows. Synaptic have integrated feeds with the full range of platform, product and portfolio data necessary for the full breadth of required reporting, including the industry's most accurate costs and charges calculator and a risk framework provided by integration with the Moody's Analytics stochastic engine.

For the first time a complete research suite is available that can take the adviser through a Mifid II compliant advice process:

- assessment of a client's risk profile by psychometric questionnaire.

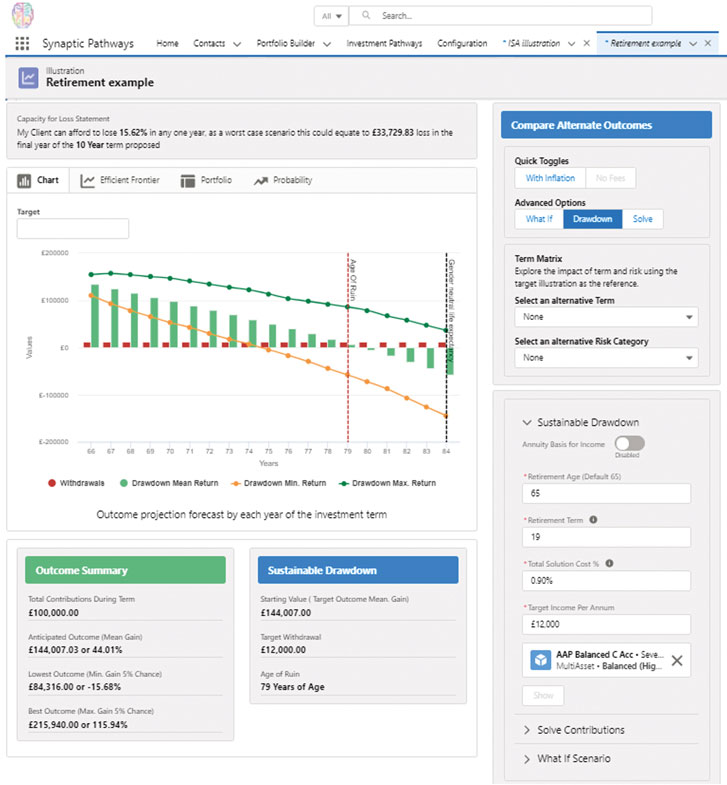

- alignment of client objectives (goal based financial planning) with suitable investment solutions mapping to a Moody's asset allocation model.

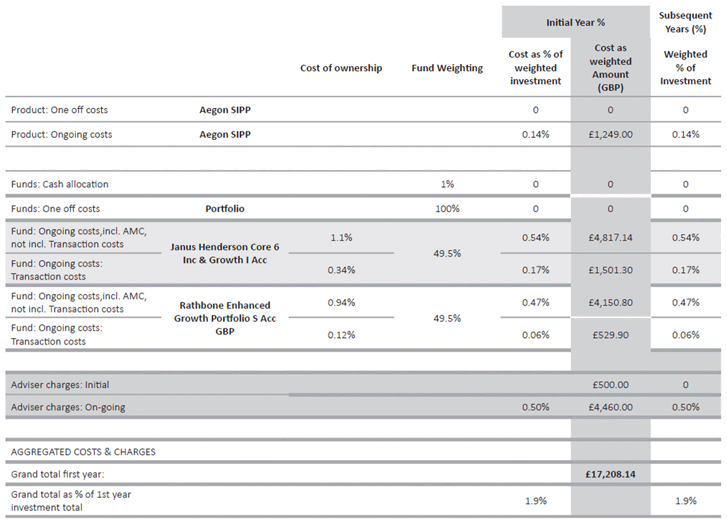

- product and fund governance provided by full Central Investment Proposition management and automatic disclosure of ex-ante costs and charges.

- the presentation of results as probability-based, stochastic forecasts, ensuring that advisers can present the likely investment outcomes to clients, and help them make informed decisions.

We believe that there are several key reasons why you may want to evaluate the new Synaptic proposition for your firm. There has never been a better time to capture the efficiencies of effective, cloud-based software.

Our market and product insights look like this:

- Firms are increasingly reliant on the benefits of technology to streamline their businesses and improve their service to clients.

- Firms need integrated access to platform, product, portfolio and fund data, capable of accurate representation of costs down to share class.

- Firms need a dependable, effective technological platform to support the advice process, ensuring all the data is automatically available for calculations on demand.

- Many firms are 'vertically integrating' and need ways to ensure groups of advisers can work consistently to the same uncompromising standards.

- All firms need effective software to replicate their investment strategies, and ensure consistent and transparent advice can be delivered by groups of advisers.

- Firms can benefit from direct access to the leading risk framework provided by Moody's, ensuring that institutional strength risk analysis can underpin all recommendations.

Here are some Synaptic Pathways highlights for you to consider:

- Integration of features in a single Salesforce platformed log on. Salesforce is the world's leading CRM software and enterprise cloud ecosystem. This ensures the intuitive usability of the software, as well as the ability to handle complex data-driven processes. Deployment of the entire Synaptic solution via Salesforce makes the evolution and deployment of upgrades and improvements possible without disruption or additional expense;.

- Comprehensive platform, product, portfolio and fund data. This includes data from discretionary and IDD providers to allow accurate illustrations and disclosures without additional research and looking up. Synaptic categorises portfolios by regulatory status: IDD, DFM, Model or Bespoke. Funds are managed by lists, managing 'parent' and child' share classes.

- Asset allocation from Moody's Analytics. The full integration of the software with the Moody's Analytics Wealth Scenario Generator, the industry's leading forecasting tool includes an asset allocation model provided by Moody's, and the ability to produce accurate illustrations to support client recommendations.

- Risk Rating of investments. The Moody's asset allocation model in the heart of the system ensures that any investment solution can be mapped to the Moody's risk categories.

- Integrated risk profiling. Avoid the pitfalls of mismatching the outcomes from your risk questionnaire with the risk profiles of your investments. Any approach that mixes and matches approaches may fall foul of this dangerous pitfall.

- Full range of reports. These provide a full audit trail of research leading to any recommendation, reflecting the specific circumstances of your client.

Following 2 years of work, Synaptic's ambition to build the UK's most advanced research suite has been realised. We are working with a group of customers, including 2 networks to provide cases studies to showcase the successful adoption of the new software.

The Synaptic proposal is to engage with any additional firms who wish to explore the benefits of setting up Synaptic to reflect their Central Investment Proposition - including segments, platform, product and portfolio selections and setting up any model portfolios that may be used by the firms advisers. Other areas that can quickly and easily configured include special deals and adviser charging. Clients can quickly and easily be set up in the client area, against whom, any research will be saved.

Any firms electing to work with Synaptic in this way will not only benefit from the input of Synaptic experts, but will be offered preferential rates on any software options they may like to take up in due course. Please call now to book a demo or a trial on 0800 783 4477 or email hello@synaptic.co.uk

Retirement planning made easier. This screenshot shows some of the rich research functionality in Synaptic Pathways. See here the calculation for the 'Age of Ruin', where a client's funds are likely to run out, for a given level of income. This has been calculated using 'particle swarm optimization' using the client's actual investment scenario.

Screen below shows the full, automatic accounting for ex-ante costs and charges:

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.