In this edition...

- Navigating the great wealth transfer Warwick Bloore, Senior Specialist, Adviser Research Centre - Vanguard Europe

- How to keep up – tackling the risks of regulatory change Gareth Johnson, Head of Investment, Management Compliance - Simplybiz

- Beyond NVIDIA: investing across the semiconductor ecosystem Helen Xiong, Deputy Manager, Monks Investment Trust - Baillie Gifford & Co

- Finding value in global equity markets John Husselbee, Head of the Liontrust, Multi-Asset Investment Team - Liontrust

- Enhanced cashflow modelling Seb Marshall, Product Manager - Synaptic

- Worldly wisdom of The Wire Ben Kumar, Head of Equity Strategy - 7IM

- Mastering the MPS Landscape Mastering the MPS Landscape, Managing Partner, Head of UK IFA Services - Evelyn Partners

- A practical guide to getting your ongoing reviews in order Jennifer Peaty, Director of Regulatory, Consultancy and Advice Quality - Simplybiz

- Is there any hope for the UK equity market? Katie Sykes, Client Engagement & Marketing Manager - RSMR

- Cash-flow modelling Sandy McGregor, Head of Policy - Simplybiz

In March 2024, the FCA issued a letter to CEOs of financial advice firms, urging them to review processes for providing retirement income advice. As the FCA noted, "[cashflow] can be a key step in providing suitable advice." Synaptic has collaborated closely with key clients to refine the Cashflow Modelling functionality within Pathways, empowering advisers to meet these standards effectively.

In March 2024, the FCA issued a letter to CEOs of financial advice firms, urging them to review processes for providing retirement income advice. As the FCA noted, "[cashflow] can be a key step in providing suitable advice." Synaptic has collaborated closely with key clients to refine the Cashflow Modelling functionality within Pathways, empowering advisers to meet these standards effectively.

The FCA's key findings in the cashflow modelling guidance from the FCA are addressed through new features in Pathways, such as:

Using Justifiable Rates of Return (Finding 2*)

Pathways integrates tightly with Moody’s Economic Scenario Generator for modelling risk and return, forming the foundation for realistic return scenarios. These can be customized according to the client’s risk tolerance, determined via the A2Risk questionnaire. Each risk category is mapped to Strategic Asset Allocations (SAAs), which reflect probable future returns under varying risk scenarios.

Planning for Uncertainty (Finding 3**)

Cashflow modelling inherently looks toward a client's future, including life events and longevity. Since many clients will live beyond the average life expectancy, planning for extended income needs or potential later-life expenses like care is essential. Pathways equips advisers to create detailed scenarios and stress tests, addressing:

• Couples’ financial planning

• Extended life expectancies

• Phased income requirements over a client’s lifetime

• Bespoke stress tests for scenarios such as significant fund reductions or lower-than-expected returns

Key Updates to Pathways:

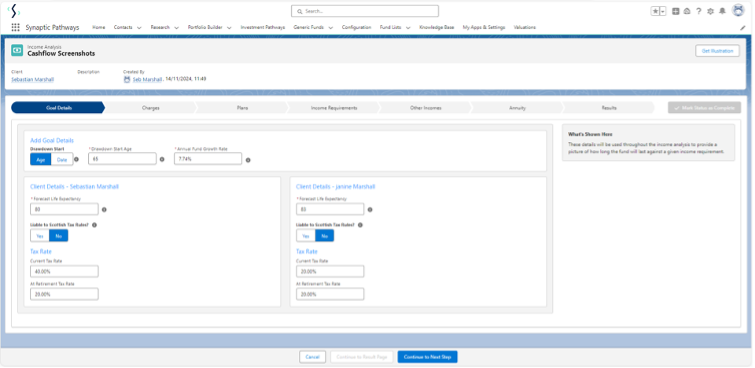

Joint Client Cashflow Scenarios

Advisers can now run cashflow scenarios for joint clients, rather than being limited to individual cases

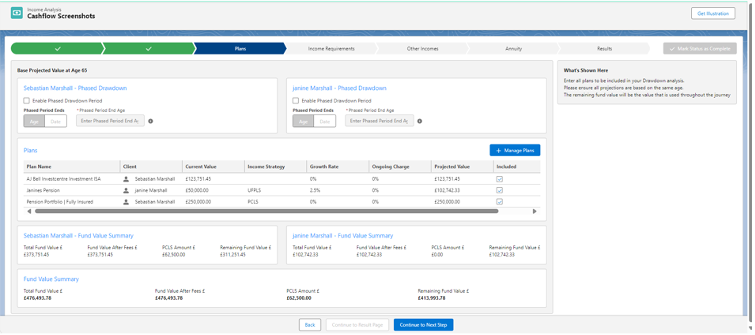

Integration of Non-Pension Holdings

Non-pension holdings can now be included in the cashflow journey, offering alternative sources to draw income from. Each pension holding also supports a unique strategy, enabling simultaneous modelling of PCLS (Pension Commencement Lump Sum) and UFPLS (Uncrystallised Funds Pension Lump Sum) withdrawals across different pensions.

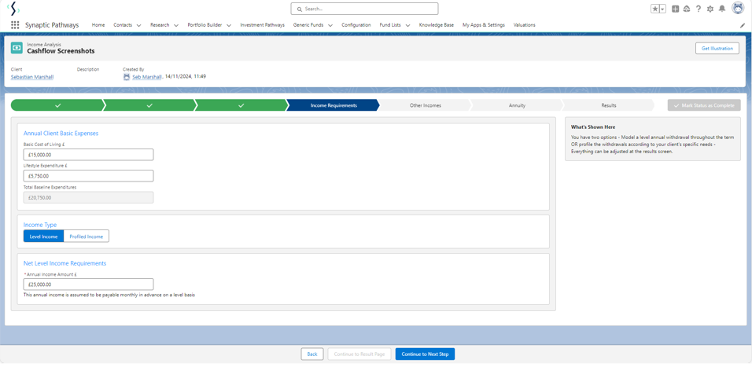

Expense Capture Boxes

To facilitate better discussions around income requirements, we’ve added expense capture boxes. These tools help pinpoint and detail the income needed for analysis with greater accuracy.

Simplified Income Input

Users can now define income requirements as an annual figure and distribute them monthly with a single click. This feature significantly simplifies the input process, especially when only annual income data is available.

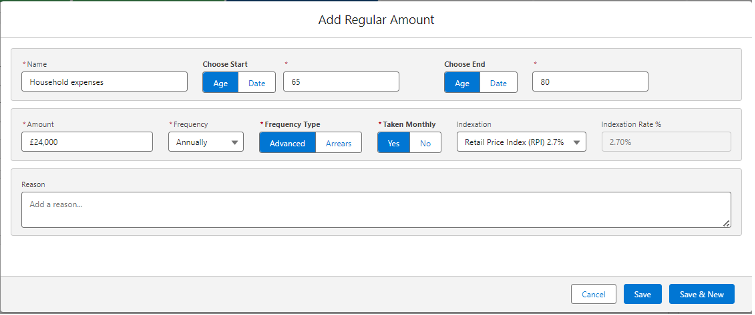

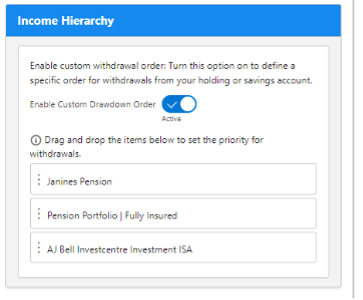

Customisable Withdrawal Order

A new feature allows users to override the default withdrawal order from income plans. This provides complete control over how income is drawn, ensuring alignment with personalised strategies.

Transform cashflow planning with Synaptic Pathways

Synaptic Pathways supports your work by offering research tools for due diligence on every investment recommendation—whether for new investments, switches, or reviews. To explore the benefits of Pathways’ cashflow modelling for accumulation and decumulation scenarios, book a demo today. Discover its features, including:

• Risk profiling and capacity for loss

• Model stress testing

• Moody’s stochastic model applications.

Empowering Financial Planners

These updates represent a significant leap forward, providing financial planners with tools that simplify processes and deliver tailored, client-centric outcomes. Pathways continues to evolve, meeting the industry’s dynamic demands.

Call to arrange a demo or a trial and transform the way your firm is able to conduct cashflow planning the Synaptic way. https://www.synaptic.co.uk/book-a-demo

0800 783 4477

hello@synaptic.co.uk

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.