In this edition...

- Navigating the great wealth transfer Warwick Bloore, Senior Specialist, Adviser Research Centre - Vanguard Europe

- How to keep up – tackling the risks of regulatory change Gareth Johnson, Head of Investment, Management Compliance - Simplybiz

- Beyond NVIDIA: investing across the semiconductor ecosystem Helen Xiong, Deputy Manager, Monks Investment Trust - Baillie Gifford & Co

- Finding value in global equity markets John Husselbee, Head of the Liontrust, Multi-Asset Investment Team - Liontrust

- Enhanced cashflow modelling Seb Marshall, Product Manager - Synaptic

- Worldly wisdom of The Wire Ben Kumar, Head of Equity Strategy - 7IM

- Mastering the MPS Landscape Mastering the MPS Landscape, Managing Partner, Head of UK IFA Services - Evelyn Partners

- A practical guide to getting your ongoing reviews in order Jennifer Peaty, Director of Regulatory, Consultancy and Advice Quality - Simplybiz

- Is there any hope for the UK equity market? Katie Sykes, Client Engagement & Marketing Manager - RSMR

- Cash-flow modelling Sandy McGregor, Head of Policy - Simplybiz

At a time when many people hold a significant amount of savings in cash, John Husselbee explains why the Liontrust Multi-Asset team is optimistic about the outlook for equity markets and where they are currently finding most value.

At a time when many people hold a significant amount of savings in cash, John Husselbee explains why the Liontrust Multi-Asset team is optimistic about the outlook for equity markets and where they are currently finding most value.

According to the FCA, over 40% of UK adults each have savings of more than £10,000, which is reassuring but it seems a great deal of this is not invested. Recent newspaper reports cite Barclays Bank estimates that 13 million UK adults hold £430 billion in cash deposits.

Cash can be a good place to park savings for the short term as the returns are not subject to the volatility experienced by investment markets. Extending the time savings are kept in cash and not investing in asset classes like equities and bonds, however, means potentially missing out on generating real returns to enable spending power to exceed the rate of inflation over the long term.

The gap between cash and investing is potentially exacerbated at the moment by the fact that interest rates have started falling and we believe stock markets in the UK and internationally are offering attractive valuations. This latter point may seem surprising given the fact that the US S&P500 index reached yet another new all-time high at the end of September. Yet it is important to remember that the US stock market has been driven to current levels in large part by a handful of mega caps including Nvidia and Apple, which have benefited from the fever-like excitement around AI.

The market environment is changing, however. Revenues that have been delivered by US mega and large caps are spreading beyond these stocks, not only in the US but also in international markets. This is at a time when cheaper valuations are available outside large caps.

Our optimism about the outlook and valuations is demonstrated by the fact that the Liontrust Multi-Asset team currently has a tactical score of four out of a maximum of five for equity markets in general. All equity markets are not equal, however, and some offer greater value than others.

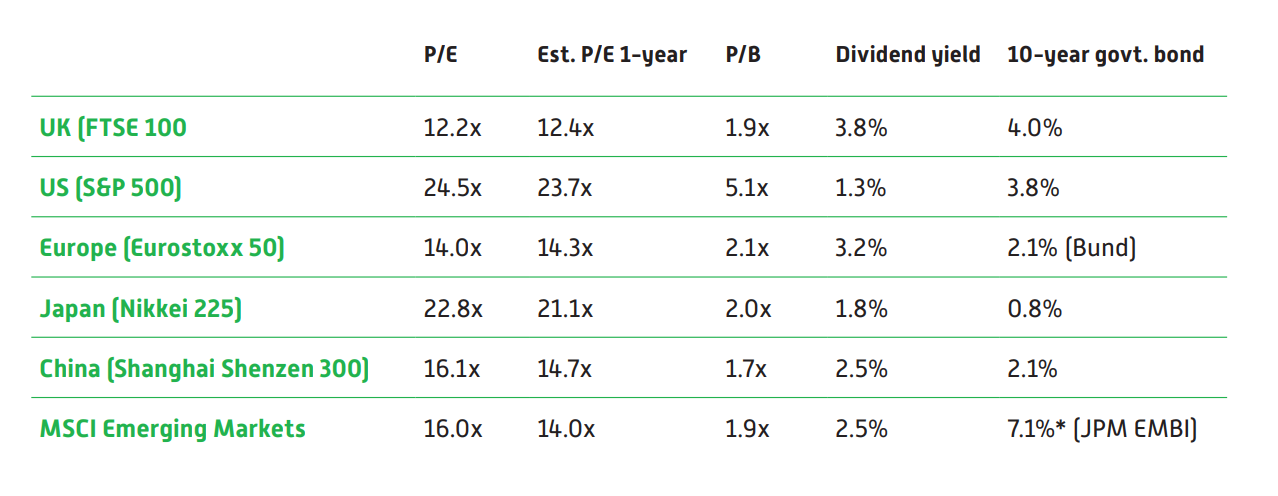

The table below shows that that on a price to earnings (PE) and price to book (PB) basis, the UK offers the most value, with ratios of 12.2 and 1.9 respectively, and we have a tactical outlook, including small caps, of a positive four out of five. Expectations were raised when the Labour government won a large electoral majority in the summer with a commitment to economic growth. While the recent Budget has not brought full clarity on how this growth will be generated, it was never likely there would be one catalyst to enable UK-listed companies to realise their attractive valuation opportunities.

"While US-China relations remain complicated, the reorganisation of strategic supply chains could create new opportunities for EMs other than China."

Valuations in global equity markets

Source: Bloomberg/Liontrust, 2 October 2024; *External (hard currency) debt. Past performance does not predict future returns.

Over the last two to three years, China’s slowing economic growth and trade tensions with the US have weighed on emerging markets (EMs). We believe there are several reasons why EMs may now be more attractive. China’s central bank recently announced a new wave of monetary stimulus and EMs could benefit from the relative appreciation of their own currencies versus a potentially weakening dollar following the US Federal Reserve’s recent half-point interest rate cut. EM countries tend to borrow in US dollars so a weaker greenback makes it easier for them and their companies to service their debts.

While US-China relations remain complicated, the reorganisation of strategic supply chains could create new opportunities for EMs other than China.

Two of the most expensive markets are the US and Japan after enjoying strong performance over the past couple of years despite the pullback in early August. However, while we are neutral on US equities from a tactical view, we do have a positive score of four out of five for US smaller companies and are bullish on the Japanese market, including smaller companies.

The fact that Japan is in an inflationary environment for the first time in a couple of decades should encourage more consumption and, together with an improving corporate picture after years of underperformance, gives us a positive view of the outlook for the stock market.

If, as we believe, the concentration in equity markets of the mega caps in the US lessens over time and revenues and share prices broaden beyond them then it is important to consider what the relative impact will be on active managers and passive vehicles within portfolios. If you take the US, which is the biggest passive market, the top 10 holdings in the S&P index represent around a third of the whole index. For the last time we saw this concentration in the S&P500, according to one of our US fund managers, you have to go back to the Great Depression. The market conditions back then were entirely different to what we have today and we do not believe all the growth comes from just a few stocks.

While passive vehicles have certainly helped us over the years in terms of a broader universe of options to use within portfolios, there is a big opportunity now for active management, particularly in mid and small caps, and for savings to work harder for investors than keeping them in cash.

Get in touch:

Visit www.liontrust.co.uk/fund-managers/multi-asset to access our latest product, pricing and corporate information to help you stay up-to-date.

+44 (0)20 7412 1777

Important information:

Capital at risk. This marketing communication does not form part of a direct offer or invitation to purchase securities.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of any Funds or services mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate an investment philosophy.

The article contains information and analysis that is believed to be accurate at the time of publication but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. Before making an investment decision, you should familiarise yourself with the different types of specific risks in your situation.

Further information can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised, and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.