In this edition...

- Navigating the Future of Retirement and Pension Planning: Key Insights for UK IFAs and Wealth Managers James Goad, Managing Director - Owen James

- Profit or Pitfall? The Investment Impact of Global Trade Tariffs Naeem Siddique, Investment Research Manager - RSMR

- Consider the cost of your swivel chair Abi Hortin, Marketing & Community Executive - Plannr Technologies Limited

- End the Taboo: Death deserves a voice Charlotte Merrills, Compliance & Associate Support Manager - APS Legal Associates

- From Calendar to Tolerance: Rethinking Portfolio Rebalancing Chris Johnston, MSc Data Analyst - ebi Portfolios

- The difference between volatility and risk Antony Champion, Managing Director - Head of Intermediaries - RBC Brewin Dolphin

- Billions in Innovation: The untold power of the UK’s tax-efficient investment schemes Prashant Trivedi, Investment Analyst - MICAP

- Decumulation in the Synaptic Pathways ecosystem Seb Marshall, Product Manager - Synaptic

- Market volatility is inevitable - Adviser’s Alpha® is enduring Warwick Bloore, Senior Specialist, Adviser Research Centre - Vanguard Europe

- Redefining Index Investment Strategies Dan Caps, Portfolio Manager - Evelyn Partners

- The FCA Protection Market study: What it means for intermediaries Kris Armstrong, Compliance Policy Manager - Simplybiz

The quiet cost nobody audits

The quiet cost nobody audits

Every advice firm pays a hidden tax: the swivel-chair swing between half-integrated tools. Industry time-and-motion studies show that a disconcerting 90-120 minutes can be added to a “straight-forward” suitability or meeting report, and up to five hours for more complex cases when duties are carried out piecemeal from system to system. Under Consumer Duty that inefficiency becomes a regulatory hazard; double-keyed data trails are the antithesis of demonstrable value.

In 2025, Plannr and AdvisoryAI set out to eliminate that waste. By pairing Plannr’s open-API CRM with AdvisoryAI’s document-automation engine, firms are able to cut end-to-end report cycles down to 15 minutes of generation plus 10 minutes of review time - an 80% reduction that saves advisers an afternoon, every afternoon.

“Technology should hum in the background, not hover over the adviser’s shoulder as a constant threat to productivity,” says Gareth Thompson, Plannr CTO.

Lesson 1 - Define the choke-point

Most digitisation projects fail because they start with features, not friction. The smart approach is to put a stopwatch on your team and identify your bottleneck. At many firms the single biggest choke-point is the production of suitability or meeting reports: drafting, formatting, compliance checks, and that dreaded copy-paste between systems.

Action step: Run your own stopwatch this week. If a task steals more than 30 minutes per client, flag it for elimination this quarter.

Lesson 2 - Stress-test on edge-cases

Vendor demos purr on pristine sample data but we know clients, and we know that real life isn’t so tidy. Shrewd firms feed prospective tools their messiest cases: multiple product switches, quirky fee structures, and legacy plan references. Embracing smart tools like AdvisoryAI’s engine which learn from every correction, means the rougher the input, the faster the platform aligns with house style.

Action step: Hand each vendor your last three ugliest client files. If they can’t cope in the room, they’ll crumble in production.

Lesson 3 - Prioritise integration over features

A single swivel-chair costs more than a fancy widget. The golden rule: any new system must treat the CRM as the source of truth and maintain one living client record. Plannr clears that bar with open-door APIs; AdvisoryAI matches it via two-way sync. The payoff? Zero re-keying, fewer errors and staff who advise instead of tab-hopping.

Action step: Map one “client fact” from initial capture to final report. Count screens touched. Anything above one is an integration gap.

Plannr was built on the principle that data should flow, not stumble. Its open-API architecture has already turned the software’s beautifully simple CRM into the natural command centre for advisers who want technology that grows with them. With the FCA’s AI Live Testing programme set for 2025, Plannr’s purposeful investment in audit-ready, regulation-friendly AI puts firms on the front foot. Its fresh alliance with AdvisoryAI pushes the benchmark for seamless, high-impact integrations still higher - leaving one pressing question: how long can any adviser afford to stay anchored to disjointed, legacy systems?

Inside the four-click loop: how it works

The Plannr × AdvisoryAI integration automates fact-find maintenance and document generation in just four simple clicks:

1. Pull. Select a client in AdvisoryAI and click Pull from Plannr. Your existing fact-find data flows in instantly thanks to the seamless two-way integration.

2. Capture. Conduct the meeting; AI assistant Evie records and transcribes the discussion while you upload any illustrations or KIDs.

3. Generate. Hit Create docs. AI assistant Emma drafts meeting notes, suitability or annual review reports in about five minutes, complete with source citations.

4. Push & Approve. A wizard highlights any field-level differences. One click Push to Plannr writes back adviser-approved changes to your CRM, preserving full data integrity while fully eliminating post-meeting admin.

Immediate gains

Zero manual re-keying – hours returned back to your team each week.

Audit-ready trail – every change linked to meeting evidence.

Instant scale – Emma & Evie are available to every Plannr user on day one; virtual employees with zero downtime.

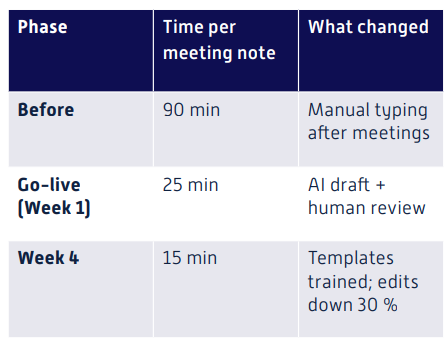

Case in point: LIFT-Financial’s 90 > 15-minute reset

LIFT-Financial Group, a chartered firm headquartered in Altrincham, faced soaring demand but capped adviser capacity because of administrative overhead. Generating meeting notes alone consumed 1.5 hours per client. After deploying AdvisoryAI (integrated into Microsoft Teams) the same task now takes 15 minutes - an 87.5 % time saving.

Outcome: advisers doubled their client capacity while maintaining personal service; proposals were issued within 48 hours instead of two weeks; team morale lifted (“I barely pick up my pen anymore!” – Declan Davies).

Beyond efficiency: compliance, experience & wellbeing

Compliance

The FCA’s Consumer Duty review lists “good quality data” and seamless information-sharing as hallmarks of good outcomes. With Plannr as your source-of-truth and AdvisoryAI pushing every amendment back into Plannr, firms gain a timestamped, searchable audit trail - a ready-made Management Information set for the Duty board report.

Client Experience

Capgemini research shows 52% of customers switch providers due to poor experiences and 38% blame siloed systems. When reports land in their inbox within 24 hours – not the old two-week cycle – advisers convert recommendations faster, deliver efficient service to clients in need, and in turn enjoy higher Net Promoter Scores.

Wellbeing

A Harvard Business Review study of knowledge workers found they toggle between apps around 1,200 times per day, losing nearly four hours a week to re-orientation fatigue. By collapsing that swivel-chair into a four-click loop, LIFT’s paraplanners reclaimed focus time and reported feeling “noticeably less drained” during busy weeks.

The open-stack audit (try it today)

1. Time test – Measure one full suitability report cycle this week.

2. Edge-case drill – Throw your ugliest case at each vendor.

3. Integration score – Award 0-5 points for every manual data hop a tool eliminates.

Advisers who keep spinning between standalone apps now risk more than lost time: they miss the decisive edge that compliant AI already delivers. Plannr’s open-API CRM, fused with AdvisoryAI’s document engine, has trimmed a typical two-hour report cycle to around twenty-five minutes-an 80 % reduction that frees an extra afternoon for advice, every afternoon. With the FCA’s AI Live Testing programme on the horizon, the firms able to show an audit-ready AI pipeline will lead; the rest will be explaining manual workarounds to both regulators and clients.

Ready to put AI at the heart of your practice? See Plannr’s effortless solutions in action-book a discovery call at plannrcrm.com.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.