In this edition...

- Navigating the Future of Retirement and Pension Planning: Key Insights for UK IFAs and Wealth Managers James Goad, Managing Director - Owen James

- Profit or Pitfall? The Investment Impact of Global Trade Tariffs Naeem Siddique, Investment Research Manager - RSMR

- Consider the cost of your swivel chair Abi Hortin, Marketing & Community Executive - Plannr Technologies Limited

- End the Taboo: Death deserves a voice Charlotte Merrills, Compliance & Associate Support Manager - APS Legal Associates

- From Calendar to Tolerance: Rethinking Portfolio Rebalancing Chris Johnston, MSc Data Analyst - ebi Portfolios

- The difference between volatility and risk Antony Champion, Managing Director - Head of Intermediaries - RBC Brewin Dolphin

- Billions in Innovation: The untold power of the UK’s tax-efficient investment schemes Prashant Trivedi, Investment Analyst - MICAP

- Decumulation in the Synaptic Pathways ecosystem Seb Marshall, Product Manager - Synaptic

- Market volatility is inevitable - Adviser’s Alpha® is enduring Warwick Bloore, Senior Specialist, Adviser Research Centre - Vanguard Europe

- Redefining Index Investment Strategies Dan Caps, Portfolio Manager - Evelyn Partners

- The FCA Protection Market study: What it means for intermediaries Kris Armstrong, Compliance Policy Manager - Simplybiz

In the last edition, I discussed the enhancements made to Synaptic Pathways around cashflow modelling and decumulation. These improvements have now been extended across the wider Pathways ecosystem, offering users the flexibility needed to apply the most appropriate Attitude to Risk (ATR) based on the nature of the research being conducted.

In the last edition, I discussed the enhancements made to Synaptic Pathways around cashflow modelling and decumulation. These improvements have now been extended across the wider Pathways ecosystem, offering users the flexibility needed to apply the most appropriate Attitude to Risk (ATR) based on the nature of the research being conducted.

As clients progress through different stages of their investment journey-whether accumulation, decumulation, or a combination of both-their attitude to risk often changes. To reflect this, we’ve introduced the ability to store two default ATR values per client: one for accumulation and one for decumulation.

Attitude to Risk for accumulation and decumulation

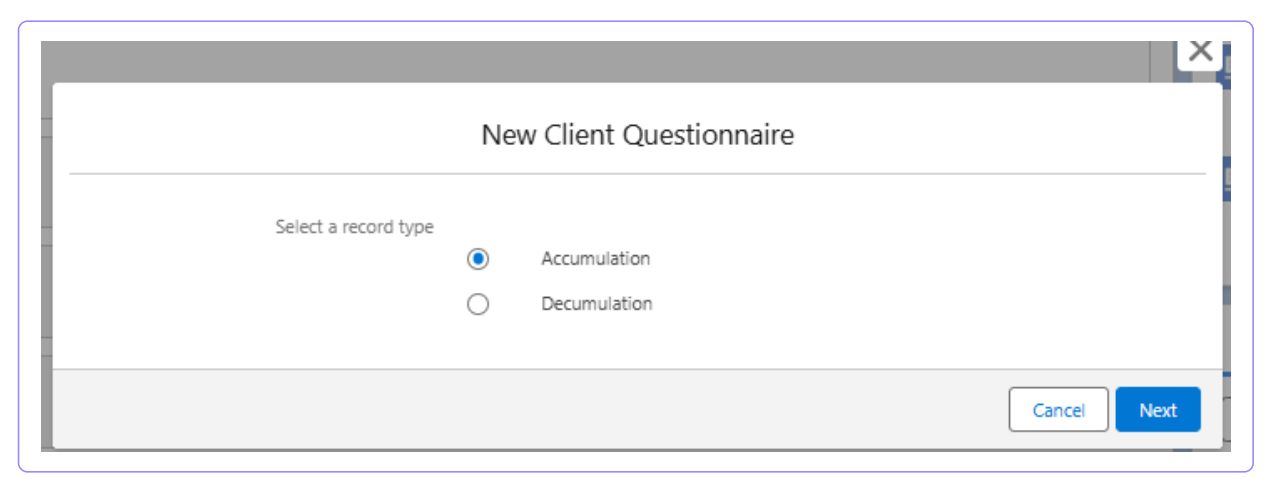

When initiating a new client questionnaire, users are now prompted to specify whether the questionnaire relates to accumulation or decumulation. These tailored question sets reflect the client’s current investment phase and ensure that the risk profiling is contextually appropriate.

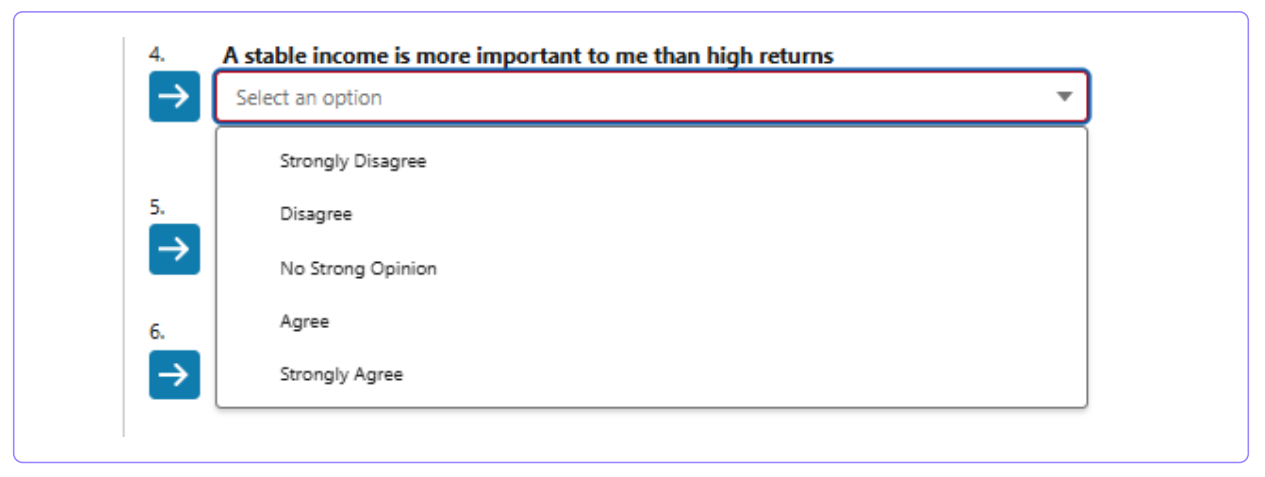

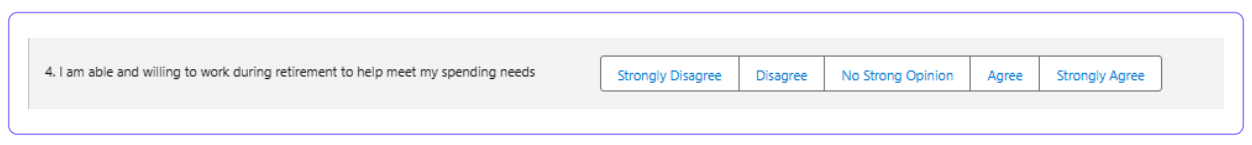

Just like the accumulation questionnaire, the decumulation version can be sent to clients in advance, allowing them to complete it at their convenience. It includes specific questions relevant to income drawdown, such as: “A stable income is more important to me than high returns.”

This targeted approach helps ensure that the resulting recommendations are aligned with the client’s immediate and future financial needs.

Using the decumulation questionnaire in research

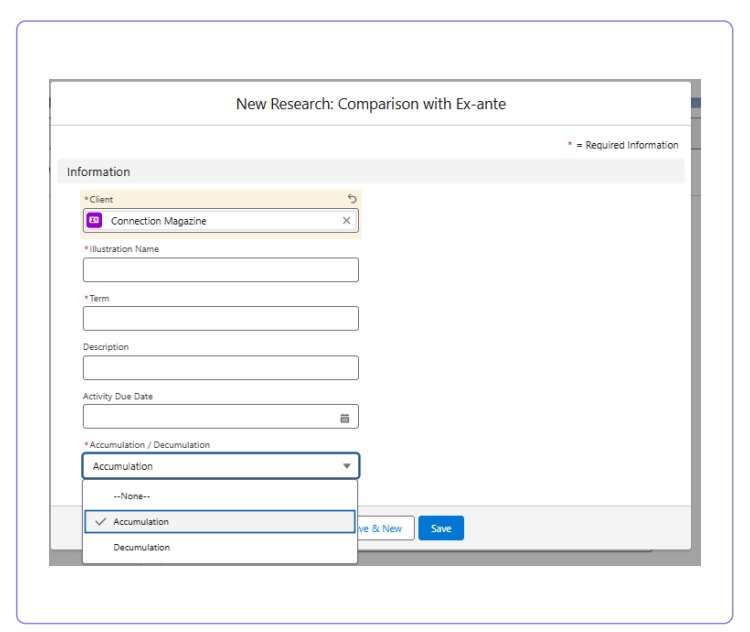

Since clients can now have two ATR profiles, we’ve introduced prompts when initiating new research, allowing users to choose which ATR to apply. This ensures that research is always aligned with the client’s current needs and stage in their investment lifecycle.

This functionality is now available across the following areas of Pathways: • Comparison with Ex-Ante • Ex-Ante • Switch • Investment Pathways • Income Analysis Depending on whether accumulation or decumulation is selected at the outset, Pathways will automatically pull through the relevant capacity for loss questions. For decumulation scenarios, these questions are specifically designed to address income sustainability and risk tolerance during drawdown.

Transform decumulation with Synaptic Pathways

Synaptic Pathways enhances your advice process by providing robust research tools to support due diligence across all investment scenarios-whether you're advising on new investments, fund switches, or portfolio reviews.

Discover how Pathways can bring clarity and confidence to your investment recommendations, and explore powerful features including:

• Comprehensive risk profiling and capacity for loss assessments

• Model stress testing

• Integration with Moody’s stochastic modelling tools

Call 0800 783 4477 or email hello@synaptic.co.uk to schedule your personalised demo and see how Synaptic Pathways can elevate your financial planning.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.