In this edition...

- Navigating the Future of Retirement and Pension Planning: Key Insights for UK IFAs and Wealth Managers James Goad, Managing Director - Owen James

- Profit or Pitfall? The Investment Impact of Global Trade Tariffs Naeem Siddique, Investment Research Manager - RSMR

- Consider the cost of your swivel chair Abi Hortin, Marketing & Community Executive - Plannr Technologies Limited

- End the Taboo: Death deserves a voice Charlotte Merrills, Compliance & Associate Support Manager - APS Legal Associates

- From Calendar to Tolerance: Rethinking Portfolio Rebalancing Chris Johnston, MSc Data Analyst - ebi Portfolios

- The difference between volatility and risk Antony Champion, Managing Director - Head of Intermediaries - RBC Brewin Dolphin

- Billions in Innovation: The untold power of the UK’s tax-efficient investment schemes Prashant Trivedi, Investment Analyst - MICAP

- Decumulation in the Synaptic Pathways ecosystem Seb Marshall, Product Manager - Synaptic

- Market volatility is inevitable - Adviser’s Alpha® is enduring Warwick Bloore, Senior Specialist, Adviser Research Centre - Vanguard Europe

- Redefining Index Investment Strategies Dan Caps, Portfolio Manager - Evelyn Partners

- The FCA Protection Market study: What it means for intermediaries Kris Armstrong, Compliance Policy Manager - Simplybiz

One of the most common mistakes investors make is to confuse volatility with risk. At best, it leads to unnecessary stress and worry, and at worst, it can lead to heavy financial losses. It is therefore vital that investors understand the difference between the two.

One of the most common mistakes investors make is to confuse volatility with risk. At best, it leads to unnecessary stress and worry, and at worst, it can lead to heavy financial losses. It is therefore vital that investors understand the difference between the two.

What is volatility?

At its simplest, volatility is a way of describing the degree by which share price values fluctuate. In volatile periods, share prices swing sharply up and down, while in less volatile periods their performance is smoother and more predictable.

Risk, on the other hand, is the chance of investments declining in value. How much investment risk you’re able to take on depends on a range of factors, most notably how long you’re investing for.

Interpreting volatility as ‘risk’ is a misjudgement often caused by watching your stock portfolio too closely. In one sense, this is perfectly understandable. The stock market can be a risky place to be in the short term, and watching the value of your life savings jump around from day to day can be gut-churning.

Taking the long view

Investing in the stock market requires a long-term perspective. History shows that over periods of ten or more years, equities generally outperform cash.

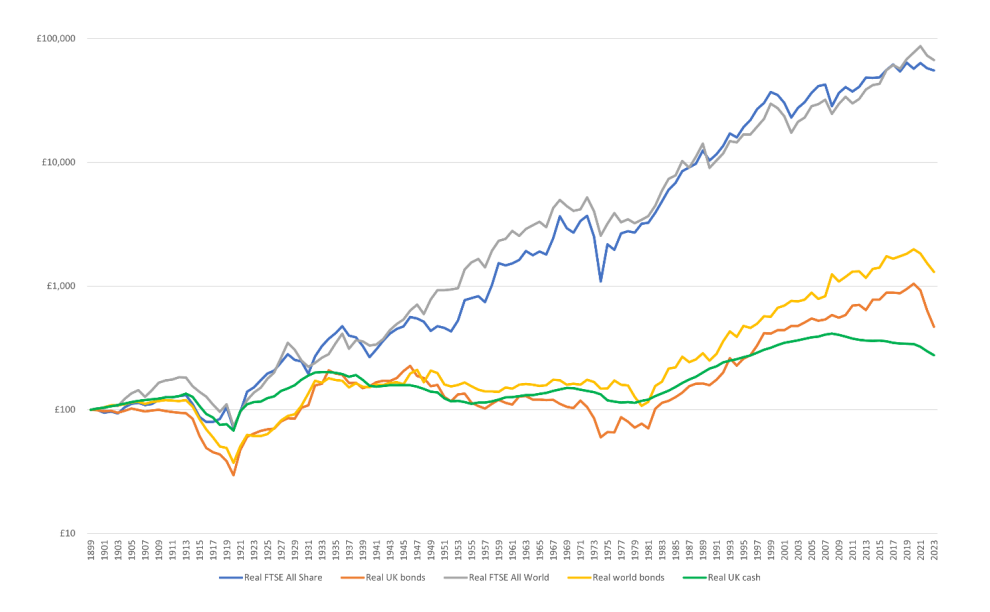

The following graph shows how different asset classes have performed compared to cash. Any balanced portfolio consisting of a mix of stocks and bonds, for example, would have outstripped cash returns by a good margin over the long term. Of course, investing comes with more risk than holding your money in a cash account, your investments may lose as well as gain value, and there are fees to consider. The best way to preserve your portfolio over the long term is to diversify your investment.

Source: RBC Brewin Dolphin / LSEG Datastream

Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance.

The past few decades have seen their share of market volatility. We have endured the recession of 2001, the market bottoming out in 2003, and the financial crisis of 2008/9, when markets were swinging up and down by 4% or 5% a day. More recently, in March 2020, stock markets suffered huge crashes as the spread of Covid-19 led to fears of a global recession.

Investors who took a short-term view may well have made a loss. The key is to remember that, over the long term, share price values tend to bounce back.

The benefits of volatility

Volatility can be a powerful force for good because these wild swings work both ways. For example, our research shows that missing the market’s five best days between December 1971 and August 2024 would have led to a 44% lower return than if you had remained invested throughout. Missing the best 20 days would have reduced returns by a staggering 84%. So, while stock market volatility may be stressful, history shows it is better to stay invested in bumpy times because long-term returns typically outweigh short-term losses.

Getting some advice can help you invest objectively and rationally and avoid knee-jerk reactions. By staying calm and focusing on the long term, you’ll reduce your chances of making a costly mistake.

The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

Get in touch:

brewin.co.uk/intermediaries

salesupport@brewin.co.uk

020 3504 7595

Important information: This is for FCA authorised individuals only and should not be distributed in whole or part to retail clients.

The value of investments, and any income from them, can fall and you may get back less than you invested. This does not constitute tax or legal advice. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. You should always check the tax implications with an accountant or tax specialist. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Opinions expressed in this publication are not necessarily the views held throughout RBC Brewin Dolphin.

RBC Brewin Dolphin is a trading name of RBC Europe Limited. RBC Europe Limited is registered in England and Wales No. 995939. Registered Address: 100 Bishopsgate, London EC2N 4AA. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.