In this edition...

- Investing in the Age of AI: Navigating the Opportunity and the Risk Katie Sykes , Senior Marketing Manager - RSMR

- The great wealth transfer Justine Randall, Chief Commercial Officer - Tatton

- The hidden cost of ‘pound-cost ravaging’ for retirees Antony Champion, Managing Director - Head of Intermediaries RBC Brewin Dolphin

- Is the 60/40 Portfolio still working? Jennie Byun, Head of UK Multi-Asset Investment Specialists - HSBC Asset Management

- Multi-asset investing in 2025: from product to partnership James Giblin, Fund Manager - L&G

- What does the US dollar’s recent weakness mean for multi-asset investors? Madison McCall, Multi-Asset Product Management Specialist - Vanguard Europe

- Reports of ESG’s death are greatly exaggerated Jonathan Simpson, Investment Oversight Analyst - ebi Portfolios

- Ten Years of Freedoms – Lessons, Gaps, and the Road Ahead Matt Ward, Communications Director - AKG Financial Analytics Ltd

- Why the UK Needs Better Education on Tax-Advantaged Investments Harry Morrison, Investment Analyst & Panel Consultant - MICAP

- Two years of Consumer Duty: The best of times, or the worst of times? Sandy McGregor, Director of Policy - Simplybiz

- Client Led, Data Driven Paul Bruns, Compliance Director - Simplybiz

- Should estate planning & will writing be part of your offering? Chloe Faulkner, Business Development Manager - APS Legal Associates

- What if your CRM wasn’t just a bit of software? Abi Hortin, Marketing Executive - Plannr Technologies Limited

- Redefining Fintech Solutions Sandy Newman, Director - ifaDASH

Why Smart Diversification Matters More Than Ever

Why Smart Diversification Matters More Than Ever

For decades, the traditional 60/40 portfolio - 60% equities and 40% bonds - has been a go-to strategy for building balanced portfolios. It offers growth from equities and downside protection from bonds. That approach worked well in a world of low inflation, low interest rates and low volatility.

But 2025 has made one thing clear: long-standing market assumptions can- and should – be questioned. US tech dominance faces fresh competition, investors are reconsidering the US-centric market cap-weighted exposure, and the safe-haven role of US Treasuries and US dollar – the former already tested during 2022 – are under pressure. This brings into question if the 60/40 portfolio is still fit for purpose.

How the HSBC Global Strategy portfolios remain relevant in an increasingly uncertain world

HSBC’s Global Strategy portfolios are a range of low-cost, globally diversified funds tailored to different client risk levels. The Balanced portfolio is similar to a traditional 60/40 in that it has a similar equity/bond allocation mix. However, not all 60/40 portfolios are alike. We outline the three key differentiators that keeps HSBC Global Strategy relevant in today’s increasingly uncertain world.

Dynamic asset allocation

In today’s environment, markets can swing sharply on sentiment, long before fundamentals catch up. A key feature of our portfolios is our dynamic asset allocation, allowing us to shift away from certain markets and regions that are overvalued or have weaker fundamentals to other, more stronger areas. Having that flexibility to respond in these moments can help protect against downside risk and smooth out returns, as it did for our portfolios during the April market volatility period.

Why does this matter now? In the past, the beta bull market supported a more passive approach to building portfolios. Looking forward, as we continue towards a regime of increasing uncertainty and dispersion in returns, dynamic asset allocation will become more of a “Essential” feature and a key differentiator for performance.

Disciplined investment process

Dynamic doesn’t mean reactive. Nor should changes be made for the sake of it. Our active positioning runs through a structured, risk-aware investment process that enables us to evaluate the full multi-asset opportunity set in a comprehensive and disciplined way. It is the anchor that enables us to avoid behavioural biases or short-termism which can easily succumb to fleeting market news or narratives.

Our process also balances risk control alongside cost efficiency, to ensure position sizing remains well balanced and returns remain attractive after transaction costs are considered. In an environment where value and suitability matters are increasing in focus, we believe our multi-dimensional active allocation approach, set at a competitive price, offers a compelling proposition for clients.

Diversification beyond traditional means

With bonds no longer the same buffer they once were, diversification needs to work harder. Opportunities for dynamic allocation are not, and arguably should not, be confined to one or two key directional views, which can easily be whipsawed by markets. Instead, we focus on breadth, spreading a greater number of diversified granular views across the portfolio.

The application of granular views not only lowers the chances of any one idea dragging down the portfolio but also increases the probability of generating alpha. Moreover, these granular active levers can be applied within the constraints of a traditional low-cost 60/40 portfolio.

Case Study: Implementing HSBC Global Strategy active views

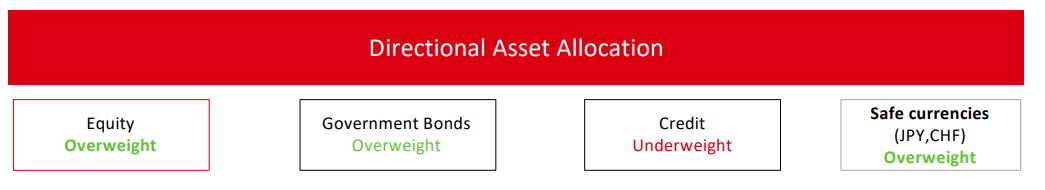

The table below outlines the two levels of active asset allocation we deploy in the portfolios. The first are the headline views across the broad asset classes, which is currently overweight equities and government bonds balanced by an underweight in credit and tilt towards safe haven currencies to express our cautious optimism amidst continued market uncertainty.

Directional asset allocation: How we tilt the overall risk exposure across broad asset classes.

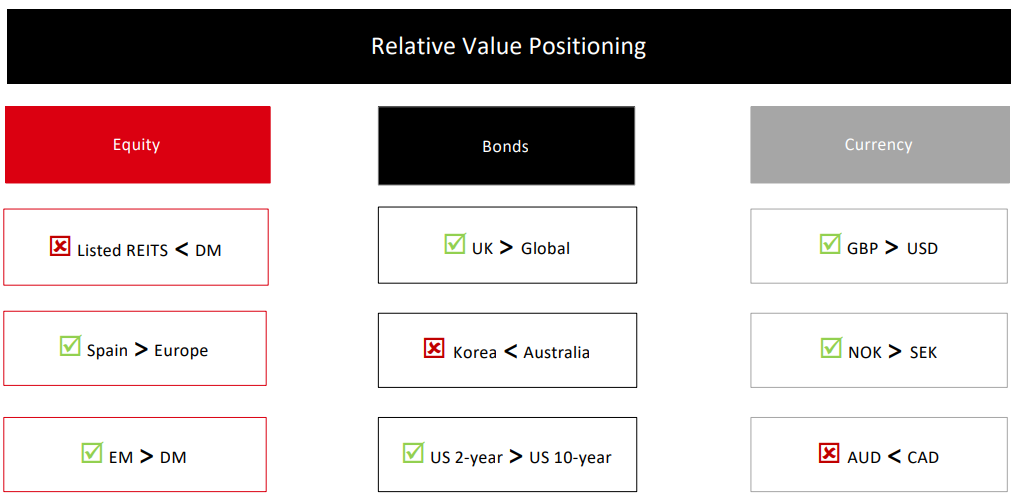

We then explore for more granular opportunities within markets. Through our comprehensive and disciplined investment process, we have identified opportunities in Spanish and emerging market equities. Within bonds, we favour UK and Australian markets. These positions, otherwise known as relative value, can be structured against the broader market, a specific region or even within a country’s market. The portfolio also implements relative value currency views.

Source: HSBC Asset Management, as of 31st August 2025. Diversification does not ensure a profit or protect against loss. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. For Illustrative only. This shouldn’t be considered as an investment advice.

The bottom line

We operate in a more fragmented, uncertain world. Tariffs are just one sign of deeper shifts - toward economic nationalism, reshoring, and strategic competition. The days of relying on static portfolio structures are likely behind us. Dynamic positioning remains key for capturing near-term dislocations but must fit within a coherent, resilient strategic framework. Diversification - in its truest, multi-dimensional form - has never been more critical.

Key Investment Risks

• Counterparty Risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations

• Credit Risk: A bond or money market security could lose value if the issuer’s financial health deteriorates

• Default Risk: The issuers of certain bonds could become unwilling or unable to make payments on their bonds

• Derivatives Risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset

• Emerging Markets Risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks

• Exchange Rate Risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly

• Interest Rate Risk: When interest rates rise, bond values generally fall. This risk of this happening is generally greater the longer the maturity of a bond investment and the higher its credit quality

• Investment Fund Risk: Investing in other funds involves certain risks an investor would not face if investing in markets directly. Governance of underlying assets can be the responsibility of third-party managers

• Investment Leverage Risk: Investment leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/ or losses due to the amplification effect from a movement in the price of the reference source

• Liquidity Risk: Liquidity risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors

• Operational Risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

The risk factors listed above are not exhaustive. Please refer to the official product documentation for the full and detailed risk disclosures.

Get in touch:

www.assetmanagement.hsbc.com

HSBC Asset Management

Important information:

For Professional Clients only and should not be distributed to or relied upon by Retail Clients.

The material contained herein is for marketing purposes and is for your information only. This document is not contractually binding nor are we required to provide this to you by any legislative provision. It does not constitute legal, tax or investment advice or a recommendation to any reader of this material to buy or sell investments. You must not, therefore, rely on the content of this document when making any investment decisions.

This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

The contents are confidential and may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. This presentation is intended for discussion only and shall not be capable of creating any contractual or other legal obligations on the part of HSBC Global Asset Management (UK) Limited or any other HSBC Group company.

The document is based on information obtained from sources believed to be reliable but which have not been independently verified. HSBC Global Asset Management (UK) Limited and HSBC Group accept no responsibility as to its accuracy or completeness. Care has been taken to ensure the accuracy of this presentation but HSBC Global Asset Management (UK) Limited accepts no responsibility for any errors or omissions contained therein.

This document and any issues or disputes arising out of or in connection with it (whether such disputes are contractual or non-contractual in nature, such as claims in tort, for breach of statute or regulation or otherwise) shall be governed by and construed in accordance with English law.

This document provides a high level overview of the recent economic environment. It is for marketing purposes and does not constitute investment research, investment advice nor a recommendation to any reader of this content to buy or sell investments. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target.

Important information:

For Professional Clients only and should not be distributed to or relied upon by Retail Clients.

The HSBC Global Strategy Portfolios are sub-funds of HSBC OpenFunds an Open Ended Investment Company that is authorised in the UK by the Financial Conduct Authority. The Authorised Corporate Director is HSBC Asset Management (Fund Services UK) Limited and the Investment Manager is HSBC Global Asset Management (UK) Limited. All applications are made on the basis of the prospectus, Key Investor Information Document (KIID), Supplementary Information Document (SID) and most recent annual and semiannual report, which can be obtained upon request free of charge from HSBC Global Asset Management (UK) Limited, 8, Canada Square, Canary Wharf, London, E14 5HQ, UK, or the local distributors. Investors and potential investors should read and note the risk warnings in the prospectus and relevant KIID and additionally, in the case of retail clients, the information contained in the supporting SID.

HSBC Global Strategy Portfolios are actively managed.

The funds may use derivatives for the purposes of efficient portfolio management i.e. to meet the investment objective of the Fund and it is not intended that their use will raise the overall risk profile of the Fund. Please note derivative instruments may involve a high degree of financial risk. These risks include the risk that a small movement in the price of an underlying security or benchmark may result in disproportionately large movement; unfavourable or favourable in the price of the derivative instrument; the risk of default by counterparty; and the risk that transactions may not be liquid.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Stock market investments should be viewed as a medium to long term investment and should be held for at least five years. Any performance information shown refers to the past and should not be seen as an indication of future returns.

To help improve our service and in the interests of security we may record and/ or monitor your communication with us. HSBC Global Asset Management (UK) Limited provides information to Institutions, Professional Advisers and their clients on the investment products and services of the HSBC Group.

Approved for issue in the UK by HSBC Global Asset Management (UK) Limited, who are authorised and regulated by the Financial Conduct Authority.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities provided through our local regulated entity, HSBC Global Asset Management (UK) Limited.

www.assetmanagement.hsbc.co.uk

Copyright © HSBC Global Asset Management (UK) Limited 2025. All rights reserved. Content ID:D046335_v1.0; Expiry Date: 28.02.2026.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.