In this edition...

- The final frontier of research and due diligence conquered Eric Armstrong, Client Director

- Hours to minutes Eric Armstrong, Client Director

- World Economic and Market Outlook Graham O’Neill, Senior Investment Consultant, RSM.

- Inflation – what to make of the current dynamics Maria Municchi, Fund Manager, Sustainable Multi Asset Fund Range M&G Investments

- Sustainable Investing – advice from an old hand Hugo Thompson, Multi-Asset Investment Specialist HSBC Asset Management

- The biggest changes in ESG investing over the last 10 years Mark Coles, Head of Nationals & Networks Tilney Smith & Williamson

- Don’t try and defy gravity Catriona McInally, Business Development Manager – Investments Prudential

- Sustainable investing – the defining decades Hamish Chamberlayne, Head of Global Sustainable Equities | Portfolio Manager Janus Henderson

- Finding diversification beyond commercial property Shayan Ratnasingam, Investment Manager Liontrust Multi-Asset team

- Looking to alternatives in an uncertain world Chris Forgan, Portfolio Manager Fidelity Multi Asset

- Developing your investment proposition (CIP or CRP) David A Norman (DAN), CEO, TCF Investment

- Intergenerational Financial Planning Gareth Davies, Pension Specialist, Scottish Widows

- Is your online client reporting up to scratch? Natalie Holt, Content Editor, The Lang Cat

- Partnering here to stay as multi-asset solutions grow Antony Champion, Head of Intermediaries, Brewin Dolphin

- How to Capitalise on the Economic Recovery, Including Morningstar’s Portfolio Positioning Leslie Alba, Associate Director, Research Morningstar Investment Management Europe

- Unemployment insurance is back Kesh Thukaram, Co-Founder Best Insurance

After a hiatus of nearly 18 months, Best Insurance has re-launched its range of instant protection – Accident, Sickness and Unemployment (ASU) insurance. This popular form of comprehensive protection covers loss of income arising from unemployment, accident, and sickness.

"Income protection insurance provides protection against unexpected loss of income due to accident, sickness, or unemployment (ASU). It is one of the most comprehensive types of income protection one can buy."

These policies have always been popular for the value they provide, the ease of getting these policies set up and the simplicity for brokers. Also known as 'short-term' income protection, these policies cover up to 65% of gross monthly income. The claims payments are tax-free, no deductions made regardless of any benefit claimed from the Government or their employer and, the benefit amounts are paid straight to your client. Also, there are no restrictions on how these benefit amounts paid is spent.

For most people, the loss of a monthly salary would severely impact their ability to maintain their lifestyle, pay their mortgage or rents, utilities, groceries and more. With Best Insurance's income protection, your clients will still be able to have the much-needed peace of mind that they do not have to deplete their savings or rely on Job Seeker's Allowance, Statutory Sick Pay or borrowing from family and friends.

Undisputed value in ASU policies for our customers

While several customers have all types of insurances such as car, home, pet, travel etc., the one thing that funds all of these, i.e. their income, gets easily ignored.

The main reason for not having these policies is down to awareness. Once clients understand that such policies exist, the value they provide, and the simplicity of buying and making claims, it tends to be one of the policies they keep and renew for several years.

From an ROI perspective, typically, it would cost £40 for £1,000 of monthly benefit. Let's assume your client makes their first claim only after ten years of buying the policy and at that point gets paid £1,000 for 12 months, i.e. £12,000. Simple maths show that this will give them an ROI of whooping 250%. All we need is to ask our clients to set aside just over £1/day to buy this peace of mind.

Attractive return for brokers

A common misconception is that ASU policies commissions are not as attractive as other protection products such as life insurance, critical illness cover, etc. Is it? Time for some simple maths again!

Commission for Best ASU policies is payable every year on an indemnified basis. Considering the average duration of seven years, a sale of just one policy per week at a monthly premium of £40 would result in commissions of about £5,760 in the first year. Over the next seven years, the cumulative commission value will be about £161,000.

The benefit doesn't stop here. Unlike lower business valuations that come with onetime indemnified commissions, these annually indemnified models fetch multiples of 5x, meaning the valuation of ASU sales will be worth nearly £800,000. All for selling just 1 ASU policy every week.

Sold correctly, the commission income from ASU will be a massive business value enhancer and bring in the much-needed blend of recurring commissions to enhance the sustainability of your business.

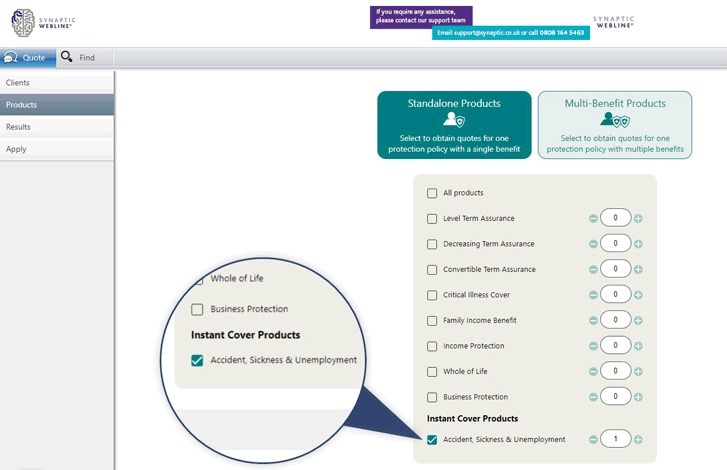

Accessing ASU with Synaptic

- Access to market leading range of ASU policies.

- No pre-registration necessary for quotes and making applications.

- First time users will be asked to register online and access is provided instantly.

About Best Insurance

Best Insurance is one of UK's largest providers of Accident, Sickness and Unemployment Insurance. For the past decade, we have been continuously refining and improving the product benefits, enhancing eligibility, making it easier for brokers to access and submit applications.

As a full-service provider, Best Insurance's role starts from designing the products in close conjunction with the insurers, modelling pricing and value, collecting premiums and managing the entire life cycle. This 360-degree approach allows Best to ensure your clients get high service levels, thereby enhancing customer satisfaction and retention.

It’s time to start selling ASU!

Please log on to Synaptic Webline at www.synaptic.co.uk or contact us on 0800 783 4477 or email customersuccess@synaptic.co.uk

www.bestinsurance.co.uk

0330 330 9465

bestbrokersupport@bestinsurance.co.uk

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.