In this edition...

- Ignore the Noise and Stick to the Strategy Eric Armstrong, Client Director, Synaptic

- Fed hikes again, but are we passed peak hawkishness? Salman Ahmed, Global Head of Macro and Strategic Asset Allocation, Fidelity International

- Duration caution as rates increase Paul Flood, Head of Mixed Assets Investment Newton Investment Management, part of BNY Mellon Investment Management

- Why investors shouldn’t overreact to talk of a recession Shaan Raithatha, Senior Economist - Vanguard, Europe

- What should I consider when investing in Alternatives in my multi-asset portfolio? Alex Funk, CIO Schroder, Investment Solutions

- Has the world changed? Mark Harris, Portfolio Manager, EPIC Investment Partners

- Swimming naked? Not us. Moody’s keeps us well protected. Eric Armstrong, Client Director, Synaptic

- The high-carbon transition Natasha Landell-Mills, Head of Stewardship, Sarasin & Partners

- Twitter, tech stocks & the untapped monetary potential Richard O’Sullivan, Investment Research Manager, RSMR

- GPUs are driving the future of computing Hamish Chamberlayne, Head of Global, Sustainable Equities

- Impact investing doesn’t mean compromising on returns M&G Investments,

- Quilter: Integrating responsible investment into your advice process Andy Miller, Investment Director Lead, Quilter

- Being green is in fashion Rahab Paracha, Sustainable multi-asset investment specialist, Rathbones

- Growth Investing: why the hunt for outliers remains compelling Stuart Dunbar, Partner, Baillie Gifford & Co

- Freedoms revisited - Where do we go from here? Matt Ward, Communications Director, AKG

It is common convention in modern portfolio construction theory that cautious to balanced investors have at least 50% of their holdings in defensive assets. For the last 20+ years, this has equated to fixed income assets. However, 2022 has abruptly challenged this convention, with consequences many investors have not faced in their careers.

This year has seen global inflation rates reach multi decade highs across most of the developed world. This is a result of a surge in global demand, linked to massive fiscal packages, changes in preferences for consumer goods, coupled with inelastic supply, further hindered by COVID and war related challenges. Initially central banks were slow to move, but they are now raising rates at an aggressive pace. Developed government bond markets have reacted accordingly with a sharp increase in yields and large declines in value. This has inflicted a lot of pain on investors, adding to already heavy losses from equity exposure. What is worse is that the diversification benefits of ‘safe-haven’ bonds, a mainstay of low to medium risk portfolios, have been stripped away by the strongest and most persistent inflation in decades.

We have used US statistics here, as they have a much longer history and are more readily available, but the result is very similar in other geographies.

• The Bloomberg US Treasury Index is in its worst drawdown since records began in 1976, down over -16% this year, which is more than double the next worst drawdown of the 1980s.

• The S&P 500 finished the first half of the year with the worst start to the year since the early 1970’s and the fourth worst on record.

• Both the S&P 500 and the Bloomberg US Aggregate registered 3 consecutive quarters of decline in 2022, a streak that has never happened in history going back to 1976 (the earliest available data for the latter index).

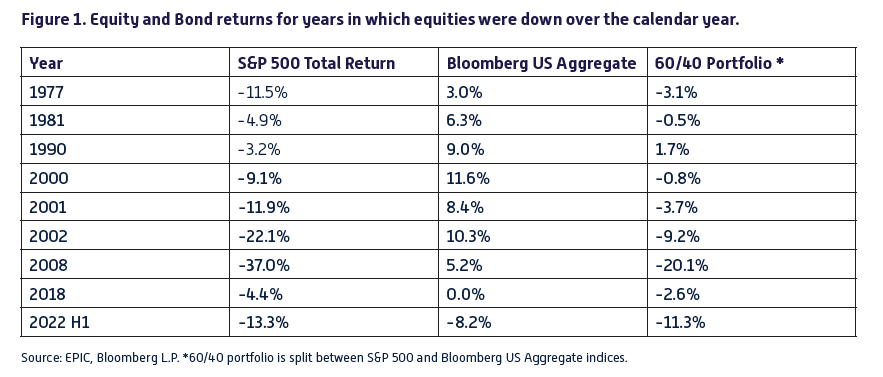

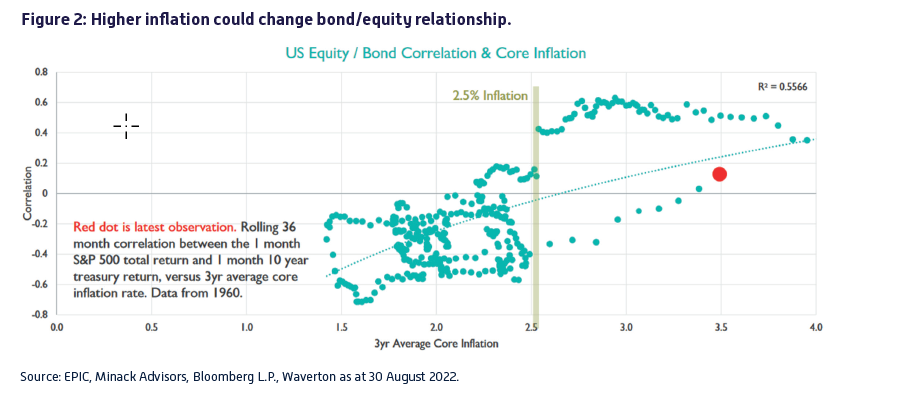

Following a near 30-year bull market in bonds and negative real yields, we highlighted the risks around heightened duration risk and traditional portfolio construction. We warned that correlations between bonds and equities could flip from negative to positive, due to the change in the economic and investment environment. It would challenge the perceived wisdom of portfolio construction for balanced and cautious investors, as government bonds might not provide as much diversification benefit in the future. In the table below (Figure 1), we can see that when equities have suffered negative returns, bonds have acted as a counterweight and rewarded. Importantly this year, both asset classes have fallen together in price terms. This has had a disastrous impact on the 60% equity 40% bond (60/40) portfolio. It has been a tectonic shift in the investing landscape for which most were ill equipped.

Property has also played a significant role in diversification within traditional pension portfolios, given its smooth return profile. However, more recently, liquidity mismatches have been a big problem with the closure of a multitude of large open-ended property fund.

The above developments show the vulnerabilities of more traditional pension approaches and the risk (both known and unknown) that portfolios can face in this inflationary environment.

So, what is the outlook from here?

There appears to be tentative signs that headline global inflation has or is likely to peak soon.

However, some of the secular deflationary forces that have been in place for decades may have been impaired by COVID effects and the war in Ukraine. Globalisation is reversing due to geopolitical concerns. Reshoring has begun in earnest to ensure supply safety in food, energy, and technology. This is likely to be inflationary. The transition to cleaner and renewable forms of energy is also anticipated to be inflationary as demand outstrips current supply capacity. Lastly, very tight labour markets resulting from historically low unemployment rates, a lower labour participation rate post COVID and reduced access to international labour markets has meant there is a risk that higher levels of wage inflation become entrenched.

All of these factors contribute to our belief that we are entering a structurally higher inflationary regime.

Under that scenario, we believe that positive correlation between bonds and equity is likely to persist and the diversification benefits of bonds will remain impaired, as the chart above demonstrates. This raises serious issues relating to the risks and suitability of traditional pension fund approaches. Ultimately, it challenges the very basis of modern portfolio construction theory.

Our approach is different and aims to tackle these issues, as well as others. Together with our partners at Dynamic Planner, we have created the UK's first purpose-built, risk managed decumulation portfolio. The objective is to mitigate sequencing and drawdown risk with a focus on capital preservation. This approach better matches retirement needs for clients. We believe we are better equipped to avoid issues surrounding traditional portfolio construction and drawdowns through two lines of defence.

Our first line of defence – Portfolio Construction:

• Holding Less in Fixed Income – reducing risk of short-term correlation with equities and over exposure to duration risk.

• Having no exposure to illiquid assets such as physical property – reducing liquidity gating risk.

• Adopting tactical use of cash – providing short term downside protection.

• Using liquid uncorrelated strategies – providing effective portfolio diversification.

Our second line of defence – rules-based approach to risk:

• Closely monitoring monthly volatility and Value at Risk – minimising risk of severe drawdowns.

• Monthly rebalancing – to maximise the risk/reward ratio of the portfolio.

The Risk Managed Decumulation 5 Model Portfolio is designed specifically for investors in retirement delivering c.5% gross income, while aiming to preserve investors’ hard-earned capital (with the flexibility to increase the income should investors wish to run down their pension at any time). The portfolio focuses on monthly risk over annual risk, and the management of the portfolio is formulated to mitigate the all-important sequencing and drawdown risk when in retirement.

If indeed the world has changed, and we may move to structurally higher inflation with the associated reduction in bond diversification ability, investors will require new and innovative solutions to manage pension assets. As at H1 2022, the S&P 500 was down -13.3%, the Bloomberg US Aggregate was down -8.2%, a typical 60/40 portfolio of those two was down -11.3% and EPIC’s Risk Managed Decumulation 5 Model Portfolio was down -3.9%.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.