In this edition...

- Ignore the Noise and Stick to the Strategy Eric Armstrong, Client Director, Synaptic

- Fed hikes again, but are we passed peak hawkishness? Salman Ahmed, Global Head of Macro and Strategic Asset Allocation, Fidelity International

- Duration caution as rates increase Paul Flood, Head of Mixed Assets Investment Newton Investment Management, part of BNY Mellon Investment Management

- Why investors shouldn’t overreact to talk of a recession Shaan Raithatha, Senior Economist - Vanguard, Europe

- What should I consider when investing in Alternatives in my multi-asset portfolio? Alex Funk, CIO Schroder, Investment Solutions

- Has the world changed? Mark Harris, Portfolio Manager, EPIC Investment Partners

- Swimming naked? Not us. Moody’s keeps us well protected. Eric Armstrong, Client Director, Synaptic

- The high-carbon transition Natasha Landell-Mills, Head of Stewardship, Sarasin & Partners

- Twitter, tech stocks & the untapped monetary potential Richard O’Sullivan, Investment Research Manager, RSMR

- GPUs are driving the future of computing Hamish Chamberlayne, Head of Global, Sustainable Equities

- Impact investing doesn’t mean compromising on returns M&G Investments,

- Quilter: Integrating responsible investment into your advice process Andy Miller, Investment Director Lead, Quilter

- Being green is in fashion Rahab Paracha, Sustainable multi-asset investment specialist, Rathbones

- Growth Investing: why the hunt for outliers remains compelling Stuart Dunbar, Partner, Baillie Gifford & Co

- Freedoms revisited - Where do we go from here? Matt Ward, Communications Director, AKG

As the direction of regulation around responsible investment becomes more defined, it brings with it a requirement to have a greater understanding of your clients’ needs and preferences, and also an opportunity to provide them with a more tailored investment solution.

Recently, I’ve been attending roadshows and talking with advisers about how they can integrate responsible investment into their advice process in a robust and repeatable way. The majority told me they are asking clients about responsible investment – which is good. In most cases though, they have told us they ask a single question, along the lines of “do you have any ethical views that may influence your investment selection?”. While that may seem ok, if you really consider it, does it enable you to understand your clients’ responsible investment preferences? To put it another way, would you ask your client a single “yes or no” question on investment risk?

To put this in context, the Office for National Statistics tell us that 75% of people are worried about climate change.* What that doesn’t tell us is to what degree they are concerned. Lift the bonnet and there’s a spectrum of views that contribute to the headline statistic – some are mildly concerned, some are deeply worried, and many are somewhere in between. The same is true for the responsible investment preferences of investors. It isn’t just a case of “yes or no”. So, what can you do to ensure that your process for understanding your clients’ responsible investment preferences is robust?

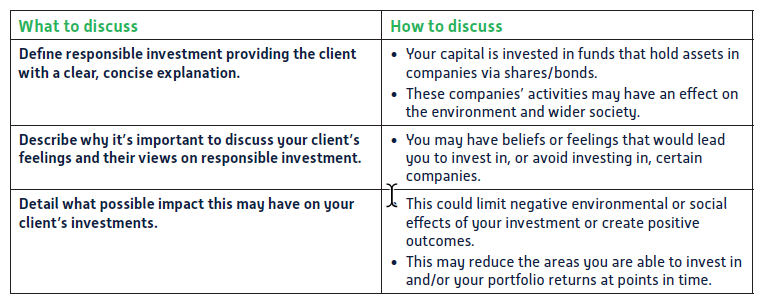

Introduce the concept

The client assessment is a good opportunity to introduce the concept of responsible investment. This is about discussing the balance between how your client may feel about investing in certain areas versus following a potentially more restricted investment approach, which could ultimately impact on investment returns. To do this, you could consider structuring your client conversations as follows:

"Going forward, regulation means that investment managers running responsible investment strategies will be required to report on the outcomes of their investment strategies."

Ask the right questions

We think there are five ‘golden rules’ that should apply whenever you ask your clients about views that may influence their investment choice, whether on the subject of responsible investment or anything else.

✔ Ask a manageable and meaningful number of questions.

✔ Avoid a binary ‘yes or no’ response.

✔ Ensure questions are clear and easily understood.

✔ Avoid biased, leading, or misleading questions.

✔ Avoid skewed results with ‘bundled’ questions.

Matching your clients to a meaningful description

Once you have asked your clients the right questions it’s important to know what to do with their responses. This is where you need to link your clients’ answers to a potential client profile or description. When considering this, here are some tips to follow:

✔ Avoid binary outputs – as your clients will have a range of opinions.

✔ Apply some science and follow a clear process, such as scoring the answers appropriately.

✔ Avoid skewing the results by attaching inappropriate weight to some answers.

✔ Describe your clients in words they understand and can agree or disagree with.

Selecting the right investments

You may have identified that some of your clients

don’t have strong views in this area – in which case

you don’t need to factor this in. However, if your

clients do have views, they should be considered

in the investment selection. This where the risk of

greenwashing rears its head.

Greenwashing is the risk that an investment may

claim to have stronger green credentials than it

does. There is also the risk that the words used by

investments may confuse the client into thinking it is

“greener” than it actually is.

By asking these three simple questions, you can gain a

lot of understanding around an investment’s make up.

1. What is the investment objective? Look beyond the

name: what is the investment designed to do?

2. Seek to understand the strategy: how will the

investment achieve its objective?

3. Review the underlying holdings of the investment.

Do the underlying investments reflect the strategy?

Reporting and limitations of data

One of the most challenging areas is knowing how to monitor investments based on their responsible investment aims and report this back to your clients. Environmental or social results of investing can be difficult to understand and measure. This is especially important to your clients who have expressed a strong interest in sustainable investment.

Going forward, regulation means that investment managers running responsible investment strategies will be required to report on the outcomes of their investment strategies. They should also provide support to advisers to report this data to their clients in an easy-to-understand way.

Through the Quilter WealthSelect Responsible and Sustainable Portfolios, we’ve done just that. We provide tools and reports that help you review the investment credentials of our portfolios, and measure how they are performing against their objectives.

Remember that adapting your advice in this area doesn’t have to be overly complex. Investing time now will help you to stay one step ahead of regulation.

*Three-quarters of adults in Great Britain worry about climate change - Office for National Statistics (ons.gov.uk)

Important Information:

Investment involves risk. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested. Because of this, an investor is not certain to make a profit on an investment and may lose money. Exchange rates may cause the value of overseas investments to rise or fall.

Please be aware that calls and electronic communications may be recorded for monitoring, regulatory and training purposes and records are available for at least five years.

The WealthSelect Managed Portfolio Service is provided by Quilter Investment Platform Limited and Quilter Life & Pensions Limited. “Quilter” is the trading name of Quilter Investment Platform Limited (which also provides an Individual Savings Account (ISA), Junior ISA (JISA) and Collective Investment Account (CIA)) and Quilter Life & Pensions Limited (which also provides a Collective Retirement Account (CRA) and Collective Investment Bonds (CIB)).

Quilter Investment Platform Limited and Quilter Life & Pensions Limited are registered in England and Wales under numbers 1680071 and 4163431 respectively. Registered Office at Senator House, 85 Queen Victoria Street, London, United Kingdom, EC4V 4AB. Quilter Investment Platform Limited is authorised and regulated by the Financial Conduct Authority. Quilter Life & Pensions Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Their Financial Services register numbers are 165359 and 207977 respectively. VAT number 386 1301 59.

Quilter uses all reasonable skill and care in compiling the information in this communication and in ensuring its accuracy, but no assurances or warranties are given. You should not rely upon the information in this communication in making investment decisions. Nothing in this communication constitutes advice or personal recommendation.

Data from third parties (“Third-Party Data”) may be included in this communication and those third parties do not accept any liability for errors and omissions. Therefore, you should make sure you understand certain important information, which can be found at platform.quilter. com/third-party-data. Where this communication contains Third-Party Data, Quilter cannot guarantee the accuracy, reliability or completeness of such Third-Party Data and accept no responsibility or liability whatsoever in respect of such Third-Party Data.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.