In this edition...

- Ignore the Noise and Stick to the Strategy Eric Armstrong, Client Director, Synaptic

- Fed hikes again, but are we passed peak hawkishness? Salman Ahmed, Global Head of Macro and Strategic Asset Allocation, Fidelity International

- Duration caution as rates increase Paul Flood, Head of Mixed Assets Investment Newton Investment Management, part of BNY Mellon Investment Management

- Why investors shouldn’t overreact to talk of a recession Shaan Raithatha, Senior Economist - Vanguard, Europe

- What should I consider when investing in Alternatives in my multi-asset portfolio? Alex Funk, CIO Schroder, Investment Solutions

- Has the world changed? Mark Harris, Portfolio Manager, EPIC Investment Partners

- Swimming naked? Not us. Moody’s keeps us well protected. Eric Armstrong, Client Director, Synaptic

- The high-carbon transition Natasha Landell-Mills, Head of Stewardship, Sarasin & Partners

- Twitter, tech stocks & the untapped monetary potential Richard O’Sullivan, Investment Research Manager, RSMR

- GPUs are driving the future of computing Hamish Chamberlayne, Head of Global, Sustainable Equities

- Impact investing doesn’t mean compromising on returns M&G Investments,

- Quilter: Integrating responsible investment into your advice process Andy Miller, Investment Director Lead, Quilter

- Being green is in fashion Rahab Paracha, Sustainable multi-asset investment specialist, Rathbones

- Growth Investing: why the hunt for outliers remains compelling Stuart Dunbar, Partner, Baillie Gifford & Co

- Freedoms revisited - Where do we go from here? Matt Ward, Communications Director, AKG

Investing the life savings of clients is an awesome responsibility, but one rarely hears of advisers failing in this task, a testament in itself to the success that advisers achieve. Trust for one’s adviser is well documented in surveys. It is no mean feat to deliver investment returns in the long term and calibrate risk to a level that is consistent with a client’s appetite and tolerance for risk.

Firms have increasingly taken over the oversight of portfolios and investments via Centralised Investment Propositions and multi-asset investments, from institutional asset managers (Insurance product providers) at a time when markets, politics and world events have made it arguably a greater challenge than ever.

No wonder more and more firms have been seeking alignment of their financial planning process with the most complete, deep and high performing asset allocation, risk and investment forecasting model from Moody’s Analytics, where institutional strength research exists at the fingertips of advisers via the new Synaptic Pathways research and due diligence solution.

It is easy to direct investments when all asset classes are lifting like the tide, but increasingly, the tide is presenting problems in the correlation of asset classes and unexpected losses that will derail client’s investments in a brutal fashion. Similarly, firms may fall foul of the central tenet of compliance – that clients should only be exposed to risk they understand and are willing and able to take.

A famous quote by Warren Buffett is often repeated - ‘Only when the tide goes out do you discover who has been swimming naked’. A successful portfolio manager can use the forecasts for asset class growth to not only set up long term investments that will perform according to expectations, deliver and exceed on investment objectives and provide the basis of keeping the client engaged and informed. If you do have a robust narrative to explain the losses as well as the asymmetric gains delivered by the markets, you will be able to coach your clients effectively through market cycles, and enable them to make informed decisions based on their investment horizon.

Moody’s Analytics helps to guard against the risk of swimming naked. Whether through leverage, lack of diversification, over exposure to certain asset classes or being forced to sell and realise portfolio losses, control of investments and confidence in the destination are critical.

"A successful portfolio manager can use the forecasts for asset class growth to not only set up long term investments that will perform according to expectations, deliver and exceed on investment objectives and provide the basis of keeping the client engaged and informed."

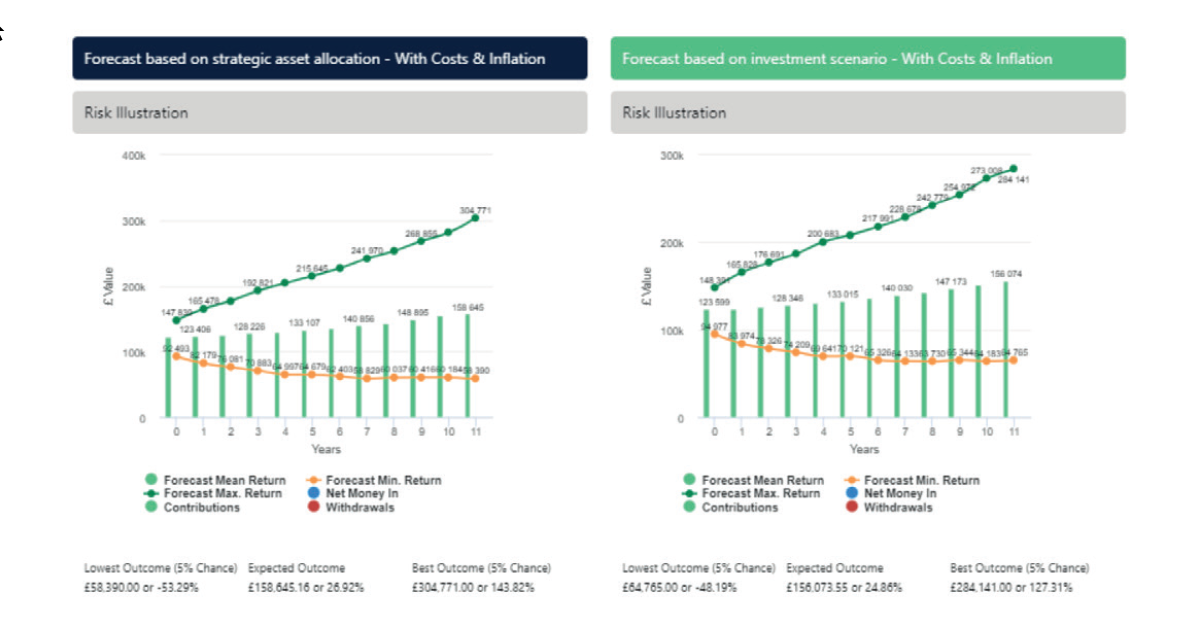

Synaptic and Moody’s provide a tool that aligns the role of the adviser to both the experience of the investment journey and with the demands of compliance. The regulator says that you should only expose your client to risk they are comfortable with, but how do you quantify risk in a consistent manner? The classis risk model seeks to balance ‘the need to take risk’ with the ‘client risk profile’ with a client’s ‘Capacity for loss’. This is especially difficult to apply across a group of advisers. There needs to be a way of pulling together growth rates, potential loss metrics and forecasting investment outcomes – this is the role of Synaptic.

Advisers know that it is staying invested that counts. Timing the market isn’t reliable and careful diversification in asset classes that will perform for a client over the term need to be arranged and overseen in portfolios.

Moody’s is more than a risk framework for loss – it is the map to the journey for these crucial strategies – providing probability-based view of the investment outcome. It quantifies expected losses as well as expected returns, all transparently set out by Synaptic in standard report formats. On top of this, the extensive mathematical modelling from the Moody's simulation includes every relevant dynamic from the investment context, including interest rates and inflation, every viable option and combination for asset class performance, good and bad.

Extract from Synaptic report showing proposed investment outcome showing probability-based stochastic forecast:

The Moody’s Wealth Scenario Generator – at the heart of the Synaptic system

The Moody’s engine is known as the Wealth Scenario Generator and is the most sophisticated tool available to firms to help set up an investment strategy or Centralised Investment Proposition. The model is based on a set of rules, on top of which a full quarterly simulation is run to create the forecast of the markets and asset class performance.

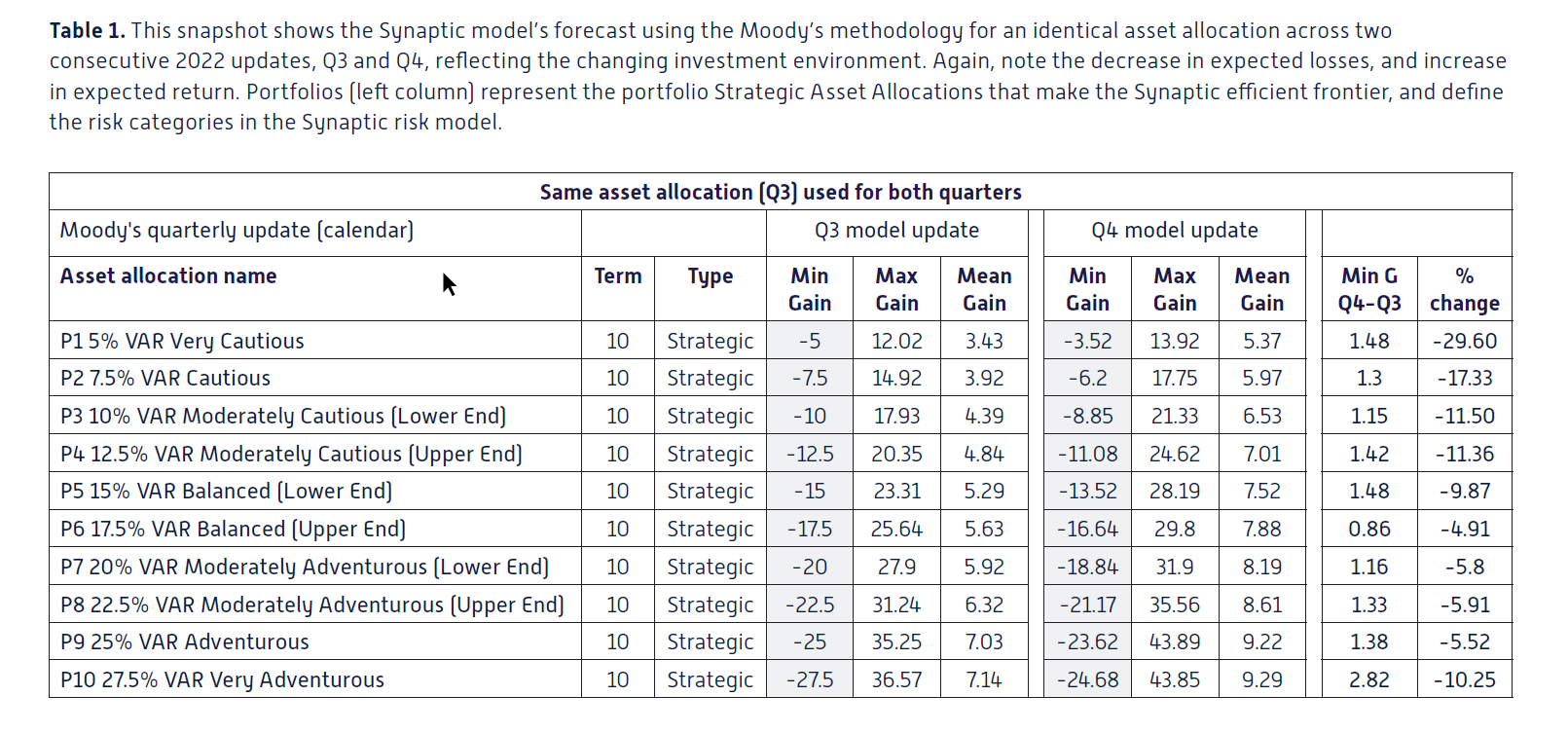

What does this look like? Obviously the recent, extraordinary world events have impacted on markets, and therefore on the model forecasts.

• Rolling 12-month market losses have been inside the percentage forecasts using the Moody’s VAR @95% (min gain) risk metric. Losses in fixed income approached the 20-year ceiling (5% likelihood). Equity losses have been less significant.

• The model is predicting significantly less risk (loss) going forward (see table 1). From a compliance point of view, this does not therefore raise any red flags as there is no increased risk in client portfolios.

• The model is predicting significantly higher nominal returns (see table 1). This is welcome of course but must be considered in the context of elevated inflation, as real returns will only come back when inflation subsides. The current Moody’s forecast for inflation over the next 12 months is 9.05%, and the expected rate in 10 years is 2.25%The average is 4-4.5%. Expected portfolio returns, including Cautious, are in excess of this bar.

Q&A

1. Does the Moody’s model have fixed or moving boundaries for its risk categories?

The boundaries are fixed. Therefore, the extent of losses that define any category are discrete and constant, irrespective of market conditions. An investor who can tolerate a VAR@95% (min gain) of -7.5% in their portfolio is always defined as ‘Cautious’. Portfolio managers will have to amend their asset allocation if they are targeting that level of risk using the Moody’s model, when market conditions change significantly. A remarkable feature of the model is its stability.

2. Is this a better method of tracking investment risk than volatility or analyst-based (qualitative) methods?

In our opinion, yes. This is the stochastic, forwardlooking approach that includes a full mathematical simulation covering all viable outcomes in order to create a probability-based distribution. This enables investors to make risk-informed decisions on a purely quant-driven basis. It is right that the risk framework should be fluid, mirroring the investment environment, adjusting the forecasts for expected returns to be as accurate as possible. Analysts are overly-prone to human error – relying on market timing is a fool’s errand.

3. What does that imply for strategies whose asset allocations remain constant going forward?

Expected losses going forward have lowered from the previous quarterly update, implying that there is less inherent risk – and that there is additional ‘headroom’, or risk budget if required.

4. Should client portfolio adjustments be made immediately?

No. Reviews should be done in a timely way as usual. Though rebalancing may be required, the drift in asset allocation has not been so severe as to require any extraordinary intervention. In any case, though the markets may be relatively lower in valuation terms, the bottom may or may not be in, given the recessionary cycle we are entering. Asset managers will have their own views as to what to do in the immediate term. Moody’s are providing a longer term perspective, not a very short term one. It is always a good time to invest when values are relatively low, as they are now, as indicated by the model.

5. What about the ratings of investments in the Synaptic Risk Rating Service?

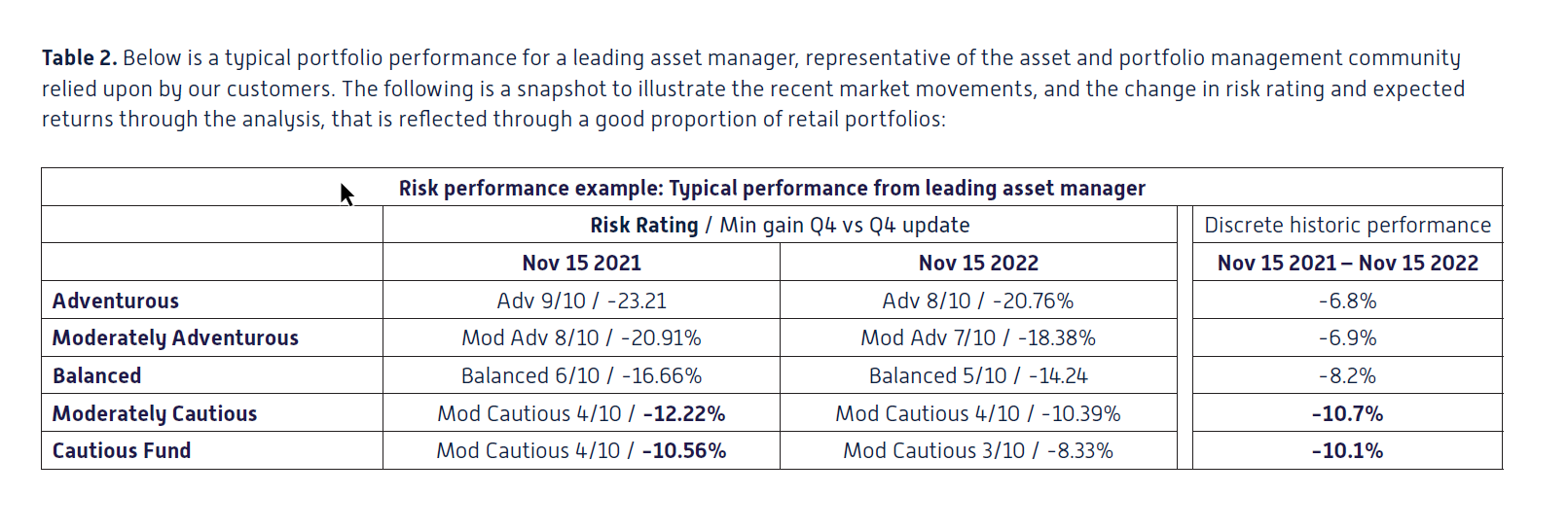

Strategies whose asset allocations are not adjusted

at this time will tend to register lower risk in the

current environment and lower returns in the

Moody’s model, and consequently may be drifting

into a lower risk categories. (See table 2).

6. What about the performance of Cautious vs Adventurous portfolios / Fixed Income vs Equity?

This is one of the most interesting phenomena we have observed over the years and possibly reflects more than one major trend. The speed of the current interest rate hikes, as well as the delay in response by the central banks has resulted in a brutal shock to the system, as central banks have rushed to make up lost ground in their attempts to control inflation. This coincided with what some experts were calling the end of a multi-decade bull market for bonds. (Some well-known research houses who rely on analysts called this several years too soon by the way). There seemed to be no more room for yields to reduce after a prolonged period of low inflation/deflation).

Very unusually, this caused some Cautious or Moderately Cautious portfolios to perform worse than their Balanced or Adventurous counterparts. (See table 2). This is the opposite of what we saw in the Great Financial Crisis of 2008 when inflation went in the other direction – equities tanked and bonds rose sharply. The hike in yields has destroyed fixed income value for sure, but it has also created room for future growth and profits in the sector. (See table 1).

NB. Of the hundreds of portfolios rated by Synaptic, there are very few Cautious Portfolios, partly as it is not economic to pay an adviser to oversee these kind of investments. The investable range really starts at Moderately Cautious. Moderately Cautious strategies have experienced losses in 2020 (Lock down) and 2022 with the current global crises, and these losses reflect the pricing of fixed income instruments. However, the Moody’s model is predicting significantly higher returns over the next few years. (See table 1). Markets are likely to have priced in a lot of the ‘downside’ from interest rates hikes and forthcoming recession already.

Summary

This all reiterates the importance of having a sensible long term investment strategy based on asset allocation, within tolerances for loss that are acceptable to clients. Moreover, it underlines the value of the Moody’s methodology in maintaining an effective investment strategy and delivering for clients, even in the difficult investment environment we are currently living through.

If you want access to institutional strength research that can be implemented seamlessly into your research and advice process, now is the time to speak to Synaptic, and make sure that you and your clients do not risk swimming naked through these challenging times.

Get in touch

0800 783 4477

The new Synaptic Pathways research and due diligence suite is now available. Get in touch to arrange a free demo or trial at your convenience.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.