In this edition...

- Financially engineered advice now standard Eric Armstrong, Client Director Synaptic Software Limited

- What do portfolios mean to advisers? John Warby, Senior Business Relationship Manager Synaptic Software Limited

- Take your firm’s asset allocation a step further than Nobel prize winning Modern Portfolio Theory Ross Holloway, Business Development Manager Synaptic Software Limited

- Risk Explorer infographic Editorial team, Synaptic Software Limited

- Quantifying the future of remote work Joe Davis, Global Chief Economist Vanguard

- Annuities: a key to smarter drawdown? Patrick Ingram, Head of Strategic Partnerships Parmenion

- Multi-asset investing that doesn’t cost the earth Mark Parry, Director, Head of Strategic and Technical Sales BMO

- MPS 2020 Review James Burns, Partner Smith & Williamson Investment Management LLP

- 2021 outlook positive, but risks remain Jon Cunliffe, Chief Investment Officer Charles Stanley

- The Chinese consumer revolution Janet Mui, Investment Director Brewin Dolphin

- EEE ESS GEE: The Sequel Steve Nelson, Head of research the lang cat

- Drivers and developments in sustainable multi-asset investing Maria Municchi, Fund Manager, Sustainable Multi Asset Fund Range M&G Investments

- RSMR Weekly Broadcast: the battle for content – deal or no deal? Richard O’Sullivan, Investment Research Manager RSMR

- COVID-19: Bringing operational financial strength into sharper focus Guy Vanner, Managing Director AKG

- Video - every adviser’s new best friend Martyn Pask, Director Asset TV

Sustainable investment approaches look to the future, by investing responsibly and supporting the environment and society. So sustainable investment strategies should aim to achieve objectives that include meeting financial goals, as well as preserving our planet's resources, recovering its climate and making life better, more equal and inclusive.

"We believe that adopting a positive ESG-tilt approach, by looking to focus on investing in entities that have more positive ESG characteristics compared to their peers, should form a core element of how we build portfolios of sustainable assets."

A multi-asset approach to sustainable investing allows investors to make use of a diverse range of asset types to achieve their objectives. Diversification offers investors the opportunity to spread their risk, with the intention of avoiding concentration in one or a few themes or assets classes that might introduce unwanted volatility in their returns. These are likely to include traditional asset classes of equities, bonds and cash, but also may now incorporate such things as infrastructure, green bonds, social bonds and speciality funds.

Equities within a sustainable strategy provide an ownership stake in businesses that are following a sustainable business model or are transitioning towards one. Bonds, or fixed income securities, represent a way of lending to companies that take a responsible approach, or even directly to fund specific projects or initiatives that aim to make a positive difference, often from supranational entities. We also include buying bonds issued by governments in our sustainable strategies, as governments around the world will typically use the bulk of their income, be they tax revenues or bond proceeds, for the good of their society. This may be in the form of providing education, welfare payments, healthcare or public pensions. Of course any government may undertake practices that some find unpalatable, and we will refrain from holding their bonds where we believe the negatives sufficiently outweigh the positives.

The pressing challenges facing environments and society know few borders and investors have extended their scope worldwide, so taking a global approach is a necessity in our view. In our sustainable strategies, we aim to find value opportunities that we believe are attractive, wherever they may arise.

The techniques and tools applied in investing sustainably continue to evolve. What may have previously amounted to simply excluding investments in certain sectors has developed into more sophisticated approaches. These approaches may require greater and more detailed analysis on the work companies are doing to meet their sustainability objectives, as well as identifying and measuring their achievements. This may involve extensive resources, which may only be available to the larger organisations.

As the spectrum of sustainable investing has developed, we have incorporated additional features to existing first stage exclusions on such factors as adherence with United Nations Global Compact Principles, as well as sector and industry exclusions. Considerations of how a potential investment may be judged on its environmental, social and governance (ESG) behaviours and contributions have now been integrated into our investment process. We believe that adopting a positive ESG-tilt approach, by looking to focus on investing in entities that have more positive ESG characteristics compared to their peers, should form a core element of how we build portfolios of sustainable assets.

To achieve this, we believe it is appropriate to use the access we typically have, as large-scale investors, to the management and ownership of companies, to engage with them to gain clearer insights into the sustainability of their business plans and processes. Engagement can help clarify investor understanding, encourage greater transparency and identify tools to measure progress towards sustainable objectives. Beyond that, we also seek to incorporate investments that actively aim and intend to make a positive impact on some of the world's pressing environmental and social challenges.

Across the investment world demand for sustainable or responsible investment products is growing and even gaining momentum. Individual savers and institutional investors alike have recognised that investing to sustain the planet's resources, improve its social well-being and look to the world's future, can go hand in hand with seeking to achieve financial security and M&G feels equally strongly about that and have been developing processes and products to help meet those goals.

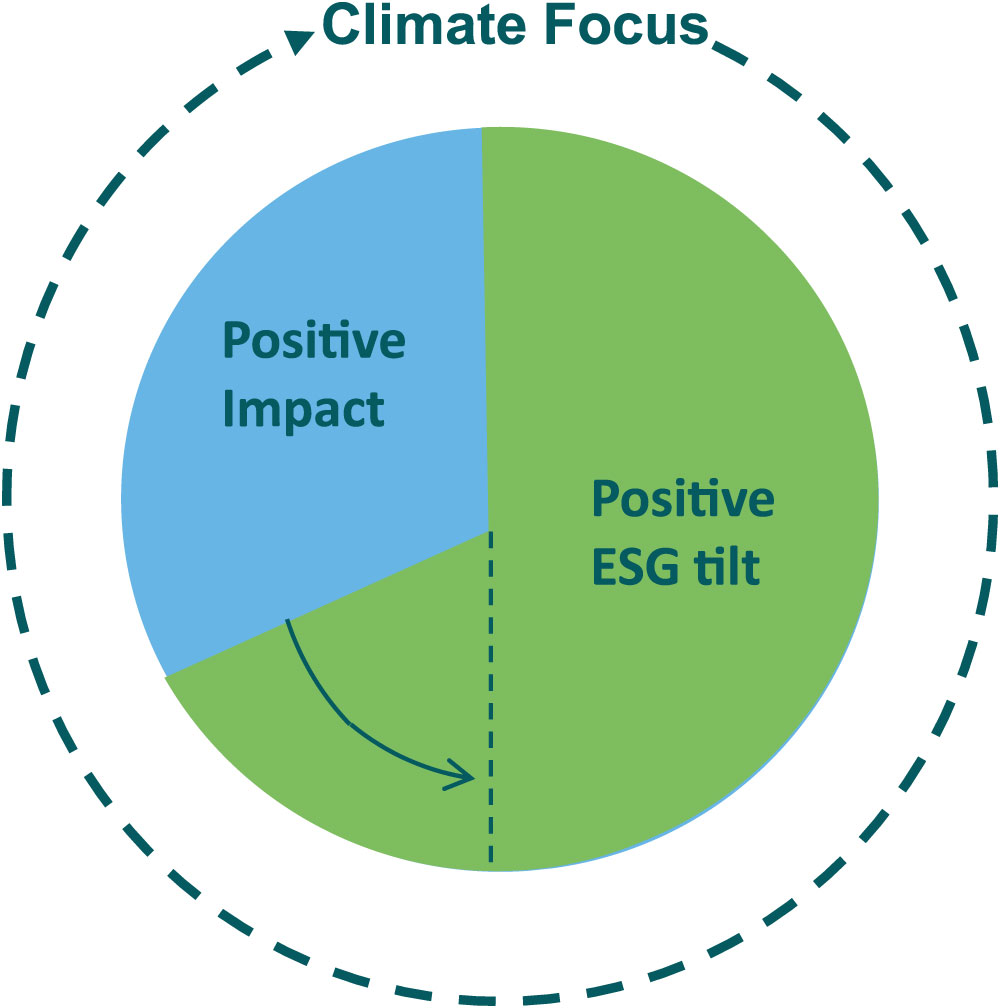

We understand that while investors may have objectives relating to a sustainable future that are similar, their expectations for financial returns and their tolerance for risk may differ. To meet that demand, M&G has launched a new range of sustainable multi asset funds, which we believe can satisfy these alternative appetites. Spread across cautious, balanced and growth profiles, these actively-managed, risk-targeted solutions combine strategic and dynamic asset allocation decisions originating from our long-standing Multi Asset team, invested in assets that incorporate positive ESG-tilt and positive impact characteristics. All those decisions are encompassed with an overarching climate focus, which concentrates on carbon intensity and climate adaptability, which we believe is crucial to achieving a more sustainable global economy.

Sustainable multi asset investing at M&G

Source: M&G, January 2021

For more information on M&G's approach to sustainability, visit our website at www.mandg.com/sustainability

The value of a fund’s assets will go down as well as up. This will cause the value of your investment to fall as well as rise and you may get back less than you originally invested.

The views expressed in this document should not be taken as a recommendation, advice or forecast.

For financial advisers only. Not for onward distribution. No other persons should rely on any information contained within. This financial promotion is issued by M&G Securities Limited which is authorised and regulated by the Financial Conduct Authority in the UK and provides ISAs and other investment products. The company’s registered office is 10 Fenchurch Avenue, London EC3M 5AG. Registered in England and Wales. Registered Number 90776.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.