In this edition...

- Financially engineered advice now standard Eric Armstrong, Client Director Synaptic Software Limited

- What do portfolios mean to advisers? John Warby, Senior Business Relationship Manager Synaptic Software Limited

- Take your firm’s asset allocation a step further than Nobel prize winning Modern Portfolio Theory Ross Holloway, Business Development Manager Synaptic Software Limited

- Risk Explorer infographic Editorial team, Synaptic Software Limited

- Quantifying the future of remote work Joe Davis, Global Chief Economist Vanguard

- Annuities: a key to smarter drawdown? Patrick Ingram, Head of Strategic Partnerships Parmenion

- Multi-asset investing that doesn’t cost the earth Mark Parry, Director, Head of Strategic and Technical Sales BMO

- MPS 2020 Review James Burns, Partner Smith & Williamson Investment Management LLP

- 2021 outlook positive, but risks remain Jon Cunliffe, Chief Investment Officer Charles Stanley

- The Chinese consumer revolution Janet Mui, Investment Director Brewin Dolphin

- EEE ESS GEE: The Sequel Steve Nelson, Head of research the lang cat

- Drivers and developments in sustainable multi-asset investing Maria Municchi, Fund Manager, Sustainable Multi Asset Fund Range M&G Investments

- RSMR Weekly Broadcast: the battle for content – deal or no deal? Richard O’Sullivan, Investment Research Manager RSMR

- COVID-19: Bringing operational financial strength into sharper focus Guy Vanner, Managing Director AKG

- Video - every adviser’s new best friend Martyn Pask, Director Asset TV

In September 2012 we launched a Managed Portfolio Service (MPS). Unique in the industry, by including investment companies and ETFs together with open ended funds, our philosophy was to provide a series of risk targeted portfolios that would be similar to the experience that Smith and Williamson private clients receive.

"We had several holdings that performed extremely well for us, the majority of which have a growth focused strategy that was very much in favour throughout most of the year. We believe this flies the flag for active management."

How did the MPS perform/fair during the pandemic crisis last spring?

We entered 2020 overweight equities and underweight bonds in the Managed Portfolio Service. This was based on the facts that global manufacturing indices were improving, global corporate earnings were continuing to grow and that Central Bank policies remained accommodative. Our positive stance initially looked correct as the S&P500 index in the US closed at a record high on the 19th February.

Unsurprisingly this risk-on stance did not set us in good stead as pandemic fears gripped stock and bond markets. It would have been very easy for us to have panicked at this moment, but as it became clear that central banks and governments were going to do whatever they could to support their economies and markets, we decided to hold our nerve. We also saw that the markets had become extremely fast-moving in both directions and due to the mechanics of most investment platforms rebalancing the portfolios could have led to clients being significantly uninvested at just the wrong time. We therefore held back from making any changes to the portfolios over the quarter and decided to wait for some stability in pricing before making asset allocation decisions.

What did the team do to protect the models during 2020?

This first rebalance in April was focused on adding some extra stability to the portfolios without taking away the ability to benefit from any rally in equities in the future. At the lower risk end of the range this involved taking some profits from index-linked bonds and gilts which had held up well and recycling the capital into UK and US corporate bonds. We also reduced exposure to UK commercial property and increased the allocation to hedge funds. Within equities we reduced the value element of some of the portfolios and increased the exposure to growth managers, most notably in Japan. At the higher end of the risk scale we slightly reduced our equity allocation where it was still elevated and reduced our direct exposure to India and Russia and increased the US and China.

By July, having seen the markets rebound significantly we felt it was an appropriate time to reduce the equity overweight in the three lowest risk portfolios back to neutral. We reduced the exposure to UK, US and Japanese equities and again increased the allocation to UK and US corporate bonds.

As we entered the Autumn we saw further clouds of uncertainty on the horizon in the shape of the US election and a possible second wave of COVID. We had also seen the equity overweight in the higher risk models get back to where it had started the year and we felt it was prudent to reduce this. Again, areas that had done particularly well for us were trimmed, namely the US, Japan and Asia.

What investments were the team most pleased to hold and what didn't work so well during the year?

We had several holdings that performed extremely well for us, the majority of which have a growth focused strategy that was very much in favour throughout most of the year. We believe this flies the flag for active management, where good managers were able to unearth companies that outperformed their domestic markets by some margin. Holdings of note here were JPMorgan Japanese (+38.7%), Baillie Gifford Japan Trust (+35.3%) and BlackRock European Dynamic (+34.8%). Some of our developing markets names were equally impressive with Schroder Asian Total Return Investment Company (+35.6%) and Hermes Global Emerging Markets (+42.5%) standing out, although they were put into the shade by Fidelity China Special Situations which rose by 68.6%.

Last, but by no means least, it is worth mentioning our core hedge fund position, BH Macro, which rose by 34.9% during the year. Most importantly the bulk of this was achieved during the darkest days of February and March.

Several funds disappointed over the year and they generally employed more of a value focus and were predominantly, although not exclusively, in the UK list where, despite a strong end to the year, the UK still returned a double-digit loss. Man GLG Undervalued Assets (-16.0%) and RWC Enhanced Income (-12.0%) were the most disappointing. Within developing markets we also had two notable laggards in Utilico Emerging Markets (-14.4%) which is heavily skewed towards infrastructure such as ports and airports that unsurprisingly struggled and BlackRock Emerging Market Equity Strategies (-12.4%) which has a significant contrarian bias and avoided many of the large cap tech names that drove the markets.

"While the news on the mutant form of the virus is clearly unwelcome, we remain positive on the outlook for stocks, not least because we believe policymakers will throw everything they can at the disease in order to beat it. We also think monetary policy will remain highly accommodative until the world has a clear route out of the crisis."

How is the MPS currently positioned?

Our fourth rebalance of the year was carried out in December. We took this as an opportunity to move overweight the UK and underweight the US, driven by what we believed to be excess pessimism towards the UK at a time when Brexit would soon be done one way or the other, vaccines were beginning to be used and the UK looked too cheap relative to virtually all other markets. The prospects for sterling also look more positive.

Overall, we remain pretty fully invested with an underweight allocation to cash. We are overweight equities and underweight bonds, although we remain overweight alternatives, primarily through hedge funds. Our positive outlook for the UK is also reflected in our overweight to UK corporate bonds. Within equities, in addition to the above UK and US positions we are overweight Europe as well as Asia & Emerging Markets.

What is your outlook for markets for 2021?

2020 was an incredibly difficult year for the developed world economies but this has not prevented markets such as that of the US from delivering strong returns. In the emerging world, Asia has performed well, partly reflecting that it was the first region to be hit by the crisis and thus the first to emerge from it; Asia has also managed COVID-19 relatively well compared to the US, UK and Europe, perhaps reflecting the benefit of experience garnered during other public health emergencies such as SARS.

While the news on the mutant form of the virus is clearly unwelcome, we remain positive on the outlook for stocks, not least because we believe policymakers will throw everything they can at the disease in order to beat it. We also think monetary policy will remain highly accommodative until the world has a clear route out of the crisis; low or near-zero interest rates are typically very supportive of long duration asset classes such as equities. We also think that stock markets that have been significant laggards in 2020, most notably the UK, can close some of the performance gap relative to other regions in 2021.

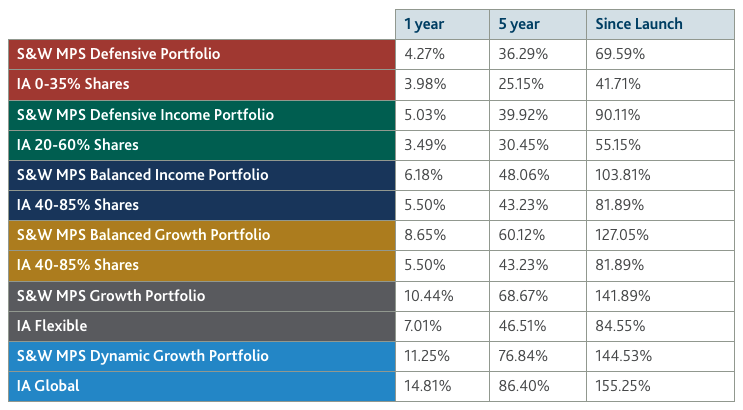

Cumulative performance to 31 December 2020

For further details, please visit: www.sandwdfm.com

Or contact Mickey Morrissey

t: 020 7131 4693

e: mickey.morrissey@smithandwilliamson.com

Past performance is not a guide to future performance. Capital at Risk. The value of investments and the income from them can fall as well as rise and you may not receive back the original amount invested. The portfolio’s performance is shown below after the effects of all charges made by the underlying holdings but before accounting for S&W’s investment management charge, and any platform fees and adviser charges. The effect of these additional fees and charges would be to reduce the returns shown. Periods over 1 year are annualised. IA = Investment Association. Source: Smith & Williamson Investment Management / FactSet as at 31.12.20 (unaudited). Periods over 1 year are annualised.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing. Investment does involve risk. The value of investments and the income from them can go down as well as up. The investor may not receive back, in total, the original amount invested. Past performance is not a guide to future performance. Rates of tax are those prevailing at the time and are subject to change without notice. Clients should always seek appropriate advice from their financial adviser before committing funds for investment. When investments are made in overseas securities, movements in exchange rates may have an effect on the value of that investment. The effect may be favourable or unfavourable.

Smith & Williamson Investment Management LLP is part of the Tilney Smith & Williamson group. Smith & Williamson Investment Management LLP is authorised and regulated by the Financial Conduct Authority.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.