In this edition...

- Financially engineered advice now standard Eric Armstrong, Client Director Synaptic Software Limited

- What do portfolios mean to advisers? John Warby, Senior Business Relationship Manager Synaptic Software Limited

- Take your firm’s asset allocation a step further than Nobel prize winning Modern Portfolio Theory Ross Holloway, Business Development Manager Synaptic Software Limited

- Risk Explorer infographic Editorial team, Synaptic Software Limited

- Quantifying the future of remote work Joe Davis, Global Chief Economist Vanguard

- Annuities: a key to smarter drawdown? Patrick Ingram, Head of Strategic Partnerships Parmenion

- Multi-asset investing that doesn’t cost the earth Mark Parry, Director, Head of Strategic and Technical Sales BMO

- MPS 2020 Review James Burns, Partner Smith & Williamson Investment Management LLP

- 2021 outlook positive, but risks remain Jon Cunliffe, Chief Investment Officer Charles Stanley

- The Chinese consumer revolution Janet Mui, Investment Director Brewin Dolphin

- EEE ESS GEE: The Sequel Steve Nelson, Head of research the lang cat

- Drivers and developments in sustainable multi-asset investing Maria Municchi, Fund Manager, Sustainable Multi Asset Fund Range M&G Investments

- RSMR Weekly Broadcast: the battle for content – deal or no deal? Richard O’Sullivan, Investment Research Manager RSMR

- COVID-19: Bringing operational financial strength into sharper focus Guy Vanner, Managing Director AKG

- Video - every adviser’s new best friend Martyn Pask, Director Asset TV

Without asset allocation and its benefits, there is no way to control risk and therefore offer a measured approach to investment returns with a credible basis of acquiring goals for clients. There is a wealth of academic support for the primacy of asset allocation as the driver for returns, just as there is a great deal of evidence showing the difficulty in maintaining demonstrable success in stock-picking.2 Thomas P. McGuigan documented the statistical likelihood of actively managed funds remaining in the top quartile over two subsequent decades (up to 2003) as low as 28.57%, with a third of funds dropping to the second quartile and the rest of the third or fourth quartiles. However, the beauty of an asset allocation approach as advocated here is that it accommodates any investment style, the full range of qualitative research, including calls on active vs passive, ESG or any other basis that a firm may wish to invest.

"Without asset allocation and its benefits, there is no way to control risk and therefore offer a measured approach to investment returns with a credible basis of acquiring goals for clients."

Harry Markowitz and Modern Portfolio Theory

The Synaptic approach to asset allocation has its roots in the pioneering, Nobel prize-winning work of economist Harry Markowitz3 in the 1950s. He described how correlation coefficients between various asset classes could be used to optimise an asset class blend capable of maximising portfolio returns and protecting against losses, with the creation of an 'efficient frontier' made up of asset allocations capable maximising returns for the lowest risk. Every adviser knows that diversification is the core principle of investing to be revered alongside cost control and the pursuit of compound interest. This research transformed possibilities for advice, and remains as relevant today as ever. Famously, Markowitz built his model based on the expected returns for asset classes based on their historical volatility, or 'mean-variance'. Volatility continues to be used as part of any calculation of risk, but has drawbacks as a result of its reliance on historical trends as the basis of forecasting.

Moody's Analytics and stochastic forecasting

Stochastic techniques involving such as those developed by Moody's Analytics are able to create probability-based forecasts by combining mathematical simulation with econometrics, where rules and assumptions describe the full range of viable investment outcomes. Put succinctly, forecasts based on forward-looking calculations have been proven to be much more accurate than forecasts based exclusively on records of historical data. Moody's can point to exceptional reliability in forecasting the expected returns on asset classes when considered in retrospect.

The Moody's model is fully integrated into the Synaptic research proposition, enabling an adviser to assist a client in making an informed investment decision. There are two key attributes captured in the risk profile obtainable for any investment: the ability to forecast the likely outcome of an investment strategy for a given investment horizon; secondly, the extent of losses expected on the journey in a 'bad year', defined as the worst year of investment returns expected in 20 years. This calculation provides the necessary insight to plan for sequence risk and adverse markets.

The Moody's efficient frontier is comparable to the Markovitzian original, but more accurate by virtue of its forward-looking research methodology.

The firm's investment strategy

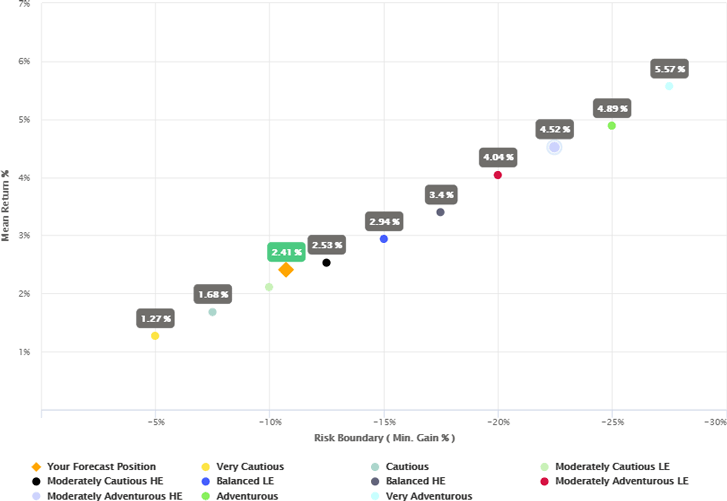

Below is the graph produced by plotting the expected returns of the asset allocation supplied by Moody's, against the Value at Risk metric or 'min gain' value, available in any Synaptic Risk profile. This ease of mapping provides the basis of ensuring portfolio risk and return characteristics are optimised for clients. Thereafter, alignment with goals can be demonstrated, and suitability is made evident. The example shows a portfolio that is way off the efficient frontier and will need rebalancing or switching.

The need to take risk

Risk is part of any assessment of suitability. The FCA says (in GC 11.01): "We will consider, for example, whether firms have robust procedures, tools and risk category descriptions (where used) to establish and check the level of risk a customer is willing and able to take, as well as assessing the suitability of investment selections."

To meet this challenge, the mapping of the questionnaire scoring should be correctly aligned to the investment strategy as represented by the asset allocations. In the case of the Synaptic proposition, the risk categories, descriptions and mapping to the asset allocations are all reviewed and maintained in alignment with the latest academic review. The strategic asset allocations are updated quarterly and the questionnaire is tested every two years.

Tactical versus strategic

Financial planning is, of course, a long-term exercise; however, the Moody's model allows Synaptic to supply tactical and strategic asset allocations as part of the risk profiling exercise. This helps you to monitor and gain insight into short-term positions that an asset manager may be taking (tilts). This was very useful, for example, at the height of the COVID-19 crisis. The strategic asset allocation is movement along the efficient frontier, whereas tactical asset allocation involves movement of the efficient frontier.

The strategic asset allocation is used by firms as a guide, or at least as a starting point for constructing portfolios, which can be optimised by testing against the strategic asset allocations.

Asset allocation in retirement

The regulator has warned advice firms of the imminent return of Thematic Reviews around suitability and the threat of enforcement, with a focus on long term saving and retirement. Strategies for retirement will increasingly be dependent on asset allocations requiring the right amount of risk, not necessarily less. The culture of our industry has always assumed a glidepath of reducing risk is the sensible approach to retirement. Obviously safety comes first, but the data and the analysis shows that investment risk has a place in retirement planning, combined with close monitoring and regular reviews. The Moody's asset allocation and forecasting capabilities offer the perfect way for modern firms to perform the research to help formulate these strategies and create the C.I.P.'s and C.R.P.'s that will deliver reliable and measured investment returns, and delight clients in the process.

The ‘Synaptic guide to risk: an advisers guide to risk profiling and asset allocation’ is free to download at www.synaptic.co.uk

- Harry Max Markowitz (born August 24, 1927) received the 1990 Nobel Memorial Prize in Economic Sciences.

- Thomas P. McGuigan, ’The Difficulty of Selecting Superior Mutual Fund Performance’, Journal of Financial Planning, February 2006

- Markowitz, H.M. (March 1952). ‘Portfolio Selection’. The Journal of Finance.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.