In this edition...

- Strategic Asset Allocation: A timeless solution Vanguard,

- The second great age of replacement business Eric Armstrong, Client Director - Synaptic

- The fragmented world of adviser tech and provider processes Natalie Holt, Content Editor - the lang cat

- Will the Consumer Duty make your CIP obsolete Antony Champion, Head of Intermediaries - Brewin Dolphin

- Einstein, Benjamin Graham and Napoleon David Macfarlane, Team Head, Discretionary Wealth Management - HSBC Asset Management

- How IFAs can unlock a smooth ride Marc O’Sullivan, Head of Investments - Wesleyan

- Reliance on others Tim Cooper, Freelance Journalist on behalf of EBI

- Boom-bust economics is back! Be warned… John Pattullo, Co-Head of Strategic Fixed Income - Janus Henderson Investors

- Through a glass, darkly Guy Monson, Senior Partner and Chief Market Strategist - Sarasin & Partners

- Diversified income fund and impact Close Brothers , Asset Management

- Sustainable futures Mike Fox, Head of Sustainable Investments - Royal London Asset Management

- Morningstar Wealth Platform: now the real work gets underway Mark Sanderson, Director - Morningstar Wealth Platform

- A new capitalism Seeking value in Japanese equities M&G Investments,

- Is it the end of an era for the UK property market Andrew Robinson, Senior Investment Analyst - RSMR

- Buy, hold or sell? Either way, you need research to evidence your decision John Warby, Business Development Manager - Synaptic

In many ways, over the last couple of years, we have had a ‘war time’ response to the COVID-19 crisis, with very easy fiscal and monetary policy working in the same direction and unfortunately, overstimulating global economies.

In many ways, over the last couple of years, we have had a ‘war time’ response to the COVID-19 crisis, with very easy fiscal and monetary policy working in the same direction and unfortunately, overstimulating global economies.

We are now approaching the ‘cold turkey’ stage. This is not much different from the political business cycles we encountered in the 1980s before central banks became independent. Now, we are experiencing very strange, scary and short-lived economic cycles with large swings that we expect are yet to come.

We believe major economies are approaching one of the most significant macroeconomic turning points in recent decades; that economic growth and inflation have reached their peak (certainly in the US) and central banks are tightening financial conditions at a time when their economies are heading into a slowdown. We believe that markets are pivoting from a ‘headline inflation’ hysteria towards what we see as quite an acute ‘growth shock and economic downturn’.

Where are we today?

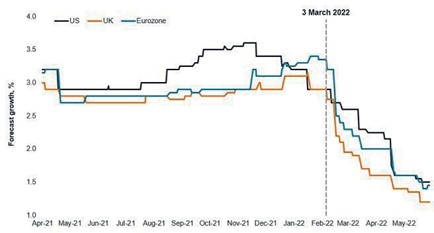

Back in autumn 2021, we mentioned that April 2022 was to be a key inflection point for growth momentum in the economies – that it would begin to collapse from a year-on-year perspective given the strength of economic data twelve months previously. The growth outlook is currently looking even worse than we expected as every region of the world is being downgraded (see chart). Further, according to the International Monetary Fund, GDP-weighted global growth is expected to be down 3.2% year-on-year in 2022 – a level normally seen in a recession.

2022 growth forecasts

Given hawkish central bank action, as inflation keeps surprising to the upside, the debate on whether there will be a soft or hard landing in the economies has now intensified.

We lean on the bearish side of the consensus in this debate. In part due to the self-induced financial tightening as a result of rising interest rates and quantitative tightening plans, but also because of ‘consumer confidence’ data. The latest figures show a drop across the globe to levels that are associated with recessions. They also reveal that consumer confidence has decoupled from the employment market, as sentiment has fallen – despite lower unemployment rates. This points to a dismal picture of household sentiment as the impact of inflation and higher energy prices put a drag on confidence at the individual level.

More corroborating evidence for our bearish stance

Tightening financial conditions are being felt everywhere and there are increasing numbers of indicators that point to a significant slowdown in growth. The strength of the US dollar, collapsing business confidence since March in the developed world, signs of banks tightening lending in the eurozone, and a downtrend in major Purchasing Managers’ Indices (PMIs), to name a few.

In the US, trucking data shows a sharp fall in demand since March, while there are similar drops in a few other consumer areas such as sales of used cars and mattresses, indicating a real shift in consumer sentiment. Housing activity is on a downward trend and in the retail sector, recent profits warning from some of the biggest retailers emphasise how many companies have over earned, over stocked and over hired on an unsustainable basis over the course of the pandemic.

Finally, the odds of a recession increase with rising oil and energy prices, which are akin to a tax on growth – while energy is a more significant factor in the Europe, US household spending on energy is also up to levels close to those seen in the oil shocks of the 1970s.

Where are we heading?

From a year on year perspective given the high base data in 2021, inflation figures should generally come down from here. The real questions are by how much, and will they remain at uncomfortable levels?

Central banks are on a mission to tame inflation, seemingly accepting the consequences of ‘demand destruction’. Given their aggressive stance plus all the other evidence, we believe that we are likely heading for a steep downturn and that a recession is unavoidable – a hard landing is almost certain in the UK and Europe with a less severe downturn expected in the US.

We have recently experienced an extraordinary boom bust cycle driven by COVID 19. In our opinion, economic cycles will likely be more boom bust going forward as the echo of COVID lingers (similar to the echo of Lehman post the Global Financial Crisis). While the next cycles might be shorter and/ or more violent, they are likely to also open up good opportunities for investors.

For more information, please visit www.janushenderson.com or email sales.support@janushenderson.com

Important Information:

The views presented are as of the date published. They are for information purposes only and should not be used or construed as investment, legal or tax advice or as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirements. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, are subject to change and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Janus Henderson Investors is the source of data unless otherwise indicated, and has reasonable belief to rely on information and data sourced from third parties. Past performance does not predict future returns. Investing involves risk, including the possible loss of principal and fluctuation of value.

Not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Janus Henderson is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents of this material have not been approved or endorsed by any regulatory agency.

Janus Henderson Investors is the name under which investment products and services are provided by the entities identified in the following jurisdictions: (a) Europe by Janus Henderson Investors International Limited (reg no.3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no.2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Henderson Management S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Outside of the U.S.: For use only by institutional, professional, qualified and sophisticated investors, qualified distributors, wholesale investors and wholesale clients as defined by the applicable jurisdiction. Not for public viewing or distribution. Marketing Communication.

Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.