In this edition...

- Strategic Asset Allocation: A timeless solution Vanguard,

- The second great age of replacement business Eric Armstrong, Client Director - Synaptic

- The fragmented world of adviser tech and provider processes Natalie Holt, Content Editor - the lang cat

- Will the Consumer Duty make your CIP obsolete Antony Champion, Head of Intermediaries - Brewin Dolphin

- Einstein, Benjamin Graham and Napoleon David Macfarlane, Team Head, Discretionary Wealth Management - HSBC Asset Management

- How IFAs can unlock a smooth ride Marc O’Sullivan, Head of Investments - Wesleyan

- Reliance on others Tim Cooper, Freelance Journalist on behalf of EBI

- Boom-bust economics is back! Be warned… John Pattullo, Co-Head of Strategic Fixed Income - Janus Henderson Investors

- Through a glass, darkly Guy Monson, Senior Partner and Chief Market Strategist - Sarasin & Partners

- Diversified income fund and impact Close Brothers , Asset Management

- Sustainable futures Mike Fox, Head of Sustainable Investments - Royal London Asset Management

- Morningstar Wealth Platform: now the real work gets underway Mark Sanderson, Director - Morningstar Wealth Platform

- A new capitalism Seeking value in Japanese equities M&G Investments,

- Is it the end of an era for the UK property market Andrew Robinson, Senior Investment Analyst - RSMR

- Buy, hold or sell? Either way, you need research to evidence your decision John Warby, Business Development Manager - Synaptic

The vantage point of research has been a fantastic place to keep abreast of industry trends, because the research requirements follow the changing dynamics very closely. The culture of research has changed from case-bycase, whole-of-market, features-based due diligence, and replaced by a requirement to research appropriate solutions for client types.

MiFID has etched this out in stone. Investment solutions must be researched at proposition level and mapped to ‘client types’. It is suitability that must be evidenced with each recommendation. This implies that a firm could in theory recommend an identical solution with each recommendation that the firm ever makes. Theoretically an independent adviser can work with a single range of riskgraded portfolios on a single platform for all clients, as long as the firm can demonstrate avoidance of the stipulated pitfalls: ‘churning’ (a suitable recommendation in the client’s interests); ‘shoehorning’ (no ‘one-size-fits-all’ that doesn’t take into account a client’s individual circumstances) and ‘costs’ (where additional costs or lack of transparency is poor value for money for the customer).

Replacement business and investment platforms

This new culture was established officially in the seminal final guidance paper from 2012:

‘Assessing suitability: Replacement business and centralised investment propositions’. The paper shaped the industry’s approach to moving from the insured provider-dominated old world to the RDR-enabled new world. This enshrined the concept of ‘replacement business’, one of the greatest gifts to advice firms, and which ultimately underpins the business model of any modern advisory business that is seeking to streamline ‘manufacture’ of investment solutions through to ‘distribution’ through any kind of aggregation or consolidation. It also means that a small firm can evolve their approach to advice and building a profitable business through the alignment of their own Centralised Investment Proposition.

The policy paper acknowledged that custody of funds under advice would be moving out of their institutional shelters in volume and that advisers, in their role as gatekeepers or ‘influencers’, would redirect hundreds of billions of investments into portfolio and fund-based investments under their direction. To put some numbers on it, the lang cat research announced that Assets Under Advice on investment platforms exceeded £500bn in May 2021. In addition, some current estimates, including from the lang cat, identify the majority of adviserinfluenced investment flows as going into firms’ Centralised Investment Propositions.

This of course provided an enormous challenge for regulators who needed to show that they had effective oversight of advisory businesses and the custody of these vast assets. This is most clearly evidenced in the PROD rules and the pipeline of forthcoming new regulation, not least the juggernaut that is Consumer Duty. Long story short, the regulator

expects firms to research suitable investment solutions for client types, provide unprecedented levels of disclosure and due diligence with each recommendation to demonstrate suitability.

"The culture of research has changed from case-by-case, whole-of-market, features-based due diligence, and replaced by a requirement to research appropriate solutions for client types. MiFID has etched this out in stone. Investment solutions must be researched at proposition level and mapped to client types’. "

The trend that kicked off with ‘replacement business’ in the first wave of transition from provider-based custody of assets to platforms in 2016, is now driving the evolution and profitability of advisory firms in the second wave of replacement business. Whereas in the first wave, firms were migrating to ‘fund supermarkets’ and the early ‘wraps’, the current era of consolidation is continuing to move assets from legacy providers. However, firms now have a whole new generation of technology supporting their ability to configure investment solutions. It is easy for a firm to configure custody for their clients’ assets under discretionary permissions or accessing institutional managers’ managed portfolio services, providing not only unprecedented value but also control, in the hands of advisers.

The investment platform industry has become a behemoth in terms of scale, certainly, but the modern Centralised Investment Proposition has almost unlimited flexibility in terms of features and style of investment. It is possible for a small firm of advisers to craft suites of portfolios and product configuration to accommodate any client type or segment, at any life stage or investment threshold.

Compression of portfolio yields and value for money

A further consideration is the compression of portfolio yields. 10 years of sustained growth in a deflationary environment since the 2008 financial crisis have to some extent, flattered portfolio managers, and provided cover for some higher prices that have been charged. Obviously, clients could afford higher prices if they could rely on returns. It was normal for a discretionary-managed investment to cost around 3% all-in, on an ad valorem basis, comprising of platform, product, portfolio, discretionary and advisory charges.

At the present moment it is hard to see how expected growth (on an inflation-adjusted basis) will even cover this extent of costs. Consider what a modern business can deliver the same package for today. We see firms offering discretionary management charges of 20bps (not 1%), platform and product costs under 30bps and fund and transaction costs in active and passive blended portfolios between half and one percent. It is possible to provide the entire package, including adviser charging at less than a third what it cost a few short years ago.

Part of the PROD requirements are that these solutions are well researched and documented, including the extent of charges that will be applied. This will become more important as the regulatory vice of Consumer Duty and Value for Money demanded by advisory firms and portfolio managers continues to close.

The role of research in managing replacement business

With these tightening margins comes an absolute necessity for efficiency and streamlining. Managing replacement business requires industrial strength processes and institutional strength research to underpin it. The only way to support a repeatable process is a research process that puts the adviser in full control with the ability to provide a compliant record for any investment recommendation on demand. This is simply not possible using resources offered by providers or tools on platforms, where these tools exist in a grey area of conflicted interests and inducements. Moreover, they only provide half the research required for a piece of replacement business, or indeed any switch, because an illustration showing the expected investment returns and cost disclosure of a proposal, supplied by a provider or platform must also include research to show the attributes and prospects of the ceding scheme or schemes. The route to operational liberation is to provide your own illustrations using independent research. Obviously, good research will also highlight the cases where it better not to move investments.

Introducing the new Synaptic Pathways research software

The good news is that all the research requirements required are now available at the touch of a button from Synaptic. The new Synaptic Pathways software can fully configure the Centralised Investment Proposition of a firm, so that complete and accurate illustrations can be generated on demand. Reports demonstrate full disclosure as well as investment forecasts that combine deterministic (using actuarial growth rates) and stochastic forecasts (using Moody’s risk framework) of both the ceding and proposed investments, allowing advisers to demonstrate expertise in financial planning in a fully compliant manner.

In the event of a switch, critical yield and hurdle rates are calculated automatically, including the ability to include multiple assumed growth rates. This is all possible thanks to series of new features in the Synaptic suite, including proprietary data on platform and product costs, the ability to identify the appropriate share class for any investment scenario.

For the first time in practice, the research required to evidence the completion of a review, including proof of suitability, can now be performed almost instantly. The burden of additional research that came in with MiFID II, requiring full assessment of suitability as part of the review process will no longer require multiple systems, the re-keying of data and excessive use of costly administrative expertise.

Some highlights of the Synaptic Centralised Investment Proposition configuration capability:

- Investment solutions can be tailored for any target market or This is the most efficient way of streamlining advice, and of course, is consistent with MiFID II and PROD. Mapping the investment solution to the target market is of the essence.

- Ability to provide accurate illustrations in line with COBS without recourse to research from third-party systems or indeed, provider or platform-based tools. Research capability in Synaptic Pathways extends to all aspects of retirement planning including calculations to evidence Sustainable Withdrawal and Phased Drawdown in pensions.

- Single report combining all the relevant information and research to support the recommendation for a switch out of legacy product or existing custody and into an investment solution defined by a firm’s Centralised Investment Proposition.

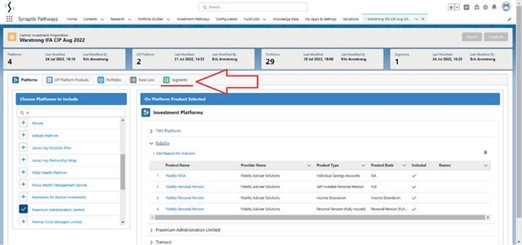

The screen below shows the panel configuration that is possible using the Synaptic Pathways C.I.P. module. The components that can be used to configure a CIP include platform, off-platform, portfolio and (approved) fund list options.

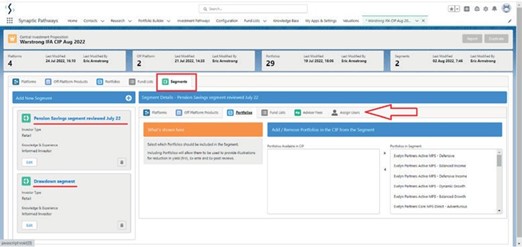

The screen below shows how to configure a segment. A segment represents the mapping of investment solutions to target market or client ‘types’, as per the FCA’s final guidance on the use of a Centralised Investment Propositions in Replacement Business. Synaptic allows firms to configure a C.I.P. to reflect their preferred way to doing business.

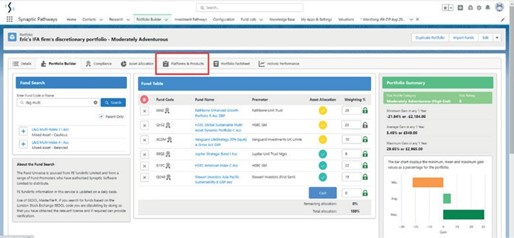

The screen below shows the ability of Synaptic Pathways to construct portfolio solutions to use in the Central Investment Proposition. Whether bespoke, model, or as in this case, discretionary, the firm has complete control. With the ‘in-house discretionary’ capability, discretionary and charges reflecting special deals with platforms, share-class options. Platform and product configuration are all reflected in a perfectly formed package ready for the adviser to create MiFID II compliant illustrations and full disclosure based on the client’s investment scenario.

Get in touch

If you are a firm choosing software to support your Centralised Investment Proposition and streamline the delivery of advice, call us for a demo or a trial.

0800 783 4477

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.