In this edition...

- Strategic Asset Allocation: A timeless solution Vanguard,

- The second great age of replacement business Eric Armstrong, Client Director - Synaptic

- The fragmented world of adviser tech and provider processes Natalie Holt, Content Editor - the lang cat

- Will the Consumer Duty make your CIP obsolete Antony Champion, Head of Intermediaries - Brewin Dolphin

- Einstein, Benjamin Graham and Napoleon David Macfarlane, Team Head, Discretionary Wealth Management - HSBC Asset Management

- How IFAs can unlock a smooth ride Marc O’Sullivan, Head of Investments - Wesleyan

- Reliance on others Tim Cooper, Freelance Journalist on behalf of EBI

- Boom-bust economics is back! Be warned… John Pattullo, Co-Head of Strategic Fixed Income - Janus Henderson Investors

- Through a glass, darkly Guy Monson, Senior Partner and Chief Market Strategist - Sarasin & Partners

- Diversified income fund and impact Close Brothers , Asset Management

- Sustainable futures Mike Fox, Head of Sustainable Investments - Royal London Asset Management

- Morningstar Wealth Platform: now the real work gets underway Mark Sanderson, Director - Morningstar Wealth Platform

- A new capitalism Seeking value in Japanese equities M&G Investments,

- Is it the end of an era for the UK property market Andrew Robinson, Senior Investment Analyst - RSMR

- Buy, hold or sell? Either way, you need research to evidence your decision John Warby, Business Development Manager - Synaptic

Synaptic has quietly introduced a new feature to our new research and due diligence software solution, Synaptic Pathways. However, it represents a shift of Homeric proportions in the provision of advice. Today we are looking at how Synaptic has created a process to conduct MiFID II compliant reviews, including the capability of providing a fully automated review process.

The system now has full manual editing capability, meaning that Holdings are fully editable at product and fund level in order to facilitate reviews and switching. This ensures that an adviser orparaplanner can always provide analysis to supporta review recommendation, buy, hold or sell.

Readers will recall that there is no ‘long stop’ to advice. Liability will follow the adviser to the grave, so it is essential to ensure that due diligence is performed correctly, and a compliant record exists for each recommendation made.

We know from various industry RFIs and conversations that we have been party to with our customers, that many firms are struggling with the increased scrutiny around reviews. Is there evidence of reviews having been conducted? Does the review evidence a comprehensive reassessment of the investment’s suitability? What about the client’s knowledge, experience or change of circumstances? How have you demonstrated that expected returns are aligned with the client’s

financial planning objectives? On-going revenue for a firm is reliant on an efficient review process. If the review is not demonstrably complete then theoretically, any recurring income for the firm should be returned to the client.

The truth is, many firms struggle with this requirement. Before MiFID II, it was only necessary for firms to demonstrate that they were providing a service to a client, they did not have to produce evidence of suitability. That has changed, and evidence of suitability is now required.

As a research house, we at Synaptic wanted to raise to this difficult challenge and put the tools into the hands of advisers and paraplanners to compete reviews to the highest possible level of due diligence and disclosure. We knew it was difficult because no other software solution has combined all the elements required to meet this particular challenge. At the moment, firms tend to use multiple standalone systems, including risk profiling, asset allocation, forecasting and costs and charges disclosure, multiple look-ups for key information and supporting documentation. Synaptic has succeeded in combining all the required components in a single seamless process.

A major benefit offered with this new functionality is the removal of obstacles in conducting Replacement Business, as well as switches or providing evidence as to why recommending remaining invested in a legacy holding is in the client’s best interest.

To facilitate a review in Synaptic Pathways, identify the holding in a client’s record. The following components need to be available for the system to conduct research to provide an illustration of the recommendation going forward, including costs and charges disclosure:

- Name of the holding and information, including policy details to identify the contract under review.

- Permissions in place with the appropriate provider if details are going to be updated automatically via contract enquiry. This is activated in the ‘Valuations tab’.

- Breakdown by underlying investments or funds.

- Asset allocation of portfolio to allow stochastic growth projections to be made.

- All costs and charges associated with holding to ensure accurate calculations to be made.

There are two routes for conducting a client review:

1. When the details of the investment holding under review are available automatically via contract enquiry, or other integration between Synaptic Pathways and the platform or product provider providing custody for the holding.

In this instance the system will populate the holding with information provided. The extent of information returned by the automated service depends on the provider, so it is essential that the adviser can edit the information in order to ensure that the details required to proceed with research are present. In many cases the information provided will include transaction information.

2. When the details of the investment holding are not available through contract enquiry or other integration.

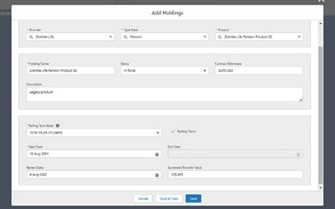

In this instance, the user simply supplies the necessary information manually and is then able to proceed. The following screen shows how details of a legacy product can be set up for a review and/or switch. Once set up, the record will be accessible from the client record.

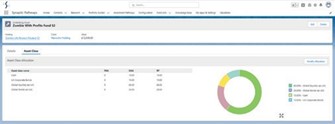

The screen below shows the editable table showing the underlying investments’ asset allocations at the point of research.

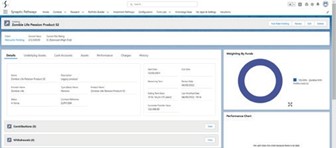

The screen below shows access to the various attributes of the holding, including underlying asset, charges, contributions and withdrawals.

Synaptic Pathways is now equipped to support advisers and firms in producing a compliant record of every investment recommendation made. The ability to move seamlessly between complex research- based tasks is one of many features that can help your firm to thrive in the new regulatory environment. The latest Synaptic Pathways feature to be released includes network controls that allow advice and governance to be managed via configuration of the firm’s Central Investment Proposition.

Get in touch

The new Synaptic Pathways research and due diligence suite is now available. Get in touch to arrange a free demo or trial at your convenience.

0800 783 4477

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.