In this edition...

- Investing in clean technology for tomorrow’s renewable economy Hamish Chamberlayne, Head of Global Sustainable Equities

- Will there be a soft landing for the UK housing market? Katie Poulson, Client Engagement & Marketing Manager - RSMR

- The changing face of growth James Budden, Director of Marketing and Distribution - Baillie Gifford & Co

- Managing CGT through unitised funds ,

- Higher inflation not the end of the 60/40 portfolio Giulio Renzi-Ricci, Head of Asset Allocation - Vanguard

- Reality will bite for central banks Ariel Bezalel, Investment Manager, Jupiter Strategic Bond Fund - Jupiter

- The Synaptic Pathways guide to research and due diligence ,

- Offering self-reliance in due diligence for reviews ,

- How to approach reviews: the task that defines firms Eric Armstrong, Client Director - Synaptic

- Integrate your Centralised Investment Proposition (CIP) with Synaptic Pathways ,

- Synaptic Pathways can take your firm’s asset allocation a step further than Nobel prize winning Modern Portfolio Theory ,

- The first rule of financial planning: insure the breadwinner Synaptic,

- Hours to minutes Synaptic,

We at Synaptic believe in the overwhelming importance and benefits of Protection. Over many years, the Synaptic Webline tool has provided billions of quotes for consumers and advisers. Every family should have life cover. Below is a summary, shown as a reminder of the importance of cover. We want to encourage all our customers to do the right thing for their clients and help arrange the right protection.

We at Synaptic believe in the overwhelming importance and benefits of Protection. Over many years, the Synaptic Webline tool has provided billions of quotes for consumers and advisers. Every family should have life cover. Below is a summary, shown as a reminder of the importance of cover. We want to encourage all our customers to do the right thing for their clients and help arrange the right protection.

Financial protection for dependents

Dependents who rely on a breadwinners’ income to support them financially will be hard hit if that income disappears, so a safety net is crucial. Death benefits can replace your income and help your loved ones continue to live day-to-day, pay off debts and cover educational expenses.

Covering outstanding debts

Life insurance is most often set up to pay off outstanding debts such as mortgages, car loans, or credit card balances, so that your loved ones are not burdened with those financial obligations in the event of your death.

Funeral and final expenses

Funerals and related expenses are costly. Life insurance can help your family cover these costs without posing additional strain at an already difficult time.

Estate planning

With an estate or valuable assets to pass on to your heirs, life insurance can help ensure that your beneficiaries receive the assets intact by providing liquidity to cover estate taxes, legal fees, and other expenses.

Business continuity

For business owners or key persons, life insurance can be crucial to ensure the continuity of the business operations. It can help cover expenses, facilitate business transfers, or provide funds to buy out a deceased partner's share.

Supplement retirement savings

Certain types of life insurance, such as Whole of Life, offer a cash value component that accumulates over time. This can be used as a source of tax-advantaged savings or as a supplement to your retirement income.

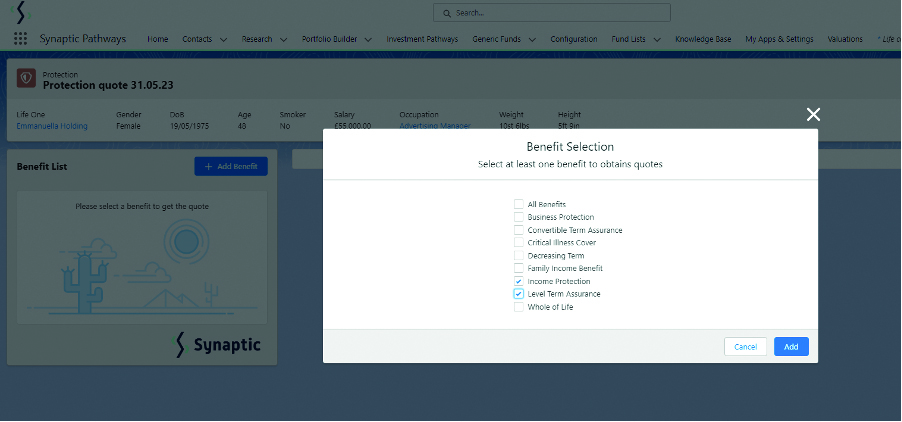

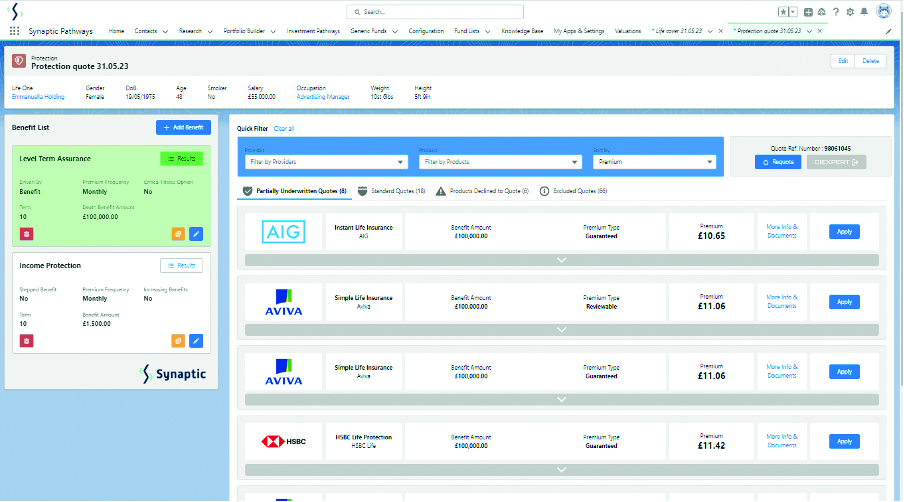

The following screenshots demonstrate the ease with which Protection quotes can be accessed using the new Protection feature in Synaptic Pathways, which is packed with user-friendly features. Quoting and buying cover for clients has never been easier:

- Client details are known in the system and pulled through automatically.

- The quote feature is accessed from within the client record where quotes are also stored. A full range of Protection products are available to be quoted simultaneously.

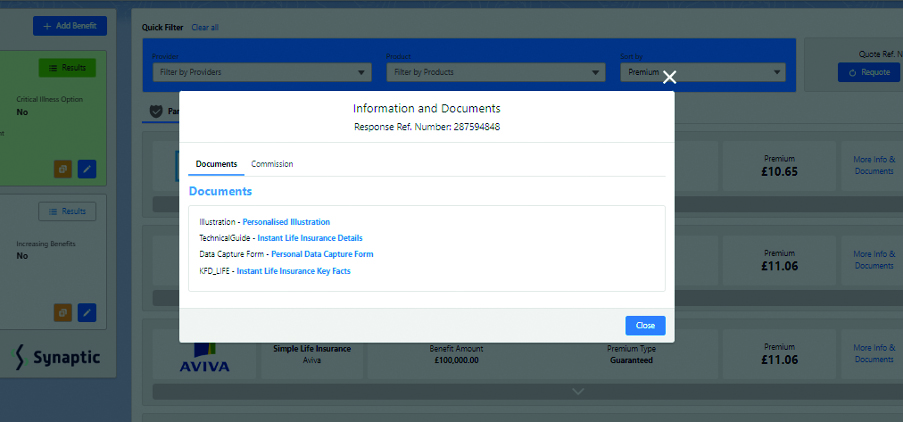

- Tiles on the left indicate the various quotes requested by the adviser, with access to links to further information (see screenshot below).

- The quotes are returned directly from the providers and ranked according to premium. The last column includes an ‘Apply’ button which will take the user directly to the provider’s extranet to manage a seamless online application.

The screen below shows the options from a menu of Protection products on which the system is able to quote:

The user can drill down into a product to access additional information and documentation:

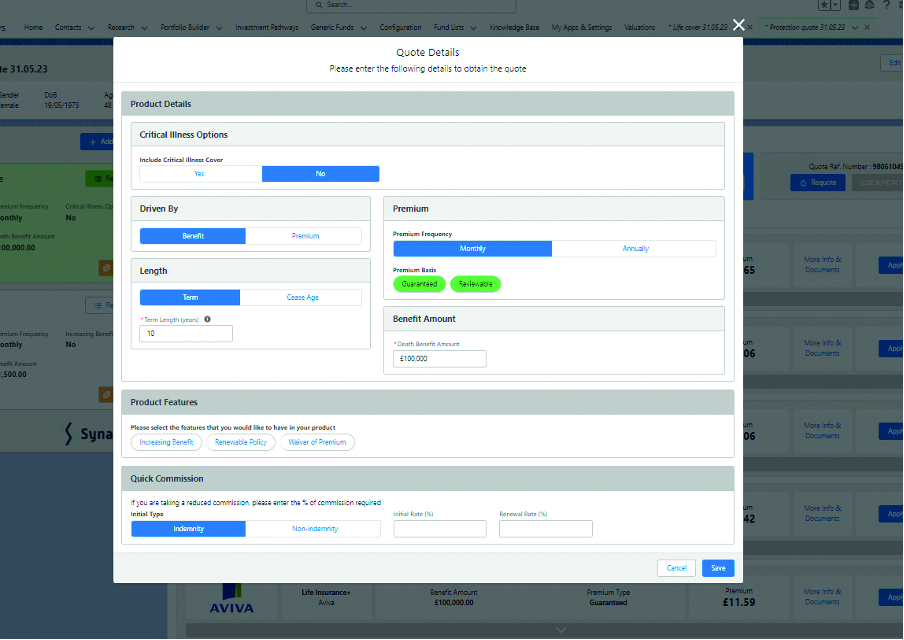

The screen below shows the ease with which adjustments to the quote can made, including commission sacrifice, if desired:

The screen below is the results screen, providing easy access to a full range of quotes. The user can click on the results for multiple quotes from multiple products:

It has never been easier to ensure your clients are adequately covered. The Protection quote feature is available for free for all users of Synaptic Pathways. For those who have not made the move to Synaptic Pathways, a standalone version is available. Call us on 0800 783 4477.

For a free trial or demo call:

0800 783 4477

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.