In this edition...

- Investing in clean technology for tomorrow’s renewable economy Hamish Chamberlayne, Head of Global Sustainable Equities

- Will there be a soft landing for the UK housing market? Katie Poulson, Client Engagement & Marketing Manager - RSMR

- The changing face of growth James Budden, Director of Marketing and Distribution - Baillie Gifford & Co

- Managing CGT through unitised funds ,

- Higher inflation not the end of the 60/40 portfolio Giulio Renzi-Ricci, Head of Asset Allocation - Vanguard

- Reality will bite for central banks Ariel Bezalel, Investment Manager, Jupiter Strategic Bond Fund - Jupiter

- The Synaptic Pathways guide to research and due diligence ,

- Offering self-reliance in due diligence for reviews ,

- How to approach reviews: the task that defines firms Eric Armstrong, Client Director - Synaptic

- Integrate your Centralised Investment Proposition (CIP) with Synaptic Pathways ,

- Synaptic Pathways can take your firm’s asset allocation a step further than Nobel prize winning Modern Portfolio Theory ,

- The first rule of financial planning: insure the breadwinner Synaptic,

- Hours to minutes Synaptic,

Synaptic Pathways offers the first fully integrated, standardised research and due diligence methodology for the review of investment holdings.

Synaptic Pathways offers the first fully integrated, standardised research and due diligence methodology for the review of investment holdings.

There are three main research journeys through Synaptic: 1. New money; 2. Switching (including pensions) and; 3. Reviews.

The latter is the most significant for several reasons. Most firms are established, and whilst they will regularly need to do switching or occasional new money illustrations, the vast majority of their due diligence resides with conducting and evidencing reviews, and in many cases exclusively so. The stats confirm this will be a continuing trend. According to McKinsey, between 2015 and 2021, the UK pensions market, measured by funds under management, grew at a compound annual growth rate of 7% from £3.8trn to £5.7trn. The advised portion (onplatform, ISA, SIPP, drawdown) increased to £1.2trn. This is where the focus for due diligence resides for advisers.

Self-reliance and clients’ interests

Before looking at some more detail around the actual illustration journey, there is another important quality that Synaptic is able to offer firms in line with Consumer Duty. Synaptic is designed to provide firms with self-reliance and capture the benefits that come from weaning off dependence on providers, platforms and asset managers, whose influence comes at a potential cost to clients’ interests. Firms need to demonstrate their investment solutions are free from bias. The design of the Synaptic proposition was designed to give control of the advice process to firms and reduce reliance on providers and other asset managers.

The efficiency of many firms is determined by the time it takes to interact with firms, including requesting valuations and illustrations. As long the Synaptic user can access information about the holding, all the necessary due diligence can now be handled by the system, including around legacy products, insured products and platform-based products. All the research and due diligence can be provided seamlessly and consistently, but also without bias.

The regulations recognise the dangers to objectivity and fiduciary care in over-reliance on providers or platforms, for example in ‘TR16/1: Assessing suitability: Research and due diligence of products and services’, when describing good and bad practice. Making decisions that benefit the firm over the clients or clients is a specific conflict of interest with potentially far reaching consequences.

The anatomy of a review – complete research and due diligence to support a review in minutes with Synaptic

1. The three ways to set up a holding in Synaptic to conduct a review:

a. Request a valuation via the new Synaptic Valuation service, using the firm’s credentials.

b. Push the holdings information from Intelliflo I.O. (part of 2 way integration).

c. Set up manually. The system has access to a wide range of data, but in the event data is missing (on legacy products), holdings are easily configured manually.

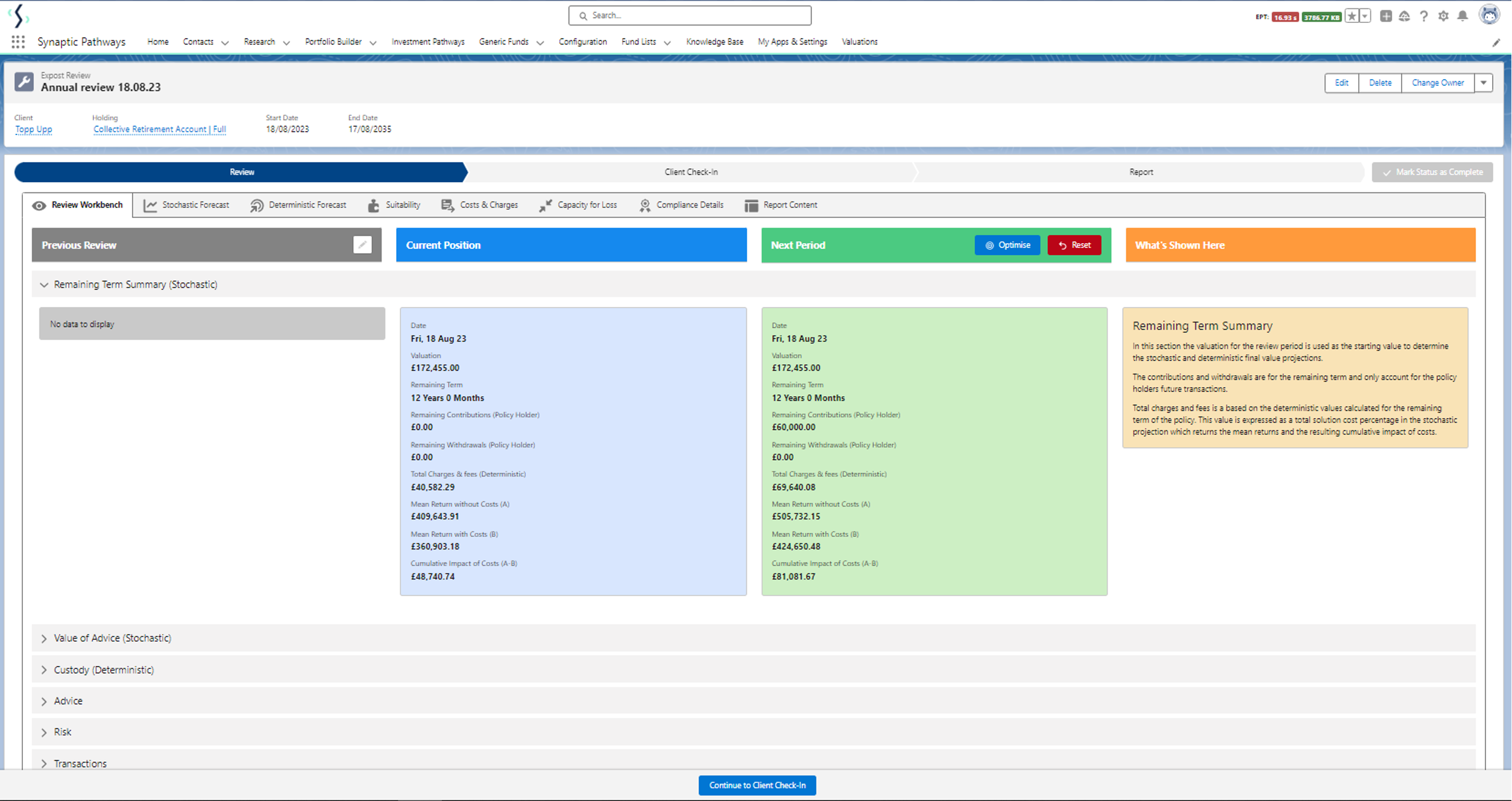

2. Set up Review. The research evidences three snapshots:

a. The previous year’s recommendation (if completed in the system);

b. the current situation, with ledger for the previous 12 months and forecasts based on current investment set up;

c. Forecast for the ‘next period’, or next 12 months.

3. Conduct Review:

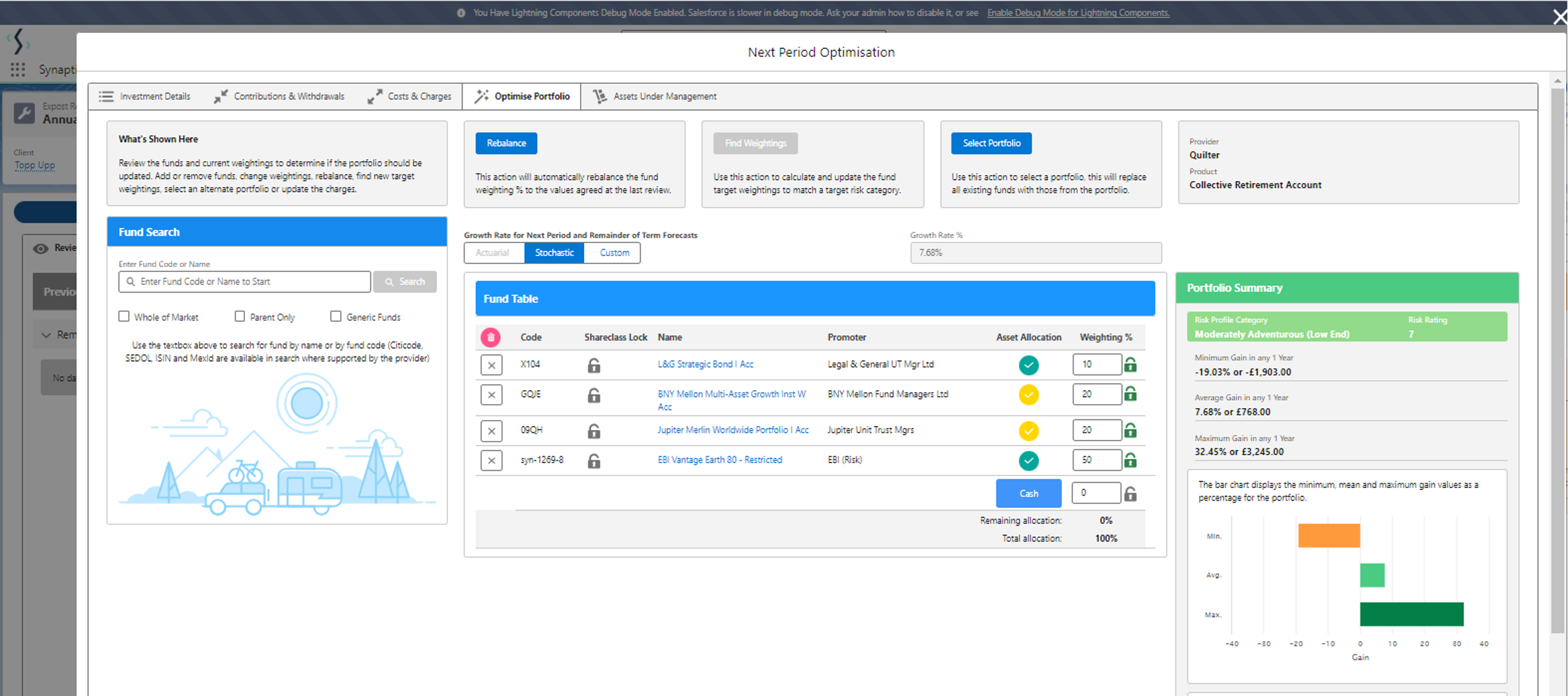

a. Make adjustments to charging, portfolio make up including rebalancing, any changes to contribution or withdrawal profile.

4. Save report for file.

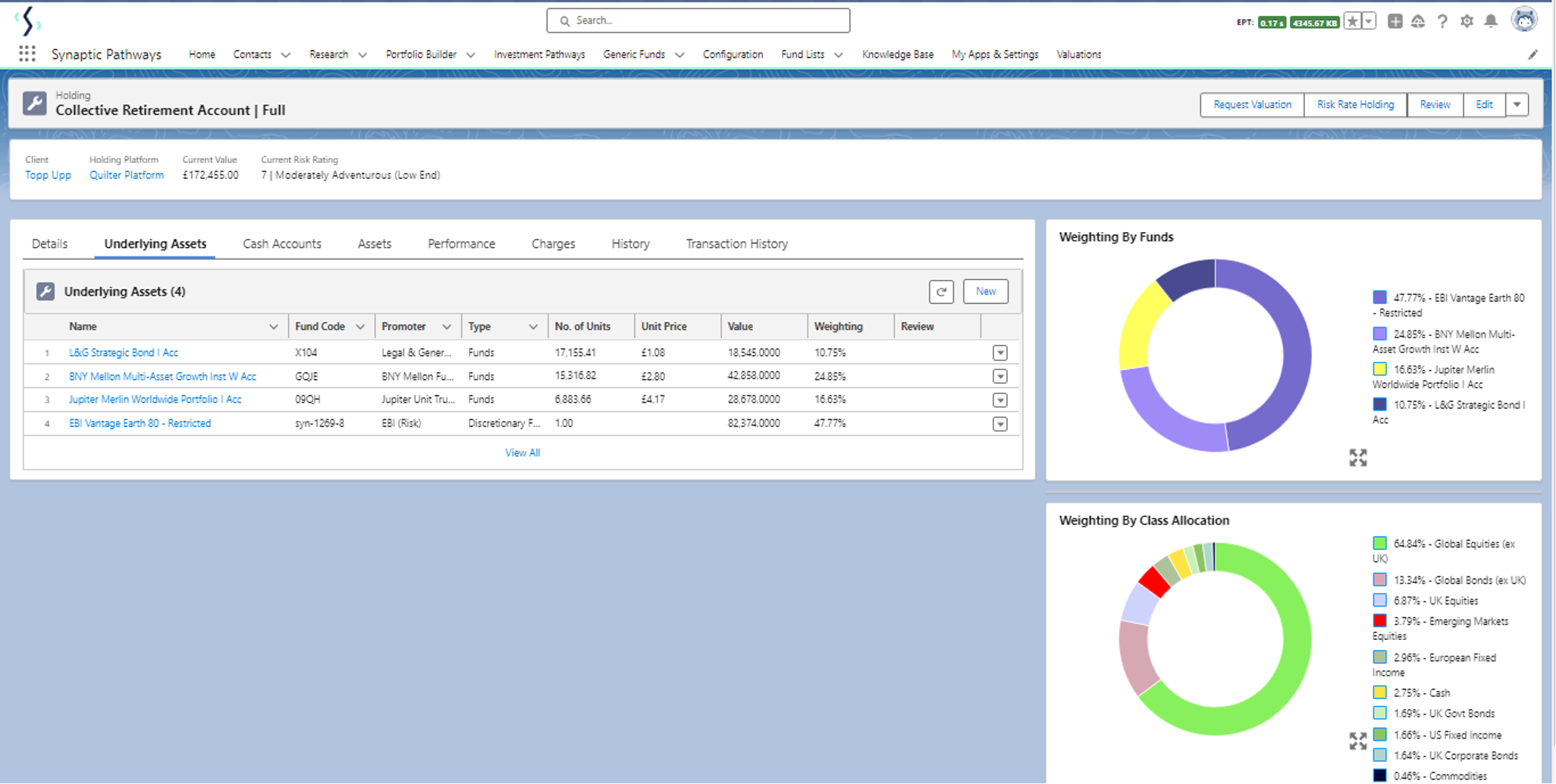

1. Create a holding This is defined with platform, product, portfolio / fund attributes

2. The results page Three different stages of the holding analysis are presented: previous (if available); current ; next period.

3. Conduct the review Contributions, withdrawals, rebalancing / amends to portfolio, adviser charging are all task that can be captured by the research.

4. Pull off the report Synaptic would be delighted to provide a demo of the research journey. Please contact us without delay for further information.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.