In this edition...

- Investing in clean technology for tomorrow’s renewable economy Hamish Chamberlayne, Head of Global Sustainable Equities

- Will there be a soft landing for the UK housing market? Katie Poulson, Client Engagement & Marketing Manager - RSMR

- The changing face of growth James Budden, Director of Marketing and Distribution - Baillie Gifford & Co

- Managing CGT through unitised funds ,

- Higher inflation not the end of the 60/40 portfolio Giulio Renzi-Ricci, Head of Asset Allocation - Vanguard

- Reality will bite for central banks Ariel Bezalel, Investment Manager, Jupiter Strategic Bond Fund - Jupiter

- The Synaptic Pathways guide to research and due diligence ,

- Offering self-reliance in due diligence for reviews ,

- How to approach reviews: the task that defines firms Eric Armstrong, Client Director - Synaptic

- Integrate your Centralised Investment Proposition (CIP) with Synaptic Pathways ,

- Synaptic Pathways can take your firm’s asset allocation a step further than Nobel prize winning Modern Portfolio Theory ,

- The first rule of financial planning: insure the breadwinner Synaptic,

- Hours to minutes Synaptic,

In July 2012, the FSA as it was, published the final guidance paper ‘Replacement business and centralised investment propositions’, relating to the use of platforms by firms. Replacement business, with a host of other business, proceeds through the gate that is the firm’s CIP, with an estimated over 90% of firms using a CIP (source: the lang cat), the CIP is a key driver for the transformation of our industry, enabling professionalism and scalability, pulling together small firms into larger, vertically integrated entities, defining both restricted and independent models; in short, it is not so much a thing… but THE thing.

In July 2012, the FSA as it was, published the final guidance paper ‘Replacement business and centralised investment propositions’, relating to the use of platforms by firms. Replacement business, with a host of other business, proceeds through the gate that is the firm’s CIP, with an estimated over 90% of firms using a CIP (source: the lang cat), the CIP is a key driver for the transformation of our industry, enabling professionalism and scalability, pulling together small firms into larger, vertically integrated entities, defining both restricted and independent models; in short, it is not so much a thing… but THE thing.

Assets under advice on platforms, built over the last decade and a half, are now in excess of £800bn, well over a half of which are advised (source: FTAdviser Nov 2022). Platforms were the big game changer, allowing firms to take greater control of custody of clients’ assets. An exodus from the insured providers and institutional asset managers began at that time, and firms started building their own portfolios on fund supermarkets and wraps, under their own direction, whether on a bespoke or model portfolio basis. As we will discuss further, the CIP is very much the engine which determines the custody of assets.

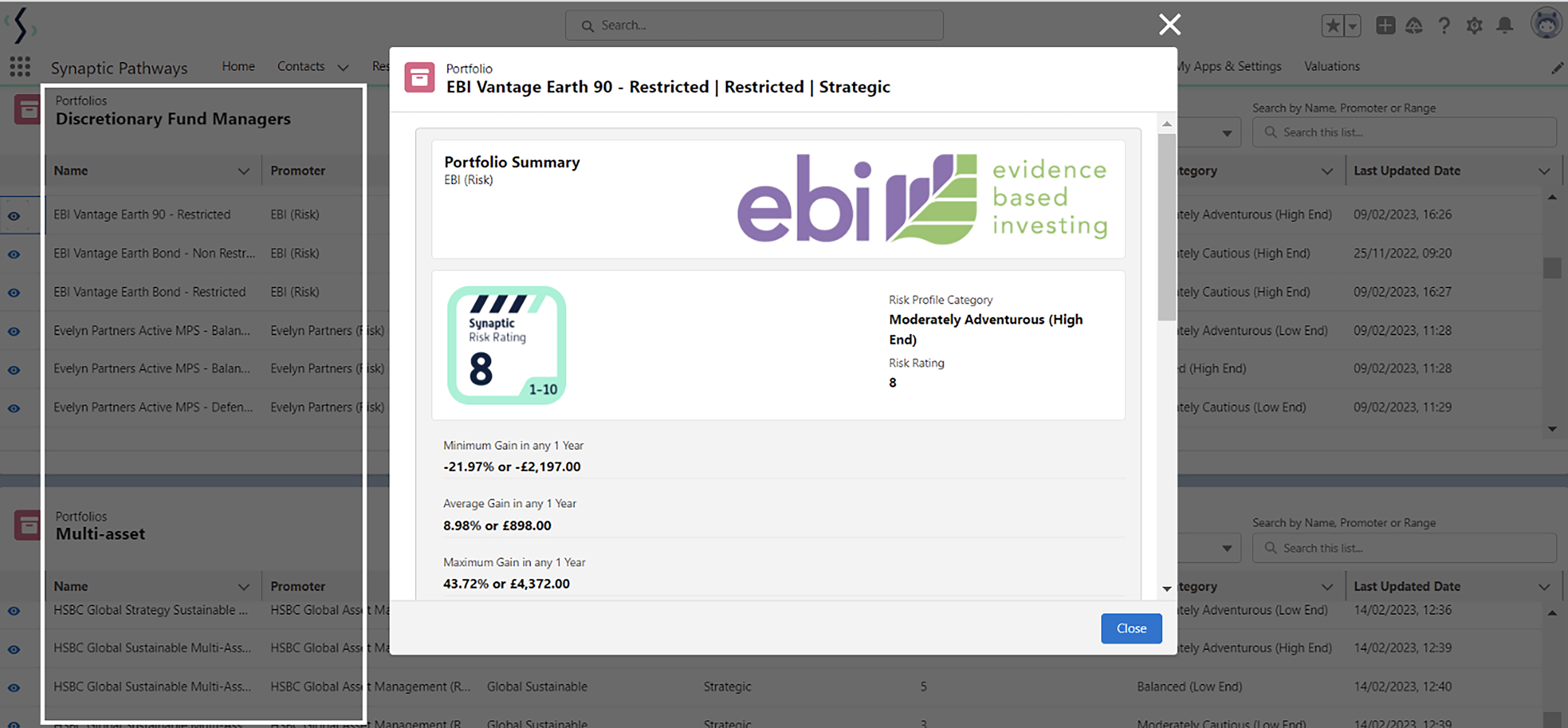

The new Synaptic Pathways research and due diligence tool is unique in putting a firm’s CIP at the centre of the advice process, enabling streamlined research to be conducted in a fully PROD and MiFID II compliant framework. This includes a research journey that can analyse legacy investments with a view to replacement business. The software allows firms to research and evidence reviews, whether the decision is made to rebroke the investments or not. This helps firms solve the problem of how to complete the work and provide audit of the research required by MiFID II to prove suitability at each review.

The CIP provides standardisation in selecting investments for recommendation to more than one client. Having investment solutions that are fully researched and maintained, any client that fits a pre-defined ‘target market’ type, or segment can be comfortably accommodated by the firm’s CIP. This of course is how the regulator believes consistency and quality of advice can be delivered by groups of advisers, creating efficiencies in the business and ensuring better client outcomes. The role of the research software is to evidence that the specific attributes of each and every recommendation are suitable not only for the segment or group of clients, but that each recommendation is suitable on a client-by-client basis. Disclosure of the attributes of the investments must include full treatment of costs and charges, including impact of charges on growth.

Outsourcing

The question that is raised throughout the industry is ‘at what point does it cease to make sense for a firm to manage a C.I.P. and at what point should they consider ‘outsourcing’’? Is this a reversal of the trend of firms managing custody of assets? Copia have produced an excellent paper available on their website where they discuss the phenomena they have observed of firms’ CIPs ‘overheating’, suggesting that firms are increasingly benefitting from partnership with investment managers.

A CIP can be made up of different investment solutions mapping to the various client types or segments - advised portfolios, in-house discretionary managed portfolios, multi-asset funds, insured solutions or increasingly managed portfolios or MPSs from Discretionary Asset Managers. You will recall the debate from the introduction of replacement business several years ago about ‘shoehorning’. The FSA confirmed that theoretically, all of a firm’s business could be placed on one platform, assuming customers were of a similar type. These different investment routes outlined have different regulatory oversight (for example IID vs MiFID II) so it is important that any research operates to the highest bar, especially with Value for Money and Consumer Duty breathing down the necks of practitioners.

Let’s look closely at these trends now, as revealed to Synaptic through the experience of networks and firms currently adopting the new Synaptic Research solution. One of the most interesting is that institutional asset managers have been refining their offering to firms, to encourage the flow of custody of assets from the ‘advised’ portfolios that were widely adopted at time of the Retail Distribution Review and the advent of platforms. This ‘replacement business’ was a deluge from their traditional havens, in part for the reasons given, but also of course as a result of the banning of commission, meaning that product providers could no longer offer incentives to firms to ensure the flow of assets into their custody. The commission ban, handily, did not apply in the same way to ‘adviser charging’, facilitated by platforms, enabling firms to continue to be paid ‘ad valorem’, as many continue today. If there is a clamp down on ad valorem payment, platforms and asset managers will adapt to support a regime with emphasis on payment of fees.

The modern Managed Portfolios (MPS) offered by today’s asset managers are generally risk-graded ranges, so very easy for firms to match to client’s requirements, based on risk tolerance, investment style and qualitative profiles including ESG. The portfolios represent good value for money combined with expert governance and oversight from established and successful asset management companies with fine track records. No wonder firms are quietly giving up ‘stock picking’.

Over 50 providers, asset managers and fund promoters are represented in the Synaptic Risk Rating service. In the new Synaptic toolset, users can generate MiFID II compliant (ex-ante and ex-post) reporting thanks to the data collected from asset managers for the Synaptic Risk Rating service. Synaptic is able to provide research to support the recommendation and review of the full range of portfolios, providing an automated process that can change the administration burden from hours to minutes and deliver on the efficiencies and consistency of advice required by firms building quality and consistency.

In the recent conference ‘Home Truths’ by the lang cat, a central message was drilled home: you may be a top financial adviser, or you may be a great asset manager, but you are unlikely to be both. The additional resources to put the ‘controls’ in place for the safe management of assets are not the same as developing an advice business. The responsibilities and regulatory oversight are likely to be prohibitive.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.