In this edition...

- What we know – and what we don’t Patrick Farrell, Chief Investment Officer and Head of Research - Charles Stanley

- Regime shift: five seismic adjustments taking place in the global economy Azad Zangana, Senior European Economist and Strategist - Schroders

- How to navigate a recession Mike Coop, Morningstar Investment Management - EMEA

- High quality bonds are primed to bloom in 2023 John Pattullo, Co-Head of Global Bonds- Janus Henderson

- Fixed Income - Research Matters Andrew Metcalf, Fixed Income Portfolio Manager - Close Brothers Asset Management

- From 'TINA to 'TANIA'... Bryn Jones, Head of Fixed Income - Rathbones

- The RSMR Broadcast: How impactful is investment management outsourcing? Scott McNiven, MPS Accounts Manager - RSMR

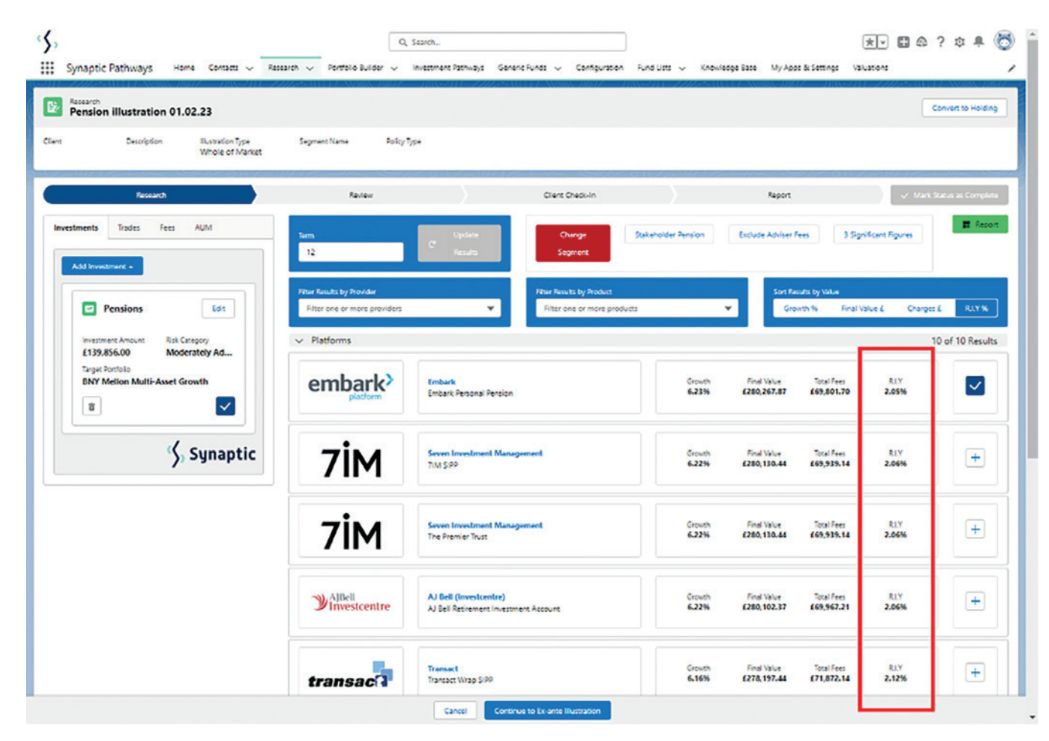

- Hours to minutes Synaptic,

- Benefits of outsourcing and model portfolios Evelyn & Partners,

- DFM Due Diligence – some observations Sean Hawkins, Head of Business Development - M&G Wealth Investments

- 2022 – The death knell for the 60/40 approach to investing? John Husselbee, Head of Multi-Asset - Liontrust

- Why ‘nature positive’ will be as big as net zero Jenn-Hui Tan, Global Head of Stewardship & Sustainable Investing - Fidelity International

- The rise of the female investor Vanessa Eve, Investment Manager - Quilter Cheviot

- Integrate your Centralised Investment Proposition (CIP) with Synaptic Pathways Eric Armstrong, Client Director - Synaptic

- The convergence of regulation in Consumer Duty Eric Armstrong, Client Director, Synaptic

- Tackle Consumer Duty with the new Synaptic integration Alan Lakey , Director - CIExpert & Highclere Financial Services Ltd

Good firms will be doing everything correctly as a matter of course. Compliance, therefore, is just a question of tying it all together and providing the various disclosures in an efficient manner. Secondly, distilling all the complexity leaves you with a requirement of ‘putting clients first’. This is already an established regulatory concept.

Good firms will be doing everything correctly as a matter of course. Compliance, therefore, is just a question of tying it all together and providing the various disclosures in an efficient manner. Secondly, distilling all the complexity leaves you with a requirement of ‘putting clients first’. This is already an established regulatory concept.

Cross cutting rules

Consumer Duty and investment risk

Synaptic: So, disclosure is essential. Also underlines the need for a robust risk framework for both aspects of the risk dynamic – expected growth and potential loss. Synaptic is the only retail investment proposition that provides full access to the Moody’s risk framework, delivering institutional strength risk analysis. The Moody’s stochastic methodology supports the management and communication of risk to the highest possible standard, including alignment to financial planning (objectives), compliant illustrations including calculations for potential loss (via Moody’s unique ‘Value at Risk’ metrics for portfolio losses) and a process to manage Capacity for Loss. Informed consent for risk around investments is very difficult to manage without quantification, especially when looking for consistency across groups of advisers, but this is a feature of the Moody’s proposition.

Products and services outcomes

Synaptic: This clarification is helpful to practitioners: operate in a PROD compliant manner and your obligations under Consumer Duty will be achieved by default. Synaptic Pathways allows firms to perform PROD compliant research at proposition level, and then deliver it as the basis of proving suitability on a case-by-case basis, within the construct of a Centralised Investment Proposition (CIP) within the software.

The price and value outcome

Synaptic: The key to delivery here is having a systematic approach to investment where full disclosure of costs is calculated and disclosed at every juncture of the research. Synaptic Pathways is able to provide cost analysis incorporating both deterministic and stochastic calculations. It must be clear what the investment proposition is, and what it costs. This is best achieved through the configuration of the Centralised Investment Proposition (CIP) in Synaptic Pathways. This also provides an automatic benchmark for the performance of investments that are not rebrokered, for whatever reason, into the firm’s CIP.

The consumer understanding outcome

Synaptic: Synaptic Pathways provides up-to-date information and research that can help build meaningful communications.

The consumer support outcome

Synaptic: In respect of support to investors, the biggest challenge is pulling together a process to support reviews. Synaptic Pathways has an automated review (ex-post) process that allows hours of research, look-ups, disclosure and calculations to be carried out in minutes.

What about the responsibilities of manufacturers?

Synaptic: in the context of the PROD rules, firms are responsible for establishing the suitability of products and services, but manufacturers are responsible for providing the necessary information. Where firms are building investment solutions themselves, for example, portfolios under discretionary permissions, they assume the responsibilities of manufacturers in relation to consumer duties. At proposition level, most of what is needed is already available in the existing Synaptic Product and Fund research tool, and material will increasingly be extended for users as the quality of the information from providers improves. Most firms are asking ‘what does this information look like?’ The answer is consistent with information that would be relevant under PROD – suitability for retail investors, product and service features, how can the product support a high level of servicing to the client, what are the investment attributes including past performance, risk and of course costs.

Monitoring and governance

Synaptic: This could be the gnarliest of the challenges from the Duty, but Synaptic Pathways provides the tools to monitor outcomes. In providing a compliant report for each investment recommendation, across new money, reviews of existing holdings and switch analysis, the Salesforce™ CRM capabilities of Synaptic can provide a view of the aggregated data in any reporting format required. Because the research is delivered through a firm’s Centralised Investment Proposition, details and outcomes from specific target market mapped solutions can also be mapped in terms of performance, by client or by segment.

Get in touch

www.synaptic.co.uk/trial

0800 783 4477

hello@synaptic.co.uk

The new Synaptic Pathways research and due diligence suite is now available. Get in touch to arrange a free demo or trial at your convenience.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.