In this edition...

- What we know – and what we don’t Patrick Farrell, Chief Investment Officer and Head of Research - Charles Stanley

- Regime shift: five seismic adjustments taking place in the global economy Azad Zangana, Senior European Economist and Strategist - Schroders

- How to navigate a recession Mike Coop, Morningstar Investment Management - EMEA

- High quality bonds are primed to bloom in 2023 John Pattullo, Co-Head of Global Bonds- Janus Henderson

- Fixed Income - Research Matters Andrew Metcalf, Fixed Income Portfolio Manager - Close Brothers Asset Management

- From 'TINA to 'TANIA'... Bryn Jones, Head of Fixed Income - Rathbones

- The RSMR Broadcast: How impactful is investment management outsourcing? Scott McNiven, MPS Accounts Manager - RSMR

- Hours to minutes Synaptic,

- Benefits of outsourcing and model portfolios Evelyn & Partners,

- DFM Due Diligence – some observations Sean Hawkins, Head of Business Development - M&G Wealth Investments

- 2022 – The death knell for the 60/40 approach to investing? John Husselbee, Head of Multi-Asset - Liontrust

- Why ‘nature positive’ will be as big as net zero Jenn-Hui Tan, Global Head of Stewardship & Sustainable Investing - Fidelity International

- The rise of the female investor Vanessa Eve, Investment Manager - Quilter Cheviot

- Integrate your Centralised Investment Proposition (CIP) with Synaptic Pathways Eric Armstrong, Client Director - Synaptic

- The convergence of regulation in Consumer Duty Eric Armstrong, Client Director, Synaptic

- Tackle Consumer Duty with the new Synaptic integration Alan Lakey , Director - CIExpert & Highclere Financial Services Ltd

In July 2012, the FSA as it was, published the final guidance paper ‘Replacement business and centralised investment propositions’, relating to the use of platforms by firms. Replacement business, with a host of other business, proceeds through the gate that is the firm’s CIP, with an estimated over 90% of firms using a CIP (source: the lang cat), the CIP is a key driver for the transformation of our industry, enabling professionalism and scalability, pulling together small firms into larger, vertically integrated entities, defining both restricted and independent models; in short, it is not so much a thing… but THE thing.

In July 2012, the FSA as it was, published the final guidance paper ‘Replacement business and centralised investment propositions’, relating to the use of platforms by firms. Replacement business, with a host of other business, proceeds through the gate that is the firm’s CIP, with an estimated over 90% of firms using a CIP (source: the lang cat), the CIP is a key driver for the transformation of our industry, enabling professionalism and scalability, pulling together small firms into larger, vertically integrated entities, defining both restricted and independent models; in short, it is not so much a thing… but THE thing.

Assets under advice on platforms, built over the last decade and a half, are now in excess of £800bn, well over a half of which are advised (source: FTAdviser Nov 2022). Platforms were the big game changer, allowing firms to take greater control of custody of clients’ assets. An exodus from the insured providers and institutional asset managers began at that time, and firms started building their own portfolios on fund supermarkets and wraps, under their own direction, whether on a bespoke or model portfolio basis. As we will discuss further, the CIP is very much the engine which determines the custody of assets.

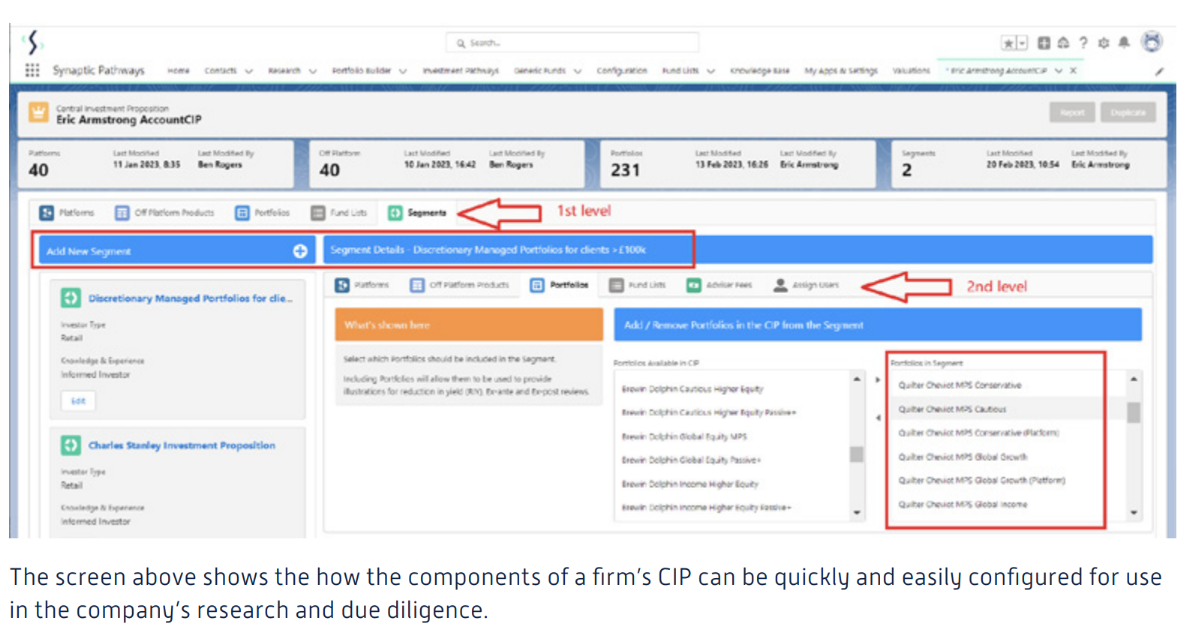

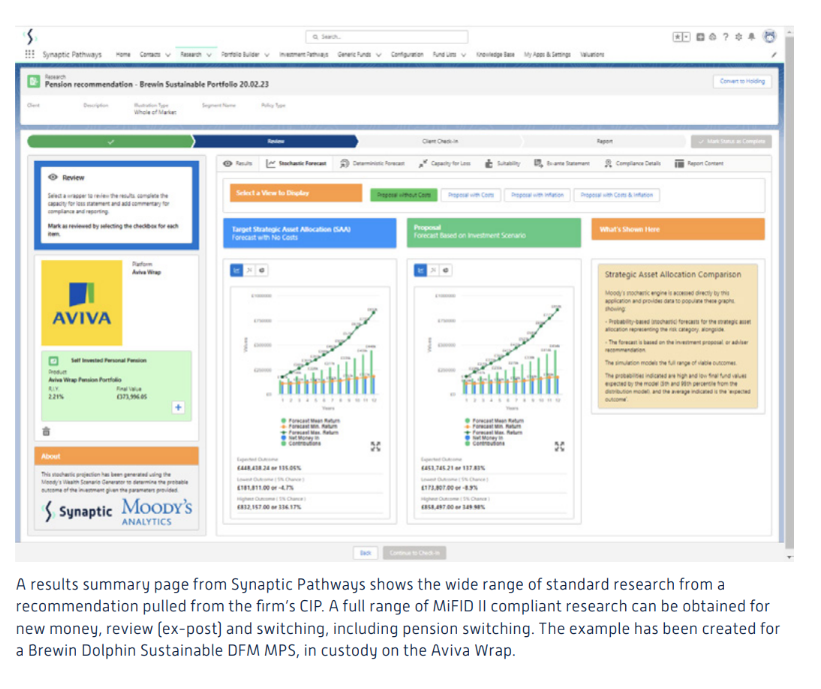

The new Synaptic Pathways research and due diligence tool is unique in putting a firm’s CIP at the centre of the advice process, enabling streamlined research to be conducted in a fully PROD and MiFID II compliant framework. This includes a research journey that can analyse legacy investments with a view to replacement business. The software allows firms to research and evidence reviews, whether the decision is made to rebroke the investments or not. This helps firms solve the problem of how to complete the work and provide audit of the research required by MiFID II to prove suitability at each review.

The CIP provides standardisation in selecting investments for recommendation to more than one client. Having investment solutions that are fully researched and maintained, any client that fits a pre-defined ‘target market’ type, or segment can be comfortably accommodated by the firm’s CIP. This of course is how the regulator believes consistency and quality of advice can be delivered by groups of advisers, creating efficiencies in the business and ensuring better client outcomes. The role of the research software is to evidence that the specific attributes of each and every recommendation are suitable not only for the segment or group of clients, but that each recommendation is suitable on a client-by-client basis. Disclosure of the attributes of the investments must include full treatment of costs and charges, including impact of charges on growth.

Outsourcing

The question that is raised throughout the industry is ‘at what point does it cease to make sense for a firm to manage a C.I.P. and at what point should they consider ‘outsourcing’’? Is this a reversal of the trend of firms managing custody of assets? Copia have produced an excellent paper available on their website where they discuss the phenomena they have observed of firms’ CIPs ‘overheating’, suggesting that firms are increasingly benefitting from partnership with investment managers.

A CIP can be made up of different investment solutions mapping to the various client types or segments - advised portfolios, in-house discretionary managed portfolios, multi-asset funds, insured solutions or increasingly managed portfolios or MPSs from Discretionary Asset Managers. You will recall the debate from the introduction of replacement business several years ago about ‘shoehorning’. The FSA confirmed that theoretically, all of a firm’s business could be placed on one platform, assuming customers were of a similar type. These different investment routes outlined have different regulatory oversight (for example IID vs MiFID II) so it is important that any research operates to the highest bar, especially with Value for Money and Consumer Duty breathing down the necks of practitioners.

Let’s look closely at these trends now, as revealed to Synaptic through the experience of networks and firms currently adopting the new Synaptic Research solution. One of the most interesting is that institutional asset managers have been refining their offering to firms, to encourage the flow of custody of assets from the ‘advised’ portfolios that were widely adopted at time of the Retail Distribution Review and the advent of platforms. This ‘replacement business’ was a deluge from their traditional havens, in part for the reasons given, but also of course as a result of the banning of commission, meaning that product providers could no longer offer incentives to firms to ensure the flow of assets into their custody. The commission ban, handily, did not apply in the same way to ‘adviser charging’, facilitated by platforms, enabling firms to continue to be paid ‘ad valorem’, as many continue today. If there is a clamp down on ad valorem payment, platforms and asset managers will adapt to support a regime with emphasis on payment of fees.

The modern Managed Portfolios (MPS) offered by today’s asset managers are generally risk-graded ranges, so very easy for firms to match to client’s requirements, based on risk tolerance, investment style and qualitative profiles including ESG. The portfolios represent good value for money combined with expert governance and oversight from established and successful asset management companies with fine track records. No wonder firms are quietly giving up ‘stock picking’.

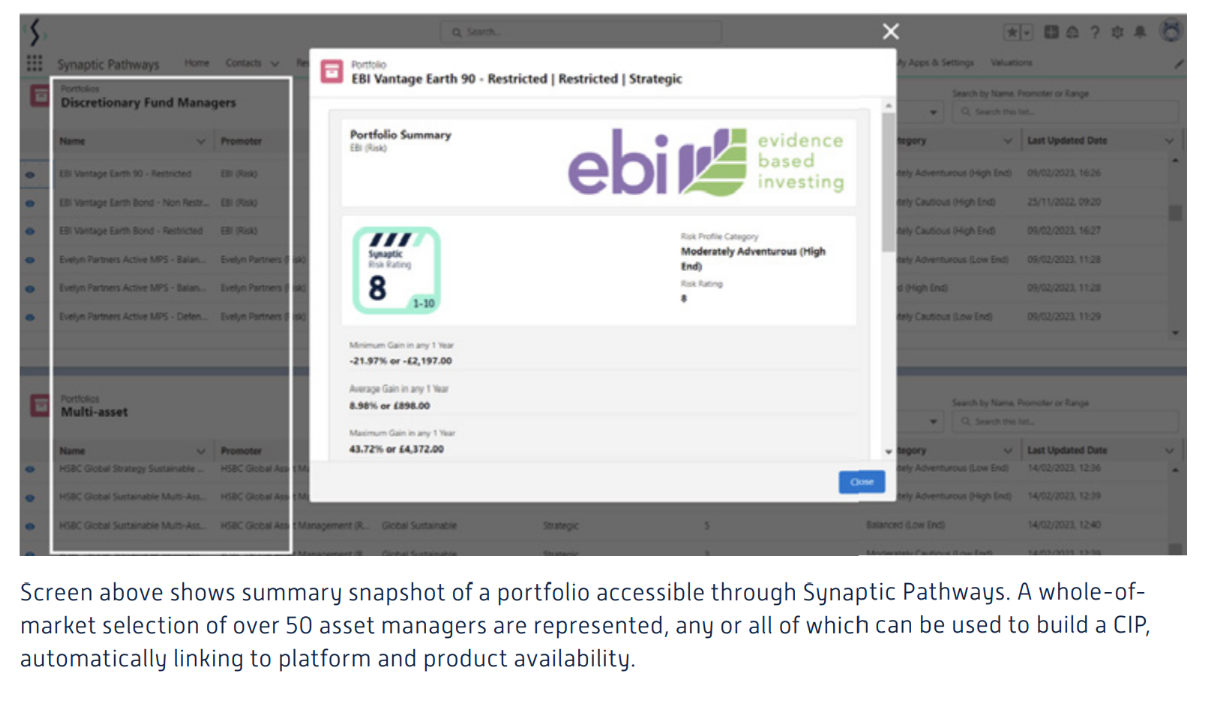

Over 50 providers, asset managers and fund promoters are represented in the Synaptic Risk Rating service. In the new Synaptic toolset, users can generate MiFID II compliant (ex-ante and ex-post) reporting thanks to the data collected from asset managers for the Synaptic Risk Rating service. Synaptic is able to provide research to support the recommendation and review of the full range of portfolios, providing an automated process that can change the administration burden from hours to minutes and deliver on the efficiencies and consistency of advice required by firms building quality and consistency.

In the recent conference ‘Home Truths’ by the lang cat, a central message was drilled home: you may be a top financial adviser, or you may be a great asset manager, but you are unlikely to be both. The additional resources to put the ‘controls’ in place for the safe management of assets are not the same as developing an advice business. The responsibilities and regulatory oversight are likely to be prohibitive.

So, what connects firms’ advice process to their asset managing partners?

Synaptic Research and Due Diligence. A key feature of the new Synaptic Pathways research solution is that the research is designed to be delivered in a PROD compliant framework through a Centralised Investment Proposition. Here are some of our current observations:

• Relatively few firms continue to recommend ‘advised’ portfolios. The handful that do tend to be those with a small number of high value clients whose portfolios have performed well over some years – and presumably are reluctant to change. As advised portfolios of course, there is an administrative overhead to gain permission before making any changes to a client’s portfolio, which precludes the scaling of the business. These tend to be the firms who are reluctant or even unable to take on new business.

• Most firms have a preferred discretionary asset manager who they like to deal with, who will receive the lion’s share of inflows from the company. We also see some firms whose advisers have built trusting relationships with more than one discretionary manager. It is typical for the firms to recognise different client types among their clientele, directing funds therefore to different investment vehicles, usually based on lifecycle or value of investment. Royal London, Prudential, Scottish Widows, LV=, Aegon and Canada Life products sit happily in the mix, as do lighter touch and often lower value investments that are directed into multi-asset solutions on the full range of platforms.

• Firms that operate under discretionary permissions are able to maintain suites of risk graded portfolios for different purposes. Typically, these include accumulation, income, responsibly invested portfolios and blends of active and passive that are cost conscious, investing in passives where appropriate.

• The modern investment platforms that combine with asset management have managed to push the cost of access to extremely low levels, even offering white labelling options to firms that can also be very attractive. Our sense is that the demarcation between portfolio management and financial advice is well respected by firms, and the technology and service exist to support these relationships, ensuring that firms can offer an outstanding investment proposition at rates that would have been unthinkable a few short years ago. The fact that there are many discretionary propositions that are charging clients nearer 3% per annum (aside: alas my family is one of them!), does not change the fact that it is possible to deliver a discretionary portfolio service at a fraction of that price. The quality reporting attached to some of these portfolio solutions is outstanding.

• The management of Investment Risk is becoming more and more central to firms’ strategies who oversee their own asset allocation, aware that the standard 60:40 constitution of a balanced portfolio has not been the ideal asset allocation over some recent periods. An example here is where many firms have shunned traditional fixed income in the periods where yields had practically disappeared. Alternatives, infrastructure, absolute return or hedged funds, commodities and other asset classes have played their part. Our observation is that firms that have broken away from the long term (or strategic) positions to navigate the difficult conditions we have experienced have being rewarded, breaking the law that forbids ‘timing the market’. For example, in the recent bleak periods for equities suffered by the markets, many asset allocators recognised the contribution that natural resources and energy could make.

Advising outside the CIP

The other key consideration we have observed across all types of firms is the requirement for research and advice to be given outside of the CIP. Even firms from the largest and most successful restricted advisory groups confirm that they are overseeing significant assets that do not reside in their CIP, on their preferred platforms or with their preferred providers. One firm who had joined one of the large industry consolidators over 5 years ago explained this week, that with assets under management of around £200 million, half of those assets were ‘still’ in ‘legacy’ products, had not moved over to the group’s CIP and would not be ‘rebroked’ unless it was demonstrably in the clients’ interests.

Whilst this points to the integrity of firms, not to mention an embrace of the spirit of Consumer Duty, the observation here is that firms must retain the ability to provide due diligence and research on assets outside of their CIP. This is why reliance on tools from providers, platforms and asset managers will almost certainly not be able to provide analysis on assets that are not intended to be rebroked into the CIP. That’s even before you take into account the rules about conflict of interest.

Synaptic Pathways provides standardised research to support recommendations in the legacy book as well as assets in custody in the CIP. To deliver advice to this standard across the board, firms must have the ability to conduct automated reviews and switch analysis, with the ability to pull down data from platforms and providers via contract enquiry and peer to peer integration, or input and use data manually where necessary, applying consistent research methodology in or outside the CIP.

To find out more about the new, innovative, integrated suite of CIP, portfolio and research tools from Synaptic, call our team on 0800 783 4477.

Get in touch

www.synaptic.co.uk/trial

0800 783 4477

hello@synaptic.co.uk

The new Synaptic Pathways research and due diligence suite is now available. Get in touch to arrange a free demo or trial at your convenience.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.