In this edition...

- What we know – and what we don’t Patrick Farrell, Chief Investment Officer and Head of Research - Charles Stanley

- Regime shift: five seismic adjustments taking place in the global economy Azad Zangana, Senior European Economist and Strategist - Schroders

- How to navigate a recession Mike Coop, Morningstar Investment Management - EMEA

- High quality bonds are primed to bloom in 2023 John Pattullo, Co-Head of Global Bonds- Janus Henderson

- Fixed Income - Research Matters Andrew Metcalf, Fixed Income Portfolio Manager - Close Brothers Asset Management

- From 'TINA to 'TANIA'... Bryn Jones, Head of Fixed Income - Rathbones

- The RSMR Broadcast: How impactful is investment management outsourcing? Scott McNiven, MPS Accounts Manager - RSMR

- Hours to minutes Synaptic,

- Benefits of outsourcing and model portfolios Evelyn & Partners,

- DFM Due Diligence – some observations Sean Hawkins, Head of Business Development - M&G Wealth Investments

- 2022 – The death knell for the 60/40 approach to investing? John Husselbee, Head of Multi-Asset - Liontrust

- Why ‘nature positive’ will be as big as net zero Jenn-Hui Tan, Global Head of Stewardship & Sustainable Investing - Fidelity International

- The rise of the female investor Vanessa Eve, Investment Manager - Quilter Cheviot

- Integrate your Centralised Investment Proposition (CIP) with Synaptic Pathways Eric Armstrong, Client Director - Synaptic

- The convergence of regulation in Consumer Duty Eric Armstrong, Client Director, Synaptic

- Tackle Consumer Duty with the new Synaptic integration Alan Lakey , Director - CIExpert & Highclere Financial Services Ltd

With Consumer Duty requirements at the forefront of industry discussion, announcing our integration with Synaptic Pathways and Webline could not be more timely. Get ready to explore everything the new integration has to offer you and your business.

With Consumer Duty requirements at the forefront of industry discussion, announcing our integration with Synaptic Pathways and Webline could not be more timely. Get ready to explore everything the new integration has to offer you and your business.

Highlighting the need for protection conversations

With much written and discussed recently about the importance of Consumer Duty, as an adviser, it’s been encouraging to read that Consumer Duty is seen as an opportunity for increased protection conversations. Of course, these should already form a fundamental part of every adviser’s daily routine.

I am dedicated to making sure my clients have the appropriate protection plans. That’s why I recommend regular client reviews, which help to ensure they obtain best value for their money.

To make this process easier, we have collaborated with Synaptic to provide an integrated solution for completing reviews of protection policies; this drastically reduces the time spent on research, allowing you to avoid the re-keying of data into multiple systems and assembles all your research into a report that’s ideal for an insightful client conversation.

Client reviews are crucial

Client reviews are crucial in ensuring that clients have the appropriate plans in place to suit both their current needs and budgets and the provision of the fair value they expect.

• Have their circumstances changed?

• Is their existing policy still the best suited to their needs?

• Have recent policy enhancements better matched their needs?

• Considering budget and discussing affordability.

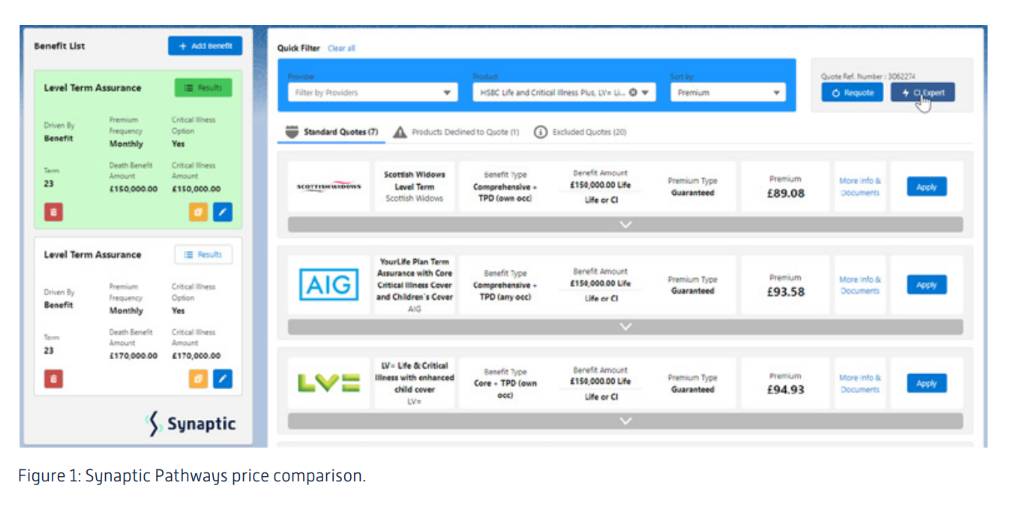

Integration makes cost vs quality comparison a breeze

The new Synaptic integration has combined the strengths of the new Pathways technology platform with those of CIExpert. We have both utilised technology to simplify advisers workflow and to focus client conversations on the salient issues.

Consumer Duty refers to ‘fair value’ but how do you assess this? The integration provides the capability to visualise and quantify the trade off between quality of cover and cost.

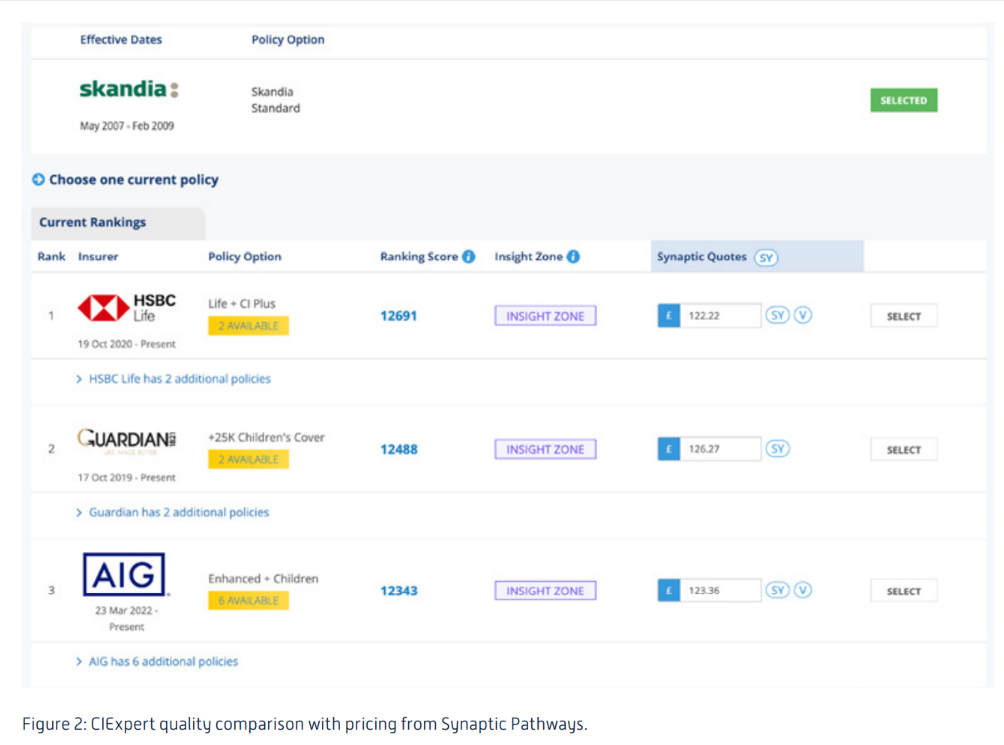

Client details entered within Synaptic Pathways and Webline are carried through to CIExpert, together with all the available quote information. These are displayed alongside our quality rankings so that price and quality can be assessed simultaneously. Navigation of the integration is intuitive, designed to streamline workflow and drastically reduce the amount of time spent on research.

Personalised assessment of ‘Value’

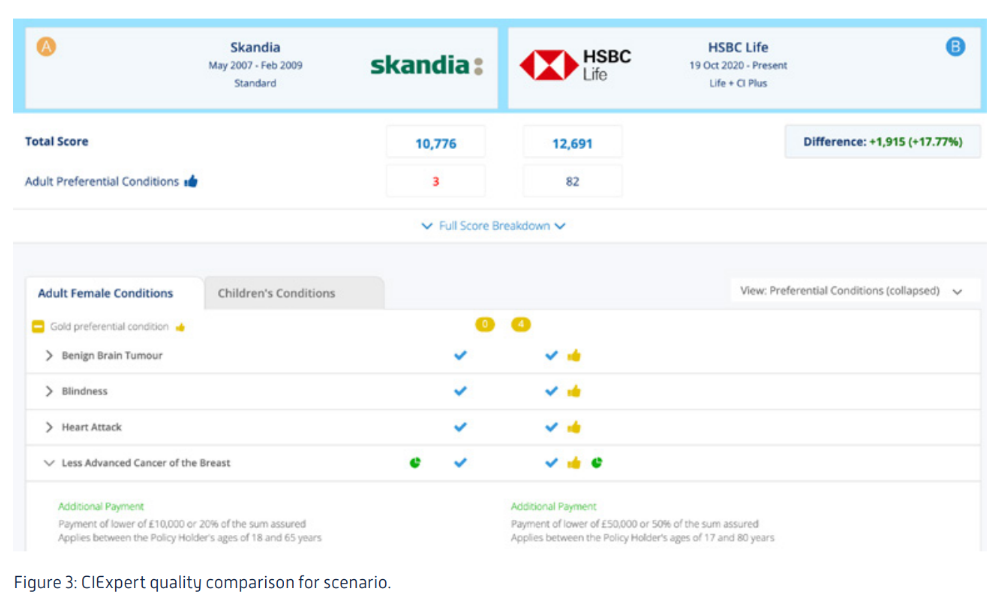

Each individual has different needs to consider and CIExpert’s personalisation is critical in encapsulating the differences between current as well as historic plans. Plans are compared based upon the likelihood of a paid claim or a higher level of payment. The % difference in quality between the plans is clearly highlighted.

Years of detailed research is combined with a complex algorithm using advanced technology to create a quality index personalised to your client’s specific needs. The clients age, gender, smoker status and how many children (by individual age) are all taken into account together with the sum assured so that the value over the plan term can be understood.

Looking at a real example

Let’s have a look at what a client review could actually look like and consider how much time each review might take?

In this example, I’m reviewing an existing life & critical illness policy. The client’s a female, age 42 with children aged 10 & 12. She has a 25 year term, £150k level life and critical illness plan from Skandia taken out in November 2008

CIC policies have enjoyed innovation in recent few years with condition coverage and particularly children’s cover improving significantly. Insurers are also competing on the added value services they provide, such as second medical opinion. Factors like this are important for a client to be made aware of:

• Awareness of Added Value Services and the breadth of features which may not be available in an existing plan.

• Children’s cover has vastly improved, often extending up to age 22 or 23. If an existing plan only extends to their 18th birthday this could be an important consideration.

Our interactive Insurer Insight Zone goes beyond the comparison of condition coverage, allowing you to easily compare other aspects of current policies that could be of considerable advantage to your client.

Potential outcomes of a review

Let’s also have a look at what the potential outcomes of a client protection review could actually be.

• The existing policy may be suitable so no change is needed.

• The level of cover may need increasing or the term extending using a GIO or a new policy.

• Replace the plan with a new insurer or portfolio of insurers.

Consumer Duty therefore should prompt regular reviews, rather than only a change in circumstances, e.g remortgaging, as it clearly provides the opportunity for better client outcomes

Integration eases your workload & saves you time

In this example a quote from Synaptic Pathways or Webline is exported into CIExpert, I just add the ages of my client’s children and select Skandia from the list of over 450 existing CI plans. This quickly and accurately establishes that the critical illness plans from many of the current insurers offer a far higher quality of cover, in many cases, over 20% higher.

Comparing premiums instantly creates a client dialogue regarding quality versus cost. The compliance report generated within minutes enables me to identify and explain any condition differences.

In my review I’ve established that she’s in good health, that her existing Skandia plan will stop when she’s 53 leaving a potential gap in cover when most needed. Her children are going to university so extending cover beyond their 18th birthdays is important and, currently, she doesn’t have access to any added value services.

Hopefully this simple example illustrates the power of this new integration and the value it has in implementing Consumer Duty reviews!

The new integration with Synaptic Pathways and Webline is now available. Contact our friendly team to arrange a

free demo or trial.

Get in touch

www.ciexpert.uk

contact@ciexpert.co.uk

0203 771 4607

www.linkedin.com/company/ciexpert/

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.