In this edition...

- What we know – and what we don’t Patrick Farrell, Chief Investment Officer and Head of Research - Charles Stanley

- Regime shift: five seismic adjustments taking place in the global economy Azad Zangana, Senior European Economist and Strategist - Schroders

- How to navigate a recession Mike Coop, Morningstar Investment Management - EMEA

- High quality bonds are primed to bloom in 2023 John Pattullo, Co-Head of Global Bonds- Janus Henderson

- Fixed Income - Research Matters Andrew Metcalf, Fixed Income Portfolio Manager - Close Brothers Asset Management

- From 'TINA to 'TANIA'... Bryn Jones, Head of Fixed Income - Rathbones

- The RSMR Broadcast: How impactful is investment management outsourcing? Scott McNiven, MPS Accounts Manager - RSMR

- Hours to minutes Synaptic,

- Benefits of outsourcing and model portfolios Evelyn & Partners,

- DFM Due Diligence – some observations Sean Hawkins, Head of Business Development - M&G Wealth Investments

- 2022 – The death knell for the 60/40 approach to investing? John Husselbee, Head of Multi-Asset - Liontrust

- Why ‘nature positive’ will be as big as net zero Jenn-Hui Tan, Global Head of Stewardship & Sustainable Investing - Fidelity International

- The rise of the female investor Vanessa Eve, Investment Manager - Quilter Cheviot

- Integrate your Centralised Investment Proposition (CIP) with Synaptic Pathways Eric Armstrong, Client Director - Synaptic

- The convergence of regulation in Consumer Duty Eric Armstrong, Client Director, Synaptic

- Tackle Consumer Duty with the new Synaptic integration Alan Lakey , Director - CIExpert & Highclere Financial Services Ltd

Every so often, ideal conditions present themselves. For the titan arum – the world’s largest unbranched flower – it can be anything between two to ten years between blooms, but when it flowers, the results are impressive. John Pattullo and Jenna Barnard, Co-Heads of Global Bonds at Janus Henderson Investors, believe high quality investment grade bonds, especially government bonds, are in a similar sweet spot heading into 2023, as a confluence of attractive yields and an inflection point in rates opens up the potential for strong returns.

Every so often, ideal conditions present themselves. For the titan arum – the world’s largest unbranched flower – it can be anything between two to ten years between blooms, but when it flowers, the results are impressive. John Pattullo and Jenna Barnard, Co-Heads of Global Bonds at Janus Henderson Investors, believe high quality investment grade bonds, especially government bonds, are in a similar sweet spot heading into 2023, as a confluence of attractive yields and an inflection point in rates opens up the potential for strong returns.

Attractive yields

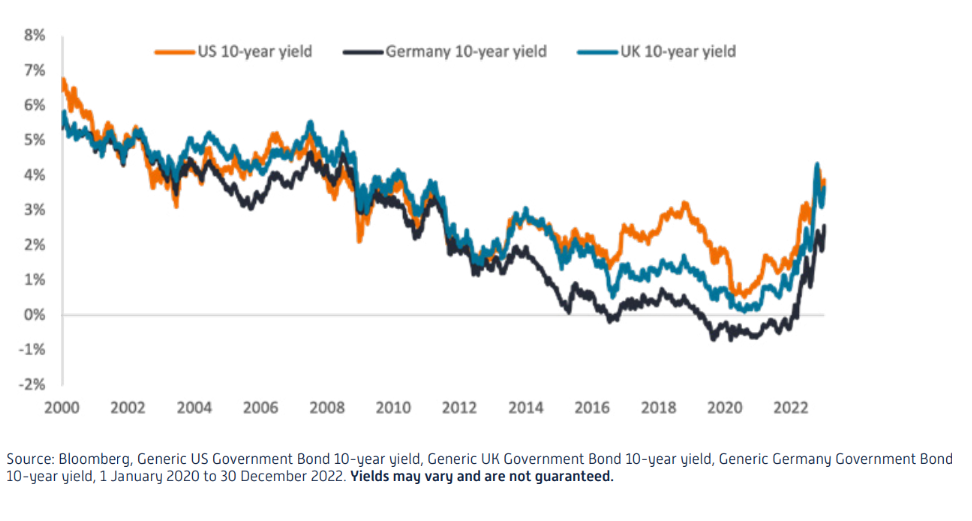

For bond markets, policy tightening in 2022 to tackle inflation was painful as yields rose. Yet the price correction lifted government bond yields back to levels not seen in more than a decade. It was a similar story with investment grade corporate bonds where both credit spreads (the difference in yield between corporate bonds and government bonds of similar maturity) and yields moved higher.

Figure 1: Yields on government bonds

2023 is an inflection point

Attractive income levels on bonds, however, are only half the picture. We think 2023 will also be an inflection point for rates – as central banks shift their policy in response to declining inflation and an economic downturn.

Bond yields have often overshot when core inflation spikes heading into an economic downturn. This decoupling of government bond yields from economic prospects occurred in 2022 as bond yields rose despite manufacturing new orders declining. We expect government bond yields to recouple with the economic data. From above 4% in the fourth quarter of 2022, we think the US 10-year government bond yield could be close to 2% by the end of 2023. This could lead to strong capital gains on government bonds and should also have positive implications for better quality investment grade corporate bonds, since these bonds are typically sensitive to rate moves.

There is no guarantee that past trends will continue or forecasts will be realised.

‘When’ not ‘if’ employment turns

We think we are progressing through a typical economic cycle, with the over-stimulus of the past couple of years giving way to a downturn and recession as policy tightening bites. Pain is already being felt in the housing market and corporate earnings appear to be peaking. We think it is only a matter of time before US non-farm payrolls begin to reflect other employment data that companies are shedding jobs.

Back in the 1970s and 1980s, the US Federal Reserve (Fed) hiked rates until it had control of inflation and then immediately started cutting. Its tolerance of rising unemployment was low. We think the Fed will take fright and start cutting rates after a few negative non-farm payroll prints – and this could come as early as the first half of 2023.

Inflation on the turn

This shift in policy is reliant on inflation coming down but inflation looks to already have peaked in the US and could come down rapidly in 2023 in Europe as well despite the energy crisis distortions. Commodity and freight prices have tumbled and a collapse in broad money growth also suggests that the upsurge in inflation is set to wash out over the course of 2023.

The risk to our view is that the jobs market remains robust and inflation refuses to fall. If that is the case, however, then we would expect to see central bank policy being more restrictive and the economic downturn being even more severe – an outcome that would ultimately favour higher rated bonds. As we see it, we think there is simply too much data stacking up in favour of our view that investment grade government and corporate bonds can put on a strong display in 2023. For more information, please visit www.janushenderson.com

About Janus Henderson:

Janus Henderson Investors is a global asset manager offering a full suite of actively managed investment products across asset classes. Established through the merger of Janus Capital and Henderson in 2017, our rich history as independent investment managers stretches back to 1934. From our origins in bottom-up, analysis-based strategies with a strong research-based approach to security selection, Janus Henderson today offers active management across equities, fixed income, alternatives and multi-asset strategies. We believe the notion of ‘connecting’ is powerful – it has shaped our evolution and our world today. At Janus Henderson, we seek to benefit clients through the connections we make. Connections enable strong relationships based on trust and insight as well as the flow of ideas among our investment teams and our engagement with companies. These connections are central to our values, to what active management stands for and to the long-term outperformance we seek to deliver. Janus Henderson has more than 348 investment professionals, expertise across all major asset classes and clients spanning the globe, entrusting us with more than £246bn.

Source: Janus Henderson Investors, as at 30 September 2022.

Important Information:

This article is intended solely for the use of professionals, defined as Eligible Counterparties or Professional Clients, and is not for general public distribution. Marketing communication. These are the views of the author at the time of publication and may differ from the views of other individuals at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them. Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and investors may not get back the amount originally invested. The information in this article does not qualify as an investment recommendation.

Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.

GC-0123-121767 01-31-2

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.