In this edition...

- Synaptic and how to deal with the impending regulatory crunch around reviews Eric Armstrong, Client Director - Synaptic

- Combining code and steel: the new wave of physical-digital firms Kirsty Gibson, Investment Manager - Baillie Gifford & Co

- Automate to Innovate: the start of the Digital Investment Transition Nick Skelhorn, Founder Corrival - Capital Management

- Getting to grips with the gender gap Laura Barnes , Director of Business Development - Nucleus Financial Platforms

- Hunt’s budget pleases hardly anyone Jupiter Asset Management,

- The case for multi-asset portfolios is even stronger Lukas Brandl-Cheng, Investment Strategy Analyst - Vanguard Europe

- Investment Perspectives from RSMR: Are you big in Japan? Stewart Smith, Head of Managed Portfolio Services - RSMR

- The case for sustainable investing Maria Municchi, Sustainable Multi Asset Fund Manager - M&G investments

- Synaptic risk ratings: methodology and approach. Risk profiling and asset allocation Eric Armstrong, Client Director - Synaptic

- Hours to minutes Synaptic,

- The first rule of financial planning: insure the breadwinner Synaptic,

- The new Protection for Synaptic Pathways has arrived Synaptic,

Despite the altered environment that we face in terms of structurally higher rates and inflation, we believe that our investments stand to benefit from significant long-term structural drivers.

Despite the altered environment that we face in terms of structurally higher rates and inflation, we believe that our investments stand to benefit from significant long-term structural drivers.

For example, while the outbreak of war in Ukraine sparked a period of underperformance for sustainability-linked assets in 2022, these events have brought into sharp focus the importance of sustainable investing, particularly around energy independence.

Many countries are striving to improve their energy security and diversify energy sources, putting renewable power and green energy technology firmly on the agenda of many governments and global companies. Also, recent government initiatives such as Repower EU in Europe and the Inflation Reduction Act in the US are directing billions of dollars of support towards the energy transition.

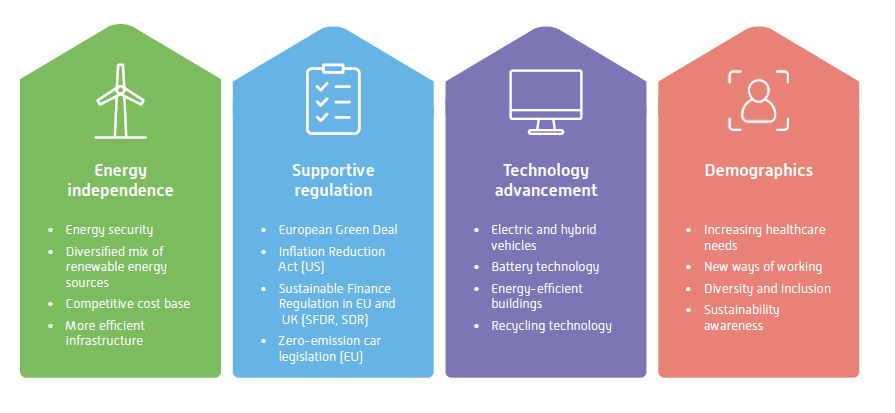

The graphic below highlights more sustainability drivers that we think are helping to create long-term investment opportunities for sustainably-focused assets.

The rapid increase in the policy rates in response to rampant inflation also put ‘sustainable’ industries under intense pressure given their perceived growth factor bias. However, with many assets now trading on attractive valuations, we think the recent dip in performance could present an excellent opportunity for investors to access the compelling long-term structural growth story linked to sustainably-focused investments, potentially providing investors with a good source of returns from here. This includes listed energy infrastructure assets (a core element of the portfolio as well as a key diversifier) which are now trading at significant discounts to NAV. As well as being clear beneficiaries of the green energy transition, these holdings offer stable and resilient income streams, potentially valuable characteristics in a world of higher structural inflation.

Despite the headwinds of potentially higher structural interest rates, and inflation, we should reiterate that we are long-term investors with a portfolio of assets which should stand to benefit from the long-term structural drivers listed above. As long-term investors, our focus is on the ability of our holdings to generate value for society and our investors over the long run. Furthermore, our portfolio of positive impact assets should continue to deliver compounding positive impacts to society as well as looking to provide financial returns.

As at 30 November 2023, each fund’s MSCI ESG score – reflecting the average ESG rating of corporate holdings as shown by MSCI’s ESG classification – was above 7 for all funds (equivalent to an MSCI ESG rating of AA). Each fund’s corporate holdings currently have a significantly lower carbon intensity (a measure of a company’s carbon emissions produced in relation to its sales) than the global equity market (MSCI World), a reflection of the climate focus running throughout the portfolios. All funds in the range are rated 6 by MSCI for their MSCI ESG government bond ratings (scores range from 0-10).

As we’ve highlighted above, the fund range continues to allocate significant exposure to positive impact investments, targeting companies that aim to actively address some of today’s big environmental and social challenges. We also hold positions dedicated to infrastructure, notably in selected companies focused on renewable energy strategies, as well as other impact assets such as green bonds where proceeds are specifically directed towards projects with sustainable objectives.

Main risks associated with these funds

The value and income from the fund's assets will go down as well as up. This will cause the value of your investment to fall as well as rise. There is no guarantee that the fund will achieve its objective and you may get back less than you originally invested.

Investments in bonds are affected by interest rates, inflation and credit ratings. It is possible that bond issuers will not pay interest or return the capital. All of these events can reduce the value of bonds held by the fund.

The fund is exposed to different currencies. Derivatives are used to minimise, but may not always eliminate, the impact of movements in currency exchange rates.

The fund may use derivatives to profit from an expected rise or fall in the value of an asset. Should the asset’s value vary in an unexpected way, the fund will incur a loss. The fund’s use of derivatives may be extensive and exceed the value of its assets (leverage). This has the effect of magnifying the size of losses and gains, resulting in greater fluctuations in the value of the fund.

Further risk factors that apply to the fund can be found in the funds’ Prospectus. The views expressed in this document should not be taken as a recommendation, advice or forecast.

The M&G Sustainable Multi Asset Cautious Fund , M&G Sustainable Multi Asset Balanced Fund and M&G Sustainable Multi Asset Growth Fund are sub-funds of M&G Investment Funds (4).

Get in touch

www.mandg.com/adviser

advisorysales@mandg.co.uk

Important Information:

For financial advisers only. Not for onward distribution. No other persons should rely on any information contained within. This financial promotion is issued by M&G Securities Limited which is authorised and regulated by the Financial Conduct Authority in the UK and provides ISAs and other investment products. The company’s registered office is 10 Fenchurch Avenue, London EC3M 5AG.

Registered in England No. 90776.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.