In this edition...

- Synaptic and how to deal with the impending regulatory crunch around reviews Eric Armstrong, Client Director - Synaptic

- Combining code and steel: the new wave of physical-digital firms Kirsty Gibson, Investment Manager - Baillie Gifford & Co

- Automate to Innovate: the start of the Digital Investment Transition Nick Skelhorn, Founder Corrival - Capital Management

- Getting to grips with the gender gap Laura Barnes , Director of Business Development - Nucleus Financial Platforms

- Hunt’s budget pleases hardly anyone Jupiter Asset Management,

- The case for multi-asset portfolios is even stronger Lukas Brandl-Cheng, Investment Strategy Analyst - Vanguard Europe

- Investment Perspectives from RSMR: Are you big in Japan? Stewart Smith, Head of Managed Portfolio Services - RSMR

- The case for sustainable investing Maria Municchi, Sustainable Multi Asset Fund Manager - M&G investments

- Synaptic risk ratings: methodology and approach. Risk profiling and asset allocation Eric Armstrong, Client Director - Synaptic

- Hours to minutes Synaptic,

- The first rule of financial planning: insure the breadwinner Synaptic,

- The new Protection for Synaptic Pathways has arrived Synaptic,

I was going to take a different direction in this quarter’s feature, but I really sat up when I read Mark Polson’s lang cat ‘Top Class Wednesday Update’ this morning, which addressed the importance of demonstrating suitability as part of the review, and its implications for firms. I know many will have seen it, but I felt compelled to explore why the topic this week is of such importance and relevance, especially to those of us who strive to assist firms in performing due diligence and research to the very highest level. The letter contained some brilliant analysis and I believe, corroboration of the Synaptic approach.

I was going to take a different direction in this quarter’s feature, but I really sat up when I read Mark Polson’s lang cat ‘Top Class Wednesday Update’ this morning, which addressed the importance of demonstrating suitability as part of the review, and its implications for firms. I know many will have seen it, but I felt compelled to explore why the topic this week is of such importance and relevance, especially to those of us who strive to assist firms in performing due diligence and research to the very highest level. The letter contained some brilliant analysis and I believe, corroboration of the Synaptic approach.

In short, the starting gun has gone off on a race everyone knew was coming but wasn’t sure what form it would take. The FCA has sent a ‘fact finding questionnaire’ to the top 20 largest firms in the land with three questions:

› Number of clients due a suitability review as part of your financial advice ongoing service.

› Number of clients who received a suitability review as part of your financial advice ongoing service.

› Number of clients who paid for ongoing advice but whose fee was refunded as the suitability review did not happen. This needs to be provided for each year back to 2017.1

Let us remind ourselves of the context here. Mark reminds us that the majority of income for firms is recurring. We know from ABI figures and other published sources that the majority of income also relates to pensions and advice in respect of pensions, so we can also deduce that this initiative is linked to the next Consumer Duty milestone – where ‘the rules and guidance’ for Consumer Duty will extend from ‘new or existing products or services’ to ‘closed products or services’. So in other words – all assets under advice fall into the scope of suitability, including all legacy products.

What does this tell us?

› Firstly, that there is an expectation that the rules that have already been set out in respect of suitability should have been followed. The suitability framework was extended through MIFID II, which introduced the requirement for suitability to be reviewed. This has been reflected in Consumer Duty which underlines the principle that a ‘firm must act to deliver good outcomes for retail customers’2 and that ‘a firm must take reasonable care to ensure the suitability of its advice and discretionary decisions.’3

› Secondly, that that clients are ‘due a suitability review’, and hopping to the third question, signalling that in the absence of reviews and proof of ongoing suitability, no payments should be taken, and therefore refunds should be made. MiFID II established that reviews were mandatory including in the event that no adjustments to the investment were necessary. Clearly, the’ best outcome’ for all stakeholders, to reuse the beloved phrase, is for reviews to be done expertly and efficiently and for the recurring payments to continue to the firms.

The concern here of course is that reviews have traditionally been difficult to streamline. Remember also that many of these legacy products were put in place before MiFID II, when ‘service’ was mandated, not full suitability, which implies much more work now than then. It has well documented that firms have not been brilliantly served by technology or the implementation of technology, with multiple systems, fractured processes and difficulties in reconciling the tasks required to administer clients’ investments. The influential report from Origo and the lang cat in 2016 ‘A disconnected world: the adviser’s reality’ documented this very effectively, including the proposal that even a skilled administrator was unable to oversee significant funds over a certain level (£30m) due to the amount of work and problems to be solved in administration.

This fact of life is particularly significant to larger, better capitalised, vertically integrated organisations for whom it is now imperative to evidence that reviews are being conducted in a timely manner, and proof of suitability exists.

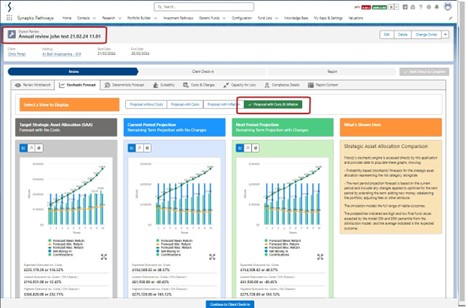

It so happens that the vision on which the new Synaptic proposition was built, now being embedded in networks and advisory firms following recent completion, was precisely aligned with the priority of assisting firms to conduct reviews to the fullest extent of automation possible - allowing a report to be generated to support every recommendation at review, with proof of suitability built in, on a standardised basis. This vision was shared with us by our customers who understood clearly the direction of travel shown by MiFID, the need for detailed disclosure on costs, accurate forecasting and a robust audit trail of advice. All these were built into the new Synaptic proposition.

During the discovery period we were speaking with firms adapting to the new MiFID regime that were spending up to 8 hours on a single client, pulling together all the necessary information to compile the report with the mandatory requirements. This is unsustainable. Our reports can be compiled in minutes.

How does Synaptic assist in meeting Consumer Duty?

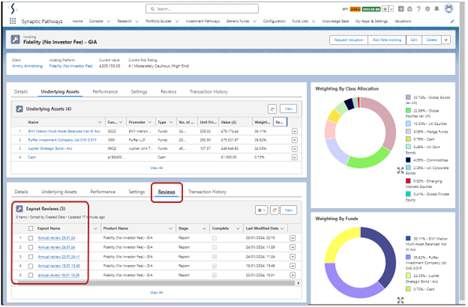

The standardised reports flow from holdings data held in the system, updated manually, integration by the back office or via Synaptic’s proprietary valuation service. This facilitates a full audit of a client’s investment journey, including any investment decisions made at review that are captured in the research. Moreover, the system has the industry’s leading calculations engine which works out Reduction in Yield figures for all investment scenarios for examination of costs whilst the forecasting capabilities, built around Moody’s stochastic capabilities, are able to summarise costs for 12 months (as per MiFID ex-ante rules) and the investment term.

Synaptic also allows firms to set up their Centralised Investment Propositions to restrict investment options on a governance basis, proving to the regulator that the PROD framework is being adhered to. In addition to transparency and disclosure, the system provides standardised forecasts in the reports that can be used to assist customers in understanding their investment journey, including stochastic graphs from Moody’s engine showing the range of probable outcomes, revealing the role of risk to the client. The adviser can scroll through different views to show growth with and without costs, with and without inflation. The process that the regulator wants to see of on-going oversight and analysis is available to Synaptic users at the click of a button.

Further dive into Suitability

Switching - reverting to our theme of ensuring that advisers are able to evidence the analysis they do in respect of closed books, Synaptic Pathways can conduct reviews or support decision to switch with analysis that provides the necessary hurdle rates and critical yield calculations.

Reviews – no changes. Even when no changes are required as part of the review, the standard review report will capture details of the previous review, the current valuation and portfolio, plus forecasts including costs for the next 12 months and specified term, all tailored to the client’s specific investment scenario.

Reviews – with changes. When an adjustment as a result of the review is required, whether rebalancing a portfolio, swapping a portfolio, changing the charging or the amounts invested, then the system will capture any changes in order to report on them. Either route, the system will now be primed to complete the following review, where all the required work to do is update the existing holdings record. All aspects of the various research options are delivered in an integrated package that combines the CRM capability of Salesforce, the research know-how of Synaptic and the risk expertise of Moody’s. There is no better way to embed modern governance and compliance into your firm’s advice process.

Image 1 shows a holding record, including list of previous reviews, risk rating, valuation, portfolio breakdown and tabs to capture costs and performance.

Image 2 shows the review feature work area in the Synaptic software journey, where recommendations and their impact can be researched and captured in reports. Shown is the forecast tab, showing likely outcomes for the investment proposal. Note the ability to tab through several different views.

Get in touch

www.synaptic.co.uk/trial

0800 783 4477

hello@synaptic.co.uk

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.