In this edition...

- Is your business ready for the AI revolution? Kyle Augustin, CEO - Fintel IQ

- It's time to upgrade Fintel IQ,

- Reflections on the summer sell-off Nick Stamenkovic, Economic Analyst - Global Multi-Asset Research - HSBC

- Managing the summer turbulence John Husselbee, Head of the Liontrust - Multi-Asset Investment Team - Liontrust

- Higher rates begin to bite Jupiter Asset Management,

- The missing link Sandy Newman, Director - ifaDASH

- Euromillions or selecting the right asset class? Antony Champion, Managing Director - Head of Intermediaries - RBC Brewin Dolphin

- 5 best practice steps for collecting feedback - and what do with it VouchedFor,

- Ensuring the right outcomes for vulnerable customers Steve Knight, Chief Operating Officer - Nucleus

- Vital future proofing through intergenerational planning Scarlett Musson, Business Development Director - APS Legal and Associates

- Japan’s online banking revolution Matthew Brett, Japan Trust Manager - Baillie Gifford & Co

- Maintaining competence, enhancing knowledge, identifying & mitigating risk Gillian Tait, Managing Director - Competent Adviser

- Is CIRP the new CIP? Zayd Ahmad, Business Consultancy Manager - SimplyBiz

- The lifetime allowance has been abolished but things haven’t got any simpler! Keeley Paddon, Head of Pensions Technical - SimplyBiz

- Investing for the future Bhavin Shah, Portfolio manager, Mixed Assets Investment team, Newton Investment Management - BNY Investments

- China: Supreme superpower or failing factory of the world? Jon Lycett, Key Accounts Manager - RSMR

- Having your cake and eating it? Jordan Sriharan, Fund Manager, Multi-Asset - Canada Life Asset Management

Why portfolio diversification is critical in volatile markets.

Why portfolio diversification is critical in volatile markets.

Recent stock market volatility has demonstrated, if we needed it to be demonstrated, that it is more important than ever to ensure your clients’ portfolios are robust enough to withstand market shocks.

Of course, it is difficult to gauge which investments are likely to outperform or underperform in a certain economic environment, and as you will read below, our research shows the chances of selecting the single best-performing asset class for ten years in a row are one in 25 billion, underscoring the importance of advisers working closely with their investment provider of choice.

What are the odds of selecting the best asset class

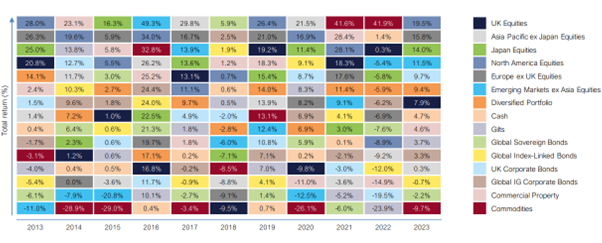

We conducted some research to find out the odds of selecting the single best-performing asset class every year over a 10-year period. We based our research on the 11 asset classes we track, including equities across a range of regions, cash, government and corporate bonds, commercial property, and commodities.

Our research found that the odds of picking the top performer for ten years in a row were one in 25 billion, meaning a client would be more likely to win the EuroMillions jackpot, where the odds of winning are one in 140 million.

Over the last ten years1 , seven out of the 11 asset classes occupied the top spot. Commodities were the top performer in 2021 and 2022, but performed the worst in 2014, 2015, 2017 and 2020, demonstrating the volatility that comes with individual categories. The spread in performance averaged 41.15% over the past decade.

Why diversification matters to you and your clients

The spread in performance across asset classes highlights the near impossibility of predicting the future, stressing the importance of portfolio diversification to help mitigate the risks of market downturns. For example, Emerging Markets ex Asia equities struggled in 2013, 2014 and 2014, but outperformed in 2016.

Why diversification is a critical element of the advice discussion

The odds of picking a winning asset class highlight the benefits of clients seeking financial advice to help withstand economic shocks and grow their wealth over the long term.

Our role in working closely with Advisers, is to structure your clients’ investments in the most effective way, working with you to create a bespoke solution that considers every element of your client’s unique circumstances.

We’ll support you with hands-on, practical help from our team. You can then focus on what you do best: building and nurturing client relationships.

Get in touch

brewin.co.uk/intermediaries

020 3504 7595

salesupport@brewin.co.uk

Important information: The value of investments, and any income from them, can fall and you may get back less than you invested. Neither simulated nor actual past performance are reliable indicators of future performance. Performance is quoted before charges which will reduce illustrated performance. Investment values may increase or decrease as a result of currency fluctuations. Information is provided only as an example and is not a recommendation to pursue a particular strategy. Information contained in this document is believed to be reliable and accurate, but without further investigation cannot be warranted as to accuracy or completeness.

RBC Brewin Dolphin is a trading name of Brewin Dolphin Limited. Brewin Dolphin Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register reference number 124444) and regulated in Jersey by the Financial Services Commission. Registered Office; 12 Smithfield Street, London, EC1A 9BD. Registered in England and Wales company number: 2135876.

Footnotes:

1: Source: LSEG Datastream

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.