In this edition...

- Is your business ready for the AI revolution? Kyle Augustin, CEO - Fintel IQ

- It's time to upgrade Fintel IQ,

- Reflections on the summer sell-off Nick Stamenkovic, Economic Analyst - Global Multi-Asset Research - HSBC

- Managing the summer turbulence John Husselbee, Head of the Liontrust - Multi-Asset Investment Team - Liontrust

- Higher rates begin to bite Jupiter Asset Management,

- The missing link Sandy Newman, Director - ifaDASH

- Euromillions or selecting the right asset class? Antony Champion, Managing Director - Head of Intermediaries - RBC Brewin Dolphin

- 5 best practice steps for collecting feedback - and what do with it VouchedFor,

- Ensuring the right outcomes for vulnerable customers Steve Knight, Chief Operating Officer - Nucleus

- Vital future proofing through intergenerational planning Scarlett Musson, Business Development Director - APS Legal and Associates

- Japan’s online banking revolution Matthew Brett, Japan Trust Manager - Baillie Gifford & Co

- Maintaining competence, enhancing knowledge, identifying & mitigating risk Gillian Tait, Managing Director - Competent Adviser

- Is CIRP the new CIP? Zayd Ahmad, Business Consultancy Manager - SimplyBiz

- The lifetime allowance has been abolished but things haven’t got any simpler! Keeley Paddon, Head of Pensions Technical - SimplyBiz

- Investing for the future Bhavin Shah, Portfolio manager, Mixed Assets Investment team, Newton Investment Management - BNY Investments

- China: Supreme superpower or failing factory of the world? Jon Lycett, Key Accounts Manager - RSMR

- Having your cake and eating it? Jordan Sriharan, Fund Manager, Multi-Asset - Canada Life Asset Management

With so much noise in the industry about technology, digitisation and AI, it is no wonder that for many, it simply feels overwhelming, too much hassle and confusing, at worst something we procrastinate over, along the lines of “when I get everything in order and have enough time, I will look into it”.

With so much noise in the industry about technology, digitisation and AI, it is no wonder that for many, it simply feels overwhelming, too much hassle and confusing, at worst something we procrastinate over, along the lines of “when I get everything in order and have enough time, I will look into it”.

The reality is that without advancements in technology, sided with a good measure of regulatory requirement, the task to “keep on top” becomes insurmountable and we revert to “the old way”. Not that there is anything necessarily terrible about the old way, but it is likely to drive you to sheer exhaustion mentally and commercially, in other words it makes no business sense and can stagnate your business. You may be utilising extremely capable qualified individuals to “do spreadsheets” which equates to poor use of resource, cost and a negative value outcome.

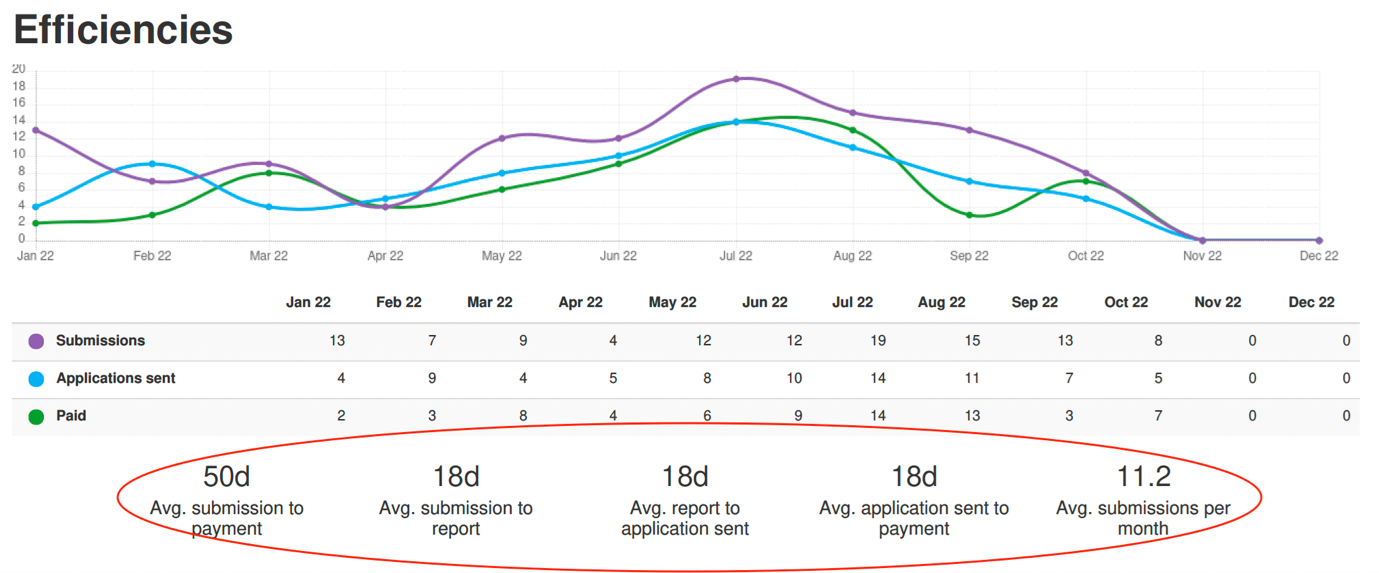

So, embracing technology and the support this offers you is paramount, which seems easy, that is until we try to work out which solution fits best, with solutions mainly aimed at the B 2 C side, leaving you asking the question on how on earth do you measure your businesses performance, look at efficiencies, measure your exceptions, manage risk, utilise resource where appropriate, all the while evidencing your MI to meet the crucial obligations for such a regulated industry.

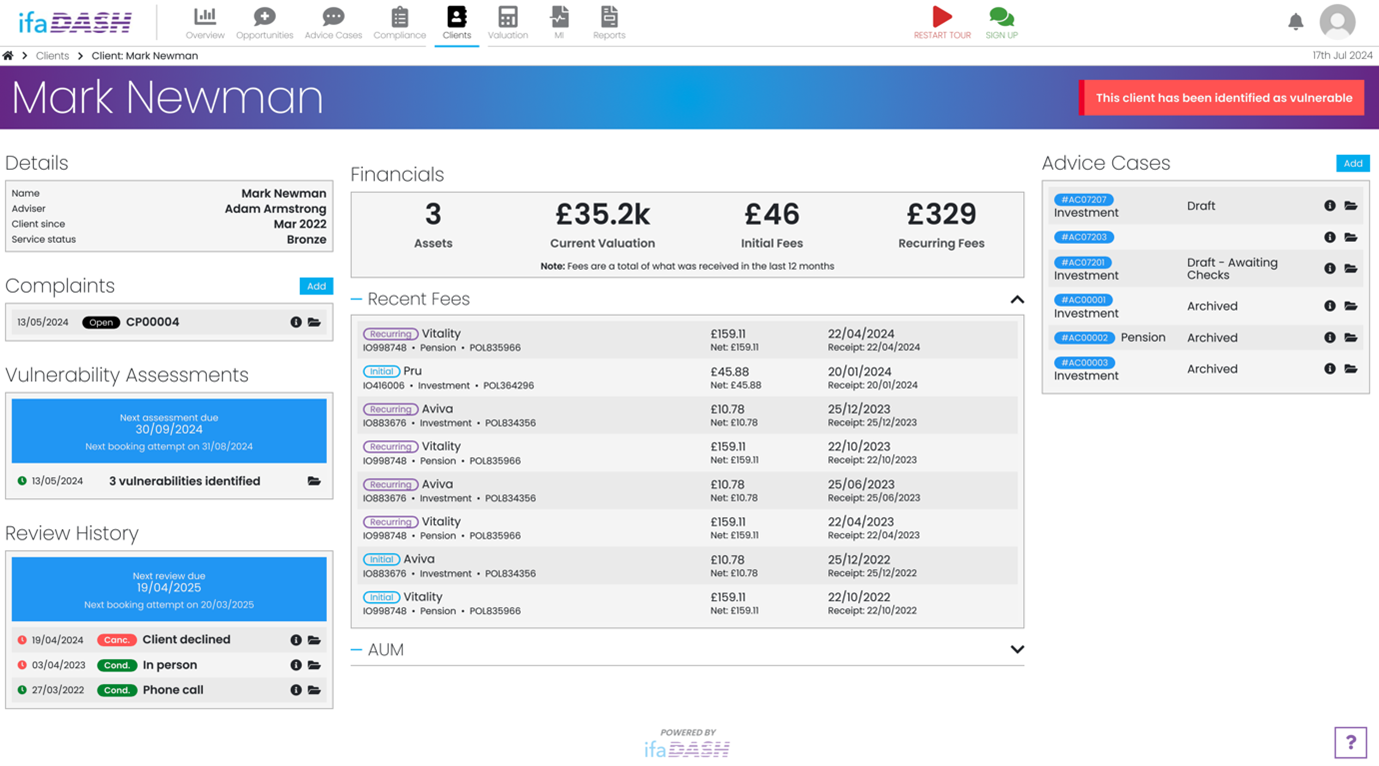

ifaDASH is a unique industry specific solution, built on open architecture it connects to sources of data within your business to measure, evaluate and evidence. It provides full visibility on the key areas that you need focus on.

It’s true what they say “shine a light on it”.

As well as the visibility aspect, ifaDASH is a business processing tool like no other. It connects departments and individuals, with configurable SLA’s and targets you can keep on top of managing your business and flagging bottlenecks so that action can be focused and directed at source.

For M&A its a simple “no brainer”, why wait until the acquired firms are embedded which can take more than 6 to 12 months, to onboard and capture information which should be available immediately and for which you have immediate responsibility?

As part of DD or at point of acquisition, plug into ifaDASH and get immediate visibility (which goes back to the date of inception be it CRM or whenever data assimilation started).

Our solution is agile and intuitive, it determines when file checks are needed and automatically passes them to the relevant departments, it alerts and keeps a full track on process, eliminates double entry or managing systems in multiple locations.

With a full compliance suite, vulnerability identifier and management plans, T&C and CPD ifaDASH captures all the necessary data, providing full MI to evidence your position eliminating hours of correlating data onto spreadsheets which frankly can be subject to human error, time and process.

Research by Octopus Money found out that since consumer duty has come in, advisers are spending more time on paperwork in fact over a third (35%) of advisers say the additional reporting requirements have increased the administrative time spent per client which is putting pressure on profit margins and the ability to serve low-asset clients. As a result, advisers indicate that time required to deliver a single advice case has more than doubled.

The Duties unintended output has been a “cull” on lower asset clients, further confirmed in a recent report by The Lang Cat, which highlighted that since the introduction of Consumer Duty rules, the number of individuals receiving professional financial advice has decreased from 11% in 2023 to 9% in 2024.

As reiterated by Octopus Money, the solution is open thinking and adoption of technology to automate and stop duplicated efforts in any firm. Our view is that ifaDASH is the only solution that can show you in real time where your time is spent, the capacity available, fees charged and of course all the necessary gap analysis that is required to manage your firm(s) and deliver better outcomes to your clients.

As the landscape is changing and there is a hunger for efficiency in the industry and value add to your business there has never been a better time to reach out and see for yourself.

Get in touch

info@ifadash.com

sandy@ifadash.co.uk

ifadash.com

ifadash

+44 7555 627419

About ifaDASH:

We operate under the banner of “less in… more out” to prevent the wrath of data and information swamping the financial services arena, by streamlining the data to the appropriate focus areas making it easier to provide clients with access to professional services.

Founding Directors come from a regulated and a governance/ risk background with a combined 60 years of expertise in their respective fields, which makes the solution apt for its intended users.

As established market leaders in our field, we are now part of the Fintel brand offering our solution to major financial organisations, networks and any size firm.

We are confident in our ability to add value to your business and invite you to reach out to explore further

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.