In this edition...

- Is your business ready for the AI revolution? Kyle Augustin, CEO - Fintel IQ

- It's time to upgrade Fintel IQ,

- Reflections on the summer sell-off Nick Stamenkovic, Economic Analyst - Global Multi-Asset Research - HSBC

- Managing the summer turbulence John Husselbee, Head of the Liontrust - Multi-Asset Investment Team - Liontrust

- Higher rates begin to bite Jupiter Asset Management,

- The missing link Sandy Newman, Director - ifaDASH

- Euromillions or selecting the right asset class? Antony Champion, Managing Director - Head of Intermediaries - RBC Brewin Dolphin

- 5 best practice steps for collecting feedback - and what do with it VouchedFor,

- Ensuring the right outcomes for vulnerable customers Steve Knight, Chief Operating Officer - Nucleus

- Vital future proofing through intergenerational planning Scarlett Musson, Business Development Director - APS Legal and Associates

- Japan’s online banking revolution Matthew Brett, Japan Trust Manager - Baillie Gifford & Co

- Maintaining competence, enhancing knowledge, identifying & mitigating risk Gillian Tait, Managing Director - Competent Adviser

- Is CIRP the new CIP? Zayd Ahmad, Business Consultancy Manager - SimplyBiz

- The lifetime allowance has been abolished but things haven’t got any simpler! Keeley Paddon, Head of Pensions Technical - SimplyBiz

- Investing for the future Bhavin Shah, Portfolio manager, Mixed Assets Investment team, Newton Investment Management - BNY Investments

- China: Supreme superpower or failing factory of the world? Jon Lycett, Key Accounts Manager - RSMR

- Having your cake and eating it? Jordan Sriharan, Fund Manager, Multi-Asset - Canada Life Asset Management

Fintel IQ empowers retail financial services through connected technology and smart workflow. Driven by our belief that everyone should have access to professional financial advice, Fintel IQ exists to build simple and integrated financial technology that increases the accessibility of financial services and upgrades the financial planning experience.

Fintel IQ empowers retail financial services through connected technology and smart workflow. Driven by our belief that everyone should have access to professional financial advice, Fintel IQ exists to build simple and integrated financial technology that increases the accessibility of financial services and upgrades the financial planning experience.

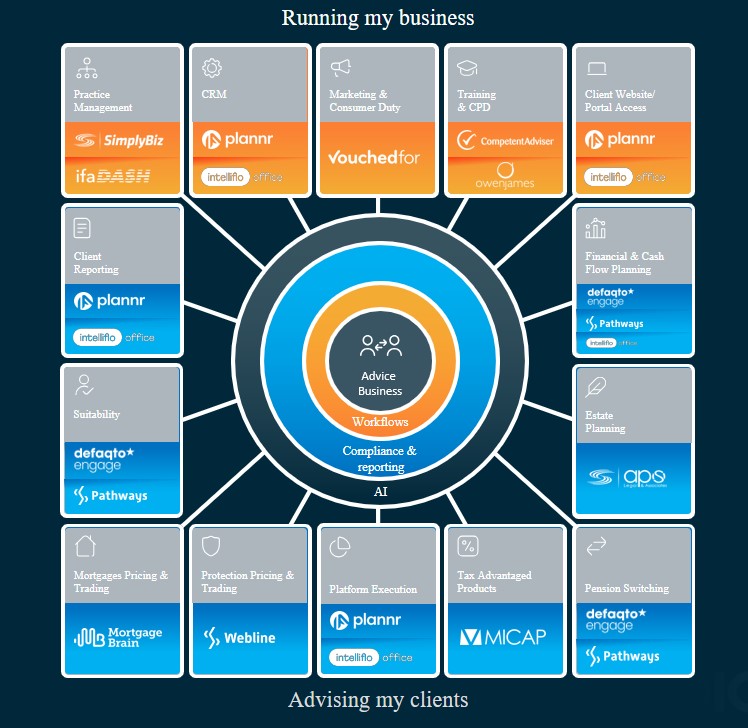

Combining leading fintech, unrivalled insights and expertise, our modular, connected platform drives efficiency and powers growth.

It is a customisable, connected technology and workflow platform developed through two-way API integrations with the best technology solutions in the sector. Creating operational efficiencies, centralising data, and improving advice outcomes, Fintel IQ enables progressive financial professionals to run and scale their businesses more effectively.

Fintel IQ has broken new ground in the provision of technology and workflow solutions for the intermediary advice market. The Fintel IQ platform creates an efficient advice process through the seamless flow of data and workflow. It has been designed specifically to help large intermediary businesses with over 100 advisers manage their advice and regulatory workflows through a single connected technology platform.

We believe that everyone should have access to professional advice, and Fintel IQ builds simple to use, connected technology, that increases the accessibility of financial services. Combining leading fintech, unrivalled insights, and expertise, our modular, connected platform supports large advice firms to operate effectively and grow quickly. Our platform will help business leaders with centralised data and MI, ensuring better outcomes consistent with Consumer Duty as well as uncovering more commercial opportunities.

"Combining leading fintech, unrivalled insights and expertise, our modular, connected platform drives efficiency and powers growth. "

Research has shown that advisers use, on average, nine pieces of software as part of their advice process, each with separate log in details, billing, and support. These complexities can result in advisers spending less time advising their clients, leading to inefficiency and a lack of quality data. Additionally, the client journey is disrupted if workflows are disjointed, and advisers waste valuable time rekeying information to connect these systems together.

The current way of running advice firms is costly and inefficient, and access to quality, real-time data is limited. We believe that connected technology and integrated services will form the bedrock of modern advice businesses. Fintel IQ uses an API first approach to integrate market leading technology into a customisable, connected platform.

Streamlining workflows and centralising data, we empower financial professionals to operate more effectively, make better decisions and grow faster.

Get in touch

LinkedIn: Fintel-iq

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.