In this edition...

- Is your business ready for the AI revolution? Kyle Augustin, CEO - Fintel IQ

- It's time to upgrade Fintel IQ,

- Reflections on the summer sell-off Nick Stamenkovic, Economic Analyst - Global Multi-Asset Research - HSBC

- Managing the summer turbulence John Husselbee, Head of the Liontrust - Multi-Asset Investment Team - Liontrust

- Higher rates begin to bite Jupiter Asset Management,

- The missing link Sandy Newman, Director - ifaDASH

- Euromillions or selecting the right asset class? Antony Champion, Managing Director - Head of Intermediaries - RBC Brewin Dolphin

- 5 best practice steps for collecting feedback - and what do with it VouchedFor,

- Ensuring the right outcomes for vulnerable customers Steve Knight, Chief Operating Officer - Nucleus

- Vital future proofing through intergenerational planning Scarlett Musson, Business Development Director - APS Legal and Associates

- Japan’s online banking revolution Matthew Brett, Japan Trust Manager - Baillie Gifford & Co

- Maintaining competence, enhancing knowledge, identifying & mitigating risk Gillian Tait, Managing Director - Competent Adviser

- Is CIRP the new CIP? Zayd Ahmad, Business Consultancy Manager - SimplyBiz

- The lifetime allowance has been abolished but things haven’t got any simpler! Keeley Paddon, Head of Pensions Technical - SimplyBiz

- Investing for the future Bhavin Shah, Portfolio manager, Mixed Assets Investment team, Newton Investment Management - BNY Investments

- China: Supreme superpower or failing factory of the world? Jon Lycett, Key Accounts Manager - RSMR

- Having your cake and eating it? Jordan Sriharan, Fund Manager, Multi-Asset - Canada Life Asset Management

For multi-asset income investors, finding sufficient income without impacting your capital is a perpetual challenge. Using anonymised examples from our peer group, we consider potential pitfalls of different approaches and show how we believe these can be avoided.

For multi-asset income investors, finding sufficient income without impacting your capital is a perpetual challenge. Using anonymised examples from our peer group, we consider potential pitfalls of different approaches and show how we believe these can be avoided.

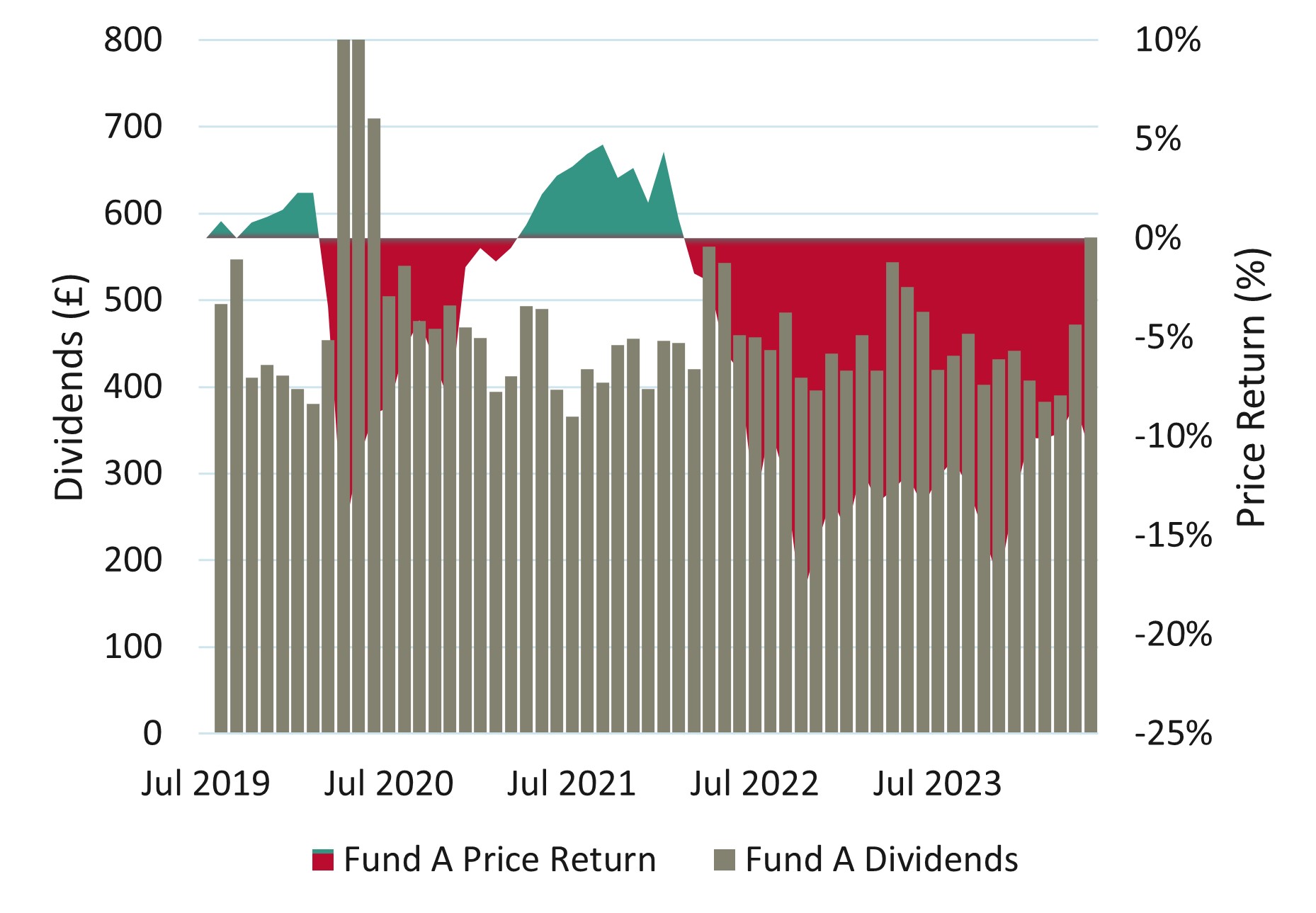

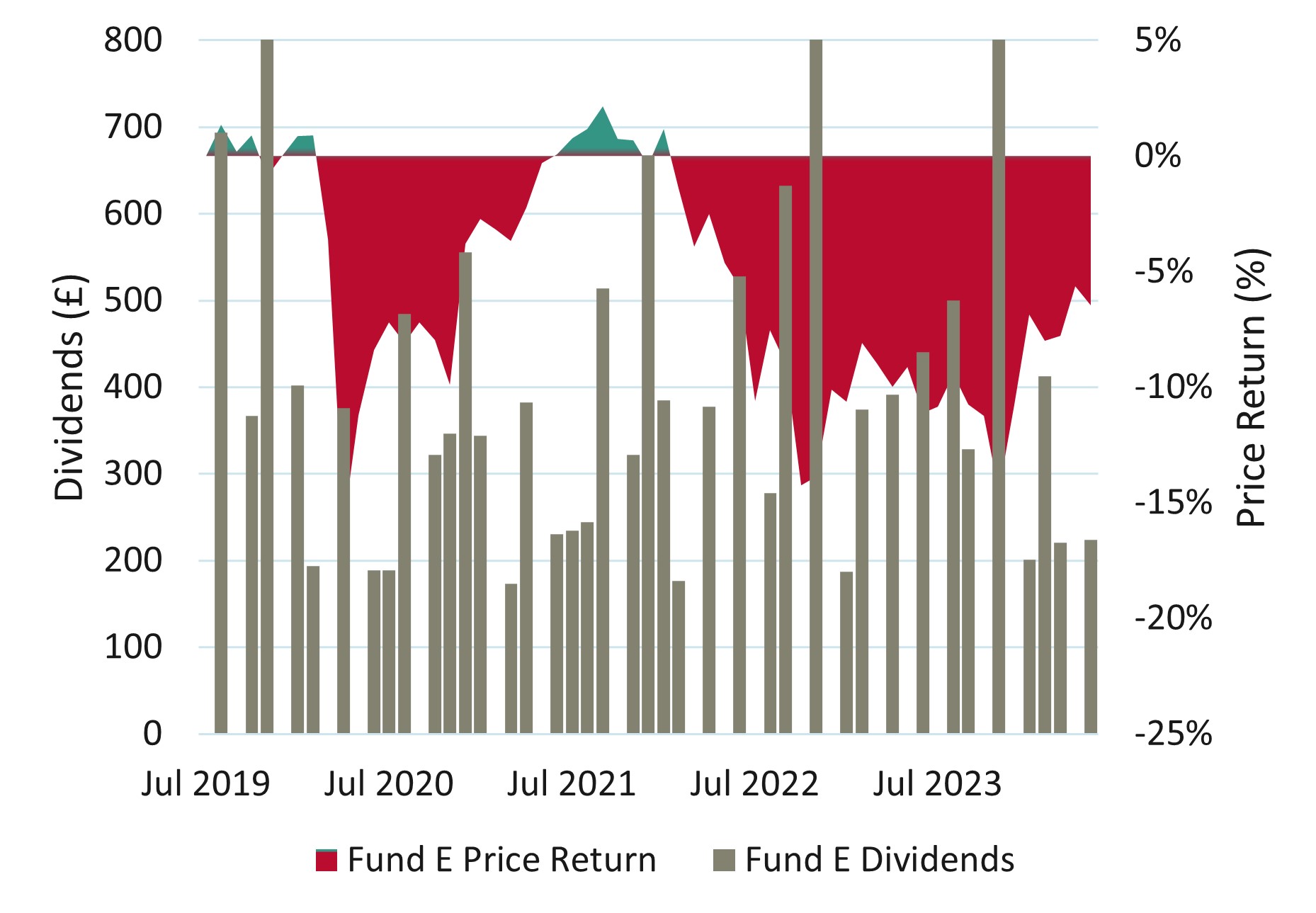

Income at any expense

Some income approaches focus on income at any expense. However, this can lead to poor customer outcomes – and clients might not be aware that while they are receiving income their capital is being depleted.

Source: Canada Life Asset Management and Morningstar as at 31 May 2024.

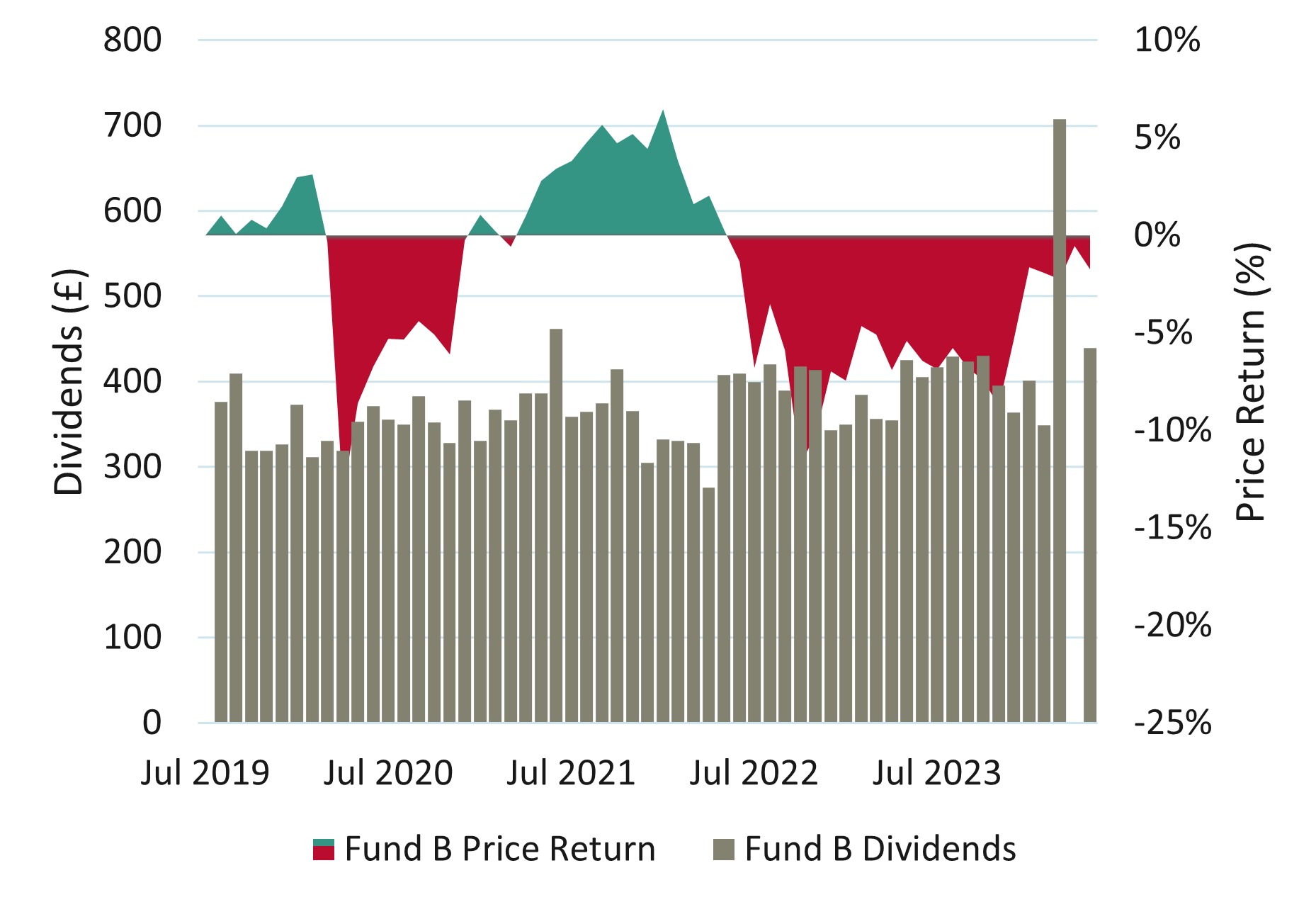

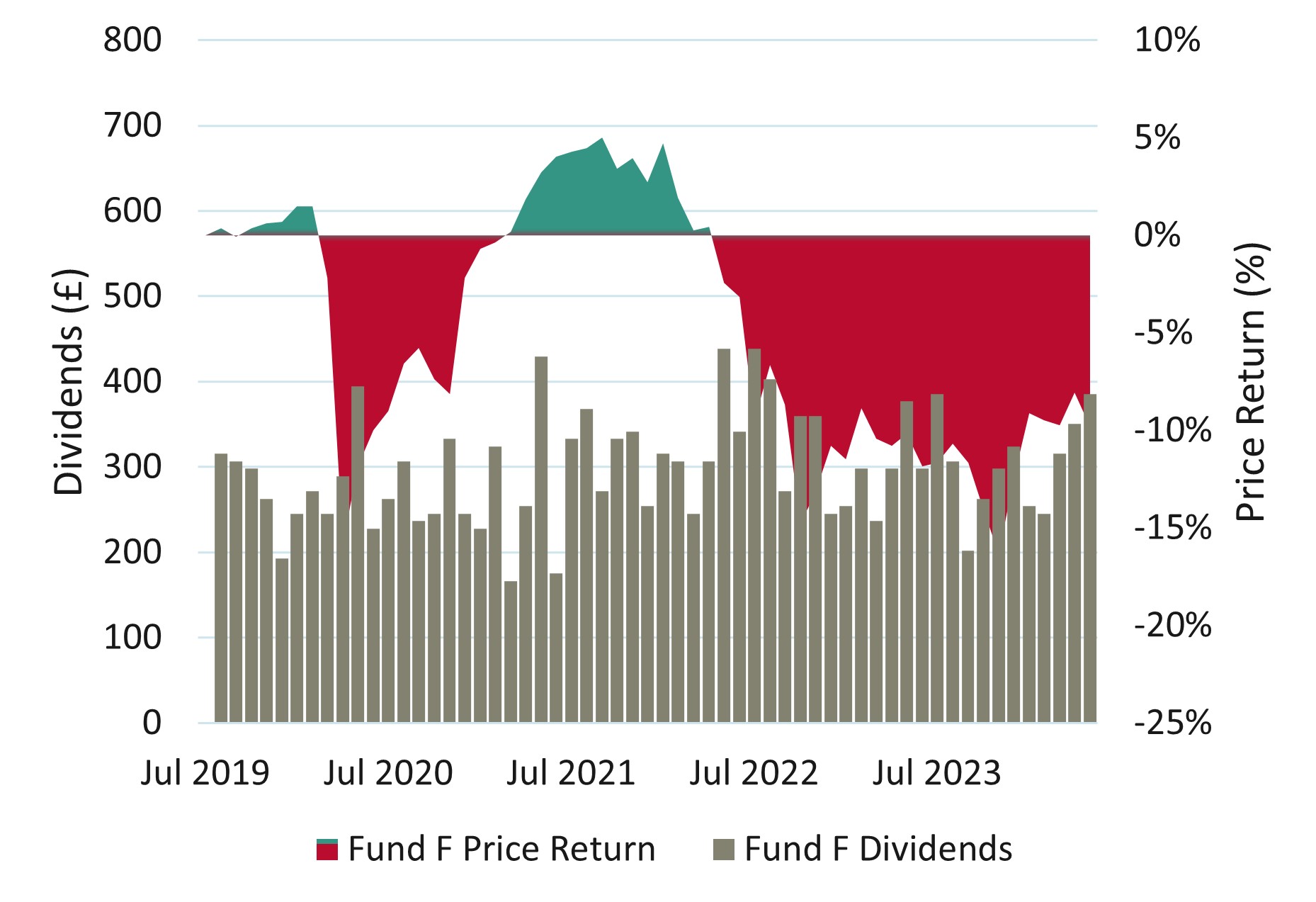

Some income approaches smooth the income. This is typically more attractive for clients in the decumulation stage. Despite the smoothing effect, this can still look like income at any expense:

Source: Canada Life Asset Management and Morningstar as at 31 May 2024.

Sometimes this represents smoothing over the cracks of capital losses. In our view, an investor is better off buying a bond or annuity in this scenario.

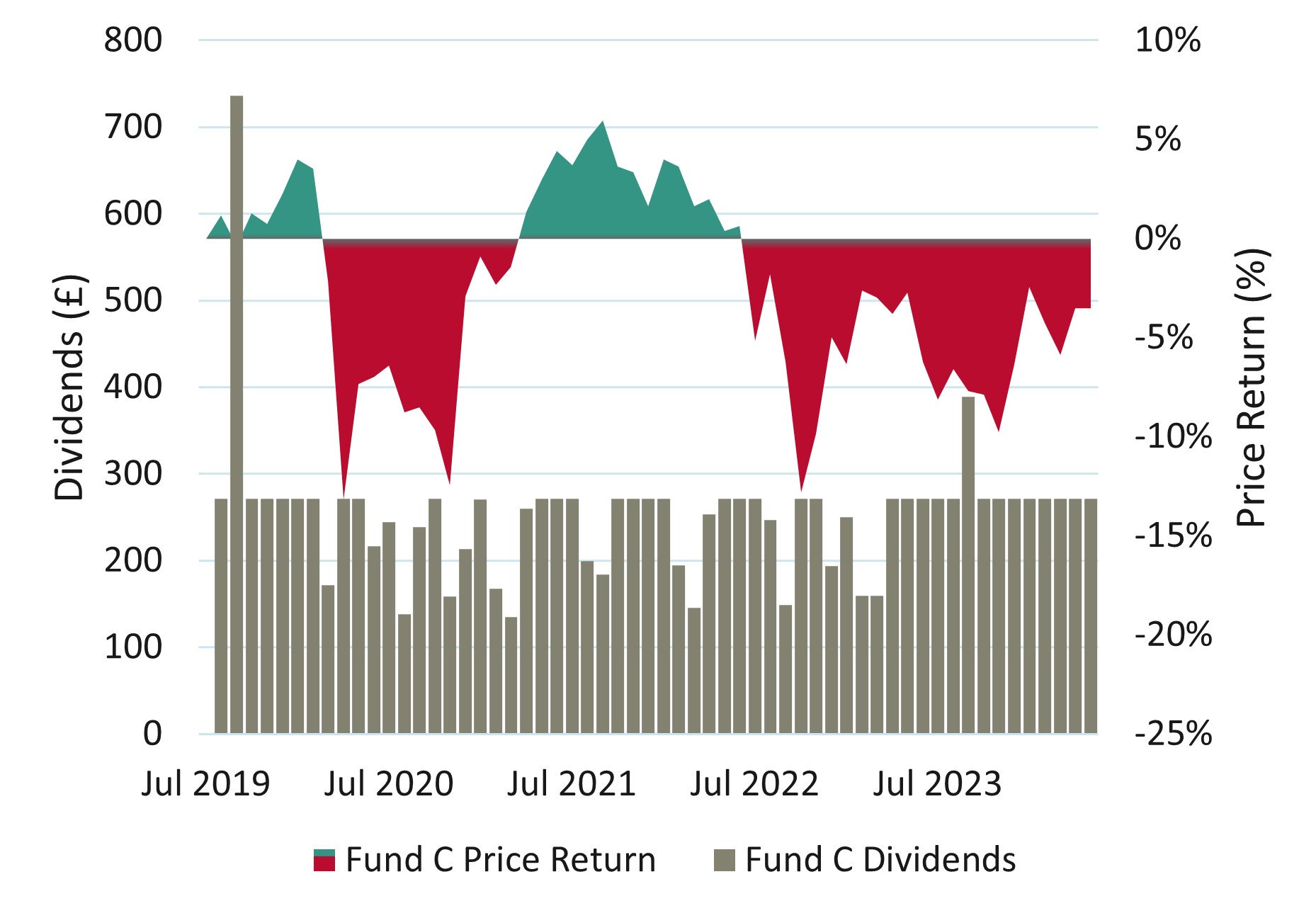

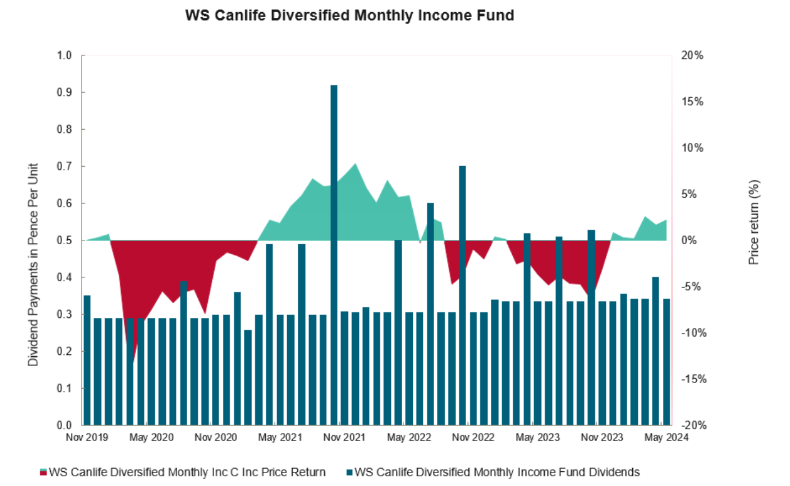

Sporadic income and low (or no) capital return

Some income approaches struggle both to generate smooth income and to generate capital returns:

Source: Canada Life Asset Management and Morningstar as at 31 May 2024.

The investor lesson from all this is a need to understand what the capital upside is from any investment. We don’t recommend measuring success purely by income payments received – whilst important, if the capital is being eroded then we believe that you may as well buy a bond or annuity

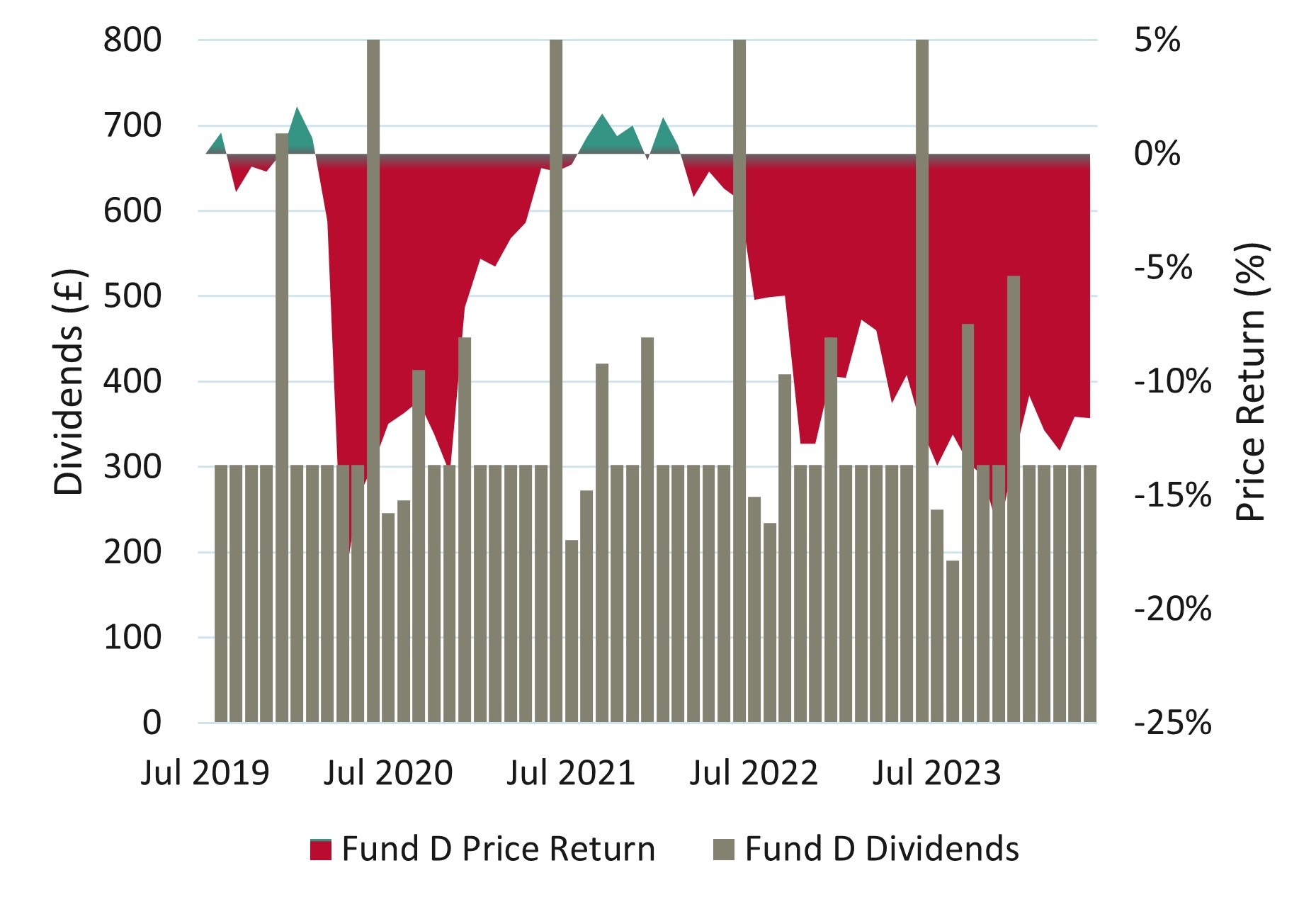

Striking the balance: a good all-rounder

WS Canlife Diversified Monthly Income Fund

Source: Canada Life Asset Management and Morningstar as at 31 May 2024. Morningstar data is bid to bid, with income re-invested, for C share class to 31 May 2024. Sector: IA Mixed Investment 20-60% Shares

Unlike many traditional income funds, the WS Canlife Diversified Monthly Income Fund pays out a steady income each month (effectively a smoothed distribution), allowing investors to budget with greater certainty. To do this, the fund sets a targeted monthly income per unit each year so, no matter the price of the underlying fund, the dividends aim to be consistent on a pound value each month.

Get in touch

canadalifeasset management.co.uk

Important information:

Past performance is not a guide to future performance. The value of investments may fall as well as rise and investors may not get back the amount invested. Income from investments may fluctuate. Currency fluctuations can also affect performance.

No guarantee, warranty or representation (express or implied) is given as to the document’s accuracy or completeness.

Data Source - © 2024 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

This article is issued for information only by Canada Life Asset Management. It does not constitute a direct offer to anyone, or a solicitation by anyone, to subscribe for shares or buy units in fund(s). Subscription for shares and buying units in the fund(s) must only be made on the basis of the latest Prospectus and the Key Investor Information Document (KIID) available at www.canadalifeassetmanagement.co.uk

Canada Life Asset Management is the brand for investment management activities undertaken by Canada Life Asset Management Limited, Canada Life Limited and Canada Life European Real Estate Limited. Canada Life Asset Management Limited (no. 03846821), Canada Life Limited (no.00973271) and Canada Life European Real Estate Limited (no. 03846823) are all registered in England and the registered office for all three entities is Canada Life Place, Potters Bar, Hertfordshire EN6 5BA. Canada Life Asset Management Limited is authorised and regulated by the Financial Conduct Authority. Canada Life Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.