In this edition...

- The future is bright for financial advice… but it will be a bumpy ride James Goad, Managing Director - Owen James

- Trump, tariffs, tech, and the rest of the world Fabian Wiesner, Head of Distribution Partnerships - Simplybiz

- Infrastructure: The UK’s untapped goldmine for investors? Katie Sykes, Client Engagement & Marketing Manager - RSMR

- The regulatory landscape for 2025 Sandy McGregor, Director of Policy - Simplybiz

- Can active and passive team up for investment success? Nick Millington, Head of Systematic Index Solutions - Aberdeen Investments

- Why your back-office tech should be invisible Abi Hortin, Implementation Specialist - Plannr Technologies Limited

- 2025 Planning and beyond… Scarlet Musson, Business Development Director - APS Legal Associates

- Marking 10 years of Multi-Asset Income BNY Investments,

- Trump, hitting the ground running Jonathan Griffiths, CFA Investment Product Manager - ebi Portfolios

- Weak UK outlook calls for nuanced approach Caroline Shaw, Portfolio Manager - Fidelity International

- Managing CGT through unitised funds Antony Champion, Managing Director, Head of Intermediaries - RBC Brewin Dolphin

- Expanding Decumulation Capabilities in Pathways Seb Marshall, Product Manager - Synaptic

- DFM due diligence and the role of financial strength consideration Matt Ward, Communications Director - AKG Financial Analytics Ltd

- Benefits of Investing on Global Listed Infrastructure Giuseppe Corona, Head of Listed Real Assets - HSBC Asset Management

- Taking stock of the new world order Ariel Bazalel, Investment Manager - Jupiter Strategic Bond Fund

Infrastructure assets encompass public and private physical structures and facilities which are essential for the stability and growth of any economy as they provide valuable services to society. These “hard infrastructure” assets mainly operate across four broad sectors – Utilities, Energy, Transportation, Communications.

Infrastructure assets encompass public and private physical structures and facilities which are essential for the stability and growth of any economy as they provide valuable services to society. These “hard infrastructure” assets mainly operate across four broad sectors – Utilities, Energy, Transportation, Communications.

Global Listed Infrastructure (GLI) refers to publicly traded companies which own and/or operate infrastructure assets worldwide. Over the past decade, we have seen more and more interest in the asset class as investors have increased their allocation to GLI. In turn, gaining liquid exposure to direct infrastructure and having a defensive building block as part of a diversified equity portfolio.

GLI as a liquid proxy for direct infrastructure

We believe investors globally now consider GLI as a liquid alternative to unlisted infrastructure, contributing to the asset class’ significant growth in the past decade . Unlisted infrastructure has distinct characteristics (namely, the ability to secure control of an asset and the lack of mark-to-market valuations), however we believe the long-term total return outcomes are more aligned with listed infrastructure despite the higher volatility due to the daily pricing available on its underlying assets.

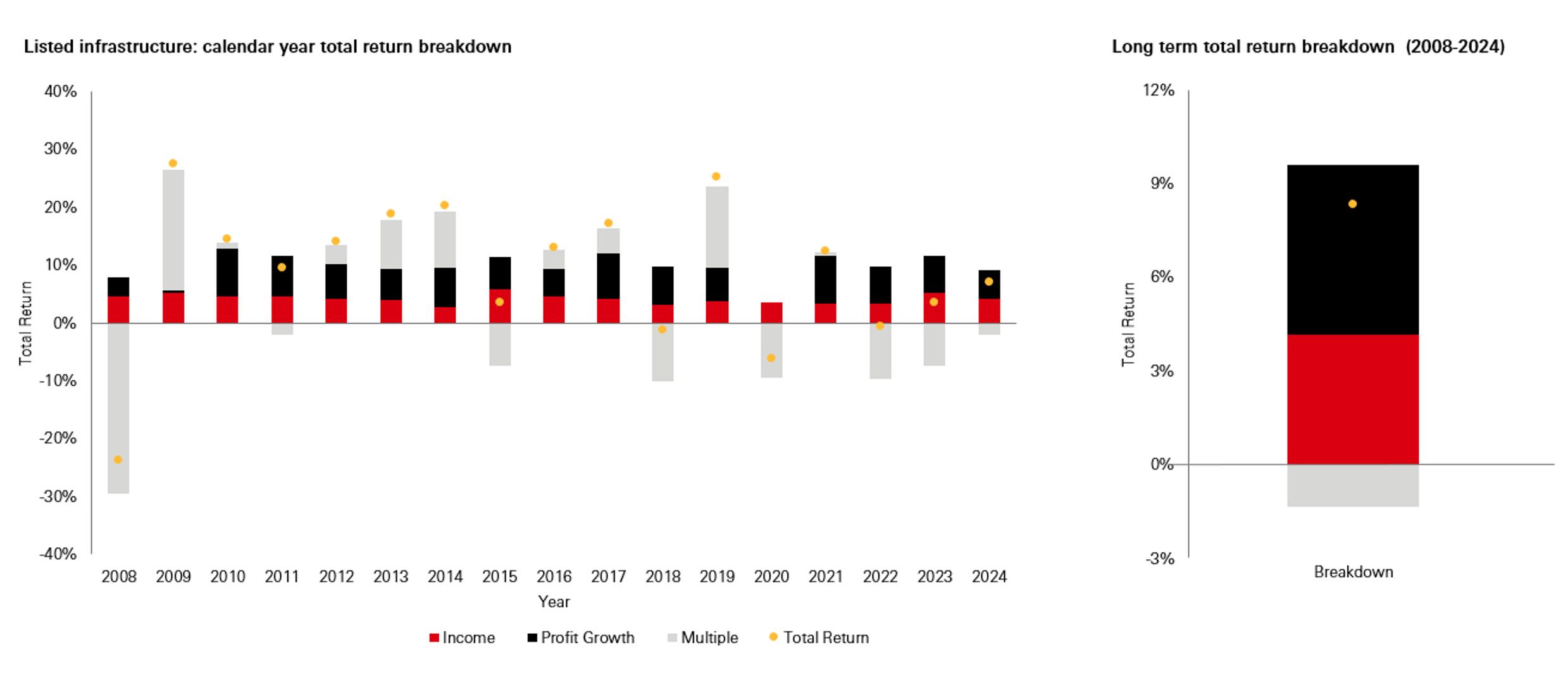

As seen in the total return breakdown charts below, the multiple effect can provide a headwind or a tailwind to listed infrastructure’s annual returns, yet in the long run, it is infrastructure asset’s underlying profit growth and dividend payments that drives total returns: not its ownership structure. Additionally, while unlisted infrastructure can have lower perceived volatility, we believe it exhibits higher transaction costs, lower liquidity, and more concentrated portfolios. On top of usually requiring higher minimum investments.

Chart 1: Total return breakdown

Source: Bloomberg. Data from 31 December 2007 to 31 December 2024. The bars in the charts represent an arithmetic sum whilst the total return is calculated using a geometric sum.

GLI can provide defensive exposure in a diversified equity portfolio

GLI has historically exhibited predictable, resilient, and inflation hedged earnings’ growth: supported by high cash distribution levels. Arguably, appealing features for asset allocators searching for a defensive building block with a low correlation to global equities to complement their portfolio.

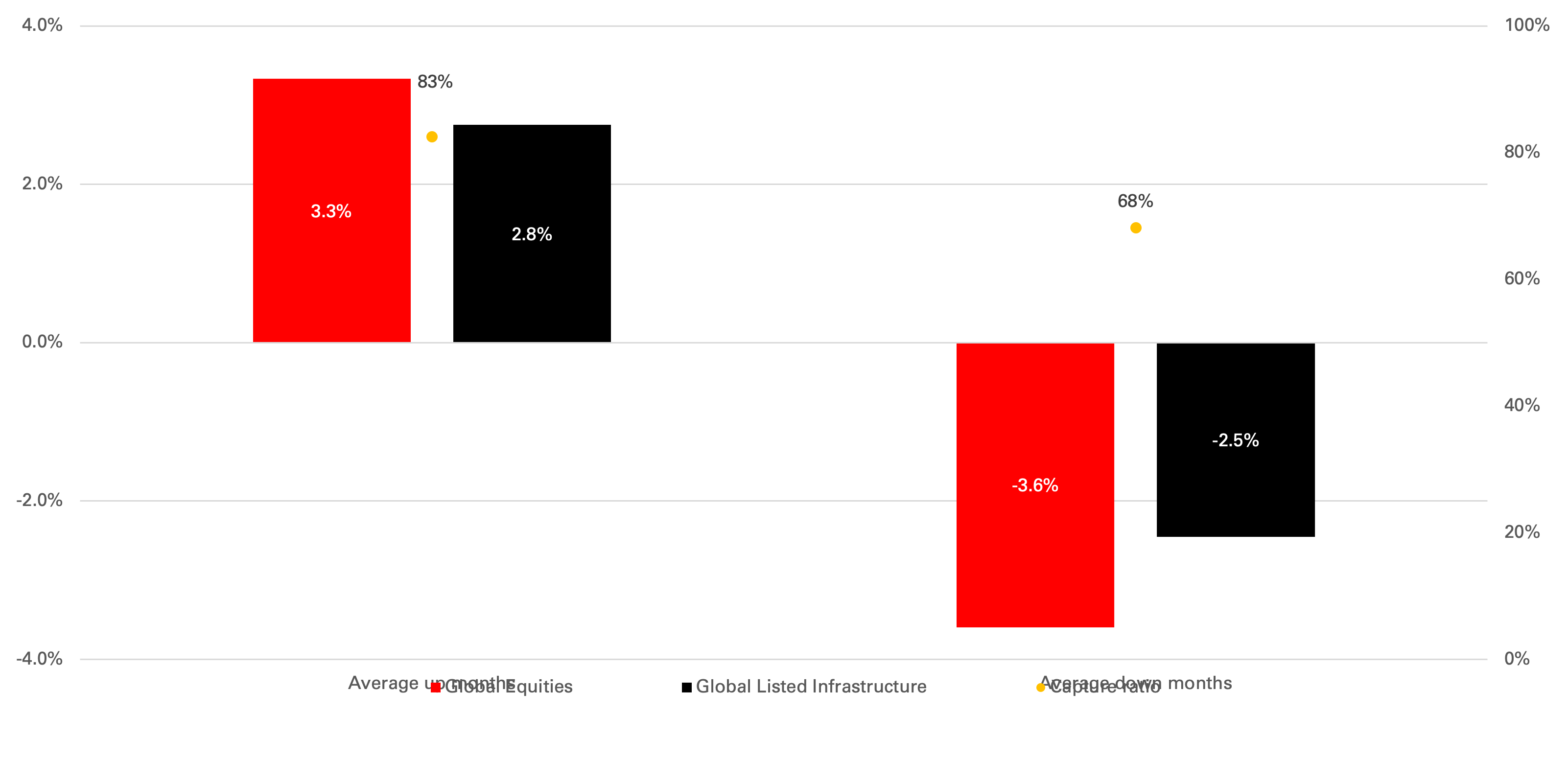

The asset class’ defensive characteristics are reflected in its performance, with potentially attractive upside/ downside capture. We believe the below chart echoes this, measuring the degree to which listed infrastructure participates in global equities’ upside during “up” months and global equities’ downside during “down” months. In turn, highlighting how the asset class’ defensive characteristics can play an important role in well-diversified asset allocation.

Chart 2: Upside vs. downside market capture

Source: Bloomberg as at 31 December 2024

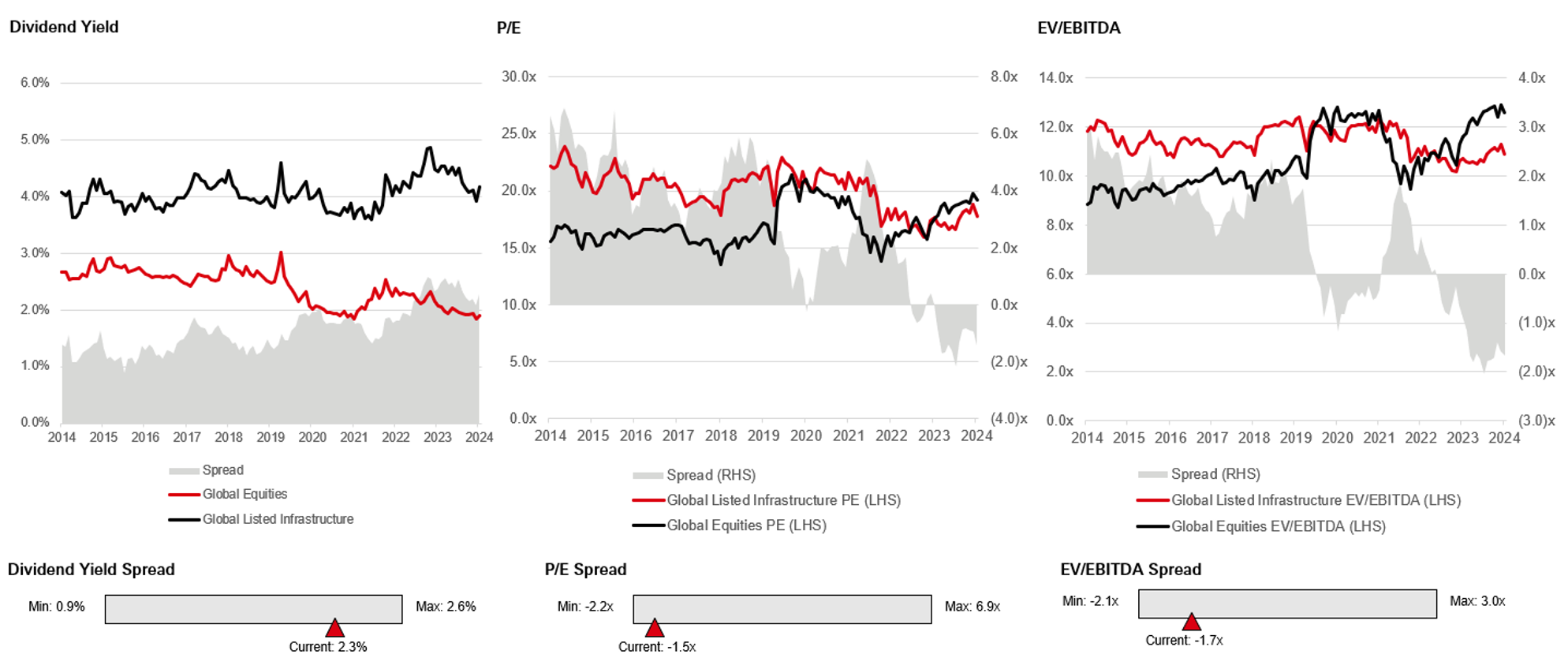

How is the asset class currently trading?

As seen in Chart 1, the multiple effect has been a headwind for the asset class over the last two years; muting the asset class’ share price performance. Nonetheless, GLI has benefitted from inflationary tailwinds and continues to deliver resilient income and profit growth. However, GLI trades at a wide discount to Global Equities (see Chart 3) across various valuation multiples.

Chart 3: Valuation metric comparisons

Source: Bloomberg as at 31 December 2024.

As shown above, the spread across multiple metrics screens as, arguably, attractive compared to historical level. As such, we believe the current trading environment presents a potential opportunity.

Key Investment Risks

• Liquidity Risk – Investors may be unable to dispose of an investment quickly or at all and at a price that’s closely related to recent similar transactions, if any. There is no guarantee of distributions and secondary market is expected to be established.

• Alternatives – There are additional risks associated with specific alternative investments within the portfolios; these investments may be less readily realisable than others and it may therefore be difficult to sell in a timely manner at a reasonable price or to obtain reliable information about their value; there may also be greater potential for significant price movements.

• Event Risk – A significant event may cause a substantial decline in the market value of all securities.

• Long-term Horizon – Investors should expect to be locked-in for the full term of the investment, which is subject to extensions.

• No Capital Protection – Investors may lose the entirety of invested capital.

• Unpredictable Cashflows – Capital may be called and distributed at short notice.

• Economic Conditions – Ability to realise/divest from existing investments depends on market conditions and the regulatory environment.

• Risk of Forfeiture – Failure to make call payments could result in forfeiture of commitment, including invested capital, without compensation.

• Default Risk – In the event of default investors risk losing their entire remaining interest in the vehicle and may be subject to legal proceedings to recover unfunded commitments.

• Reliance on Third-party Management Teams – Underlying investments will be managed by various third-party management teams that will in aggregate determine the eventual returns for the investor, if any.

The risk factors listed above are not exhaustive. Please refer to the official product documentation for the full and detailed risk disclosures.

Author biography

Giuseppe Corona is the Head of Listed Real Assets at HSBC Asset Management, based in the London office. He joined the financial industry in 1999 and began portfolio management in 2008. Prior to joining HSBC, Mr Corona spent ten years in AMP Capital’s Global Listed Infrastructure Team where he was appointed Head of Global Listed Infrastructure in 2016. He has also spent time with Exane-BNP Paribas, Swan, and Bear Stearns.

Important information:

For Professional Clients only.

The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Alternative investments are generally illiquid and long term in nature. This material does not constitute investment advise or recommendation to any reader of this material to buy or sell investments. Any views expressed are subject to change at any time.

Issued and approved in the UK by HSBC Global Asset Management (UK) Limited (“AMEU”), which is authorised and regulated by the Financial Conduct Authority. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. HSBC Asset Management is the brand name for the asset management business of the HSBC Group.

The material contained herein is for marketing purposes and is for your information only. This document is not contractually binding nor are we required to provide this to you by any legislative provision. It does not constitute legal, tax or investment advice or a recommendation to any reader of this material to buy or sell investments. You must not, therefore, rely on the content of this document when making any investment decisions. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe to any investment. The contents are confidential and may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose.This document is intended for discussion only and shall not be capable of creating any contractual or other legal obligations on the part of AMEU or any other HSBC Group company. This document is based on information obtained from sources believed to be reliable, but which have not been independently verified. AMEU and HSBC Group accept no responsibility as to its accuracy or completeness. Care has been taken to ensure the accuracy of this presentation, but AMEU accepts no responsibility for any errors or omissions contained therein.

This document and any issues or disputes arising out of or in connection with it (whether such disputes are contractual or non-contractual in nature, such as claims in tort, for breach of statute or regulation or otherwise) shall be governed by and construed in accordance with English law.

Recipients of this communication who intend to acquire an investment in a Fund are reminded that any such acquisition may only be made on the basis of the final form of the Offering Memorandum or Prospectus, fund legal documentation, and on satisfaction of the requirements of the applicable Subscription Document. It is the responsibility of prospective investors to satisfy themselves as to full compliance with the relevant laws and regulations of any territory in connection with any application to participate in the Fund.

www.assetmanagement.hsbc.co.uk

Copyright © HSBC Global Asset Management (UK) Limited 2025. All rights reserved.

Content ID: D040872; Expiry Date: 31.12.2025

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.