In this edition...

- The future is bright for financial advice… but it will be a bumpy ride James Goad, Managing Director - Owen James

- Trump, tariffs, tech, and the rest of the world Fabian Wiesner, Head of Distribution Partnerships - Simplybiz

- Infrastructure: The UK’s untapped goldmine for investors? Katie Sykes, Client Engagement & Marketing Manager - RSMR

- The regulatory landscape for 2025 Sandy McGregor, Director of Policy - Simplybiz

- Can active and passive team up for investment success? Nick Millington, Head of Systematic Index Solutions - Aberdeen Investments

- Why your back-office tech should be invisible Abi Hortin, Implementation Specialist - Plannr Technologies Limited

- 2025 Planning and beyond… Scarlet Musson, Business Development Director - APS Legal Associates

- Marking 10 years of Multi-Asset Income BNY Investments,

- Trump, hitting the ground running Jonathan Griffiths, CFA Investment Product Manager - ebi Portfolios

- Weak UK outlook calls for nuanced approach Caroline Shaw, Portfolio Manager - Fidelity International

- Managing CGT through unitised funds Antony Champion, Managing Director, Head of Intermediaries - RBC Brewin Dolphin

- Expanding Decumulation Capabilities in Pathways Seb Marshall, Product Manager - Synaptic

- DFM due diligence and the role of financial strength consideration Matt Ward, Communications Director - AKG Financial Analytics Ltd

- Benefits of Investing on Global Listed Infrastructure Giuseppe Corona, Head of Listed Real Assets - HSBC Asset Management

- Taking stock of the new world order Ariel Bazalel, Investment Manager - Jupiter Strategic Bond Fund

The BNY Mellon Multi-Asset Income Fund (MAIF) has turned 10. To celebrate its birthday, Newton head of mixed asset investments and portfolio manager Paul Flood considers the role the fund can play in generating a natural income in retirement.

The BNY Mellon Multi-Asset Income Fund (MAIF) has turned 10. To celebrate its birthday, Newton head of mixed asset investments and portfolio manager Paul Flood considers the role the fund can play in generating a natural income in retirement.

What risks do advisers need to consider when taking clients down the capital withdrawal route in retirement?

Sequencing risk is a big concern. We believe using a natural income can address sequencing risk. Companies paying an income have tended to be more robust, with lower volatility and a quicker recovery time in periods of stress. Taking the natural income can avoid the need to sell units to fund the income. As a result, advisers can keep clients invested over the longer term rather than being at the behest of behavioural biases when markets are stressed.

Why use a multi-asset approach to achieve a natural income?

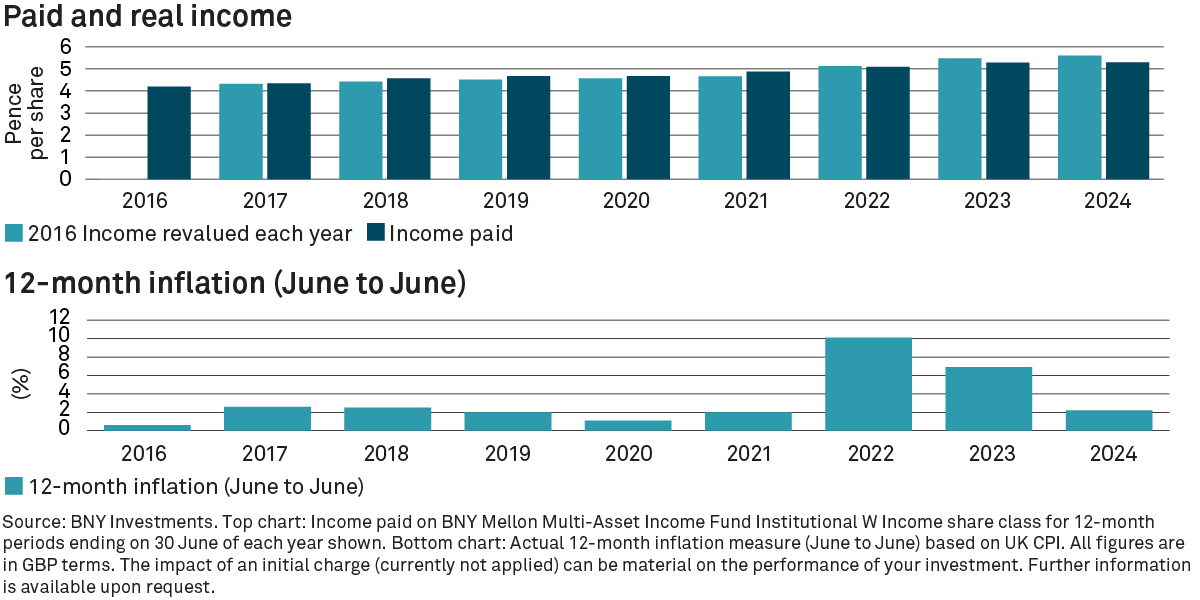

Why limit yourself to one asset class? We believe multi-asset income investing provides a greater degree of freedom. For example, if equity market valuations are high and we see better opportunities in the bond market, we can switch. Within industries we can also think about the opportunities not just for income, but also for capital growth that will allow us to grow the income to keep pace with inflation over the longer term.

How do you construct the portfolio to deliver income?

We think it is important to be directly invested so we have better sight on the income delivered from cash flows. It also creates one holistic portfolio rather than a fund of funds approach, which tends to be reliant on just the asset allocation to deliver diversification. Bottom-up stock selection allows us to identify the best risk/reward potential within a company’s capital structure, as opposed to aiming to achieve this through asset allocation alone. This prevents us being exposed to similar risk factors across multiple asset classes.

How successful have you been in delivering the income?

Since the inception of the fund in 2015, we've managed to deliver a stable income in each financial year. That has been achieved during a time when interest rates were very low and through some challenging periods such as the global pandemic and the 2022 sell-off in the equity and bond markets.

Investors may look at the volatility of capital but for retirees is the stability of the income stream as, if not more, important?

In retirement it is important to think about the volatility of income. We believe this approach is in line with the Financial Conduct Authority’s (FCA) thematic review of retirement income advice. It can also help avoid the behavioural biases of buying and selling at the wrong time, allowing advisers to better plan for retirement clients.

Some investors might be tempted to look at yield as a measure of the income received but that's not actually the case, is it?

No. I think if you reach too high for income there is a risk that you could undermine the capital. Income maximiser strategies are one way of, as the name suggests, maximising the income. They do this by using derivatives to sell ‘calls’ at a given share price. But if the company’s shares do well, you can end up effectively paying out income at the expense of capital. We avoid that because we want to grow the capital base as well as generate income. If you're giving up capital upside, you're less likely to be able to grow the capital base which is your income generating capability of the future.

So, at what point should an adviser introduce the concept of natural income to a client?

With the FCA focusing on the suitability of retirement advice, we're seeing growing interest in products that can help advisers deliver that. We think there's an opportunity to bring natural income in earlier than at retirement. Investors in MAIF may consider buying it in the lead up to retirement by purchasing the accumulation share class.

BNY Mellon Multi-Asset Income Fund

Investment objective

The Fund aims to achieve income together with the potential for capital growth over the long term (5 years or more).

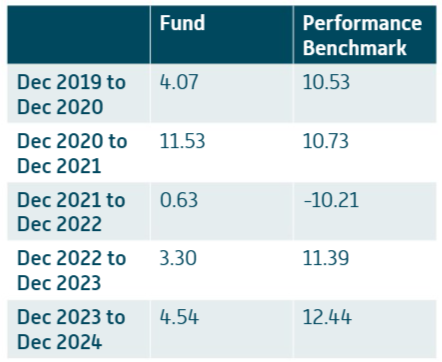

Performance benchmark

The Fund will measure its performance against a composite index, comprising 60% MSCI AC World NR Index and 40% ICE Bank of America Global Broad Market GBP Hedged TR Index, as a comparator benchmark (the "Benchmark"). The Fund will use the Benchmark as an appropriate comparator because the Investment Manager utilises this index when measuring the Fund's income yield.

The Fund is actively managed, which means the Investment Manager has absolute discretion to invest outside the Benchmark subject to the investment objective and policies disclosed in the Prospectus. While the Fund’s holdings may include constituents of the Benchmark, the selection of investments and their weightings in the portfolio are not influenced by the Benchmark. The investment strategy does not restrict the extent to which the Investment Manager may deviate from the Benchmark.

The Fund can invest more than 35% of net assets in different Transferable Securities and Money Market Instruments issued or guaranteed by any EEA State, its local authorities, a third country or public international bodies of which one or more EEA States are members.

Performance - 12 month returns (%)

Source: Lipper as at 31 December 2024. Fund performance for the Institutional Shares W (Accumulation) calculated as total return, including reinvested income net of UK tax and charges, based on net asset value. All figures are in GBP terms. The impact of an initial charge (currently not applied) can be material on the performance of your investment. Further information is available upon request.

For more information and to find out more please visit www.bny.com/investments

Past performance is not a guide to future performance.

The value of investments can fall. Investors may not get back the amount invested. Income from investments may vary and is not guaranteed.

Key risks associated with this fund:

- There is no guarantee that the Fund will achieve its objectives.

- Investments in bonds/money market securities are affected by interest rates and inflation trends which may negatively affect the value of the Fund.

- The issuer of a security held by the Fund may not pay income or repay capital to the Fund when due.

- Companies with high-dividend rates are at a greater risk of not being able to meet these payments and are more sensitive to interest rate risk.

- The Fund takes its charges from the capital of the Fund. Investors should be aware that this has the effect of lowering the capital value of your investment and limiting the potential for future capital growth. On redemption, you may not receive back the full amount you initially invested.

Get in touch:

Important information:

For Professional clients only. This is a financial promotion.

For a full list of risks applicable to this fund, please refer to the Prospectus or other offering documents. Please refer to the fund documents. Go to www.bnymellonim.com. Any views and opinions are those of the investment manager, unless otherwise noted. This is not investment research or a research recommendation for regulatory purposes. For further information visit www.bnymellonim.com.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.