In this edition...

- The future is bright for financial advice… but it will be a bumpy ride James Goad, Managing Director - Owen James

- Trump, tariffs, tech, and the rest of the world Fabian Wiesner, Head of Distribution Partnerships - Simplybiz

- Infrastructure: The UK’s untapped goldmine for investors? Katie Sykes, Client Engagement & Marketing Manager - RSMR

- The regulatory landscape for 2025 Sandy McGregor, Director of Policy - Simplybiz

- Can active and passive team up for investment success? Nick Millington, Head of Systematic Index Solutions - Aberdeen Investments

- Why your back-office tech should be invisible Abi Hortin, Implementation Specialist - Plannr Technologies Limited

- 2025 Planning and beyond… Scarlet Musson, Business Development Director - APS Legal Associates

- Marking 10 years of Multi-Asset Income BNY Investments,

- Trump, hitting the ground running Jonathan Griffiths, CFA Investment Product Manager - ebi Portfolios

- Weak UK outlook calls for nuanced approach Caroline Shaw, Portfolio Manager - Fidelity International

- Managing CGT through unitised funds Antony Champion, Managing Director, Head of Intermediaries - RBC Brewin Dolphin

- Expanding Decumulation Capabilities in Pathways Seb Marshall, Product Manager - Synaptic

- DFM due diligence and the role of financial strength consideration Matt Ward, Communications Director - AKG Financial Analytics Ltd

- Benefits of Investing on Global Listed Infrastructure Giuseppe Corona, Head of Listed Real Assets - HSBC Asset Management

- Taking stock of the new world order Ariel Bazalel, Investment Manager - Jupiter Strategic Bond Fund

One of the key findings from the FCA review into Cashflow is the need for advisers to use justifiable rates of returns when conducting cashflow analysis and decumulation projections. Currently, Pathways integrates with Moody’s Economic Scenario Generator to model risk and return, incorporating the Clients attitude to risk (ATR), as determined via the A2Risk questionnaire.

One of the key findings from the FCA review into Cashflow is the need for advisers to use justifiable rates of returns when conducting cashflow analysis and decumulation projections. Currently, Pathways integrates with Moody’s Economic Scenario Generator to model risk and return, incorporating the Clients attitude to risk (ATR), as determined via the A2Risk questionnaire.

As a client’s attitude to risk can shift depending on the stage of their investment journey, a secondary ATR for clients in decumulation has been introduced.

The decumulation questionnaire will feature a distinct set of questions, separate from those used in accumulation, along with dedicated questions on decumulation capacity and loss tolerance.

This new functionality enables Pathways users to store two default ATR values for each client - one for accumulation and one for decumulation. The software will automatically pull the relevant ATR and capacity for loss values based on the type of research being conducted, which means that firms and advisers can be confident they comply with the latest FCA guidance.

In the previous issue of Connection, we highlighted improvements to Pathways’ income analysis features. We are now adding even more functionality to further support users conducting income analysis. This latest wave of development has introduced and improved the following parts of the journey:

• Network functions for setting inflation rates and stress test scenarios

• Stress test scenario overlays

• Support for additional income resources

• Enhancements to results layout.

Ongoing Enhancements to Income Analysis

Network/firm functions

To give networks and firms greater control over the presets their advisers use, we have developed inputs for Inflation rates and stress test scenarios. This ensures that all users remain consistent with scenarios they are creating.

Stress test scenario overlays

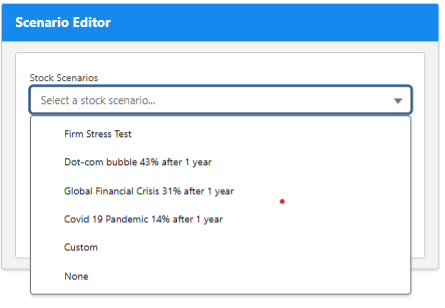

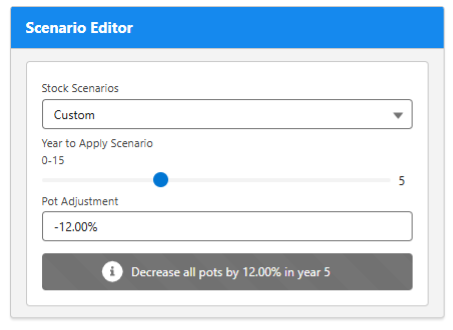

This update introduces stress test scenarios to allow users to model the impact of market crashes on future income and investment pots. The solution includes four built-in stress tests, and users can easily input their own values to simulate future market downturns.

Additional Income Sources

When conducting cashflow and income analysis, clients often have various income sources to consider at various different stages of their cashflow cycle. Now within Income Analysis, users can model one-off income sources in two ways:

• As a lump sum that is spent immediately, or

• As a lump sum that contributes to income during the remainder of the analysis term.

This enhances flexibility in modelling all available income sources for clients.

Results Layout Enhancements

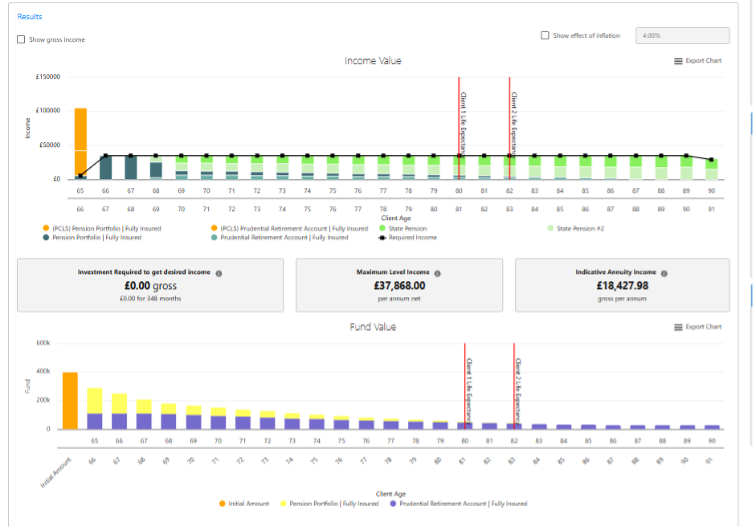

To accommodate recent changes in the income analysis journey, we’ve redesigned the results page. The updated layout includes:

• Making the initial results ‘read-only’ so that there is a baseline scenario to refer back to.

• Display of second client ages and life expectancy on graphs

• Inclusion of a stochastic projection graph alongside deterministic graphs

• Inclusion of the stress test inputs.

Transform Your Cashflow Planning with Synaptic Pathways

Synaptic Pathways supports your advisory work by providing powerful research tools to support due diligence on every investment recommendation - whether for new investments, switches, or reviews. Key features include:

• Risk profiling and capacity for loss assessment

• Model stress testing

• Moody’s stochastic model applications.

Unlock the full potential of Pathways’ advanced cashflow modelling for both accumulation and decumulation scenarios. Call us today at 0800 783 4477 or email hello@synaptic.co.uk to schedule your personalised demo and see how Pathways can elevate your financial planning.

Get in touch:

0800 783 4477

hello@synaptic.co.uk

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.