In this edition...

- The future is bright for financial advice… but it will be a bumpy ride James Goad, Managing Director - Owen James

- Trump, tariffs, tech, and the rest of the world Fabian Wiesner, Head of Distribution Partnerships - Simplybiz

- Infrastructure: The UK’s untapped goldmine for investors? Katie Sykes, Client Engagement & Marketing Manager - RSMR

- The regulatory landscape for 2025 Sandy McGregor, Director of Policy - Simplybiz

- Can active and passive team up for investment success? Nick Millington, Head of Systematic Index Solutions - Aberdeen Investments

- Why your back-office tech should be invisible Abi Hortin, Implementation Specialist - Plannr Technologies Limited

- 2025 Planning and beyond… Scarlet Musson, Business Development Director - APS Legal Associates

- Marking 10 years of Multi-Asset Income BNY Investments,

- Trump, hitting the ground running Jonathan Griffiths, CFA Investment Product Manager - ebi Portfolios

- Weak UK outlook calls for nuanced approach Caroline Shaw, Portfolio Manager - Fidelity International

- Managing CGT through unitised funds Antony Champion, Managing Director, Head of Intermediaries - RBC Brewin Dolphin

- Expanding Decumulation Capabilities in Pathways Seb Marshall, Product Manager - Synaptic

- DFM due diligence and the role of financial strength consideration Matt Ward, Communications Director - AKG Financial Analytics Ltd

- Benefits of Investing on Global Listed Infrastructure Giuseppe Corona, Head of Listed Real Assets - HSBC Asset Management

- Taking stock of the new world order Ariel Bazalel, Investment Manager - Jupiter Strategic Bond Fund

Ariel Bezalel and Harry Richards, investment managers of the Jupiter Strategic Bond Fund assess the prospects for the global economy amid a demanding valuation backdrop and a fast-developing tariff war.

Ariel Bezalel and Harry Richards, investment managers of the Jupiter Strategic Bond Fund assess the prospects for the global economy amid a demanding valuation backdrop and a fast-developing tariff war.

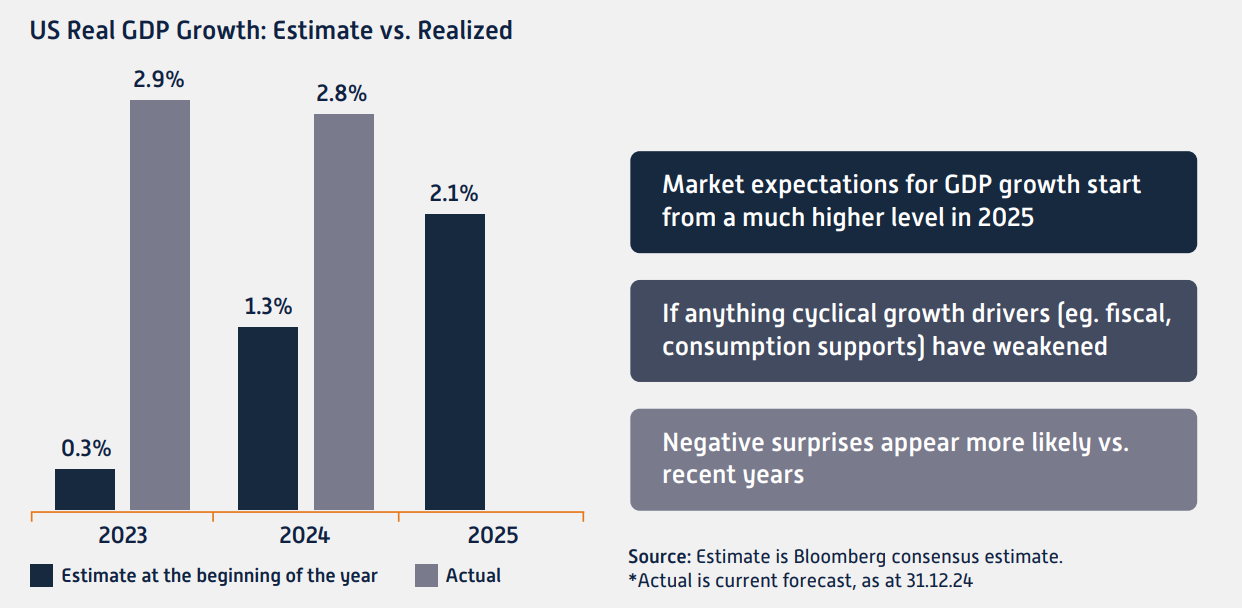

The US economy grew faster than forecast in 2023 and 2024, defying consensus expectations. A surge in fiscal spending in the post-COVID period, a resilient job market and a rally in risk assets underpinned growth in the last two years, with the long-term nature of US mortgages helping cushion the impact of aggressive rate increases.

Can the US economy repeat the robust growth of the last two years again? While consensus estimates suggest that could be the case, we expect downward surprises as there are many areas of weakness, including cyclical sectors such as manufacturing and housing. Such sectors have been soft since the hiking cycle began and appear to be under pressure in the current environment of higher rates and higher costs.

GDP growth: excess of optimism?

Tepid labour market

While the job market remains strong, with relatively low unemployment, the conditions have softened over the past 12 to 18 months. The hiring pace has slowed significantly, and a large portion of the hiring is confined to the government, healthcare and private education sectors.

In contrast, cyclical sectors have been exhibiting an anaemic rate of employment growth. Additionally, classic metrics of labour market turnover such as the hiring rate or the quits rate give the picture of a labour market characterized by very low churn. Most Americans who want to be employed have a job but may find it challenging to find a new job if they lose the existing one. This leaves space for a more material increase in unemployment if layoffs were to accelerate for any reason.

Furthermore, with President Donald Trump’s administration focused on reining in spending, the public sector could start to see some material job losses soon. This would likely affect consumption. After several years of extremely robust demand and private spending, we continue to believe some deceleration might be warranted, especially when looking at the rise in delinquencies on consumer credit. Uncertainty on trade policy could also be a factor driving lower investment and lower hiring in the private sector in the US from here.

In recent weeks, bond markets have ramped up their expectations for further rate cuts by the US Federal Reserve. The markets are now pricing in three quarter point rate cuts instead of just one at the beginning of the year. The first few weeks of Trump’s presidency has been hectic and unsettling for the markets, with US 10-year bond yields falling about 70 basis points from a two-year peak of 4.80% and the S&P 500 eroding all its gains made after he was elected. The focus of the markets has been on the steep tariffs imposed on Mexico, Canada and China as well as the travails of Ukraine.

In Europe, weak data across PMIs, industrial production and sluggish consumption continue to push the European Central Bank (ECB) towards a faster cutting cycle compared to the Fed, although the German government’s plan to loosen its purse strings to increase defence spending has cast a shadow over the pace of reduction. In the UK, over the last part of 2024 markets had priced out most of the easing from the Bank of England (BOE), bringing yields on Gilts to levels not seen since 2008. We think such degree of tightening might be unsustainable in the long run for the UK economy. Confidence amongst businesses and consumers has nosedived since the infamous first budget of Rachel Reeves last year.

Inflation trajectory

Although inflation has slowed after peaking in 2022, it still remains a drag for the bond market and a concern for central bankers. However, we are optimistic about the path of inflation.

It’s also worth highlighting that a large component of US YoY CPI is still coming from highly lagged components of the basket such as shelter and auto insurance. For shelter, the adjustment process has been unexpectedly slow but looking at overall trends in new rental markets in the last 12 to 18 months, there’s been a normalization.

In recent weeks, market focus has shifted from actual data to expectations of new exogenous shocks coming especially from changes in US policy. Trump’s tariff policy is just once instance of how unpredictable and erratic US news flow could be in the next quarters.

Republicans have won such a large mandate also due to the discontent generated by the cost-of-living crisis seen under the previous administration and the Trump administration will try to avoid inducing new inflationary waves. We also believe that Treasury Secretary Scott Bessent will seek to rein in government spending, going by his recent remarks about the state of government finances.

Energy prices are another important factor that can help keep inflation in check. Trump and his staff have made sufficiently clear that the desired direction for oil prices should be lower. Whether this comes from increased production or more pressure on OPEC remains to be seen.

Government bonds are in favour

Given the above, we continue to see value in government bonds across developed markets, if anything as a powerful hedging tool in case of a more material and unexpected slowdown. US rates are still the core holding, but global ex-US rates and in particular UK and Australia look attractive as well, given structural weaknesses in these economies. Corporate credit continues to look expensive at this juncture, with credit spreads close to all time tights. As always, it’s very hard to exactly time the moment of material widening in spreads.

As such, given our long duration bias we still prefer to include some credit exposure across our portfolios as a diversifier. However, within such credit exposure we are very selective.

Get in touch

www.jupiteram.com

020 3817 1050

JupiterAM_UK

jupiter-asset-management

clientservices@jupiteram.com

Important Information: This document is intended for investment professionals and is not for the use or benefit of other persons. This document is for informational purposes only and is not investment advice. Investment involves risk. Past performance is no guide to the future. You are advised to exercise caution. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. It is the responsibility of any person in possession of this document to inform themselves, and to observe, all applicable laws and regulations of relevant jurisdictions. Market and exchange rate movements can cause the value of an investment to fall as well as rise, and you may get back less than originally invested. The views expressed are those of the individuals mentioned at the time of writing, are not necessarily those of Jupiter as a whole, and may be subject to change. This is particularly true during periods of rapidly changing market circumstances. Every effort is made to ensure the accuracy of the information, but no assurance or warranties are given. Holding examples are for illustrative purposes only and are not a recommendation to buy or sell. Issued in the UK by Jupiter Asset Management Limited (JAM), registered address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ is authorised and regulated by the Financial Conduct Authority.

Sign up for updates

Keep up to speed with everything you need to know each quarter, by email or post.